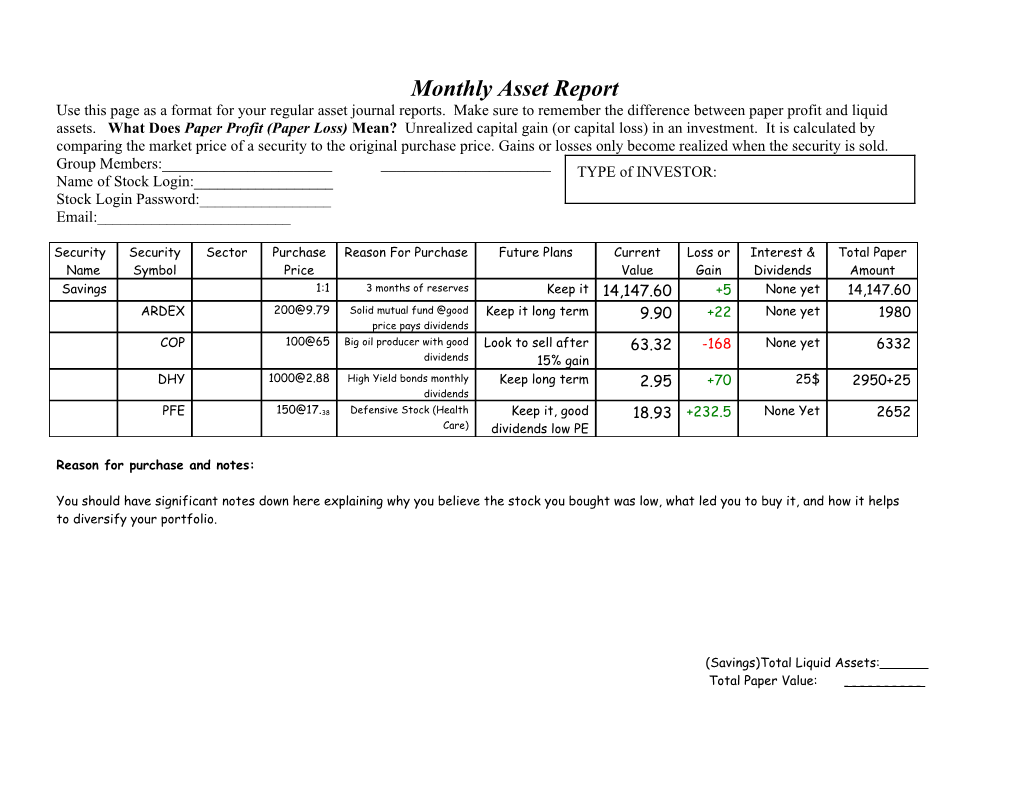

Monthly Asset Report Use this page as a format for your regular asset journal reports. Make sure to remember the difference between paper profit and liquid assets. What Does Paper Profit (Paper Loss) Mean? Unrealized capital gain (or capital loss) in an investment. It is calculated by comparing the market price of a security to the original purchase price. Gains or losses only become realized when the security is sold. Group Members:______TYPE of INVESTOR: Name of Stock Login:______Stock Login Password:______Email:______

Security Security Sector Purchase Reason For Purchase Future Plans Current Loss or Interest & Total Paper Name Symbol Price Value Gain Dividends Amount Savings 1:1 3 months of reserves Keep it 14,147.60 +5 None yet 14,147.60 ARDEX [email protected] Solid mutual fund @good Keep it long term 9.90 +22 None yet 1980 price pays dividends COP 100@65 Big oil producer with good Look to sell after 63.32 -168 None yet 6332 dividends 15% gain DHY [email protected] High Yield bonds monthly Keep long term 2.95 +70 25$ 2950+25 dividends PFE [email protected] Defensive Stock (Health Keep it, good 18.93 +232.5 None Yet 2652 Care) dividends low PE

Reason for purchase and notes:

You should have significant notes down here explaining why you believe the stock you bought was low, what led you to buy it, and how it helps to diversify your portfolio.

(Savings)Total Liquid Assets:______Total Paper Value: ______Group Members:______TYPE of INVESTOR: Name of Stock Login:______Stock Login Password:______Email:______

Security Security Sector Purchase Purchase Reason For Purchase Future Plans Current Loss Interest & Total Paper Name Symbol Date Price Value Gain Dividends Amount

Savings)Total Liquid Assets:______Total Paper Stock Value: ______Total Net Worth: ______

______