Lecture Notes – 15 October 2012 Today we are going to start talking about the conduct of Monetary Policy. The goal of the next couple of lectures will be to talk about how the Fed conducts monetary policy. We will start by talking about the effects of various tools used by the Fed. We will then lead into a discussion on how the Fed translates it policy goals into these tools.

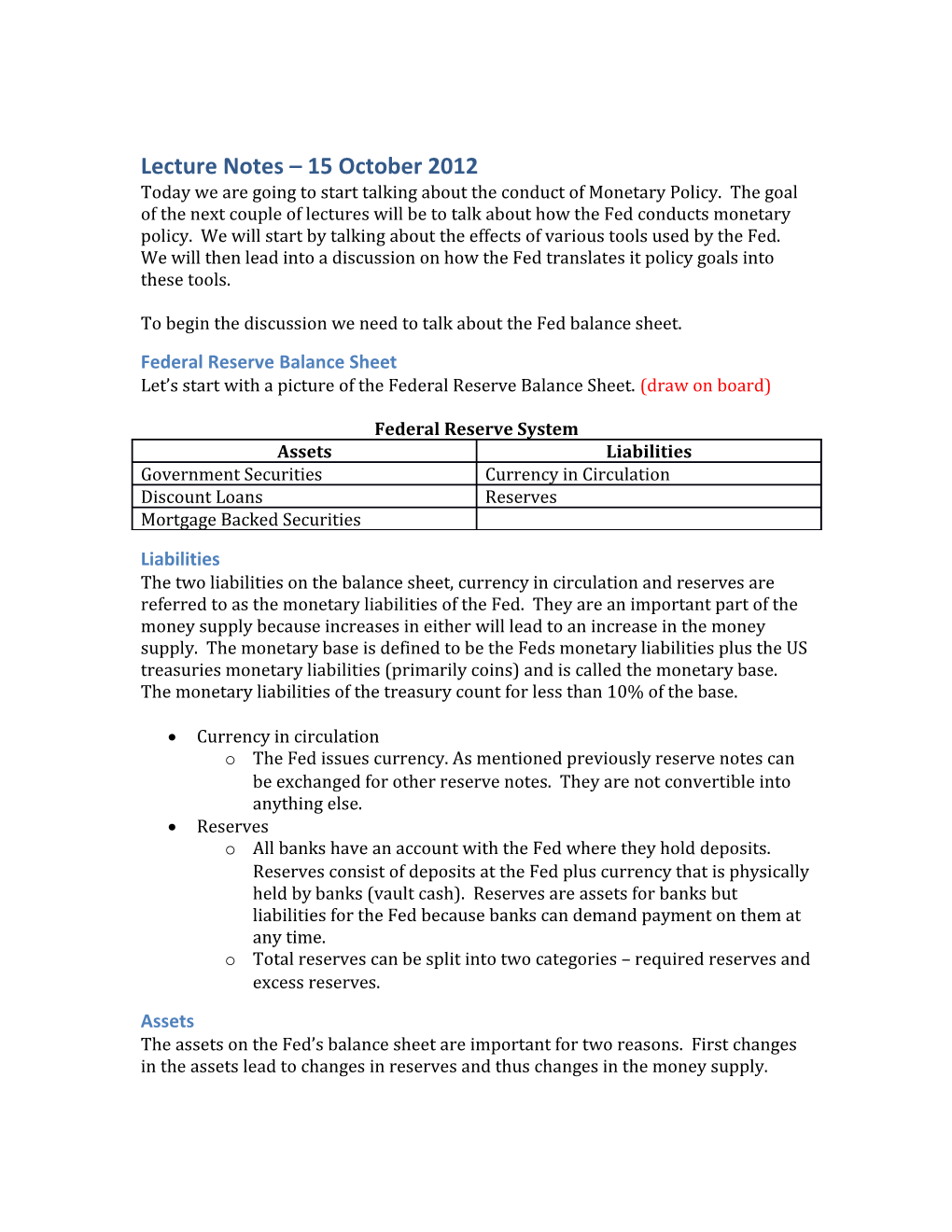

To begin the discussion we need to talk about the Fed balance sheet. Federal Reserve Balance Sheet Let’s start with a picture of the Federal Reserve Balance Sheet. (draw on board)

Federal Reserve System Assets Liabilities Government Securities Currency in Circulation Discount Loans Reserves Mortgage Backed Securities

Liabilities The two liabilities on the balance sheet, currency in circulation and reserves are referred to as the monetary liabilities of the Fed. They are an important part of the money supply because increases in either will lead to an increase in the money supply. The monetary base is defined to be the Feds monetary liabilities plus the US treasuries monetary liabilities (primarily coins) and is called the monetary base. The monetary liabilities of the treasury count for less than 10% of the base.

Currency in circulation o The Fed issues currency. As mentioned previously reserve notes can be exchanged for other reserve notes. They are not convertible into anything else. Reserves o All banks have an account with the Fed where they hold deposits. Reserves consist of deposits at the Fed plus currency that is physically held by banks (vault cash). Reserves are assets for banks but liabilities for the Fed because banks can demand payment on them at any time. o Total reserves can be split into two categories – required reserves and excess reserves. Assets The assets on the Fed’s balance sheet are important for two reasons. First changes in the assets lead to changes in reserves and thus changes in the money supply. Second, because these assets earn interest and generally more interest than that paid on reserves the Fed makes billions each year. This is one of the ways that the Fed maintains independence from the government. Excess returns from the Fed are then returned to the Treasury.

There are two types of assets on the Fed’s balance sheet. Government Securities – these are securities issued by the U.S. treasury Discount Loans – The fed can provide reserves to the banking system by making discount loans. The interest charged for these loans is called the discount rate. Mortgage Backed Securities – These are securities guaranteed by Fannie, Freddie and Ginnie Mae.

The balance sheet currently looks something like the following:

Assets Liabilities Type Face Value Type Amount Government 1.66tr Currency in 1.14tr Securities Circulation Discount Loans 1.5bn Reserve Balances 1.5tr Mortgage Backed 830bn Securities

At the end of 2006 the balance sheet looked like: Assets Liabilities Type Face Value Type Amount Government 779bn Currency in 817bn Securities Circulation Discount Loans 488m Reserve Balances 6.8bn Repos 33bn

A quick comment The balance sheets look a little bit different. You see an explosion in the amount of assets held at the Federal Reserve and an explosion in the reserve balances. Here’s a chart of the reserve data from 2006 to the present. If you read about Fed policy this is a hot topic of discussion.

In order to get to an explanation of what is going on here we need understand how Fed actions affect the Fed Funds rate through supply/demand analysis of reserves. The Fed Fund Rate Recall that the Fed Funds rate is the rate at which banks lend excess reserves overnight. Note that the Fed has a target rate where they want to Fed Funds but they do not directly control the rate. The rate is determined by actual trades in reserves.

Let’s start with a supply and Demand graph for Reserves. Let’s start with the graph from the book. Demand Curve The amount of reserves can be split into two components – required reserves and excess reserves. Thus the demand for reserves equals the required reserves plus the excess reserves demanded. There is an opportunity cost to holding the excess reserves – namely the interest rate that could have been earned by lending out the reserves minus the interest rate earned on those reserves. The interest rate on reserves is 25 basis points. Note this puts a theoretical floor on the Fed Funds rate. Why would a bank lend reserves at a lower rate than that which they can earn by holding them?

It is worth having a quick discussion here. The rates are not in the correct order. The interest rate on reserves is above the Fed Funds rate. If a bank could earn 25ps on reserves or lend them to another bank at Fed Funds = 15bps why would they do the transaction?

I have a couple of possible explanations – neither particularly satisfying or complete. First it could be that banks are not acting rationally. The rates are all basically zero and so maybe there is a lack of care being taken. I do not buy this argument. Bankers I have met have generally been reasonable careful when it comes to charging a fair interest rate even if it is nearly zero. The second explanation I have heard is that Fannie and Freddie (GSE’s) • The Federal Reserve now pays interest on reserves held by banks, but cannot by law pay interest on reserves held by the government sponsored enterprises (GSEs). • GSEs earn some interest on reserves by selling the reserves to banks, but the rates earned by the GSEs are far below rates received by the banks. Tbis is from a published piece from the Fed so it sounds reasonable – why I don’t understand is why Fannie and Freddie have reserves. Supply curve The supply of reserves can be broken into two components as well: Non-borrowed reserves – these are the amount of reserves supplied by the Fed’s open market operations Borrowed reserves – the amount of reserves borrowed by the Fed

Again thinking about the relationship between fed funds and the discount rate. Generally if a bank needs reserves then it will borrow these reserves at the cheapest rate possible. This means that fed funds must be less than the discount rate. Otherwise no one would borrow at fed funds and would instead borrow reserves directly from the Fed. If Fed Funds were above the discount rate then a bank would be able to make a risk- less profit by borrowing at the discount rate and lending at fed funds. The reason the supply curve is horizontal here is that they would be happy to do this at any supply level.

Of course one would then expect that no one would borrow from at the discount rate unless there were issues. Sometimes these might be simple liquidity issues – other times it might be that a particular institution is in financial distress.

Assuming that the amount of reserves is fixed at any particular time. The supply graph is vertical because supply is indifferent to the Fed funds rate.

Discount Lending Generally this is for temporary funding as the rate is much higher than the Fed Funds target. There are three types of discount loans made through the “Discount Window” at a regional Federal Reserve bank.

These are: The primary credit program. Loans under this program are generally made overnight to depository institutions in sound financial conditions. Generally this can be used for any purpose and very few questions will be asked. The secondary credit program. Institutions not eligible for primary credit apply for secondary credit. This is seen as a back-up source of funding for very short periods, or to facilitate an orderly resolution of serious financial difficulties at an institution. Reserve banks will collect information to ensure that the borrowing is consistent with the program. The seasonal credit program is for smaller institutions that have recurring intra-year fluctuations in funding needs – banks that service agricultural and seasonal resort communities for example. Generally banks will be smaller than $500m in assets. Currently these rates are: Primary credit – 75bps Secondary credit – primary credit + 50bs = 125bps Seasonal credit - 25bps

Certainly from the Fed balance sheet one can see that discount lending forms a small part of the Federal Reserve activities both now and before the crisis.

Generally one would expect that changes in the discount rate (primary credit) are going to make no difference to reserves as we can see from the supply demand graph.

Every once in a while it might be that the discount rate goes below fed funds. This would generally be caused by one of the reserve banks protesting at Fed policy. So if the Fed raised the fed funds target and then asked all of the reserve banks to propose a suitable increase in the discount rate they might not do it quickly. Reserve Requirements When the required reserve ration increases, required reserves increase and thus the quantity of reserves demanded increases for any given interest rate. In this analysis it is assumed that the current non-borrowed reserves is sufficient to cover the increase in required reserves and thus the supply curve does not shift to the right as well. Thus this change will increase the demand for reserves and thus push up the fed funds rate. Reserve Requirements Requirement Liability Type % of liabilities Effective date Net transaction accounts 1 $0 to $11.5 million2 0 12-29-11

More than $11.5 million to $71.0 3 12-29-11 million3 More than $71.0 million 10 12-29-11 Nonpersonal time deposits 0 12-27-90 Eurocurrency liabilities 0 12-27-90

The Fed has discretion to vary the 10% rate between 8% and 14% and in extraordinary circumstances can set it to be as high as 18%.

The problem with changing reserves is that increasing reserves can create an immediate liquidity problem for banks with low excess reserves. When the Fed has increased these requirements in the past it has helped by conducting open market purchases to increase excess reserves and also decreasing the discount rate to make borrowed reserves more available. Also it is much easier for the Fed to purchase or sell securities through open market operations to change the level of reserves in the system. Open Market Operations These are the main tool through which the Fed conducts monetary policy. There are two types of open market operations Dynamic Open Market Operations o These are operations that are intended to change the level of reserves and the monetary base. Defensive Open market Operations o These are operations that are intended to offset movements in other factors that affect reserves and the monetary base. These are often done as Repos. . Repos are short-term temporary transactions. The Fed might buy a bond and arrange that the seller will repurchase them in a short time (1-15 days). This is called a repurchase agreement (repo). There is also a reverse repo where the Fed might sell a bond and agree with the purchaser to buy it back. . This will have the effect of temporarily increasing/decreasing reserves and allows the Fed to manipulate the fed funds rate through supply and demand.

The advantages of open market operations over other types of tools are: 1. The Fed has complete control 2. Flexible and precise 3. Easily reversed 4. Implemented quickly

Generally what happens at the trading desk at the NY Fed is: 1. Staff reviews activities of the previous day and issue forecasts of factors that affect supply and demand 2. This information is reviewed to determine what changes need to be made to obtain the desired Fed Funds rate 3. Government securities dealers are contacted to better determine market conditions 4. Projections are compared with the Monetary Affairs division of the Board of Governors. 5. Once a plan of action is agreed it is carried out.

Let’s look at an example where the Fed buys bonds from banks. In this situation the There are several types of open market operations. If the Fed buys bonds from banks then the proceeds will be credited into their reserve account – increasing the supply of reserves. There are two situations to consider. First you might have the supply increases and the fed funds rates will fall when the market finds a new equilibrium. Second you might have a situation where the fed funds rate falls to the discount rate. In this situation the fed funds rate will not change. Let’s talk about what used to happen when the interest rate on reserves was zero. What happens when the Fed buys $100 from the public (non-bank). The balance sheet prior to the transaction looked like NonBank Public Assets Liabilities Securities 100

And afterwards we have NonBank Public Assets Liabilities Securities 0 Checkable deposits 100

The seller then deposits the check in a local bank Banking System Assets Liabilities Reserves 100 Checkable 100 Deposits The effect on the Fed’s balance sheet is: Federal Reserve Assets Liabilities Securities 100 Reserves 100 So the fed has increased its assets by $100 and its reserves by $100.

In supply/demand terms we have shifted the supply of reserves to the right. This has the effect of lowering the Fed Funds rate.

After this transaction will these reserves be required or excess? Assuming that before this transaction all required reserves were available then 90 dollars of these would be excess and 10 dollars would be required. No Interest on Reserves and the Money Multiplier The traditional exposition on excess reserves goes as follows. One would expect that an increase in bank reserves should be multiplied into a much larger increase in the money supply as banks expand their deposits and lending activities. The expansion in deposits should then raise reserve requirements to the point where there are little or no excess reserves in the system.

This should work in the no interest on reserves situation because a bank holding excess reserves would seek to lend out these reserves at any positive interest rate (you earn more by doing this). This additional lending will decrease the short term interest rate. The lending will also create additional deposits. Because the increase in required reserves is small, however, the process will repeat itself until one of two things happen – either the increase in lending and deposits have removed the excess reserves from the system and one finds a new equilibrium interest rate or interest rates fall to zero and there is no further incentive for lending. Let’s go back to our Fed selling a security example and see what happens in practice. As they are earning nothing on the reserves they will try to get rid of the excess reserves. They can do this by lending the money out – either as excess reserves or to an individual. Thus someone receives a loan from Bank A. NonBank Public B Assets Liabilities Checkable deposit 90 Loan 90

Banking System Assets Liabilities Reserves 100 Checkable Deposits 190 Loan 100 Federal Reserve Assets Liabilities Securities 100 Reserves 100

Now how many of the reserves are required and how many are excess? 19 and 81. Clearly we can do this again and again. If the interest paid on reserves is zero then 90 dollars of excess reserves will be turned into.

90*(1+.9+.9^2+.9^3+.9^4+…)= 900 We have another control for the fed funds interest rate. If the investment opportunities yield less than fed funds then the incentive will be to lend the reserves to other banks rather than lend the reserves to individuals. The net result will be the same assuming that there are other opportunities for other banks in the system.

On the other hand downward pressure will be placed on the Fed Funds rate both because the amount of excess reserves has increased so the supply/demand graph will shift and also because there are few investment opportunities for which these reserves can be invested.

Interest on Reserves As of October 2008 the Federal Reserve began to pay interest on reserves. Currently the Fed pays 25 basis points on reserves. For years the Federal Reserve asked Congress to pass legislation allowing it to pay interest on reserves. The book raises a couple of arguments as to why the Fed wanted to pay interest on reserves. The first argument is that it reduces the effective tax on deposits from reserves. Basically the opportunity cost for a bank of holding reserves is the interest that a bank could earn by lending out the reserves minus the interest paid by the fed on reserves. When interest rates were higher then banks would go to extraordinary lengths to reduce them. With the interest rate on reserves set to close to Fed Funds then this opportunity cost is dramatically lowered.

The other arguments regarding paying interest on reserves have to do with supply and demand for reserves. I’ll get to these when we go through some supply and demand arguments.

The second argument regarding interest on reserves has to do with supply and demand of reserves. It puts a floor under the fed funds rate and thus limits the fluctuation of the Fed funds rate. We will discuss this shortly.

The final argument has again to do with supply and demand. When the Fed buys long term bonds this increases reserves. If the Fed does not pay interest on excess reserves then