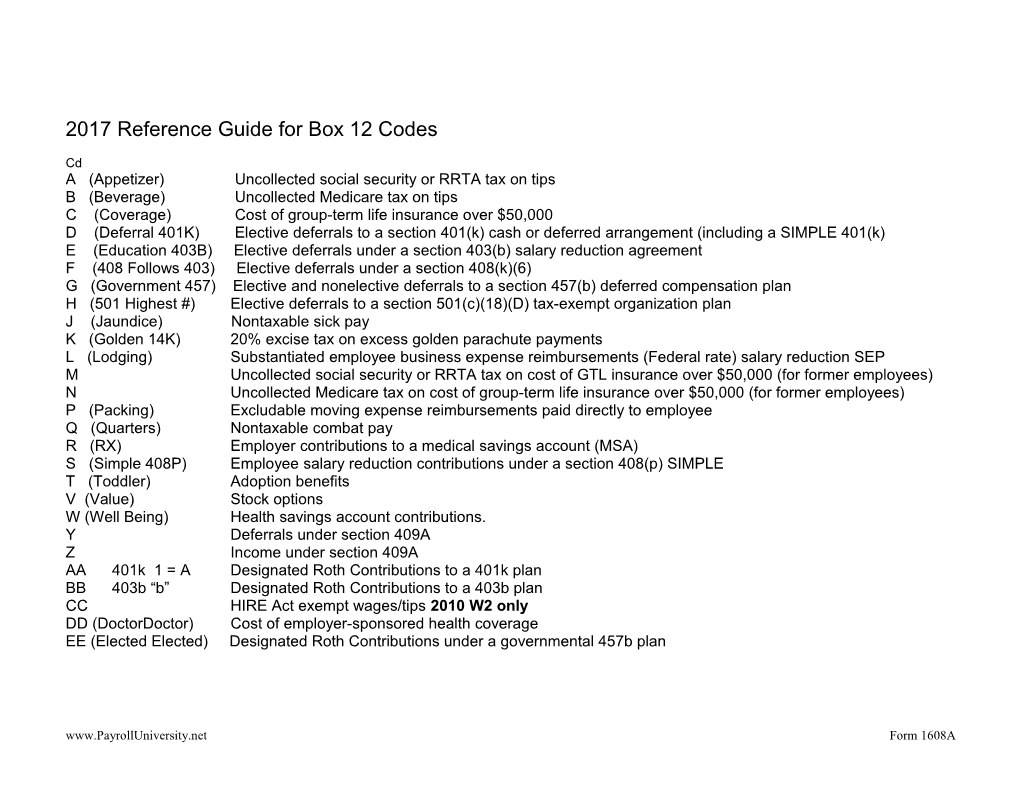

2017 Reference Guide for Box 12 Codes

Cd A (Appetizer) Uncollected social security or RRTA tax on tips B (Beverage) Uncollected Medicare tax on tips C (Coverage) Cost of group-term life insurance over $50,000 D (Deferral 401K) Elective deferrals to a section 401(k) cash or deferred arrangement (including a SIMPLE 401(k) E (Education 403B) Elective deferrals under a section 403(b) salary reduction agreement F (408 Follows 403) Elective deferrals under a section 408(k)(6) G (Government 457) Elective and nonelective deferrals to a section 457(b) deferred compensation plan H (501 Highest #) Elective deferrals to a section 501(c)(18)(D) tax-exempt organization plan J (Jaundice) Nontaxable sick pay K (Golden 14K) 20% excise tax on excess golden parachute payments L (Lodging) Substantiated employee business expense reimbursements (Federal rate) salary reduction SEP M Uncollected social security or RRTA tax on cost of GTL insurance over $50,000 (for former employees) N Uncollected Medicare tax on cost of group-term life insurance over $50,000 (for former employees) P (Packing) Excludable moving expense reimbursements paid directly to employee Q (Quarters) Nontaxable combat pay R (RX) Employer contributions to a medical savings account (MSA) S (Simple 408P) Employee salary reduction contributions under a section 408(p) SIMPLE T (Toddler) Adoption benefits V (Value) Stock options W (Well Being) Health savings account contributions. Y Deferrals under section 409A Z Income under section 409A AA 401k 1 = A Designated Roth Contributions to a 401k plan BB 403b “b” Designated Roth Contributions to a 403b plan CC HIRE Act exempt wages/tips 2010 W2 only DD (DoctorDoctor) Cost of employer-sponsored health coverage EE (Elected Elected) Designated Roth Contributions under a governmental 457b plan

www.PayrollUniversity.net Form 1608A