Last Name ______First Name ______ID ______Operations Management I 73-331 Fall 2003 Odette School of Business University of Windsor

Final Exam Solution Monday, December 15, 8:30 – 11:30 a.m. Chrysler Hall North G 133

Instructor: Mohammed Fazle Baki Aids Permitted: Calculator, straightedge, and 3 one-sided formula sheets. Time available: 3 hours Instructions: This exam has 34 pages including this cover page, 1 blank page and 8 pages of Table It’s not necessary to return tables and formula sheets Please be sure to put your name and student ID number on each odd numbered pages Show your results up to four decimal places Show your work

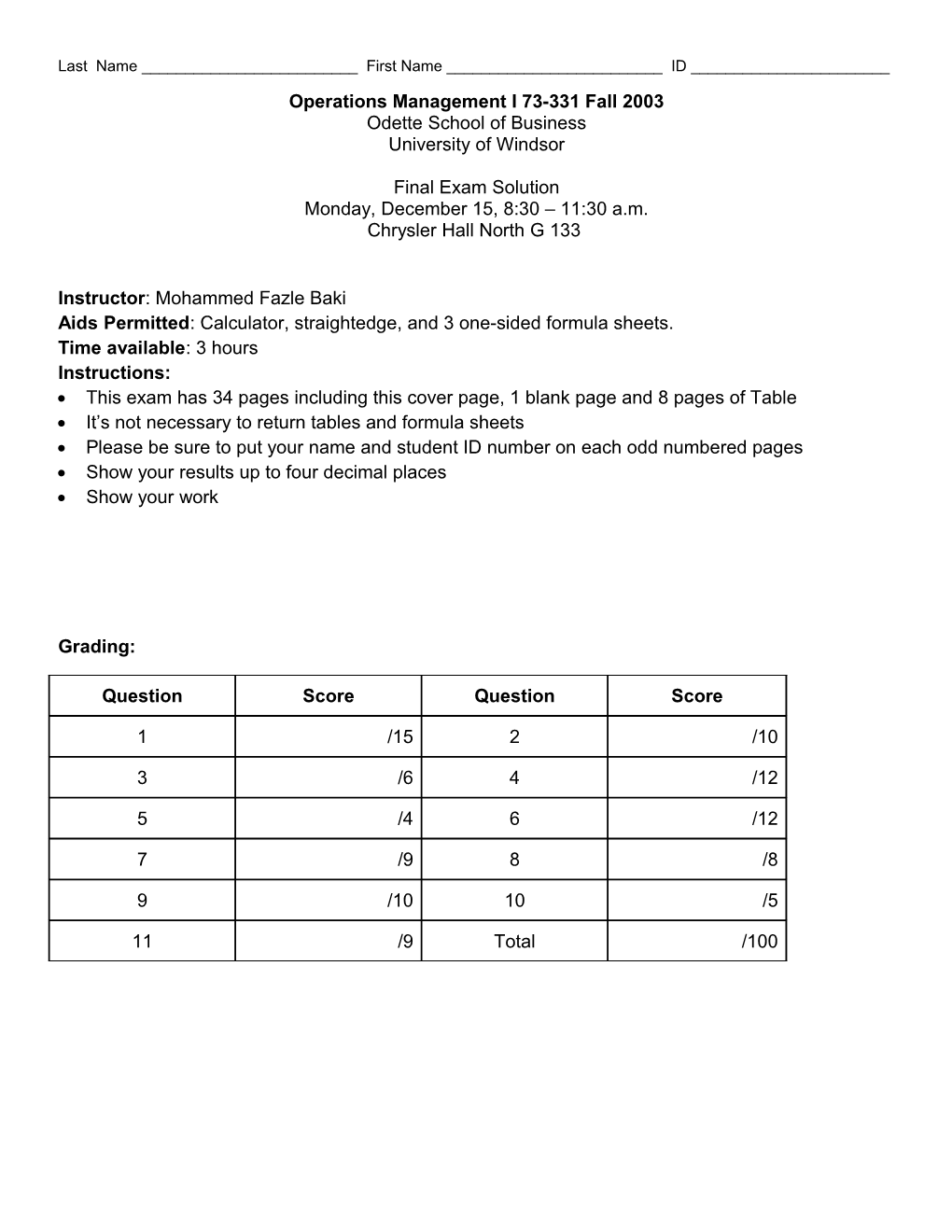

Grading:

Question Score Question Score

1 /15 2 /10

3 /6 4 /12

5 /4 6 /12

7 /9 8 /8

9 /10 10 /5

11 /9 Total /100 Name:______ID:______

Question 1: (15 points) Circle the most appropriate answer 1.1 Consider estimating learning curve parameter values using regression on lnuand lnY u. What is a best interpretation of intercept, c ? a. The slope is lnc b. The slope is ec c. An estimate of the time required by the first unit is lnc d. An estimate of the time required by the first unit is ec

1.2 Consider the EOQ model with price breaks. The optimal solution is a. the cheapest realizable EOQ b. one of the EOQs c. one of the breakpoints d. the cheapest realizable EOQ or a cheaper breakpoint

1.3 Forecasting error is described by a. weighted moving average b. mean absolute deviation c. both d. none

1.4 The dynamic capacity addition model assumes all of the following except a. a constant rate of increase of demand over a finite planning horizon b. the same capacity addition at an equal interval of time c. economies of scale d. continuous compounding

1.5 Which of the following are advantages of the Exponential Smoothing model? a. Less computation b. Less memory requirement c. Both d. None

1.6 Smoothing cost includes a. cost to advertise and interview candidates b. severance pay c. both d. none

1.7 Chase strategy attempts to produce a. a constant amount each period b. as much as needed c. both d. none

1.8 Annual holding cost and is the same as annual ordering/setup cost at a. EOQ and EPQ b. EOQ but not EPQ c. EPQ but not EOQ d. none of the above

2 Name:______ID:______1.9 Which of the following is not a characteristic of the rotation cycle policy? a. There is only one setup for each product in each cycle b. The products are produced in the same sequence in each cycle c. Only one product is produced at any time d. For each product, the economic production quantity (EPQ) is produced in each cycle

1.10 To find an optimal Q, R policy with Type II service, the penalty cost is a. not estimated b. estimated from the cost of backorder c. estimated from the cost of lost sales d. computed using the standardized loss function

1.11 Which of the following is not an input to the MRP system? a. The production schedule of the finished products b. The production schedule of the components/subassemblies c. Bill of Materials d. Inventory records

1.12 Which of the following is not an assumption in the space constraint model? a. A known, fixed and uniform demand rate b. Known and fixed cost parameters c. A single product carried in the inventory d. The same order size every cycle

1.13 Least Unit Cost (LUC) method performs best if a. the production environment is make-to-order or assemble-to-order b. the production environment is make-to-stock or assemble-to-stock c. inventory costs do not change over time d. inventory costs change over time

1.14 Andon a. is the authority to stop a production line b. makes problems visible c. lights signal quality problems d. prevents defects

1.15 The Q, R policy is used for a. multi-period component/subassemblies b. multi-period finished products c. single-period discrete demand d. single-period continuous demand

3 Name:______ID:______

Question 2: (10 points) A Japanese steel manufacturer is considering expanding operations. From experience, it estimates that new capacity additions obey the law f y ky 0.65, where the cost, f y, is measured in millions of dollars and y is measured in tons of steel produced. If the demand for steel is assumed to grow at the constant rate of 3,000 tons per year and future costs are discounted using a 16 percent discount rate a. (2 points) Determine the optimal timing of Figure 1-14 plant additions. 1.00 0.90 a 0.65 (given) a

0.80 =

rx 0.80 (from Figure 1-14)

n 0.70 o i

rx 0.80 t x 5 years c 0.60 n

r 0.16 u

F 0.50 0.40 0.30 0 1 2 b. (2 points) Determine the optimal size of each addition. u = rx Optimal size = xD 3,000 5 15,000 tons per year c. (2 points) If the size of the refinery is doubled, what is the percentage increase in the construction costs? f 2y k2y0.65 20.65 1.57 57% increase f y ky0.65 d. (2 points) If a plant size of 30,000 tons per year costs 18 million dollars, find k . f y 18 f y ky a k 0.02214 y a 30,0000.65 e. (2 points) Continue from parts a, b and d. What is the present cost of the next 2 additions? The first one is added today and the second one after the number of years obtained in part a. For y 15,000 tons, the cost f y ky a 0.0221415,0000.65 11.4719 million dollar Present cost 11.4719 11.4719 1 0.165 11.4719 11.4719 0.4761 11.4719 5.4619 16.9338 million dollar

4 Name:______ID:______

Question 3: (6 points) The Paris Paint Company is in the process of planning labor force requirements and production levels for the next four quarters. The marketing department has provided production with the following forecasts of demand for Paris Paint over the next year: Quarter Demand Forecast (in thousands of gallons) 1 450 2 800 3 750 4 200 Assume that there are currently 275 employees with the company. Employees are hired for at least one full quarter. Hiring costs amount to $400 per employee and firing costs are $800 per employee. Inventory costs are $0.25 per gallon per quarter. It is estimated that one worker produces 1,500 gallons of paint each quarter. Assume that Paris currently has 200,000 gallons of paint in inventory and would like to end the year with an inventory of at least 300,000 gallons. a. (3 points) Determine the minimum constant workforce plan (i.e., level strategy) for Paris Paint. Assume that stock-outs are not allowed. Quarter Production Cumulative Units Cumulative Workers Requirement Production Produced Per Units Required (000 gallons) Requirement Worker Produced Per Worker (000 gallons) (000 gallons) (000 gallons) 1 450-200=250 250 1.5 (given) 1.5 250/1.5 167 2 800 250+800=1,050 1.5 3 1050/ 3 350* 3 750 1,050+750=1,800 1.5 4.5 1800/ 4.5 400 4 200+300=500 1,800+500=2,300 1.5 6 2300/ 6 384 Since the maximum workers required is 400, the minimum constant workforce plan must use 400 workers. So, the number of workers to hire = 400 – 275 = 125 workers. b. (3 points) Determine the hiring, firing, and inventory holding cost of the plan derived in part a. Quarter Beginning Production Ending Inventory = Production + Beginning Inventory (000 gallons) Inventory – Demand (000 gallons) (000 gallons) 1 200 400(1.5)=600 600+200-450=350 2 350 600 600+350-800=150 3 150 600 600+150-750=0 4 0 600 600+0-200=400 Total ending inventory = (350+150+0+400) = 900 thousand gallons

5 Name:______ID:______

Inventory holding cost = 900,000 0.25 = $225,000 Hiring cost = 125(400) = $50,000 Total cost = 225,000+50,000 = $275,000

Question 4: (12 points) A popular brand of tennis shoe has had the following demand history by quarters over a two-year period. Quarter Demand Quarter Demand 2002 2003 1 25 1 33 2 35 2 47 3 45 3 55 4 40 4 50 a. (4 points) Determine the seasonal factors for each quarter by the method of centered moving averages N = 4 The demand is quarterly, there are 4 quarters in each year. Centered (B/D) Period Demand MA(4) MA Ratio A B C D E 1 25 38.5 0.649350649 2 35 38.5 0.909090909 3 45 37.25 1.208053691 4 40 36.25 39.75 1.006289308 5 33 38.25 42.5 0.776470588 6 47 41.25 45 1.044444444 7 55 43.75 43.75 1.257142857 8 50 46.25 43.75 1.142857143

Final Seasonal Seasonal Period Factors Factors 1 0.71291062 0.7135 2 0.97676768 0.9775 3 1.23259827 1.2336 4 1.07457323 1.0754 Total 3.9968498 4.0000

6 Name:______ID:______b. (4 points) Compute the deseasonalized demand series. Using the method of linear regression, determine the slope and intercept of the straight line that best fits the deseasonalized series. x Deseasonalized xy x 2 Demand

1 35.03989219 35.03989219 1 2 35.80425166 71.60850331 4 3 36.47949307 109.4384792 9 4 37.1947644 148.7790576 16 5 46.25265769 231.2632884 25 6 48.07999508 288.4799705 36 7 44.58604708 312.1023296 49 8 46.4934555 371.947644 64 Sum 36 329.9305567 1568.659165 204 Average 4.5 41.24131958

n n n n x y x y i i i i 8(1568.6592) 36(329.9306) Slope i1 i1 i1 1.9993 n n 2 8(204) (36)2 2 n xi xi i1 i1 Intercept y slope(x) 41.2413 (1.9993)(4.5) 32.2443 c. (4 points) Predict the demand of all quarters of 2004. Plot the original demand of 2002-2003 and predicted demand of 2004. Deseasonalized demand, y 32.2443 1.9993x First quarter of 2004: x 9, y 32.2443 1.9993 9 50.2383 To get the predicted demand, reseasonalize, y 50.2383 0.7135 35.8436 Second quarter of 2004: x 10, y 32.2443 1.999310 52.2376 To get the predicted demand, reseasonalize, y 52.2376 0.9775 51.0642 Third quarter of 2004: x 11, y 32.2443 1.999311 54.2369 To get the predicted demand, reseasonalize, y 54.23691.2336 66.9050 Fourth quarter of 2004: x 12, y 32.2443 1.999312 56.2363 To get the predicted demand, reseasonalize, y 56.23631.0754 60.4776

7 Name:______ID:______

Demand

80 70 60

d 50 n a 40 m e

D 30 20 10 0 0 1 2 3 4 5 6 7 8 9 10 11 12 Period

Question 5: (4 points) Green City sells a particular model of lawn mower, with most of the sales being made in the summer months. Green city makes a one-time purchase of the lawn mowers prior to each summer season at a cost of $150 each and sells each lawn mower for $210. The demand is normally distributed with a mean of 1200 and a standard deviation of 80. Find the optimal order quantity if a. (2 points) any lawn mower unsold at the end of summer season are marked down to $75 and sold in a special fall sale.

cu Selling price – purchase price = 210-150 = $60/unit

co Purchase price – salvage value = 150-75 = $75/unit c 60 For the optimal order quantity Q , Probability(demand Q ), p u 0.4444 cu co 60 75 Find the standard normal z -value for which cumulative area on the left, p 0.4444 . Using Table A-1 Table A-1 gives the area between z 0 and positive z -values. Since p 0.4444 0.50, the z -value is negative and corresponds to area = 0.50-0.4444 = 0.0556 Hence, z 0.14. Using Table A-4 Since p 0.4444 0.50, the z -value is negative and corresponds to 1 Fz 0.4444 Hence, z 0.14. Q* z 1,200 0.1480 1,188.8 1,189 units b. (2 points) any lawn mower unsold at the end of summer season are marked down to $120 and sold in a special fall sale.

cu Selling price – purchase price = 210-150 = $60/unit

co Purchase price – salvage value = 150-120 = $30/unit

8 Name:______ID:______

c 60 For the optimal order quantity Q , Probability(demand Q ), p u 0.6666 cu co 60 30 Find the standard normal z -value for which cumulative area on the left, p 0.6666 . Using Table A-1 Table A-1 gives the area between z 0 and positive z -values. Since p 0.6666 0.50, the z -value is positive and corresponds to area = 0.6666-0.50 = 0.0166 Hence, z 0.43. Using Table A-4 Since p 0.6666 0.50, the z -value is positive and corresponds to Fz 0.6666 Hence, z 0.43 Q* z 1,200 0.4380 1,234.4 1,234 units

Question 6: (12 points) Suppose that Item A has a production rate of 1,152 items per year, unit cost of $16.00, a setup cost of $144, and a monthly demand of 48 units. It is estimated that cost of capital is approximately 20 percent per year. Storage cost amounts to 3 percent and breakage to 2 percent of the value of each item. a. (2 points) Compute EPQ of Item A. K $144 1248 576 units per year I 0.20 0.03 0.02 0.25 h Ic 0.2516 $4 per unit per year P 1,152 units per year 2K 2K 2144576 2144576 Q* 288 EPQ, h' 576 2 units h1 4.001 P 1,152 b. (3 points) What are the maximum inventory and cycle time of Item A? What is the percentage of idle time of the facility if the facility is dedicated to produce Item A only? 576 Maximum inventory, H Q* 1 2881 144 units P 1,152 Q* 288 Cycle time, T * 0.50 year 576 Q* 288 Uptime, T 0.25 year, Downtime, T * T 0.50 0.25 0.25 year 1 P 1,152 1 T 0.25 Percentage of downtime in each cycle = 2 0.50 50% T * 0.50

9 Name:______ID:______Item B has a production rate of 1500 items per year, a unit cost of $32.00, an ordering cost of $90.90, and a monthly demand of 30 units. Recall that the cost of capital is approximately 20 percent per year. Storage cost amounts to 3 percent and breakage to 2 percent of the value of each item. c. (2 points) What is the cycle time if both Items A and B are produced in a single facility? Consider negligible setup times for both Items A and B.

2 K j 2K K 2144 90.90 T * A B h' h' h' j j A A B B A B hA 1 A hB 1 B PA PB

2144 90.90 2234.90 576 3012 B 2 576 0.25 32 1 3012 4.001 576 IcB 1 B 1,152 PB 1,500

469.8 469.8 =0.375 years 1,152 6.08 360 3,340.8 d. (5 points) Continue from part c. What are the maximum inventory of Items A and B? What is the percentage of idle time of the facility if the facility is used to produce only Items A and B? * QA AT 576 0.375 216 units * QB BT 3012 0.375 135 units

QA 216 Uptime of A, TA 0.1875 years PA 1,152

QB 135 Uptime of B, TB 0.09 years PB 1,500 576 * A Maximum inventory, H A QA 1 2161 108 units PA 1,152 360 * B Maximum inventory, H B QB 1 1351 102.6 units PB 1,500 * Idle time = T TA TB 0.375 0.1875 0.09 0.09 years in each cycle IdleTime 0.0975 Hence, percentage of idle time = 0.26 26% T * 0.375

Question 7: (9 points) The home appliance department of a large department store is planning to use a lot size-reorder point system to control the replenishment of a particular model of FM table radio. The store sells an average of 360 radios each year. The annual demand follows a normal distribution with a standard deviation of 60. The store pays $80 for each radio. The holding cost is 25 percent per year. Fixed costs of replenishment amount to $100. If a customer demands the radio when it is out of stock, the customer will generally go elsewhere. Replenishment lead-time is three weeks. Assume 48 weeks in a year.

10 Name:______ID:______a. (3 points) Find an optimal (Q,R) policy with probability(stockout)=0.35.

2K 2K 2100360 72,000 Step 1: Q EOQ 3,600 60 units h Ic 0.2580 20 Step 2: Probability (stockout) = 0.35 Fz = Probability (no stockout) = 1-Probability(stockout) = 1-0.35 = 0.65 Find z for which area on the left = Fz 0.65 From Table A-1, z 0.385 for area = 0.65-0.50 = 0.15 From Table A-4, z 0.385 for Fz 0.65 Step 3: Compute reorder point, R z 3603/ 48 22.5

y 60 3/ 48 15 R z 22.5 0.38515 28.275 units Hence an optimal policy is Q 60 units, R 28 units b. (2 points) Compute the annual holding cost resulting from the (Q,R) policy obtained in part a. hQ IcQ 0.2580 60 20 60 Annual holding cost, regular = $600 2 2 2 2 Safety stock = R 28.275 22.5 5.775 units Annual holding cost, safety stock = hR 0.25805.775 $115.5 hQ Annual holding cost = hR = 600 + 115.5 = $715.50 2 c. (2 points) Compute the annual ordering cost resulting from the (Q,R) policy obtained in part a. K 100 360 Annual ordering cost = $600 Q 60 d. (2 points) Compute the expected annual number of units stockout resulting from the (Q,R) policy obtained in part a. 0.2374 0.2339 Lz 0.23565 for z 0.385 from Table A-4 2 n Lz 150.23565 3.53475 units/cycle n 2.53475 360 Annual number of units stockout = 21.2085 units Q 60

11 Name:______ID:______Question 8: (8 points) Consider Question 7 again. The question is re-written below:

The home appliance department of a large department store is planning to use a lot size-reorder point system to control the replenishment of a particular model of FM table radio. The store sells an average of 360 radios each year. The annual demand follows a normal distribution with a standard deviation of 60. The store pays $80 for each radio. The holding cost is 25 percent per year. Fixed costs of replenishment amount to $100. If a customer demands the radio when it is out of stock, the customer will generally go elsewhere. Replenishment lead-time is three weeks. Assume 48 weeks in a year.

Find an optimal (Q,R) policy with fill rate = 0.95. Use the iterative method and show 2 iterations. Show your computation on the next page and summarize your results in the table below:

Summary of results: Fixed cost (K) 100 Note: K and h Holding cost (h) 20 are input data Mean annual demand (lambda) 360 input data Lead time (tau) in years 0.0625 input data Lead time demand parameters: mu 22.5 <--- computed sigma 15.00 input data Type 2 service, fill rate, beta 0.95 input data Iteration 1 Iteration 2 Step 1 Q= EOQ 60 Step 2 n= Q(1 ) 3 L(z)= n / 0.2 z= Table A1/A4,pp. 835 - 41 0.49 R= z 29.85 Step 3 Area on the right=1-F(z) Table A1/A4,pp. 835 - 41 0.3121 0.3483 Step 4 Modified Q= n /(1 F(z)) 2K / h (n /(1 F(z)))2 70.3774 70.9477 Step 5 n= Q(1 ) 3.5189 3.5474 L(z)= n / 0.2346 0.2365 z= Table A1/A4,pp. 835 - 41 0.39 0.385 R= z 28.35 28.275

h Ic 0.2580 20, 3/ 48 0.0625, 360 0.0625 22.5, y 60 0.0625 15 Iteration 1 2k 2(100)(3600) Step 1: Q EOQ 60 units h 20 Step 2: n Q(1 ) 60(1 0.95) 3 n 3 L(z) 0.20 15 z 0.49 (Table A-4) R z 22.5 0.49 15 29.85 Step 3: 1 F(z) 0.3121(Table A-4)

12 Name:______ID:______

2 2 n 2K n 3 2(100)(360) 3 Step 4: Q 70.3774 1 F(z) h 1 F(z) 0.3121 20 0.3121 (not near 60, more iterations are necessary) Step 5: n Q(1 ) 70.3774(1 0.95) 3.5189 n 3.5189 L(z) 0.2346 15 z 0.39 (Table A-4) R z 22.5 0.39 15 28.35

Iteration 2 Step 3: 1 F(z) 0.3483(Table A-4) 2 2 n 2K n 3 2(100)(360) 3 Step 4: Q 70.9476 (same as 1 F(z) h 1 F(z) 0.3483 20 0.3483 before, stop the process after finding R ) Step 5: n Q(1 ) 70.9476(1 0.95) 3.5474 n 3.5474 L(z) 0.2365 15 z 0.385 (Table A-4) R z 22.5 0.38515 28.275 Q and R converge. An optimal policy is Q=71, R=28 (rounded to the nearest integer)

Question 9: (10 points) Each unit of A is composed of three units of B and two units of C. Each unit of B is composed of four units of C and five units of D. Items A, B and C have on-hand inventories of 50, 100 and 200 units respectively. Item B has a scheduled receipt of 40 units in period 1, and D has a scheduled receipt of 150 units in Period 1. Lot-for-lot (L4L) is used for Item A. Item B requires a minimum lot size of 50 units. Each of the Items C and D is required to be purchased in multiples of 100. Lead times are one period for each Items A, B and C, and two periods for Item D. The gross requirements for A are 30 in Period 2, 25 in Period 5, and 80 in Period 8. Find the planned order releases for all items to meet the requirements over the next 10 periods. a. (2 points) Construct a product structure tree.

A Level 0

B(3) Level 1

C(4) D(5) C(2) Level 2

b. (2 points) Consider Item A. Find the planned order releases and on-hand units in period 10

13 Name:______ID:______

Period 1 2 3 4 5 6 7 8 9 10 Item Gross 30 25 80 Requirements A Scheduled receipts On hand from 50 50 20 20 20 0 0 80 0 0 LT= prior period 1 Net 5 80 requirements Time-phased Net 5 80 Q= Requirements L4L Planned order 5 80 releases Planned order 5 80 delivery c. (2 points) Consider Item B. Find the planned order releases and on-hand units in period 10. Period 1 2 3 4 5 6 7 8 9 10 Item Gross 15 240 Requirements B Scheduled 40 receipts On hand from 100 140 140 140 125 125 125 0 0 0 LT= prior period 1 Net 115 Requirements Time-phased Net 115 Q >= Requirements 50 Planned order 115 releases Planned order 115 delivery d. (2 points) Consider Item C. Find the planned order releases and on-hand units in period 10. Period 1 2 3 4 5 6 7 8 9 10 Item Gross 10 460 160 Requirements C Scheduled receipts On hand from 200 200 200 200 190 190 30 70 70 70 LT= prior period 1 Net 270 130 requirements Time-phased Net 270 200 Q= Requirements 100 Planned order 300 200 releases Planned order 300 200 delivery

14 Name:______ID:______e. (2 points) Consider Item D. Find the planned order releases and on-hand units in period 10. Period 1 2 3 4 5 6 7 8 9 10 Item Gross 575 Requirements D Scheduled 150 receipts On hand from 150 150 150 150 150 75 75 75 75 LT= prior period 2 Net 425 requirements Time-phased Net 425 Q= Requirements 100 Planned order 500 releases Planned order 500 delivery

Question 10: (5 points) A single inventory item is ordered from an outside supplier. The anticipated demand for this item over the next 7 months is 13, 11, 14, 13, 7, 8, 5. Current inventory of this item is 3, and the ending inventory should be 4. Assume a holding cost of $2 per unit per month and a setup cost of $75. Assume a zero lead time. Determine the order policy for this item over the next 7 months.

Use the Least Unit Cost heuristic.

Net requirements: r1 13 3 10,r2 11,r3 14,r4 13,r5 7,r6 8,r7 5 4 9

Months Q I1 I2 I3 I4 I5 I6 I7 Holding Ordering Cost Cost

1 to 1 10 75 7.5 1 to 2 21 11 22 75 4.62 1 to 3 35 25 14 78 75 4.37 1 to 4 48 38 27 13 156 75 4.81 stop 4 to 4 13 75 5.77 4 to 5 20 7 14 75 4.45 4 to 6 28 15 8 46 75 4.32 4 to 7 37 24 17 9 100 75 4.73 stop 7 to 7 9 75 8.3333 a. (3 points) State your order policy:

Month Lot size to order 1 35 4 28 7 9

15 Name:______ID:______b. (2 points) Using the table below, show the ending inventory that results from your order policy at the end of each month: Month 1 2 3 4 5 6 7 Gross Requirements 13 11 14 13 7 8 5 Beginning Inventory 3 25 14 0 15 8 0 Net Requirements 10 13 5 Time-phased Net Requirements 10 13 5 Planned order Release 35 28 9 Planned Deliveries 35 28 9 Ending Inventory 25 14 0 15 8 0 4

Question 11: (9 points) Consider Question 10 again. The question is re-written below:

A single inventory item is ordered from an outside supplier. The anticipated demand for this item over the next 7 months is 13, 11, 14, 13, 7, 8, 5. Current inventory of this item is 3, and the ending inventory should be 4. Assume a holding cost of $2 per unit per month and a setup cost of $75. Assume a zero lead time. Determine the order policy for this item over the next 7 months.

a (3 points) Suppose that the maximum order size is 12 per month. Does there exist a feasible solution? If there does not exist a feasible solution, what is first month when there will be a shortage?

Month Production Capacity Cumulative Cumulative capacity Requirement Production Requirement 1 13-3=10 12 10 <= 12 2 11 12 21 <= 24 3 14 12 35 <= 36 4 13 12 48 <= 48 5 7 12 55 <= 60 6 8 12 63 <= 72 7 5+4=9 12 72 <= 84

Yes, there is a feasible solution.

Consider Question 10 again. The question is re-written below:

A single inventory item is ordered from an outside supplier. The anticipated demand for this item over the next 7 months is 13, 11, 14, 13, 7, 8, 5. Current inventory of this item is 3, and the ending inventory should be 4. Assume a holding cost of $2 per unit per month and a setup cost of $75. Assume a zero lead time. Determine the order policy for this item over the next 7 months.

(b) (3 points) Suppose that the maximum order size is 12 per month. Use lot-shifting technique to obtain a feasible solution (without using holding and setup cost). Show your final solution in the table given below.

16 Name:______ID:______

Month Production Actual Production Production Excess Capacity Requirement Capacity 1 13-3=10 10 11 12 2 11 11 12 3 14 12 4 13 12 5 7 7 6 8 8 7 5+4=9 9

A feasible solution obtained by lot-shifting technique: Month 1 2 3 4 5 6 7 Actual Production 12 12 12 12 7 8 9

Consider Question 10 again. The question is re-written below:

A single inventory item is ordered from an outside supplier. The anticipated demand for this item over the next 7 months is 13, 11, 14, 13, 7, 8, 5. Current inventory of this item is 3, and the ending inventory should be 4. Assume a holding cost of $2 per unit per month and a setup cost of $75. Assume a zero lead time. Determine the order policy for this item over the next 7 months.

(c) (3 points) Improve the solution obtained in Part (b) . Assuming a maximum order size of 12 units per month and using the back-shifting technique, find another solution that has less total holding and setup cost than the solution obtained in Part (b) . Show your final solution in the table given below.

Back-shift 9 units of Month 7? Check if it’s better to backshift 4 units to Month 6 and 5 units to Month 5 Additional holding cost = 4(1)(2)+5(2)(2) = 28 < 75 = savings in ordering cost Back-shift

Improved solution: Month 1 2 3 4 5 6 7 Actual Production 12 12 12 12 12 12 --

17