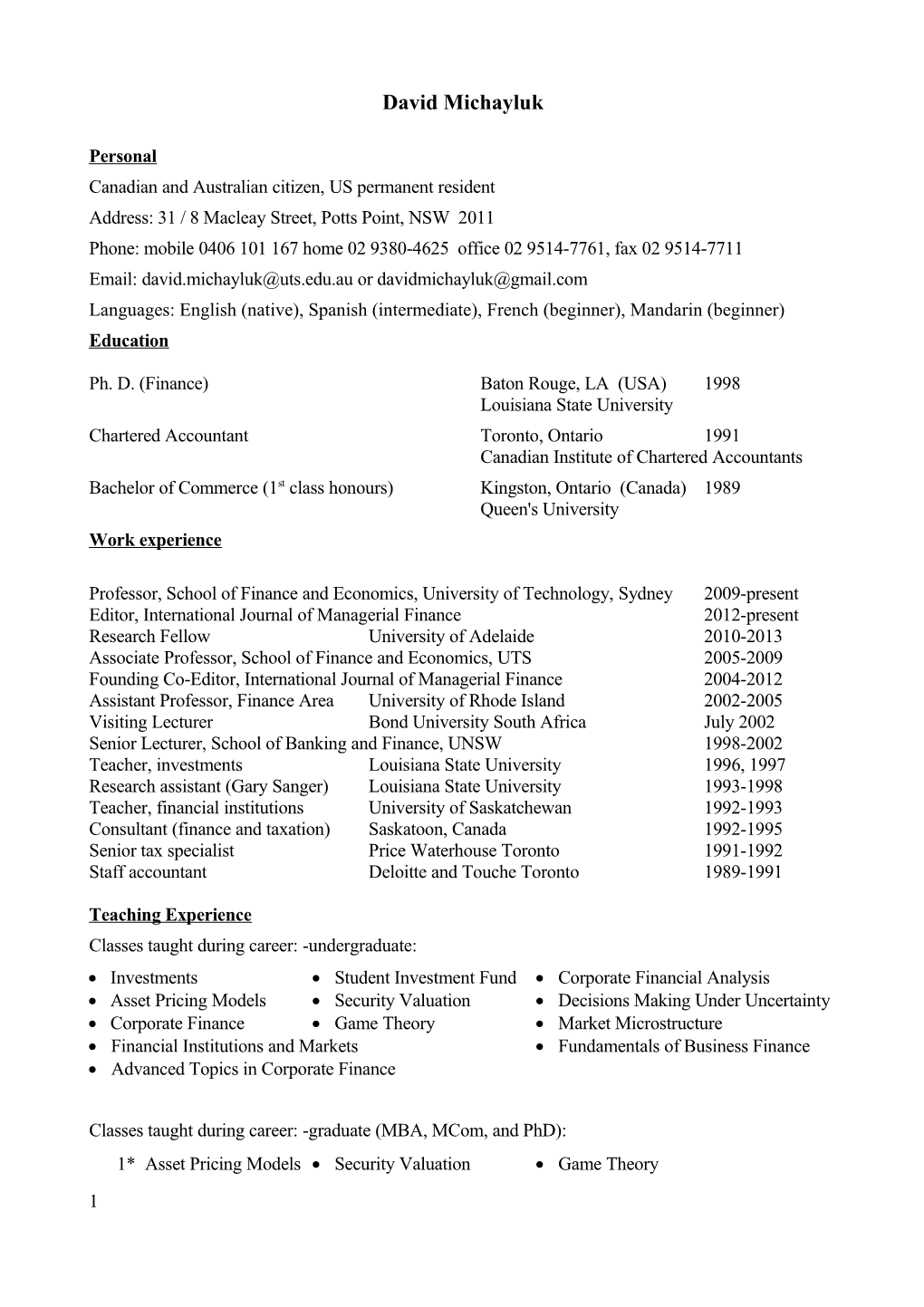

David Michayluk

Personal Canadian and Australian citizen, US permanent resident Address: 31 / 8 Macleay Street, Potts Point, NSW 2011 Phone: mobile 0406 101 167 home 02 9380-4625 office 02 9514-7761, fax 02 9514-7711 Email: [email protected] or [email protected] Languages: English (native), Spanish (intermediate), French (beginner), Mandarin (beginner) Education

Ph. D. (Finance) Baton Rouge, LA (USA) 1998 Louisiana State University Chartered Accountant Toronto, Ontario 1991 Canadian Institute of Chartered Accountants Bachelor of Commerce (1st class honours) Kingston, Ontario (Canada) 1989 Queen's University Work experience

Professor, School of Finance and Economics, University of Technology, Sydney 2009-present Editor, International Journal of Managerial Finance 2012-present Research Fellow University of Adelaide 2010-2013 Associate Professor, School of Finance and Economics, UTS 2005-2009 Founding Co-Editor, International Journal of Managerial Finance 2004-2012 Assistant Professor, Finance Area University of Rhode Island 2002-2005 Visiting Lecturer Bond University South Africa July 2002 Senior Lecturer, School of Banking and Finance, UNSW 1998-2002 Teacher, investments Louisiana State University 1996, 1997 Research assistant (Gary Sanger) Louisiana State University 1993-1998 Teacher, financial institutions University of Saskatchewan 1992-1993 Consultant (finance and taxation) Saskatoon, Canada 1992-1995 Senior tax specialist Price Waterhouse Toronto 1991-1992 Staff accountant Deloitte and Touche Toronto 1989-1991

Teaching Experience Classes taught during career: -undergraduate: Investments Student Investment Fund Corporate Financial Analysis Asset Pricing Models Security Valuation Decisions Making Under Uncertainty Corporate Finance Game Theory Market Microstructure Financial Institutions and Markets Fundamentals of Business Finance Advanced Topics in Corporate Finance

Classes taught during career: -graduate (MBA, MCom, and PhD): 1* Asset Pricing Models Security Valuation Game Theory

1 2* Market Microstructure Decision Making Under Uncertainty 3* Corporate Financial Analysis Research Activities Research Awards Best Paper Award, “Asymmetric Volatility, Correlation and Returns Dynamics Between the US and UK Securitise Real Estate Markets” with Pat Wilson and Ralf Zurbruegg at IPD Property Investment, 11th Annual European Real Estate Society Conference 2004, Milan announced at ERES 2005, Dublin. Book Chapters “Stock Splits, Stock Dividends, and Reverse Stock Splits,” in H Kent Baker (Editor) Dividends and Dividend Policy, 325-341, John Wiley & Sons, New Jersey, 2009. Accepted/Published Papers

David Michayluk and Ralf Zurbrugg. 2013. Do Lead Articles Signal Higher Quality in the Digital Age? Evidence from Finance Journals, Scientometrics, forthcoming. David Michayluk and Gerhard Van de Venter. 2013. Financial Risk Tolerance: An Analysis of Unexplored Factors, Financial Services Review, forthcoming. Gerhard Van de Venter, David Michayluk, and Geoff Davey. 2012. A Longitudinal Study of Financial Risk Tolerance, Journal of Economic Psychology 33 (4), 794-800. David Lam, Bing-Xuan Lin and David Michayluk. 2011. Demand and Supply and their Relationship with Liquidity: Evidence from the S&P 500 Change to Free Float, Financial Analysts Journal 67 (10), 55-71. David Michayluk and Ruoyun Zhao. 2010. Stock Splits and Bond Yields: Isolating the Signaling Hypothesis, Financial Review 45, 375-386. William Bertin, Paul Fowler, David Michayluk and Laurie Prather. 2010. An Analysis of Australian Exchange Traded Options and Warrants, Journal of Economics and Finance 34, 150-172. Bing-Xuan Lin, David Michayluk, Henry R. Oppenheimer and Sanjiv Sabherwal. 2009. French and U.S. Trading of Cross-Listed Stocks Around the Period of U.S. Decimalization: Volume, Spreads, and Depth Effects, International Review of Financial Analysis 18, 223-231. Paul Kofman, David Michayluk and James T. Moser. 2009. Reversing the Lead, or a Series of Unfortunate Events? NYMEX, ICE and Amaranth, Journal of Futures Markets 29, 1130- 1160. Henry Yip, David Michayluk, Laurie Prather, and Li-Anne Woo. 2009. What do Options have to do with it? Including Information from the Options Market in Bid-Ask Spread Decomposition, Asia-Pacific Journal of Financial Studies 38 (3), 455-489. David Michayluk and Karyn Neuhauser. 2008. Is Liquidity Symmetric? A Study of Newly Listed Internet and Technology Stocks. International Review of Finance 8 (3-4), 159-178. William Bertin, David Michayluk and Laurie Prather, 2008, Liquidity Issues Surrounding Neglected Firms, Investment Management and Financial Innovations 5 (1), 57-65. David Michayluk. 2008. The Rise and Fall of Single-Letter Ticker Symbols, Business History 50 (3), 368-385. David Michayluk and Laurie Prather. 2008. A Liquidity-Based Trade Direction Algorithm. Multinational Finance Journal 12 (1/2), 45-66.

2 Gerhard Van de Venter and David Michayluk. 2008. An Insight into Overconfidence in the Forecasting Abilities of Financial Advisors, Australian Journal of Management 32, 545-557. Bing-Xuan Lin, David Michayluk, Henry Oppenheimer and Shawn Reid. 2008. Hubris Amongst Japanese Bidders. Pacific Basin Finance Journal 16, 121-159. Alan Graham, Bing-Xuan Lin, David Michayluk and Pamela Stuerke. 2007. Sarbanes-Oxley: Some Unintended Consequences. Journal of Business and Economic Perspectives 33 (1), 39-46. Gerhard Van de Venter and David Michayluk. 2007. Subjectivity in Judgements: Further Evidence from the Financial Planning Industry, Journal of Wealth Management 10 #3 (Winter), 17- 24. Prem Matthew, David Michayluk and Paul Kofman. 2007. Are Foreign Issuers Complying with Regulation Fair Disclosure? Journal of International Financial Markets, Institutions and Money 17, 246-260. David Michayluk and Karyn Neuhauser. 2006. Investor Overreaction during Market Declines: Evidence from the 1997 Asian Financial Crisis. Journal of Financial Research 29, 217-234. David Michayluk and Gary Sanger. 2006. The Day End Effect on the Paris Bourse. Journal of Financial Research 29, 131-162. David Michayluk, Pat Wilson and Ralf Zurbruegg. 2006. Asymmetric Volatility, Correlation and Returns Dynamics Between the US and UK Securitised Real Estate Markets. Real Estate Economics 34, 109-131. William Bertin, Paul Kofman, David Michayluk and Laurie Prather. 2005. Intraday REIT Liquidity, Journal of Real Estate Research 27, 155-176. John Broussard, David Michayluk and Walter Neely. 2005. The Role of Growth in Long Term Investment Returns. The Journal of Applied Business Research 21, 93-105. Bing-Xuan Lin and David Michayluk. 2004. The Liquidity Response to Auditor Reputation Concerns. Finance Letters 2, 1-18. John L. Glascock, David Michayluk and Karyn Neuhauser. 2004. The Riskiness of REITs Surrounding the October 1997 Stock Market Decline. Journal of Real Estate Finance and Economics 28 (#4), 339-354. Arman Kosedag and David Michayluk. 2004. Repeated LBOs – The Case of Multiple LBO Transactions. Quarterly Journal of Business and Economics 43, 111-122. William Bertin, David Michayluk, Laurie Prather. 2003. Trading Costs Surrounding Earnings and Recommendations Announcements. Journal of Accounting and Finance Research 11, 90- 107. Cynthia McDonald and David Michayluk. 2003. Suspicious Trading Halts. Journal of Multinational Financial Management 13, 251-263. Arman Kosedag and David Michayluk. 2000. Dividend Initiations and Reverse LBOs. Review of Financial Economics 9 (1), 55-63. Paul Brockman and David Michayluk. 1998. The Persistent Holiday Effect: Additional Evidence. Applied Economics Letters 5 (4), 205-209. Paul Brockman and David Michayluk. 1998. Individual versus Institutional Investors and the Weekend Effect. Journal of Economics and Finance 22 (1), 71-86. Paul Brockman and David Michayluk. 1997. The Holiday Anomaly: An Investigation of Firm Size versus Share Price Effects. Quarterly Journal of Business and Economics 36 (3), 23-36. 3 Completed papers under revision or submission to conferences “ When no-news is bad news: Failing to increase dividends” submitted to the Eastern Finance Association annual meeting Boston 2012, with Karyn Neuhauser and Scott Walker. “When no-news is bad news: Failing to increase dividends” submitted to the Southwestern Finance Association annual meeting New Orleans 2012, with Karyn Neuhauser and Scott Walker. “Improving Liquidity Representation on the Australian Stock Exchange”. “Are Certain Dividend Increases Predictable? The Effect of Repeated Annual Dividend Increases on Market Returns,” with Scott Walker and Karyn Neuhauser. “The Impact of Short Selling Restrictions and Extreme Uncertainty on Liquidity and Order Flow: Evidence from the London Stock Exchange,” with Mathew Clifton. “Are Short Sellers Really Informed?” with Leonardo Fernandez. “Automated Liquidity Provision and the Demise of Traditional Market Making,” with Austin Gerig “Intraday Variation in Components of the Bid-Ask Spread," with P. Matthew and B. Roth, second submission to The Financial Review.

Refereed papers in conference proceedings “ Is Liquidity Symmetric? A Study of Newly Listed Internet and Technology Stocks,” with Karyn Neuhauser. 2005 American Academy of Accounting and Finance. “ The Impact of Immaterial Corporate Disclosure on Market Liquidity: Evidence of the Disjunction Effect,” with B. Lin. 2004 Decision Sciences Institute Proceedings. “News Releases When the Markets Are Closed,” with W. del Corral, D. Colwell and L. Woo. 2004. Northern Finance Association. “Trading Costs Surrounding Earnings and Recommendations Announcements ,” with W. Bertin, D. Michayluk, L. Prather and F. Raiszadeh. 2002. American Academy of Accounting and Finance. “ An Analysis of Liquidity for Real Estate Investment Trust,” with W. Bertin, P. Kofman, D. Michayluk, L. Prather and F. Raiszadeh. 2001. Decision Sciences Institute. “Expert Recommendations in the ‘Dartboard’ Column,” with W. Bertin, L. Prather and F. Raiszadeh. 2001. American Academy of Accounting and Finance.

Working papers

“ Modelling adverse selection on electronic order-driven markets”, with L. Mercorelli and A.D. Hall. “Financial Planners’ Interpretations: A Survey of Asset Allocation Recommendations, with Tobias Willhem van de Venter. “The Factors That Influence Financial Planners’ Risk Tolerance Assessment,” with Gerhard van de Venter. “Evidence on the Similarity of Liquidity Measures Across Asia-Pacific Stock Exchanges,” with Bing- Xuan Lin. “ Market Microstructure Response to Analysts Earnings Forecasts on Canadian Cross-Listed Securities,” with B. Lin, H. Oppenheimer and S. Sabherwal. “Liquidity, Market Structure, and Stock Splits,” with P. Kofman.

4 Grants (in AUD $ unless otherwise noted) Australian Research Council Linkage Grant 2012-2014, with C Plewa, J Sweeney, R Zurbruegg, “Funding our future: Perceptions of value of financial planning advice”, $100,000. Faculty Teaching and Learning Grant UTS 2008, "Using student response systems to improve student engagement and teaching quality", $7,000. Paul Woolley Centre for the Study of Market Dsyfunctionality 2008, “Market efficiency across international equity markets”, $2,500. Faculty Research Grant UTS 2008, with R Zhao, “Equity liquidity: Another factor in determining capital structure?”, $9,985. Paul Woolley Centre for the Study of Market Dsyfunctionality 2007, “Liquidity dysfunctionality on the Australian Stock Exchange”, $4,000. Faculty Teaching and Learning Grant UTS 2007, "Personalised Numerical Questions to Enhance Feedback and Encourage Honesty", $1,996. Faculty Research Grant UTS 2007, with AD Hall, “How Hidden Orders Affect Liquidity”, $9,931. Faculty Research Grant UTS 2007, “Rethinking Australian Stock Exchange Trading Metrics to Better Measure Liquidity”, $9,931. University of Adelaide, 2007, “Lead Articles”, with Ralf Zurbruegg, $3,500. National Science Foundation Grant, 2007-2009, with JD Farmer, A Lo, R Mantega, J Wilkins, F Lillo, M Girvan, J Geanakopolos, B Hollifield, B LeBaron, W Moro and J Dunne, US$ 749,661, “Financial markets as an empirical laboratory to study an evolving ecology of human decision making”. Faculty Research Grant UTS 2006, $10,000, “Financial Efficiency Around Corporate and Domicile Listing Changes”. Faculty Research Grant UTS 2006, $6,000, “Identifying, Characterizing and Improving Illiquid Stocks in Australia”. Supervisory Experience PhD Theses

Patel, Vinay Large Price Changes PhD student began studying 2012.

Ma, Guojie Real Estate PhD student began studying 2012.

Dosanjh, Jagjeev Market Efficiency PhD student began studying 2012, CMCRC2 student, ASX industry partner.

Fernandez, Leonardo Disclosure Regulations, Earnings Informativeness and the Timeliness of Price Discovery PhD awarded 2012, University of Technology, Sydney

5 Matthew Clifton PhD awarded 2011, Capital Market CRC2, University of Technology, Sydney Industry partner London Stock Exchange

Walker, Scott Declining Effect of Repeated Events: Does the Market Anticipate the Pattern? PhD stage 2 assessment completed, University of Technology, Sydney

Van de Venter, Tobias Willem (Gerhard) The Relationship between Risk Profile Methodology and Factors correlated to Financial Risk Taking PhD awarded October 2008, University of Technology, Sydney

Yip, Henry (co-supervised) A Hybrid Model of the Components of the Bid-Ask Spread PhD awarded October 2002, University of New South Wales

Undergraduate Honours Theses Marc Love Hong Kong Short Selling BBus (Honours) awarded 2012, UTS Ryan Gibson Financial Risk Tolerance and the Role of Financial Advisors BBus (Honours) awarded 2011, UTS Cacciotti, Daniel The Effect of CFDs on the underlying stock characteristics BBus (Honours) awarded 2010, UTS. Fortunato, Stephen Rethinking How to Measure Price Impact BBus (Honours) awarded 2010, UTS. Chenu, Daniel Determination of the Applicability of Complex Biological Systems Models to the Financial System BBus (Honours) awarded 2007, UTS. Lam, David The Effect of Free Float on Liquidity Surrounding the S&P 500 Index Change BBus (Honours) awarded 2006, UTS. Bertie, Alex Returns and Volatility at the Open: An Empirical Analysis of NYSE Specialists BCom (Honours) awarded 2000, UNSW. Fowler, Paul Price Discovery in the Australian Derivatives Market: The Case of Options versus Warrants BCom (Honours) awarded 2000, UNSW. Roth, Ben An Intraday Examination of the Bid-Ask Component Variation on the New York Stock Exchange BCom (Honours) awarded 2000, UNSW. Independent Studies Michael Miler An Analysis of Asymmetric Liquidity Measures May 2003, University of Rhode Island

Matthew Moreau 6 The Ability of Financial and Trading Information to Predict Bank Takeovers December 2003, University of Rhode Island

David Sharpe Do Options Always Enhance the Liquidity of the Underlying Stock? December 2003, University of Rhode Island

Cayne Holland Liquidity and the Neglected Firm Effect December 2003, University of Rhode Island

Robert Athas Changes in Institutional Stock Holdings and the Effect on Liquidity May 2004, University of Rhode Island

Christopher Valois The Effect of Price Limit Relaxation on Trading Characteristics in Taiwan December 2004, University of Rhode Island

Todd McEntee A Study in Event Studies: Unresolved Questions May 2005, University of Rhode Island

Christopher Valois An Analysis of Intraday Liquidity Patterns on the Madrid Stock Exchange May 2005, University of Rhode Island

External Examiner

C.C. Sim, Doctor of Philosophy “Financial Behaviour Under Risk and Uncertainty: Role of Experience and Emotion” Dec 2011, University of Malaya, Kuala Lumpur, Malaysia

T. Putnins, Doctor of Philosophy “Closing Price Manipulation and the Integrity of Stock Exchanges” Dec 2009, University of Sydney

N. Zamani, Doctor of Philosophy “Investigating the Role of Trading in the Dynamics of Price Formation in Financial Markets” Jan 2009, University of Sydney E. Morton, BBus (Honours) “Risk Taking and Loan Pricing of Different Types of Lending Institutions: An Empirical Analysis of the US Corporate Loan Market” Dec 2005, University of Technology, Sydney S. Ail, Ph.D. “ The Return-Volume Relationship for Emerging Markets – Analysis of the Internet Technology Bubble in the United States” Dec 2005, University of Adelaide C. Clarke, BCom (Honours) “ A Measure of the Multi-Dimensional Market Liquidity as a Priced Asset Factor: Evidence from the Australian Stock Exchange” Sept 2005, U Newcastle M. Hansen, BEcon (Honours) “Price Discovery in Interest Rate Markets: A Lead-Lag Relationship” 7 Nov 2005, U Western Sydney A. D. Sawtell, MCom (Honours) “ Australian On-Market Share Buybacks: Corporate Liquidity, Bid-Ask Spread Components and the Development of a Spread Decomposition Model Within an EGARCH-M Framework” May 2004, UNSW

Professional Service

Founding Co-Editor, International Journal of Managerial Finance launched 2004, published by Emerald Journals, UK Editor, 2013-present

UTS Committees and Service Chair, Discipline Group Research Committee, 2013-present Deputy Head of Discipline Group-Strategic, 2013-present SIRCA liason for UTS 2005-present Faculty Research Committee 2009-present FIRN local co-ordinator 2007-2008, 2010-present Postgraduate MBA (work experience) review 2010-2012 Bachelor of Business (Shanghai) review 2010 Bachelor of Business Capstone committee 2010 University Graduate School committee 2009-2010 Undergraduate Finance Major review 2009-2010 School Honours Program review 2010 Elected to Faculty Selection Committee for Associate Dean (Teaching and Learning - Postgraduate) March 2009 Faculty Sabbatical (PEP) committee 2008-2009, 2012 Elected to Faculty Board, November 2008-2010 Deputy Head of School 2007-2010 Chair, School Research Committee 2007-2010 Member, School Research Committee 2005-2006 School Quality Committee 2005-2006 School selection committees 2005-2012

URI College Committees and Service College Graduate Affairs and Research Committee 2002-4 Associate Dean Search Committee 2004 Ph.D. Program Director’s Committee 2004 Trading Room Coordinator Faculty Advisor for Financial Management Association Chapter

UNSW College Committees and Service International Exchange and Study Abroad Advisor Assistant Director of Undergraduate Honours Programs Professional Memberships American Finance Association 1993-present Financial Management Association 1993-present Eastern Finance Association 1993-present Canadian Institute of Chartered Accountants Program Committee Financial Management Association Annual Meeting 1999-present 8 External Reviewer Finance Programs, University of Adelaide, November 2009

Selected Presentations

L. Fernandez and D. Michayluk, Continuous disclosure requirements and the timeliness of price discovery in Australia, Edwards Syposium, University of Saskatchewan, 2011.

D. Michayluk and S. Walker, Are certain dividend increases predictable? The effect of repeated dividend increases on market returns, Financial Management Association annual meeting, New York, October 2010.

D. Michayluk and A. Akyol, Day end returns on the Istanbul Stock Exchange, Multinational Finance Society annual meeting, Barcelona, Spain, June 2010.

M. Clifton and D. Michayluk, The impact of short selling restrictions and extreme uncertainty on liquidity and order flow: Evidence from the London Stock Exchange, Multinational Finance Society annual meeting, Barcelona, Spain, June 2010.

G. Van de Venter and D. Michayluk, A Longitudinal Study of Financial Risk Tolerance, Financial Management Association annual meeting, Reno, Nevada, October 2009. L. Fernandez and D. Michayluk, Are Short Sellers Really Informed? Northern Finance Association annual meeting, Niagara on the Lake, Canada, September 2009. D. Michayluk, L. Prather, H. Yip, L. Woo, Decomposing the Bid-Ask Spread of Stock Options: A Trade and Risk Indicator Model, Multinational Finance Society annual meeting, Rythemos, Crete, Greece, June 2009. A. C. Akyol and D. Michayluk, Is There Closing Price Manipulation on the Istanbul Stock Exchange?, The Asian Finance Association Annual Conference, Brisbane, Australia June 2009. P. Mathew and D. Michayluk, How Does Bunching Affect Bid-Ask Spread Component Estimation?, Financial Management Association Annual Meeting, Dallas, October 2008. D. Michayluk, Are Traders Always Opportunistic? Santa Fe Institute, First Steps Toward Understanding Market Ecologies, July, 2008. W. Bertin, D. Michayluk, L. Prather, Liquidity Issues Surrounding Neglected Firms, Multinational Finance Society annual conference, Orlando, Florida, July, 2008. D. Michayluk, Liquidity Dysfunctionality on the Australian Stock Exchange, Microstructure Meeting, University of Sydney, Sydney, Australia, March 2008. L. Mercorelli, D. Michayluk and AD Hall, Modeling Adverse Selection on Electronic Order-Driven Markets, Reserve Bank of Australia, November 2007. D. Michayluk, Liquidity Dysfunctionality on the Australian Stock Exchange, Paul Woolley Centre Conference on Capital Markets Dysfunctionality, UTS, Sydney, Australia, October 2007. D. Lam, B. Lin, and D. Michayluk, Free Float, Financial Management Association Annual Meeting Orlando, Florida, October 2007. W. Bertin, P. Fowler, D. Michayluk and L. Prather, The Intraday Price Behaviour of Australian Exchange Traded Options and Warrants, Pacific Basin Finance, Economics, Accounting and Management annual conference, Ho Chi Minh City, Vietnam, July 2007.

9 W. Bertin, P. Fowler, D. Michayluk and L. Prather, The Intraday Price Behaviour of Australian Exchange Traded Options and Warrants, Multinational Finance Society annual conference, Thessaloniki, Greece, July 2007. P. Kofman and D. Michayluk, Liquidity and Stock Splits, Santa Fe Institute, New Mexico, USA, April 2007. W. Bertin, D. Michayluk and L. Prather, Price Discovery in Options and Warrants Markets, Eastern Finance Association, New Orleans, April 2007. D. Michayluk and K. Neuhauser, Is Liquidity Symmetric? Eastern Finance Association, New Orleans, April 2007. B.X. Lin, D. Michayluk, H. Oppenheimer and S. Sabherwal, French and US Trading of Cross- Listed Stocks around the Period of US Decimalization: Volume, Spreads and Depth Effects, Eastern Finance Association , New Orleans, April 2007. D. Michayluk and R. Zhao, Risk Changes Subsequent to Stock Splits, Eastern Finance Association, New Orleans, April 2007. BX Lin, D Michayluk, H Oppenheimer and S Sabherwal, French and US Trading of Cross-Listed Stocks around the Period of US Decimalization: Volume, Spreads and Depth Effects, French Finance Association (AFFI), Paris, December 2006. D Michayluk and R Zhao, Risk Changes Subsequent to Stock Splits, Southern Finance Association, Destin, Florida, November 2006. Financial Management Association, Salt Lake City, Utah, October 2006 “Decomposing the Bid- Ask Spread of Stock Options: A Trade and Risk Indicator Model,” with Henry Yip, Laurie Prather and Li-Anne Woo. European Financial Management Association, Madrid, Spain, July 2006 “Decomposing the Bid- Ask Spread: A Cross Market Model Using Options Data,” with Henry Yip, Laurie Prather and Li- Anne Woo. American Accounting Association Midwest Regional Meeting, Chicago, March 2006 “Sarbanes- Oxley: Some Unintended Consequences,” with A. Graham, B. Lin and P. Stuerke. Financial Management Association Annual Meeting, Chicago, October 2005 “Cross-Industry Differences in Liquidity: Evidence from an Examination of New Issues,” with Karyn Neuhauser. American Accounting Association Northeast Regional Meeting, New York, April 2005 “Sarbanes- Oxley: Some Unintended Consequences,” with A. Graham, B. Lin and P. Stuerke. Eastern Finance Association Annual Meeting, Norfolk, Virginia, April 2005 “A Liquidity Motivated Algorithm for Discerning Trade Direction,” with L. Prather. Eastern Finance Association Annual Meeting, Norfolk, Virginia, April 2005 “The Impact of Immaterial Corporate Disclosure on Market Liquidity: Evidence of the Disjunction Effect,” with W. Bertin and B. Lin. Decision Science Institute Conference, Boston, November 2004 “The Impact of Immaterial Corporate Disclosure on Market Liquidity: Evidence of the Disjunction Effect,” with B. Lin. Southern Finance Association Annual Meeting, Naples, Florida, November 2004 “The Impact of Immaterial Corporate Disclosure on Market Liquidity: Evidence of the Disjunction Effect,” with B. Lin. Financial Management Association, New Orleans, October 2004 “Overreaction or Increased Uncertainty: Evidence from the October 1997 Stock Market Decline,” with Karyn Neuhauser.

10 Northern Finance Association, St. John’s, Newfoundland, Canada, September 2004 “News Releases When the Markets Are Closed,” with Wayne del Corral, David Colwell and Li-Anne Woo. Eastern Finance Association, Mystic, CT, April 2004 “Liquidity and the Intraday Variation in Components of the Bid-Ask Spread” with Laurie Prather, Prem Mathew and Ben Roth. Eastern Finance Association, Mystic, CT, April 2004 “Liquidity and the Neglected Firm Effect,” with Will Bertin and Cayne Holland. Eastern Finance Association, Mystic, CT, April 2004 “Overreaction or Increased Uncertainty: Evidence from the October 1997 Stock Market Decline,” with Karyn Neuhauser. Financial Management Association, Denver, Colorado, October 2003 “How Has Regulation Fair Disclosure Affected Liquidity? with Paul Kofman and Prem Mathew. Financial Management Association, Denver, Colorado, October 2003 “News Releases When the Markets Are Closed,” with Wayne del Corral, David Colwell and Li-Anne Woo. Multinational Finance Association, Montreal, Quebec, June 2003 “A Liquidity-Based Trade Initiation Algorithm,” with Laurie Prather. Washington Area Finance Association, April 2002 “The Riskiness of REITs Surrounding the October 1997 Stock Market Decline,” with John Glascock and Karyn Neuhauser. European Financial Management Association, Paris, June 2001 “Returns and Volatility at the Open: An Empirical Analysis of NYSE Specialists,” with Li-Anne Woo and Alex Bertie. Multinational Finance Association, Verona, Italy, June 2001 “Returns and Volatility at the Open: An Empirical Analysis of NYSE Specialists,” with Li-Anne Woo and Alex Bertie. American Real Estate and Urban Economics Association Meeting at the Allied Social Sciences Annual Meeting, New Orleans January 2001. “Intraday REIT Liquidity” Financial Management Association, Seattle October 2000 “Suspicious Trading Halts” with Cynthia McDonald. Southern Finance Association, Key West, Florida, November, 1999 “Execution Costs on the Paris Bourse” Financial Management Association, Orlando, Florida, October 1999. “Dividend Initiations and Re- LBOs” Multinational Finance Society Meeting, Toronto, July 1999. ”Lee-Ready and TORQ new test” Multinational Finance Society Meeting, Toronto, July 1999. ” Trading Halts and the Paris Bourse” American Real Estate and Urban Economics Association Meeting at the Allied Social Sciences Annual Meeting, January 1999. “REITs” Financial Management Association, Chicago, October 1998 “Execution Costs on the Paris Bourse” European Financial Management Association, Portugal, June 1998. “The Role of Growth in Long Term Investment Returns,” with J. Broussard and W. Neely. European Financial Management Association, Zurich, Switzerland, May 1997 “The Day End Effect on the Paris Bourse,” with G. Sanger. Southern Finance Association, Baltimore, Maryland, November 1997 “Day of the Week Effect: Differences Across NYSE Specialist Firms” Eastern Finance Association, Panama City, Florida, April 1997. “Day of the Week Effect: Differences Across NYSE Specialist Firms”

11 SouthWestern Finance Association, New Orleans, Louisiana, March 1997. “Preferred Stock: Differences Across NYSE Specialist Firms” SouthWestern Finance Association, March 1996, San Antonio, Texas “The Role of Growth in Long Term Investment Returns,” with J. Broussard and W. Neely Financial Management Association, New Orleans, Louisiana, October 1996 “The Role of Growth in Long Term Investment Returns,” with J. Broussard and W. Neely

12