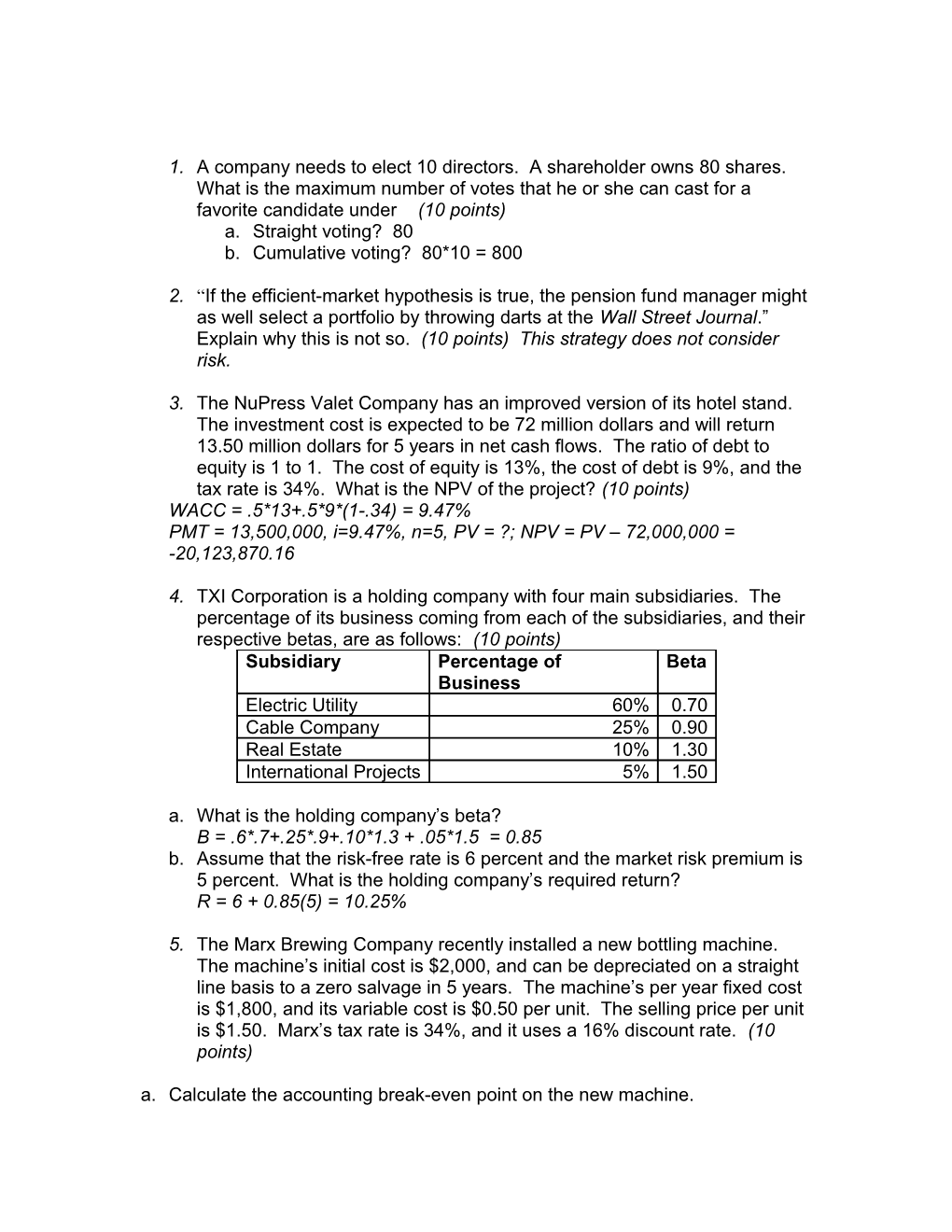

1. A company needs to elect 10 directors. A shareholder owns 80 shares. What is the maximum number of votes that he or she can cast for a favorite candidate under (10 points) a. Straight voting? 80 b. Cumulative voting? 80*10 = 800

2. “If the efficient-market hypothesis is true, the pension fund manager might as well select a portfolio by throwing darts at the Wall Street Journal.” Explain why this is not so. (10 points) This strategy does not consider risk.

3. The NuPress Valet Company has an improved version of its hotel stand. The investment cost is expected to be 72 million dollars and will return 13.50 million dollars for 5 years in net cash flows. The ratio of debt to equity is 1 to 1. The cost of equity is 13%, the cost of debt is 9%, and the tax rate is 34%. What is the NPV of the project? (10 points) WACC = .5*13+.5*9*(1-.34) = 9.47% PMT = 13,500,000, i=9.47%, n=5, PV = ?; NPV = PV – 72,000,000 = -20,123,870.16

4. TXI Corporation is a holding company with four main subsidiaries. The percentage of its business coming from each of the subsidiaries, and their respective betas, are as follows: (10 points) Subsidiary Percentage of Beta Business Electric Utility 60% 0.70 Cable Company 25% 0.90 Real Estate 10% 1.30 International Projects 5% 1.50

a. What is the holding company’s beta? Β = .6*.7+.25*.9+.10*1.3 + .05*1.5 = 0.85 b. Assume that the risk-free rate is 6 percent and the market risk premium is 5 percent. What is the holding company’s required return? R = 6 + 0.85(5) = 10.25%

5. The Marx Brewing Company recently installed a new bottling machine. The machine’s initial cost is $2,000, and can be depreciated on a straight line basis to a zero salvage in 5 years. The machine’s per year fixed cost is $1,800, and its variable cost is $0.50 per unit. The selling price per unit is $1.50. Marx’s tax rate is 34%, and it uses a 16% discount rate. (10 points) a. Calculate the accounting break-even point on the new machine. Q=(1800+400)/1.0 = 2,200 b. Calculate the present-value break-even point. (Q-1800)(1-.34)+.34*400 = OCF Find the OCF that makes NPV = 0. Let PV = 2000, n=5, I=16%, PMT=? = 610.82=OCF; Substituting above find Q=2519.

6. Use the probability distribution to answer the following questions: (30 points) Return on Return on State Prob Security A Security B Boom .6 15% 8% Bust .4 5% 20% Expected Return 11% 12.8% Standard Deviation 4.9% 5.88% a. What is the expected return on Security B? 12.8% b. What is the expected return on a portfolio that is 40% invested in A and 60% invested in B? 12.08% c. What is the standard deviation of Security A? 4.9% d. What is the expected return on a portfolio that is equally split among A, B and the risk free asset? The expected return on the risk free asset is 4%. 9.27% (11+12.8+4)/3 e. What is the covariance between A and B? -28.8%% Cov = .6(15-11)(8-12.8)+.4(5-11)(20-12.8) f. What is the standard deviation of a portfolio with weights of .25 in security A and the remainder in security B? 3.2% Portfolio Standard Deviation = .252(4.9)2+.752(5.88)2+2*.25*.75*(-28.8) Or = .6(9.75-12.35)2+.4(16.25-12.35)2

7. You are evaluating a project for The Ultimate recreational tennis racket. You estimate the sales price of The Ultimate to be $400 and sales volume to be 1,000 units in year 1, 1,250 units in year 2, and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000, which is depreciated straight-line to zero over the 3-year project life. The actual market value of the initial investment at the end of year 3 is $35,000. Initial net working capital investment in the project is $75,000. The tax rate is 34% and the required return on the project is 10%. (20 points)

a. What is the initial cash flow? CF0 = -165,000-75,000=-240,000 b. What is the operating cash flow for the project in year 2? OCF2=(400*1250-225*1250-100,000)(1-.34) + 55,000(.34) c. What is the depreciation tax-shield in year 3? D*T = 18,700 d. What is the total cash flow for the project in year 3? OCF3 = (400*1325-225*1325-100,000)(1-.34)+18,700=$105,737.50 CF(SV) = 35,000-(35,000-0)(.34)=23,100; CF(NWC) = 75,000 CF3 = 203,837.50