MANAGERIAL ECONOMICS 2008/09

PRACTICE EXAMINATION PAPER

DURATION = 2 HOURS

You must answer 10 questions from Part A, and 3 questions from Part B.

PART A

ANSWER ANY 10 QUESTIONS FROM PART A

PART A CARRIES 40% OF THE TOTAL MARK

A1. In consumer theory, the slope of an indifference curve shows: a. The change in utility from consumption of an additional unit of the good. b. The ratio of the prices of the two goods. c. The price elasticity of demand. d. The rate at which the consumer is willing to exchange one good for another, while utility is held constant. e. None of the above.

P 120

100

80 ) $ (

60 e c i r P

40 Demand

20

Q

0 200 400 600 800 1,000 1,200

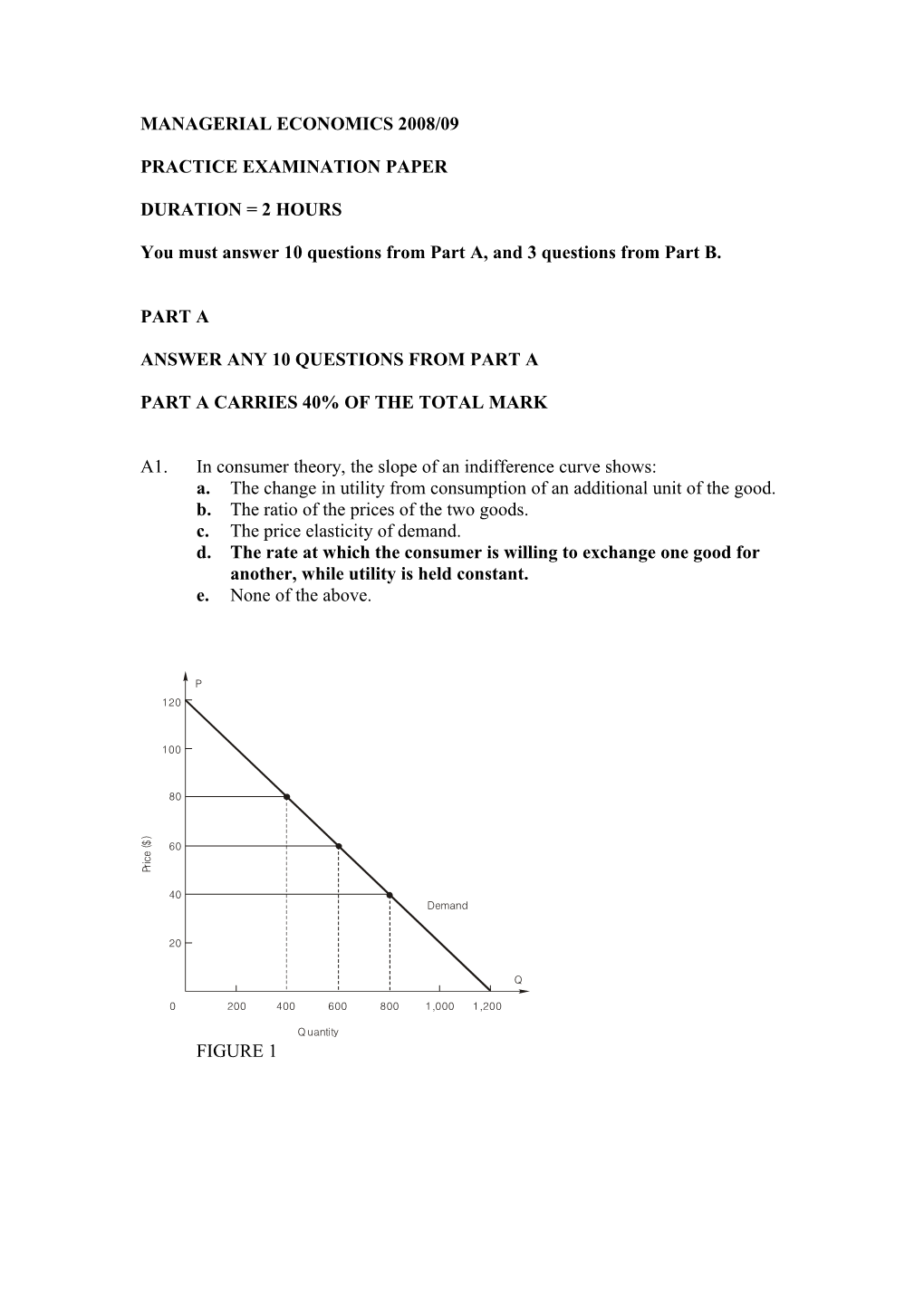

Q uantity FIGURE 1 A2. REFER TO FIGURE 1

What is the point price elasticity of demand when price is $80? a. 0.50 b. 0.75 c. 1.00 d. 1.60 e. 2.00

Q 1200 10 P 120

Q P 80 E 10 2.00 P Q 400

A3. REFER TO FIGURE 1

What is the interval (arc) elasticity of demand over the price range $40 to $60? a. 0.71 b. 0.94 c. 1.00 d. 1.42 e. 2.12

Q 1200 10 P 120

Q average P 50 E 10 0.71 P averageQ 700

A4. Fill in the blanks in the following table:

Units Total Average Marginal of labour product product product 1 40 40 40 2 88 44 48 3 129 43 41 4 164 41 35 5 190 38 26 6 204 34 14

Row 1: TP=AP=MP=40 when L=1

Row 2: AP=TP/L = 88/2 = 44 MP=TP(L-2)-TP(L=1)=88-40-48 Row 3: TP(L=3)=TP(L=2)+MP=88+41=129 AP = mTP/L = 129/3 =43

Row 4: TP = APL = 414 = 164 MP=TP(L=4)-TP(L=3)=164-129=35

Row 5: Same as Row 2

Row 6: Same as Row 4

A5. Which of the following statements is true?

a. In the short run all inputs are fixed. b. In the long run a firm is making the optimal input choice when the marginal rate of technical substitution is equal to the input price ratio. c. Diminishing returns to labor means that adding one more worker will decrease output. d. Increasing returns to scale means that as the firm becomes larger, its costs decrease and its profit increases. e. Constant returns to scale means that as the firm uses more labour and capital to produce more output, its profits remain constant. A6. A firm is using 50 units of labor and 100 units of capital to produce 2,000 units of output. The price of labor is $200 per unit and the price of capital is $100 per unit. At these input levels, another unit of labor adds 400 units to output and another unit of capital adds 600 units to output. The firm

a. Is minimizing the cost of producing 2,000 units of output. b. Could produce 6 more units of output at the same cost by switching $1 from labor to capital. c. Could produce 4 more units of output at the same cost by switching $1 from labor to capital. d. Could keep output constant and reduce cost by using more capital and less labor. e. Both c and d

The last $ spent on labour adds 400/200 = 2 units of output. The last $ spent on capital adds 600/100 = 6 units of output. Therefore by switching $1 from labour to capital, the firm could gain -2+6 = +4 units of output.

MP MP Alternatively, K 6, L 2 r w Therefore the firm should use more capital and less labour.

A7. In a competitive industry the market-determined price is $12. A firm is currently producing 50 units of output; average total cost is $10, marginal cost is $15, and average variable cost is $7. In order to maximize profit, the firm should: a. Produce more because the firm is earning a profit of $100. b. Keep output the same because the firm is earning a profit of $100. c. Produce more because the next unit of output increases profit by $2. d. Produce less because the last unit of output decreased profit by $3.

MR = P = $12. SMC = $15. Therefore the firm lost $3 on the lat unit of output. The firm should reduce output, until MR=SMC. FIGURE 2 A8. REFER TO FIGURE 2

In the short run, market price in a perfectly competitive industry is $2.60. The maximum profit that a perfectly competitive firm can earn is:

a. $2860 b. $2600 c. $1600 d. $1100 e. $800

When P=MR=2.60, MR=SMC at Q=1100 and ATC=1.60 Therefore profit = (2.60-1.60)1100 = 1100

A9. A monopolist will

a. Always charge a price higher than average cost. b. Always charge a price higher than marginal cost. c. Shut down if price is lower than average fixed cost.. d. Shut down if price is lower than average cost. e. Always earn a positive economic profit.

A10. In game theory, what is a Nash equilibrium?

a. A solution that represents the best possible outcome for both firms. b. A cooperative solution. c. A solution that represents the best outcome for each firm, assuming that the strategy chosen by the other firm stays unchanged. d. A solution in which both firms select their dominant strategies. e. None of the above.

A11. In a duopoly with two firms A and B, A’s best-response curve is upward- sloping because

a. When B increases its quantity produced and sold, A should always increase its price. b. When B increases its price, A should always increase its price. c. A’s profit is always positively related to the price A charges. d. Both a and c. e. Both b and c. A12. For price discrimination to be possible

a. It must be difficult for consumers in one market to sell to consumers in another market. b. Every consumer must have the same individual demand curve. c. The seller must produce several different brands or varieties of its product or service. d. a and c. e. b and c.

PART B

ANSWER ANY 3 QUESTIONS FROM PART B

PART B CARRIES 60% OF THE TOTAL MARK

Y

700 Total effect (A to B)

600 Substitution effect

500

Y Income effect

d o

o 400 g

f o

y t i t A n

a 300 u Q

200 B II

100

I X

0 100 200 300 400 500 600 700 800

Q uantity of good X FIGURE 3

B1. Figure 3 refers to the effect of an increase in the price of Good X.

(a) If the consumer’s income is $900 and the price per unit of Good Y is $2, what is the price of good X after the increase in price takes place?

Use the budget line that passes through (X=300, Y=0) and (X=0, Y=450)

At (X=300, Y=0), XPX =300PX = 900 Therefore PX = 900/300 = $3 (b) What is the marginal rate of substitution of Good Y for Good X at the consumer’s utility maximizing position after the increase in the price of Good X takes place?

MRS = slope of indifference curve = slope of budget line = PX/PY = 3/2 = 1.5

(c) Use the diagram to identify the substitution effect and the income effect of the increase in the price of Good X (precise numerical answers are not required.).

See diagram.

(d) Is Good X a normal good or an inferior good? Explain your answer.

Good X is an inferior good. The increase in PX causes the real value of the consumer’s income to decrease. But the income effect is positive; i.e. as the real value of income decreases, consumption of Good X increases.

(e) Draw on the graph the effect on the position of the budget line of a reduction in the consumer’s income to $600, which takes place after the price of Good X has increased.

See diagram: budget line runs from (X=200, Y=0) to (X=0, Y=300).

B2. Explain briefly what is meant by each of the following terms. You may use diagrams if you wish.

(a) Economic efficiency.

Economic efficiency means the firm is producing the maximum output it can produce from a given set of inputs. The inputs are being used up to their full capability.

(b) Technical efficiency.

Technical efficiency means the firm is producing a given amount of output as cheaply as possible. Technical efficiency requires the selection of the best combination of inputs given the current input prices, and it requires economic efficiency so that the inputs are being used to produce as much output as they are capable of producing.

(c) Isoquant.

An isoquant shows all the combinations of two inputs (labour and capital) that are capable of producing the same level of output – see diagram. Capital

Isoquant

K L

MRTS = slope = K/L

Labour

(d) Marginal rate of technical substitution.

The marginal rate of technical substitiution (MRTS) is the rate at which one input can be substituted for another, while total output remains constant. The MRTS is the slope of the isoquant – see diagram.

(e) Increasing returns to scale.

A given proportionate increase in the use of all inputs leads to a greater-than- proportionate increase in output (e.g. if all inputs are increased by 10%, output increases by 20%). Increasing returns to scale implies the firm benefits from economies of scale.

B3. (a) What are the assumptions of the theoretical model of monopoly?

1. There are many buyers, but there is only one seller. 2. The good or service produced and sold is unique, and there are no substitutes (complete product differentiation). 3. There are high barriers to entry, and the entry of outside firms into the industry is blocked. 4. The buyers and the seller may have either perfect or imperfect information. 5. Geographical location could be the defining characteristic which gives the selling firm its monopoly position, so transport costs could be positive.

(b) Show how a monopolist selects its profit-maximizing output level in the short run. Draw a diagram that shows the firm earning a positive economic profit in the short run. Price, Average cost

SMC

P

ATC

ATC

D

MR

Q Quantity

(c) A monopolist may earn a positive economic profit in the long run, because its monopoly position is protected by barriers to entry. Briefly describe the main types of barrier to entry.

Economies of scale can act as a barrier to entry. A new firm may have to produce at a large scale in order to achieve the minimum long run average cost (LAC). A firm that does not achieve the minimum LAC may face a large cost disadvantage.

An established firm has an absolute cost advantage if the LAC of the entrant is higher than the LAC of the established firm. The established firm may use a more efficient production process, or hold a patent. It may control access to certain inputs, or it may have access to cheaper sources of fi- nance.

Legal barriers to entry include registration, certification and licensing of businesses and products; monopoly rights granted by law; patents; and any taxation or employment law that makes entry difficult.

If there are brand loyalties, it is difficult for an entrant to tempt customers away from their existing suppliers.

Consumer lock-in occurs when high switching costs are incurred if the consumer shifts to another brand. Finally, there are network externalities when an established firm has already established a large network of customers, and it is more convenient for new customers to use the same established network as everyone else.

(d) Compare the long run profit maximizing equilibrium for a monopoly with the long run profit maximizing equilibrium for a firm in monopolistic competition. Discuss the similarities and differences between these two cases.

Price, Average cost

LMC

P LAC SMC ATC LAC=ATC

D MR

Quantity Q

MONOPOLY

Price, Average cost

LMC

LAC SMC ATC P= LAC=ATC D

MR

Quantity Q

MONOPOLISTIC COMPETITION The monopolist’s demand curve is the market demand curve. It is possible for the monopolist to earn a positive economic profit in the long run, with P>LAC.

The monopolistic competitor’s demand curve is the demand for its brand. There are close substitutes produced by competitors, and demand is relatively price elsatic. It is not possible for the firm to earn a positive economic profit in the long run, because entry would cause any positive economic profit to disappear. The long run equilibrium is located at a point of tangency between D and LAC, with P=LAC and zero economic profit.

B4. The following payoff table shows the profits to two firms, A and B, that need to decide whether to allocate a high or a low advertising budget:

B’s strategy High Low High +50 +60 +90 +30 A’s strategy Low +40 +100 +70 +80

(a) Identify the dominant strategy equilibrium for this game, and explain your answer.

To find A’s dominant strategy:

If B chooses High, A should choose High (+50>+40). If B chooses Low, A should choose High (+90>+70).

Therefore High is A’s dominant strategy.

To find B’s dominant strategy:

If A chooses High, B should choose High (+60>+30). If A chooses Low, B should choose High (+100>+80).

Therefore High is B’s dominant strategy.

Therefore (High, High) is the dominant strategy equilibrium.

(b) Is there an alternative cooperative solution that could offer both players a higher return than they achieve at the dominant strategy equilibrium?

(Low, Low) would give both players a higher return than they achieve at the dominant strategy equilibrium. (+70, +80) is better than (+50, +60) for both players. However, (Low, Low) is strategically unstable: there are incentives for both players to ‘cheat’ and revert from low to High.

(c) What factors might be helpful in allowing the firms to stay with the cooperative solution. 1. Good communication between the firms. If the firms meet or talk frequently, they can exchange information and monitor each other’s actions, and they are more likely to stick to the cooperative solution.

2. If one firm can react or retaliate quickly if the other firm ‘cheats’, then they are more likely to stick to the cooperative solution. If retaliation takes a long time, the cooperative solution is more likely to break down.

3. If the game is repeated frequently, the firms are likely to learn from experience that cooperation is better ‘cheating’. They learn over time that heavy advertising leads to heavy advertising from competitors, that tends to cancel out any short-term gains.