February 02, 2015

Rite Aid Corporation (RAD-NYSE)

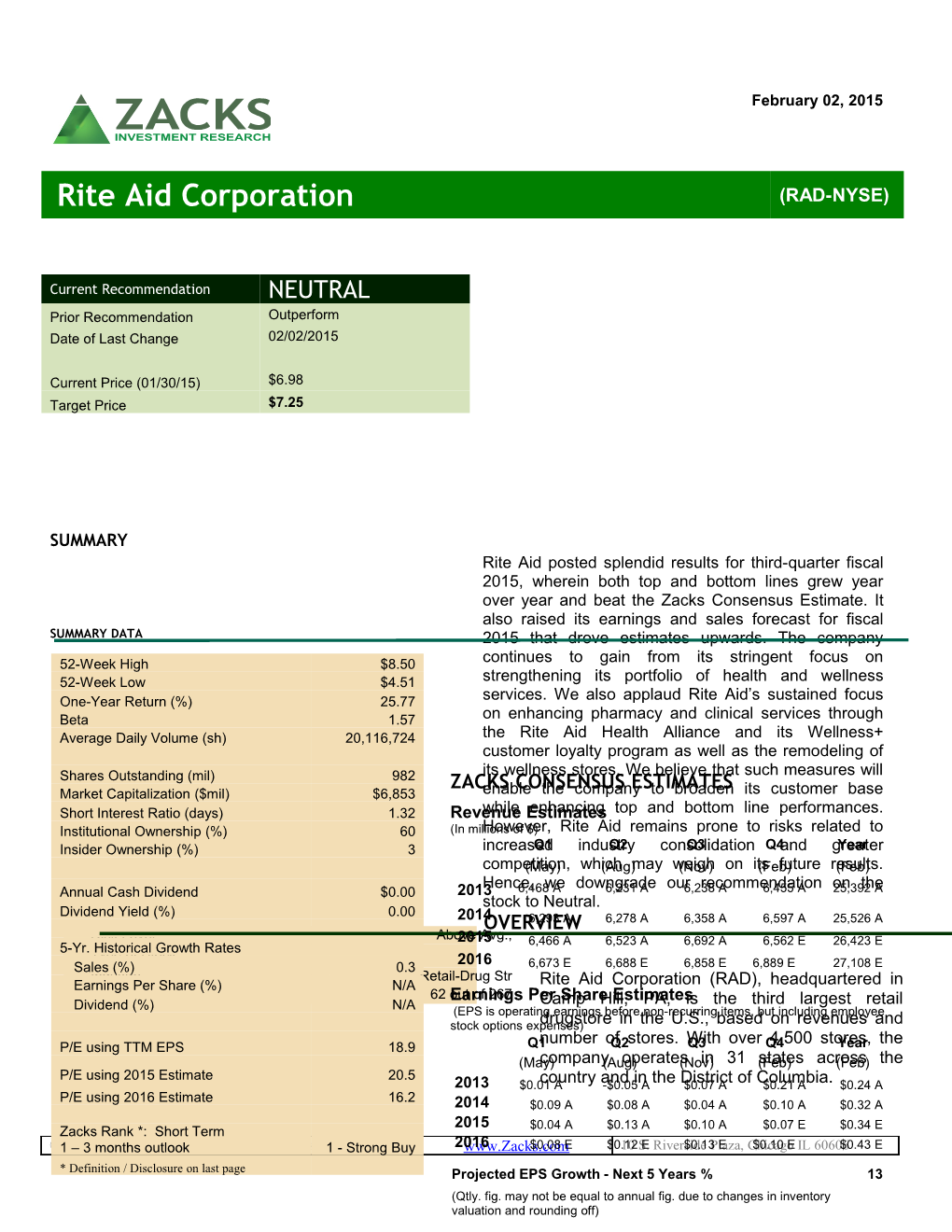

Current Recommendation NEUTRAL Prior Recommendation Outperform Date of Last Change 02/02/2015

Current Price (01/30/15) $6.98 Target Price $7.25

SUMMARY Rite Aid posted splendid results for third-quarter fiscal 2015, wherein both top and bottom lines grew year over year and beat the Zacks Consensus Estimate. It also raised its earnings and sales forecast for fiscal SUMMARY DATA 2015 that drove estimates upwards. The company 52-Week High $8.50 continues to gain from its stringent focus on 52-Week Low $4.51 strengthening its portfolio of health and wellness One-Year Return (%) 25.77 services. We also applaud Rite Aid’s sustained focus Beta 1.57 on enhancing pharmacy and clinical services through Average Daily Volume (sh) 20,116,724 the Rite Aid Health Alliance and its Wellness+ customer loyalty program as well as the remodeling of its wellness stores. We believe that such measures will Shares Outstanding (mil) 982 ZACKS CONSENSUS ESTIMATES Market Capitalization ($mil) $6,853 enable the company to broaden its customer base Short Interest Ratio (days) 1.32 Revenuewhile Estimates enhancing top and bottom line performances. Institutional Ownership (%) 60 (In millionsHowever, of $) Rite Aid remains prone to risks related to Insider Ownership (%) 3 increasedQ1 industryQ2 consolidationQ3 Q4 and greaterYear competition,(May) which(Aug) may weigh(Nov) on its(Feb) future results.(Feb) Hence, we downgrade our recommendation on the Annual Cash Dividend $0.00 2013 6,468 A 6,231 A 6,238 A 6,455 A 25,392 A stock to Neutral. Dividend Yield (%) 0.00 2014OVERVIEW6,293 A 6,278 A 6,358 A 6,597 A 25,526 A Risk Level * Above2015 Avg., 6,466 A 6,523 A 6,692 A 6,562 E 26,423 E 5-Yr. Historical Growth Rates Type of Stock 2016 Sales (%) 0.3 6,673 E 6,688 E 6,858 E 6,889 E 27,108 E Industry Retail-Drug Str Earnings Per Share (%) N/A Rite Aid Corporation (RAD), headquartered in Zacks Industry Rank * 62 outEarnings of 267 PerCamp Share Hill, Estimates PA, is the third largest retail Dividend (%) N/A (EPS is operating earnings before non-recurring items, but including employee stock options expenses)drugstore in the U.S., based on revenues and number of stores. With over 4,500 stores, the P/E using TTM EPS 18.9 Q1 Q2 Q3 Q4 Year (May)company(Aug) operates(Nov) in 31 (Feb) states across(Feb) the P/E using 2015 Estimate 20.5 2013 $0.01country A and-$0.05 in A the District$0.07 A of Columbia.$0.21 A $0.24 A P/E using 2016 Estimate 16.2 2014 $0.09 A $0.08 A $0.04 A $0.10 A $0.32 A 2015 Zacks Rank *: Short Term $0.04 A $0.13 A $0.10 A $0.07 E $0.34 E ©1 2015 – 3 monthsZacks Investment outlook Research, All Rights reserved.1 - Strong Buy 2016www.Zacks.com$0.08 E $0.1210 S.E Riverside$0.13 Plaza, E Chicago$0.10 E IL 60606$0.43 E

* Definition / Disclosure on last page Projected EPS Growth - Next 5 Years % 13 (Qtly. fig. may not be equal to annual fig. due to changes in inventory valuation and rounding off) The company’s pharmacy operations accounted for 67.9% of fiscal 2014 total sales while the remaining 32.1% was generated by a wide assortment of "front end" products. The front end products include over-the-counter (OTC) medications accounting for 9.8% of fiscal 2014 total sales, health and beauty aids contributing 5.1% to total sales in the fiscal and general merchandise which includes personal care items, cosmetics, household items, beverages, convenience foods, greeting cards, seasonal merchandise, numerous other convenience products and photo processing contributing 17.2% to total sales.

Around 61% of the Rite Aid’s stores are focused on remodeling its wellness stores, freestanding, about 52% consist of drive-thru which now feature a new Vision Center, pharmacy and 48% include a GNC store within Diabetic Diagnostic Center, Men’s Rite Aid Store. Grooming, Nail bar, Hair care aisle, Grab and go cooler and so on. The newly Rite Aid purchases all of its pharmaceutical renovated wellness stores tempt (branded or generic) from McKesson Corp. customers to spend more time on selecting Moreover, the company purchases its non- their personal care products, thereby pharmaceutical merchandise from various enabling the company to generate manufacturers and suppliers. increased sales. Recently, the company reopened a remodeled wellness store in Beverly Hills, featuring its most successful REASONS TO BUY merchandising concepts as well as innovative inclusions like a Fresh Day Café and a patio area to enhance the shopping Strong Q3 Earnings and Robust experience. As of the third-quarter end, Guidance Drive Estimates Upward: Rite Rite Aid had remodeled more than a third Aid posted better-than-anticipated results of its entire store base across the country, for third-quarter fiscal 2015 with both top operating a total of 1,529 Wellness stores. and bottom line improving year over year. The company intends to remodel 450 The company’s robust performance in the stores to the wellness store format in fiscal quarter was attributed to strong same-store 2015. sales (comps) growth driven by a rise in prescription count as well as improved Strategic Initiatives to Drive Growth: gross margin due to efficient expense Rite Aid has been undertaking a number of management. Further, the company gained strategies to drive growth such as the from its stringent focus on strengthening its expansion of its pharmacy and clinical portfolio of health and wellness services. services and the reduction of costs. The Additionally, the company raised its sales, company has applied additional resources, adjusted EBITDA, net income and earnings such as Wellness+ customer loyalty per share guidance for fiscal 2015, which program as well as Flu Immunization has led to upward revisions in the Zacks program to stimulate customer demand Consensus Estimate for the fourth quarter, amid the challenging macroeconomic fiscal 2015 and 2016 in the last 60 days. scenario. The company’s Wellness+ customer loyalty program has been Enhancing Customer Experience to successful in attracting customers as the Gain Market Share: In order to increase Wellness+ members in fiscal 2014 its market share in an extremely accounted for 78% of front-end sales. On competitive industry, the company has

Equity Research RAD | Page 2 the cost front, the company is focusing on bargaining power, thereby resulting in generating cost savings through increased pressure on the company’s centralized indirect procurement of drugs products and services prices. To compete and reduction in supply chain costs. We with such large enterprises, Rite Aid will believe that these programs and initiatives have to either increase its revenue streams will enable the company to increase its or reduce costs. customer base and facilitate generation of long-term profitability as well. Uncertainty Over Future Growth Prospects due to Slow down in Health Alliance Program – A New Pharmacy Sales: In the United States, Strategy to Boost Top-line: Rite Aid pharmacy sales growth has slowed down Health Alliance is Rite Aid’s health due to longer FDA approval process, drug management arm, under which it works safety concerns, and a loss of individual together with different healthcare providers health insurance due to unemployment and to offer holistic care to patients suffering an increase in the use of non-brand drugs, from chronic or poly-chronic health which are less expensive but generate problems. Started in Mar 2014, Rite Aid higher gross margin. These factors may has been aggressively focusing on undermine the company’s growth expansion of its Health Alliance program prospects and profitability. across all its stores in order to improve customer traffic and top line. Rite Aid’s Competitive Risks: Rite Aid’s generic Health Alliance is currently available at the drug sales are adversely affected by Wal- company’s Buffalo, NY; Greensboro, NC; Mart’s strategy of entering the retail and Hershey, PA area pharmacies generic drug market. Due to Wal-Mart’s together with the latest extension into the wide array of manufacturers in India, Israel, Southern California region. The company’s and the U.S., the mass merchant offer recent partnerships for the expansion of its generic drugs at a discounted price Health Alliance program were with compared to its rival companies. California-based healthcare services provider, Heritage Provider Network (HPN) in Southern California and Penn State Hershey Health System in Hershey, PA, both of which were undertaken in June. Earlier, in April, Rite Aid had acquired Boston-based Health Dialog Services Corporation from Bupa Ltd., a London- RECENT NEWS based healthcare company, to expand its program. Rite Aid's Altered Credit Facility to Ease Debt Financing – Jan 13, 2015 REASONS TO SELL Rite Aid Corporation declared that it has made amendments to its current senior secured credit Consolidating Healthcare Industry – A facility, including the expansion of its borrowing Major Threat: Over the last few years, capacity and extension of the current maturity. many healthcare companies have merged to form a larger enterprise. As an The altered credit facility has raised the enterprise, these companies enjoy greater company’s borrowing capacity to up to $3 billion power as well as cost and pricing benefits. or $3.7 billion, if the retailer fully repays its The merger of Walgreen and Alliance Senior Secured Notes, bearing an interest rate Boots is a recent example of such alliance, of 8.00% and due 2020. which will together generate annual revenue of over $76 billion. Continuation of We note that the expansion of borrowing such a trend will reduce Rite Aid’s capacity has provided the company with greater

Equity Research RAD | Page 3 flexibility to pay its secured term loan. This is evident as Rite Aid utilized the loans from its new facility to fully settle and retire its Tranche Rite Aid Posts Robust Q3 Earnings & Raises 7 Senior Secured Term Loan, due 2020, with FY15 View – Dec 18, 2014 an outstanding balance of $1.147 billion. Apart from this, the company used these borrowings Rite Aid Corporation reported earnings of $0.10 to pay other related fees. per share, which rose over two-fold from the prior-year quarter and was double the Zacks Also, Rite Aid announced that it has extended Consensus Estimate. its current maturity to Jan 2020. As a result of this extension, the company expects to The company’s robust performance in the generate annual interest cost savings of nearly quarter is attributed to strong same-store sales $20 million or $50 million, depending on the (comps) growth driven by a rise in prescription borrowing capacity expansion to $3 billion or count as well as improved gross margin due to $3.7 billion, respectively. efficient expense management. Further, the company gained from its stringent focus on strengthening its portfolio of health and Rite Aid Reports Solid December Sales Data wellness services which also contributed – Jan 2, 2015 materially to its performance in the quarter.

Rite Aid Corporation’s comparable-store sales Rite Aid's third-quarter revenue rose 5.3% year (comps) for the four weeks ended Dec 27 rose over year to $6,692.3 million and surpassed the 5.3%. The improvement reflected an increase in Zacks Consensus Estimate of $6,643 million. front-end and pharmacy comps as well as Top-line growth was mainly driven by a 5.4% higher prescription count at comparable stores. increase in comps.

Pharmacy comps were up 7.3% that included a During the quarter, pharmacy comps increased negative impact of nearly 123 basis points from 7.2%, despite a negative impact of 228 basis generic drug introduction. Front-end comps points (bps) due to the introduction of new climbed 1.7%, while prescription count at generic drugs. Additionally, prescriptions filled comparable stores improved 5.1%. at comparable stores increased 4.5%, while front-end comps rose 1.6%. Prescription sales Rite Aid’s total drugstore sales stood at $2.212 constituted about 69.8% of total drugstore billion, up 4.9% from the year-ago figure of sales, while third-party prescription revenues $2.109 billion. Prescription sales constituted accounted for 97.6% of the pharmacy sales. 64.8% of total drugstore sales, while third-party prescription sales accounted for 97.6% of Quarter in Detail pharmacy sales. Coming to other financial details, Rite Aid's Further, the company reported a 4.3% rise in FIFO gross profit increased 5.4% year over comps for the 43-week period ended Dec 27. year to $1,924.9 million. Gross margin Pharmacy and front-end comps for the period expanded 4 bps to 28.76%, driven by higher were up 5.9% and 1%, respectively, while sales and expense leverage. Though selling, prescription count at comparable stores rose general and administrative (SG&A) expenses 3.6%. rose 3.7% to $1,692.4 million, as a percentage of sales it contracted 38 bps to 25.29%, Total drugstore sales for the 43-week period primarily due to effective cost management. improved 3.9% to $21.762 billion against $20.953 billion reported in the year-ago Rite Aid’s adjusted EBITDA increased 17.9% comparable period. Prescription sales year over year to $332.8 million. Moreover, as a constituted 68.6% of total drugstore sales. percentage of sales, it expanded 53 bps to Third-party prescription sales accounted for 4.97%. 97.5% of pharmacy sales.

Equity Research RAD | Page 4 Balance Sheet & Cash Flow 4.25% compared with the previously projected range of 3%–4%. At quarter-end, Rite Aid had cash and cash equivalents of $233 million and long-term debt Further, the company now expects adjusted (excluding current maturities) of $5,673.6 earnings before interest, taxes, depreciation million. The company ended the quarter with and amortization (EBITDA) for fiscal 2015 to $944 million of liquidity. Rite Aid had $780 range from $1.275–$1.305 billion compared million worth of outstanding debt under its $1.8 with $1.200–$1.275 billion guided earlier. Net billion senior secured credit facility and $71 income forecast for the fiscal is slashed to the million worth of outstanding letters of credit. $315–$370 million range from $223–$333 million. During the first three quarters of fiscal 2015, the company generated cash flow of $11.7 million As a result, full-year earnings per share are from operating activities and incurred capital estimated to be in the range of $0.31–$0.37 as expenditure of nearly $131.3 million. against the earlier forecast of $0.22–$0.33. The earnings per share estimate is primarily based For fiscal 2015, the company expects capital on the projected comps range and expectations expenditure of $525 million, out of which $250 of improvement in pharmacy margins. million is anticipated to be deployed toward store remodeling while $100 million will be spent on buying file. Additionally, the company VALUATION hopes to generate free cash flow of about $325–$375 million in fiscal 2015, on the back of lower pharmacy inventory and the acquisition of Rite Aid’s current trailing 12-month earnings RediClinic and Health Dialog. multiple is 18.9x, compared with the 17.1x for industry average and 18.6x for the S&P 500. Store Update Over the last five years, Rite Aid’s shares have traded in a range of 6.8x to 32.2x trailing 12- Rite Aid stores continue to undergo renovation, month earnings. Moreover, the stock is trading with 103 outlets being remodeled in the quarter. at a discount to the industry average based on Additionally, the company relocated 3 stores, forward earnings estimate. Our target price of expanded 1 store, acquired 6 stores and shut $7.25, based on 16.9x 2016 EPS, reflects this down 6 outlets during the quarter. As of quarter- view. end, the company completed wellness remodels at 1,529 stores. As of Nov 29, 2014, Rite Aid operated 4,572 stores across 31 states Key Indicators and the District of Columbia. P/E P/E 5-Yr 5-Yr P/E P/E Est. 5-Yr P/CF P/E High Low In fiscal 2015, the company intends to open 3 F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) new outlets,Rite Aid relocate Corporation 16 (RAD) stores, acquire 8 20.5 16.2 13.0 9.4 18.9 32.2 6.8 outlets and remodel 450 stores. Industry Average 24.1 41.7 13.5 14.1 17.1 N/A 9.0 S&P 500 16.1 15.1 10.7 16.1 18.6 19.4 12.0 Guidance Walgreen Boots Alliance Inc. (WBA) 20.5 16.7 11.6 15.9 22.1 22.7 11.4 Driven by CVSthe Caremarkstrong third-quarter Corp. (CVS) performance, 19.5 17.1 13.7 17.6 22.6 21.8 10.0 the companyHerbalife raised Limited its sales, (HLF) adjusted EBITDA, 6.2 6.5 2.4 4.7 5.4 21.5 6.5 GNC Holdings Inc. (GNC) 14.3 12.9 9.8 12.8 15.5 22.1 11.3 net income and earnings perTTM share is trailing guidance 12 months; for F1 is 2015 and F2 is 2016, CF is operating cash flow fiscal 2015. The company now anticipates sales for fiscal 2015 to be between $26.25P/B billion and $26.4 billion versus the previousLast guidanceP/B P/B ROE D/E Div Yield EV/EBITDA range of $26 to $26.3 billion. It hasQtr. also 5-Yrraised High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) Rite Aid Corporation its comps(RAD) growth guidance range0.2 to 3.75%–N/A N/A N/A -3.2 0.0 11.7

Industry Average 24.8 24.8 24.8 43.5 -0.4 0.5 N/A S&P 500 5.1 Equity9.8 Research3.2 24.8 N/A RAD2.0 | Page 5 N/A Equity Research RAD | Page 6 Earnings Surprise and Estimate Revision History DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of RAD. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1117 companies covered: Outperform - 15.8%, Neutral - 77.2%, Underperform – 6.4%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Equity Research RAD | Page 7