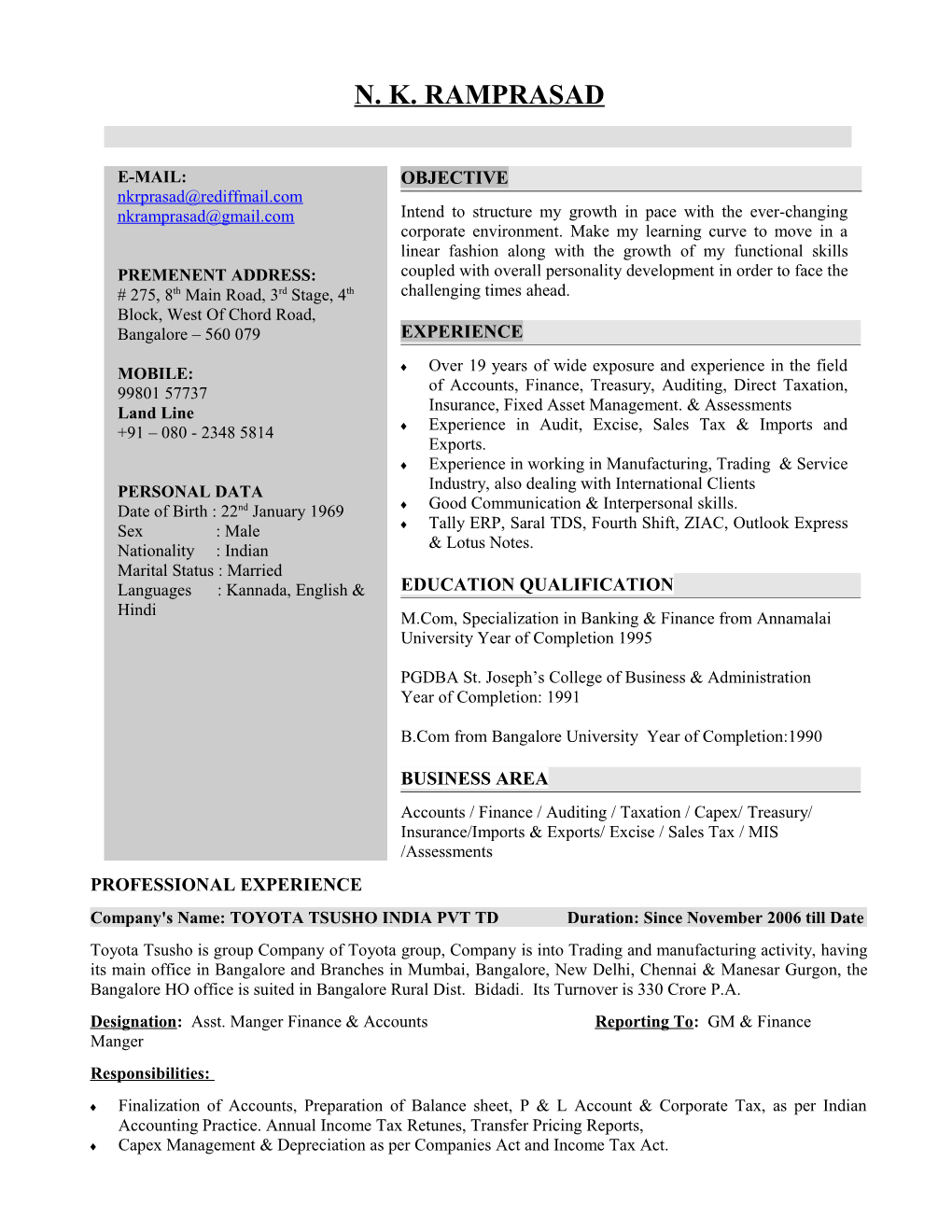

N. K. RAMPRASAD

E-MAIL: OBJECTIVE [email protected] [email protected] Intend to structure my growth in pace with the ever-changing corporate environment. Make my learning curve to move in a linear fashion along with the growth of my functional skills PREMENENT ADDRESS: coupled with overall personality development in order to face the # 275, 8th Main Road, 3rd Stage, 4th challenging times ahead. Block, West Of Chord Road, Bangalore – 560 079 EXPERIENCE

MOBILE: Over 19 years of wide exposure and experience in the field 99801 57737 of Accounts, Finance, Treasury, Auditing, Direct Taxation, Land Line Insurance, Fixed Asset Management. & Assessments +91 – 080 - 2348 5814 Experience in Audit, Excise, Sales Tax & Imports and Exports. Experience in working in Manufacturing, Trading & Service PERSONAL DATA Industry, also dealing with International Clients Date of Birth : 22nd January 1969 Good Communication & Interpersonal skills. Sex : Male Tally ERP, Saral TDS, Fourth Shift, ZIAC, Outlook Express Nationality : Indian & Lotus Notes. Marital Status : Married Languages : Kannada, English & EDUCATION QUALIFICATION Hindi M.Com, Specialization in Banking & Finance from Annamalai University Year of Completion 1995

PGDBA St. Joseph’s College of Business & Administration Year of Completion: 1991

B.Com from Bangalore University Year of Completion:1990

BUSINESS AREA Accounts / Finance / Auditing / Taxation / Capex/ Treasury/ Insurance/Imports & Exports/ Excise / Sales Tax / MIS /Assessments PROFESSIONAL EXPERIENCE Company's Name: TOYOTA TSUSHO INDIA PVT TD Duration: Since November 2006 till Date Toyota Tsusho is group Company of Toyota group, Company is into Trading and manufacturing activity, having its main office in Bangalore and Branches in Mumbai, Bangalore, New Delhi, Chennai & Manesar Gurgon, the Bangalore HO office is suited in Bangalore Rural Dist. Bidadi. Its Turnover is 330 Crore P.A. Designation: Asst. Manger Finance & Accounts Reporting To: GM & Finance Manger Responsibilities:

Finalization of Accounts, Preparation of Balance sheet, P & L Account & Corporate Tax, as per Indian Accounting Practice. Annual Income Tax Retunes, Transfer Pricing Reports, Capex Management & Depreciation as per Companies Act and Income Tax Act. Handling Fund Flow Management for all Branches. Responsible for Audit, Bank, Four ex Booking, Debtors and Creditors Reconciliation and Scrutiny of Ledger Assisting in preparation of reports in relates to Japan Reporting (Tores Software). Independently handling Insurance of all Branches. Handling of Corporate Tax as per Company Act and IT Act & FBT. Independently handling Income Tax, TP Assessments. Preparation of monthly stock statement and filing with bank, TDS Computation, IT Quarterly e-return, using Saral TDS Corporate Software, Income Tax, Service Tax, Excise PLA & Sales Tax Payments through E-Payment. Independently Taking Care of Tally ERP 9 1.61 Software. MIS Activities – Involved in analysis and preparation of MIS reports, Cash flow statements, Age wise analysis of Debtors and Creditors. Company's Name: ITC Filtrona Ltd., Duration: October 2005 To November 2006 Designation: Deputy Manager Accounts Reporting To: Financial Controller Responsibilities:

Finalisation of Accounts, Preparation of Balance sheet, P & L Account & Corporate Tax, as per Indian and UK Accounting Practice. Depreciation as per Companies Act & Income Tax Act., Insurance, Fund Management, Capex , Audit, Reconciliation of Bank, Debtors and Creditors, Scrutiny of Ledger, Related party Transaction for TP Audit, TDS Activity, Preparation of Stock Statements, Stock Audit, Attending for Assessments, Handling of Corporate Tax as per Company Act and IT Act & FBT. MIS Activities

Company's Name: Heidelberg Prominent Fluid Controls (I) (P) Ltd., Duration: August 1997-February 2005 Designation: Senior Accounts & Administration Officer Reporting To: Managing Director Responsibilities:

Looking after Book keeping, Banking Transactions, Capex, Scrutiny of ledgers, Reconciliation of Bank Account, Handling Audit, Finalization of Accounts, Computation of company Income Tax, Excise, Sales Tax, Import & Export, Costing, Looking after TDS & Retunes Filing, Preparation of Various MIS, Personal & Administrative Activity. Attending Assessment of Excise, Sales Tax & Income Tax Department Company's Name: Sandur Prominent Fluid Controls Ltd., Duration: February 1997 – July 1997 Designation: Accounts Officer Reporting To: General Manager Responsibilities:

Looking after Book keeping, Banking Transactions, Scrutiny of ledgers, Reconciliation of Bank Account, Handling Audit, Finalization of Accounts as per AS 16, Computation of company Income Tax, Excise Records, Sales Tax, Import & Export documentation, Product Costing, Looking after TDS & Retunes Filing, Preparation of Various MIS, Personal Department Activity. Attending Assessment of Excise, Sales Tax & Income Tax Department

Company's Name: Gemini Dyeing & Printing Mills Ltd., Duration: January 1991 – January 1997 Designation: Junior Accounts Officer Reporting To: Manager – Finance & Accounts Responsibilities: Books Keeping, Writing Cheques, Banking Transactions, Exports Documentation, Handling TDS, Preparing Sales Tax, Professional Tax, TDS Returns, Reconciliation of Bank Accounts and Inter Branch Transactions. Scrutiny of Legers Assisting in Finalization of Accounts