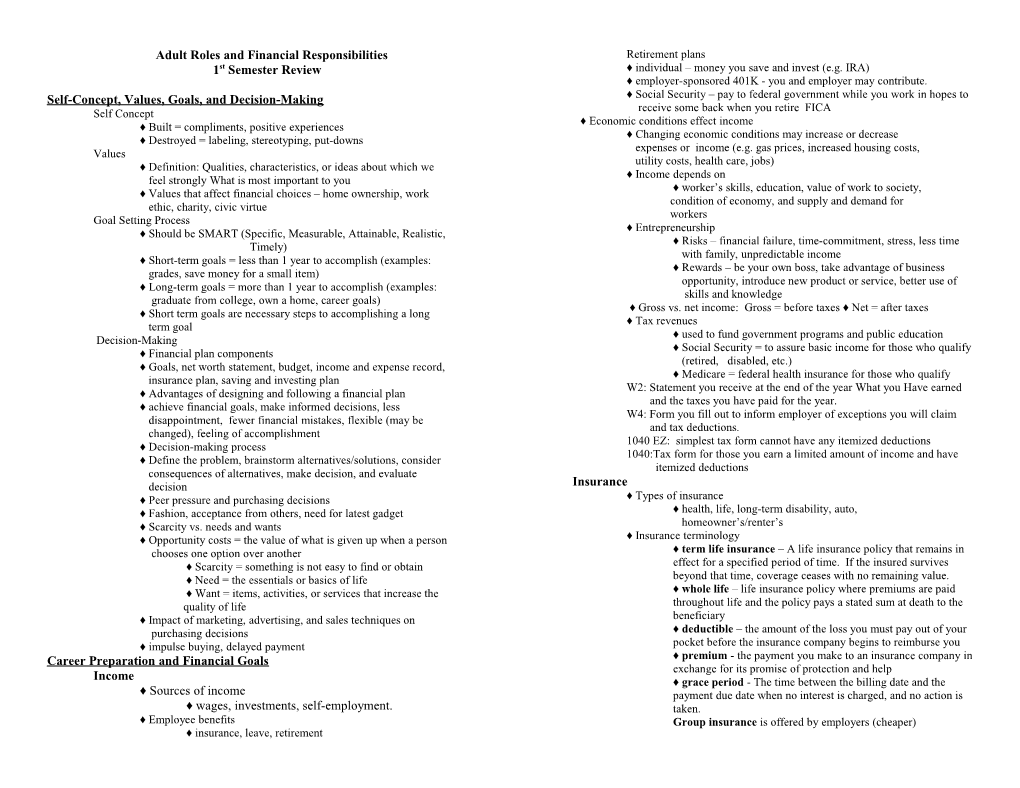

Adult Roles and Financial Responsibilities Retirement plans 1st Semester Review ♦ individual – money you save and invest (e.g. IRA) ♦ employer-sponsored 401K - you and employer may contribute. Self-Concept, Values, Goals, and Decision-Making ♦ Social Security – pay to federal government while you work in hopes to receive some back when you retire FICA Self Concept ♦ Economic conditions effect income ♦ Built = compliments, positive experiences ♦ Changing economic conditions may increase or decrease ♦ Destroyed = labeling, stereotyping, put-downs expenses or income (e.g. gas prices, increased housing costs, Values utility costs, health care, jobs) ♦ Definition: Qualities, characteristics, or ideas about which we ♦ Income depends on feel strongly What is most important to you ♦ worker’s skills, education, value of work to society, ♦ Values that affect financial choices – home ownership, work condition of economy, and supply and demand for ethic, charity, civic virtue workers Goal Setting Process ♦ Entrepreneurship ♦ Should be SMART (Specific, Measurable, Attainable, Realistic, ♦ Risks – financial failure, time-commitment, stress, less time Timely) with family, unpredictable income ♦ Short-term goals = less than 1 year to accomplish (examples: ♦ Rewards – be your own boss, take advantage of business grades, save money for a small item) opportunity, introduce new product or service, better use of ♦ Long-term goals = more than 1 year to accomplish (examples: skills and knowledge graduate from college, own a home, career goals) ♦ Gross vs. net income: Gross = before taxes ♦ Net = after taxes ♦ Short term goals are necessary steps to accomplishing a long ♦ Tax revenues term goal ♦ used to fund government programs and public education Decision-Making ♦ Social Security = to assure basic income for those who qualify ♦ Financial plan components (retired, disabled, etc.) ♦ Goals, net worth statement, budget, income and expense record, ♦ Medicare = federal health insurance for those who qualify insurance plan, saving and investing plan W2: Statement you receive at the end of the year What you Have earned ♦ Advantages of designing and following a financial plan and the taxes you have paid for the year. ♦ achieve financial goals, make informed decisions, less W4: Form you fill out to inform employer of exceptions you will claim disappointment, fewer financial mistakes, flexible (may be and tax deductions. changed), feeling of accomplishment 1040 EZ: simplest tax form cannot have any itemized deductions ♦ Decision-making process 1040:Tax form for those you earn a limited amount of income and have ♦ Define the problem, brainstorm alternatives/solutions, consider itemized deductions consequences of alternatives, make decision, and evaluate decision Insurance ♦ Peer pressure and purchasing decisions ♦ Types of insurance ♦ Fashion, acceptance from others, need for latest gadget ♦ health, life, long-term disability, auto, ♦ Scarcity vs. needs and wants homeowner’s/renter’s ♦ Opportunity costs = the value of what is given up when a person ♦ Insurance terminology chooses one option over another ♦ term life insurance – A life insurance policy that remains in ♦ Scarcity = something is not easy to find or obtain effect for a specified period of time. If the insured survives ♦ Need = the essentials or basics of life beyond that time, coverage ceases with no remaining value. ♦ Want = items, activities, or services that increase the ♦ whole life – life insurance policy where premiums are paid quality of life throughout life and the policy pays a stated sum at death to the ♦ Impact of marketing, advertising, and sales techniques on beneficiary purchasing decisions ♦ deductible – the amount of the loss you must pay out of your ♦ impulse buying, delayed payment pocket before the insurance company begins to reimburse you Career Preparation and Financial Goals ♦ premium - the payment you make to an insurance company in exchange for its promise of protection and help Income ♦ grace period - The time between the billing date and the ♦ Sources of income payment due date when no interest is charged, and no action is ♦ wages, investments, self-employment. taken. ♦ Employee benefits Group insurance is offered by employers (cheaper) ♦ insurance, leave, retirement Budgeting Budgeting terms Communication ♦ Budget – itemized forecast of income and expenses expected for Levels of communication some period in the future ♦ Superficial = majority of our communication (events, weather, etc.) ♦ Fixed expense – doesn’t change over time (e.g. car payment, ♦ Personal = talking about feelings, beliefs, & opinions that mean mortgage payment, insurance premium) something to you ♦ Variable expense – changes constantly (e.g. food, clothing, ♦ Validating = reinforces peoples’ feelings about themselves entertainment) Destructive Tools – envelope system, computer programs, paper tracking ♦ Blaming, interrupting, endless fighting, character assassination, Opportunity cost in budget implementation – takes time to plan and calling in reinforcements, withdrawal, need to be right evaluate but will help keep spending within income and help Constructive meet financial goals ♦ “I” messages, clarity, timing, asking questions, reflective To become financially independent, you must spend less than you earn listening, respect & consideration, avoiding intense anger Active/reflective listening Recommended budget ♦ listener mirrors back the thoughts and/or feelings the speaker ♦ Housing 25-35% experiencing ♦ Food 15-20% ♦ Asking questions, nod for understanding, positive body ♦ Transportation 17% language, appropriate conversation distance ♦ Clothing 7% Non-verbal Communication: Body -Language; orientation, posture, ♦ Debt < 20% gestures, face & eyes, touching, clothing Consumerism Personal Space: Intimate/ Personal/ Social/ Public Rights ♦ To safety, to be informed, to choose, to be heard Culture can change the distance of personal space. Comparison shopping Dating Purposes of Dating: socialize, mate selection and fun ♦ looking at different brands and models of the same item in Stages of Dating: gushy, playing games and goal oriented various stores to compare price, quality, features, and store When dating show concern for the partners feeling services before buying price isn’t an indicator of quality Love VS Infatuation ♦ It is important to read labels to know exactly what you are STD’s curable/not curable buying and to make an accurate comparison Sexual Responsibility Values consistent with behavior Agencies and publications for consumer protection Refusal skills must be clear ♦ Better Business Bureau, FDA, FTC, CPSC, Bureau of Consumer Date rape: power and dominance Protection, Consumer Reports Teen Pregnancy Identity Theft and Fraud Violence and Abuse Cycle ♦ Check credit report often, keep SSN secure, properly dispose of ADDED NOTES: outdated documents, limit personal information in wallet or purse Understanding financial contracts ♦ disclosure information, grace period, payment penalties, method of interest calculation

Avoiding excessive debt and collection practices ♦ sell assets, negotiate a repayment schedule Illegal frauds/scams ♦ ponzi/pyramid schemes and affinity fraud