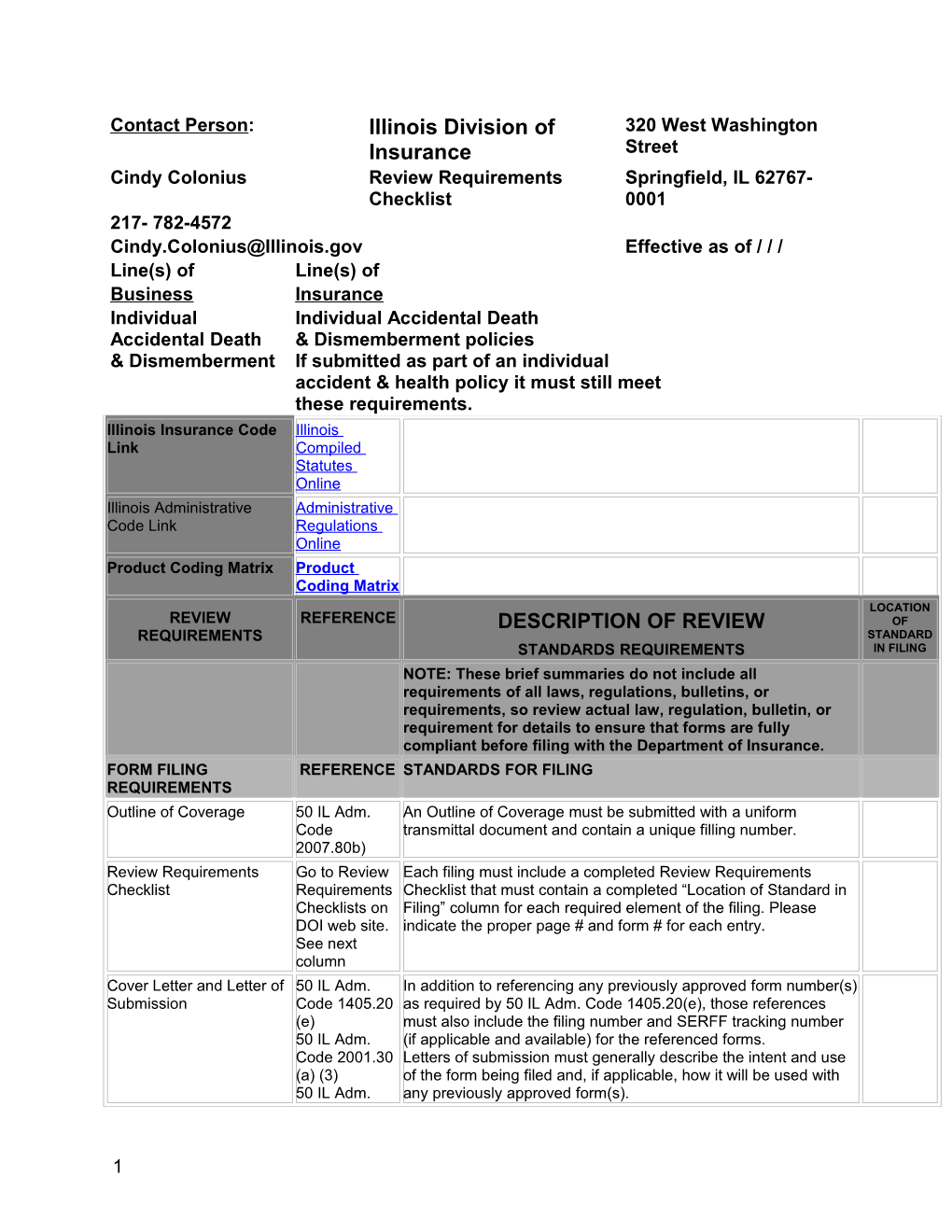

Contact Person: Illinois Division of 320 West Washington Insurance Street Cindy Colonius Review Requirements Springfield, IL 62767- Checklist 0001 217- 782-4572 [email protected] Effective as of / / / Line(s) of Line(s) of Business Insurance Individual Individual Accidental Death Accidental Death & Dismemberment policies & Dismemberment If submitted as part of an individual accident & health policy it must still meet these requirements. Illinois Insurance Code Illinois Link Compiled Statutes Online Illinois Administrative Administrative Code Link Regulations Online Product Coding Matrix Product Coding Matrix LOCATION REVIEW REFERENCE DESCRIPTION OF REVIEW OF REQUIREMENTS STANDARD STANDARDS REQUIREMENTS IN FILING NOTE: These brief summaries do not include all requirements of all laws, regulations, bulletins, or requirements, so review actual law, regulation, bulletin, or requirement for details to ensure that forms are fully compliant before filing with the Department of Insurance. FORM FILING REFERENCE STANDARDS FOR FILING REQUIREMENTS Outline of Coverage 50 IL Adm. An Outline of Coverage must be submitted with a uniform Code transmittal document and contain a unique filling number. 2007.80b) Review Requirements Go to Review Each filing must include a completed Review Requirements Checklist Requirements Checklist that must contain a completed “Location of Standard in Checklists on Filing” column for each required element of the filing. Please DOI web site. indicate the proper page # and form # for each entry. See next column Cover Letter and Letter of 50 IL Adm. In addition to referencing any previously approved form number(s) Submission Code 1405.20 as required by 50 IL Adm. Code 1405.20(e), those references (e) must also include the filing number and SERFF tracking number 50 IL Adm. (if applicable and available) for the referenced forms. Code 2001.30 Letters of submission must generally describe the intent and use (a) (3) of the form being filed and, if applicable, how it will be used with 50 IL Adm. any previously approved form(s).

1 Code 916.40 (b) Rates 215 ILCS Rates must be submitted with a uniform transmittal document and 5/355 contain a unique filing number. GENERAL REFERENCE DESCRIPTION OF REVIEW STANDARDS REQUIREMENTS REQUIREMENTS FOR ALL FILINGS Accident and Health 215 ILCS Each accident and health policy must contain the provisions Required Provisions 5/357.1 contained in 3/357.2-3/357.13 Form of Policy 215 ILCS No policy of accident and health insurance may be delivered or 5/356a issued for deliver to any person in this state unless it adheres to the provisions of this section. Entire Contract 215 ILCS The policy, including the application and any amendments and 5/357.1 riders, constitutes the entire contract of insurance and no change 215 ILCS is valid unless approved by an executive officer of the company 5/357.2 and unless such approval be endorsed hereon or attached hereto. Time Limit on Certain 215 ILCS A policy is incontestable two years from the date of issue except Defenses 5/357.1 for fraudulent misstatements made by the applicant on the 215 ILCS application. 5/357.3 Notice of Claim 215 ILCS Written notice of claim should be submitted to the company within 5/357.1 20 days of the occurrence or commencement of any loss. 215 ILCS 5/357.6 Legal Action 215 ILCS No such action shall be brought after 3 years from the date of due 5/357.1 proof of loss is required to be furnished. 215 ILCS 5/357.12 Claim Forms 215 ILCS The company shall furnish those forms needed to submit proofs of 5/357.1 loss within 15 days. 215 ILCS 5/357.7 Payment of Claims 215 ILCS Benefits may be assigned. 5/357.1 215 ILCS 5/357.10 Timely Payment of Claims 215 ILCS Claims must be paid within 30 days following receipt of written 5/357.1 due proof of loss. 215 ILCS 5/357.9 Grace Period 215 ILCS A grace period of not less than 7 days (weekly premium), 10 days 5/357.1 (monthly premium) and 31 days for all other policies is required. 215 ILCS 5/357.4 Proof of Loss 215 ILCS Written proofs of loss should be submitted to the company within 5/357.1 90 days of loss. 215 ILCS 5/357.8 Physical Exam and 215 ILCS An insurer, at its own expense, has the right and opportunity to Autopsy 5/357.1 examine the insured when, and as often, as it may reasonably

2 215 ILCS require during a claim’s pending period. It may conduct an 5/357.11 autopsy in the case of death where it is not forbidden by law. Change of Beneficiary 215 ILCS The individual designating a beneficiary retains the right to change 5/357.1 that designation unless he/she makes that designation 215 ILCS irrevocable. 5/357.13 Reinstatement 215 ILCS A policy may be reinstated with or without an application as 5/357.1 provided. 215 ILCS 5/357.5 Spousal Conversion 215 ILCS Policies of accident and health must contain a conversion 5/356d provision, made available without evidence of insurability, for dependent spouses upon a valid judgment of dissolution of the marriage if such application is made within 60 days following the date of judgment. Pending & Adopted 215 ILCS No policy that covers the insured’s immediate family or children Children 5/356h may exclude or limit coverage of an adopted child or a child not residing with the insured (foster child). A child residing with an insured pursuant to an interim court order of adoption is considered an adopted child. ADMINISTRATIVE CODE REFERENCE DESCRIPTION OF REVIEW STANDARDS REQUIREMENTS PROVISIONS Renewability 50 IL. Adm. The renewal provision must appear on the first page of the policy. Code 2007.80(a)(1) Pre-Existing Conditions 50 IL. Adm. The minimum definition for pre-existing condition is included within Code 2005 Rule 2005. A separate paragraph concerning pre-existing 50 IL. Adm. conditions limitations must be included in the contract that limits Code such conditions. 2007.80(a)(5) Free Look 50 IL. Adm The policy must contain a 10-day free look provision. Code 2007.80(a)(7) 215 ILCS 5/355a (5)(a) Replacement Question 50 IL. Adm. The application must contain a replacement question designed to Code elicit information concerning whether the policy will replace any 2007.90a) existing accident and health coverage. Terms not Allowed 50 IL. Adm. "External," "Violent," "Visible" or similar words of description or Code 2007.50 characterization are not allowed. The use of the term, "independent of all other causes" is ambiguous when used in the definition of injury and is not allowed. Allowable Exclusions 50 IL. Adm. No policy may limit or exclude coverage by type of illness, Code accident, treatment or medical condition except as provided. 2007.60(e) Covered Condition 50 IL. Adm. A policy, endorsement or rider may not exclude treatment or Complications Code services arising from complications of a covered condition. 2007.60(h) Minimum Standards 50 IL. Adm. This section of the Rule outlines minimum standards for accident Code 2007.70 and health benefits.

3 Required Disclosures 50 IL. Adm. This Section of the Rule contains guidelines on required policy Code 2007.80 and disclosure provisions. Discrimination 50 IL. Adm. Provides guidelines on unfair discrimination based on sex, sexual Code 2603 preference or marital status. Right of Reimbursement 50 IL Adm. Provides guidelines for reimbursement and subrogation rights due and Subrogation Code 2020 to negligence of a third party. Required Statement for 50 IL. Adm. Policies must contain a statement on the face page that says, Accident Only Policies Code "THIS IN AN ACCIDENT ONLY POLICY AND DOES NOT PAY 2007.80(a)(6) BENEFITS FOR LOSS FROM ILLNESS" Cash Value Rider Not 50 IL. Adm. The Rule only allows cash value riders for disability, hospital Permitted Code indemnity and specified disease policies. 2007.60(c) OPTIONAL PROVISIONS REFERENCE DESCRIPTION OF REVIEW STANDARDS REQUIREMENTS Change of Occupation 215 ILCS An insured who is injured or becomes sick after having changed 5/357.15 occupations to one classified as either more or less hazardous, will have a suitable premium adjustment made as provided. Misstatement of Age 215 ILCS If the age of the insured has been misstated, all amounts payable 5/357.16 under this policy shall be such as the premium paid would have purchased at the correct age.

Other Insurance in 215 ILCS Excess coverage protection provisions. Company 5/357.17 Insurance with Other 215 ILCS Excess coverage protection provisions for insurance with other Companies 5/357.19 companies for indemnity type policies. Unpaid Premium 215 ILCS Upon the payment of a claim under the policy, any premium then 5/357.21 due and unpaid or covered by any note or written order may be deducted. Cancellation 215 ILCS Cancellation provisions with prior notification requirements. 5/357.22 Subject to HIPAA requirements. Disclosure of Conformity 215 ILCS Any provision of the policy, which, on its effective date, is in with State Statutes 5/357.23 conflict with the statutes of the state in which the insured resides on such date, is hereby amended to conform to the minimum requirements of such statutes. Illegal Occupation 215 ILCS An insurer shall not be liable for any loss to which a contributing 5/357.24 cause was the insured's commission of or attempt to commit a felony or to which a contributing cause was the insured's being engaged in an illegal occupation. Pro-rata Refund 215 ILCS Insurers must provide pro-rata refunds of premium upon receipt of 5/357.31 proper notification of insured’s death. Refund may not be based on short-rate table. GENERAL REFERENCE DESCRIPTION OF REVIEW STANDARDS REQUIREMENTS INFORMATION Discretionary Authority 215ILCS Insurers are not permitted to place discretionary authority 5/143(1) language in contracts of accident and health. 50 IL Adm. Code 2001.3 Use of SSN on ID Cards 815 ILCS 505 The focus of HB 4712 is on any card required for an individual to 2QQ access products or services, while SB 2545 is more limited in that 215 ILCS it just focuses on insurance cards.

4 138/15 HB 4712 prevents a person from: Publicly posting or displaying an individual’s SSN; Printing an individual’s SSN on any card required for the individual to access products or services, however, an entity providing an insurance card must print on the card a unique identification number as required by 215 ILCS 138/15. Being required to transmit an SSN over the Internet to access a web site unless the connection is secure or the SSN is encrypted; Requiring the individual to use his/her SSN to access a web site unless a PIN number or other authentication device is also used; and, Printing an individual’s SSN on any materials mailed to an individual unless required by state or federal law.

Insurers are required to comply with both provisions. DEPARTMENT REFERENCE DESCRIPTION OF REVIEW STANDARDS REQUIREMENTS POSITIONS Intoxication Definition 215 ILCS An intoxication definition must be included in the policy if it is listed 5/143(1) as an exclusion. A reasonable example would be, "Intoxication means that which is defined and determined by the laws of the jurisdiction where the loss or cause of the loss was incurred."

Definition of the term 215 ILCS The term, "of all other causes" is considered ambiguous when “injury” 5/143(1) used in the definition of injury. Felonious Assault 215 ILCS The policy may contain a Felonious Assault provision but the 5/143(1) following language is prohibited, "Felonious Assault inflicted by persons other than fellow employees or members of the insured's family or household." An assault can be committed by an immediate family member or fellow employee that would constitute a willful and unlawful use of force and is considered a felony or misdemeanor in most jurisdictions in the United States. Prohibited Language 215 ILCS The following language is prohibited in a policy, "The Assault must 5/143(1) not be either a moving violation as defined under the applicable state or motor vehicle laws." A motor vehicle can be used to cause an assault and therefore, may entail a moving violation. As long as language is clear and does not contain language as stated above, this benefit is allowed. Prohibited Benefits 215 ILCS The following benefits are prohibited: "Day Care Benefit", 5/143(1) "Spouse Training", Education Benefit", "Home Modification", "Car Modification", "Workplace Modification", and "Vocational Rehabilitation." These types of benefits are considered discriminatory. They have to be contingent upon a disability, not an injury or death. These benefits are not a true accident and health benefit.

HIV/AIDS Questions on 215 ILCS Questions designed to elicit information regarding AIDS, ARC and Application 5/143(1) HIV must be specifically related to the testing, diagnosis or

5 treatment done by a physician or an appropriately licensed clinical professional acting within the scope of his/her license.

6