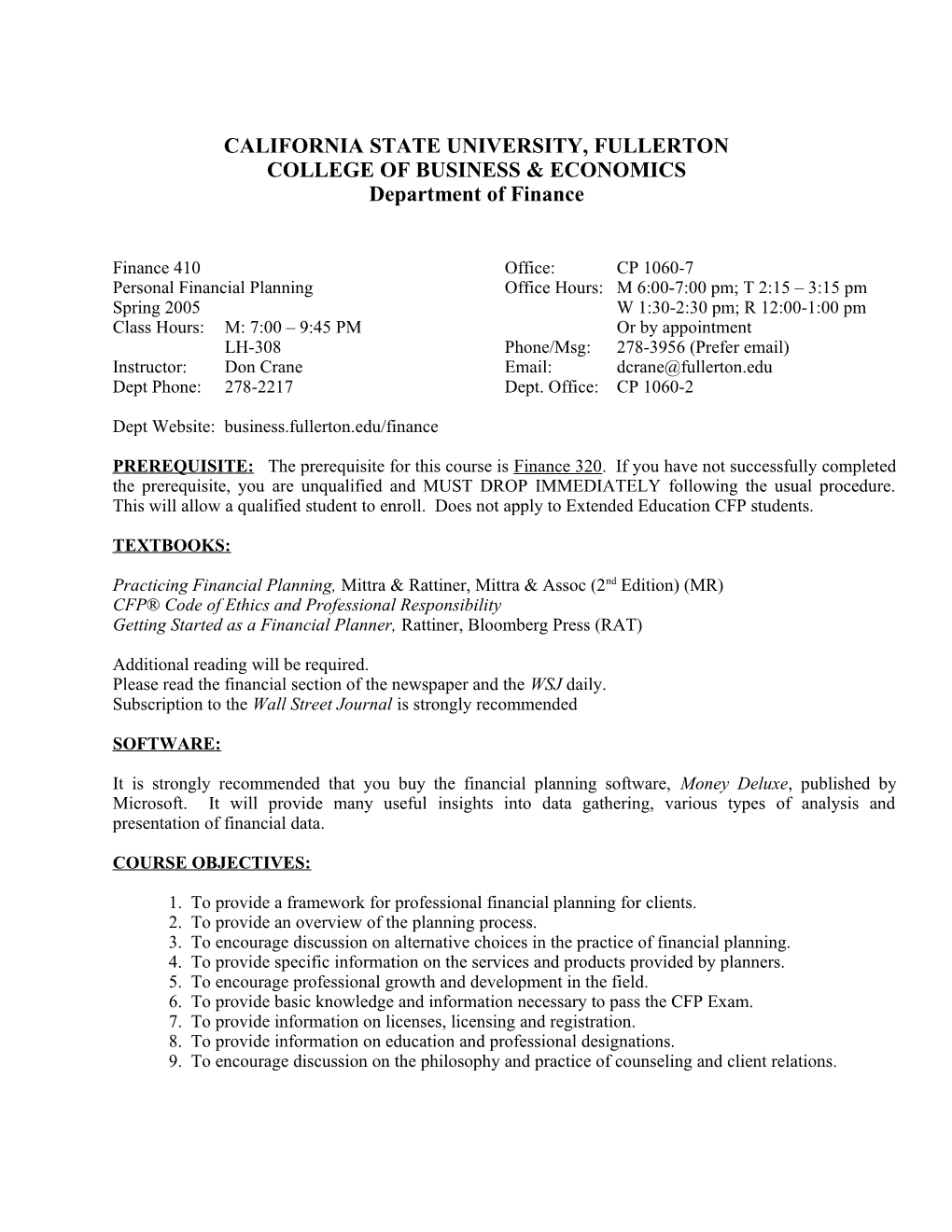

CALIFORNIA STATE UNIVERSITY, FULLERTON COLLEGE OF BUSINESS & ECONOMICS Department of Finance

Finance 410 Office: CP 1060-7 Personal Financial Planning Office Hours: M 6:00-7:00 pm; T 2:15 – 3:15 pm Spring 2005 W 1:30-2:30 pm; R 12:00-1:00 pm Class Hours: M: 7:00 – 9:45 PM Or by appointment LH-308 Phone/Msg: 278-3956 (Prefer email) Instructor: Don Crane Email: [email protected] Dept Phone: 278-2217 Dept. Office: CP 1060-2

Dept Website: business.fullerton.edu/finance

PREREQUISITE: The prerequisite for this course is Finance 320. If you have not successfully completed the prerequisite, you are unqualified and MUST DROP IMMEDIATELY following the usual procedure. This will allow a qualified student to enroll. Does not apply to Extended Education CFP students.

TEXTBOOKS:

Practicing Financial Planning, Mittra & Rattiner, Mittra & Assoc (2nd Edition) (MR) CFP® Code of Ethics and Professional Responsibility Getting Started as a Financial Planner, Rattiner, Bloomberg Press (RAT)

Additional reading will be required. Please read the financial section of the newspaper and the WSJ daily. Subscription to the Wall Street Journal is strongly recommended

SOFTWARE:

It is strongly recommended that you buy the financial planning software, Money Deluxe, published by Microsoft. It will provide many useful insights into data gathering, various types of analysis and presentation of financial data.

COURSE OBJECTIVES:

1. To provide a framework for professional financial planning for clients. 2. To provide an overview of the planning process. 3. To encourage discussion on alternative choices in the practice of financial planning. 4. To provide specific information on the services and products provided by planners. 5. To encourage professional growth and development in the field. 6. To provide basic knowledge and information necessary to pass the CFP Exam. 7. To provide information on licenses, licensing and registration. 8. To provide information on education and professional designations. 9. To encourage discussion on the philosophy and practice of counseling and client relations. 2

COURSE FORMAT:

Lecture; some time will be available during the class sessions for discussion of student term projects later in the semester.

GRADES: Midterm exam...... …30% Final exam...... 40% (comprehensive) Project...... 30% *Failure to complete the term project with a "D" or better results in an "F" in the course.

You may obtain 5 extra points by attending one monthly FPA meeting and writing a one page summary of the presentations. Another 5 points may be obtained by attending an approved seminar or conference and writing it up. Copy to all class members in both cases.

You may obtain 5 extra points by obtaining a financial planning software demo diskette, literature related to the program, and writing a one-page summary of its features, pros, cons, etc.—same for pre-approved book or “journal” article. Copy to all class members.

You may obtain 5 extra credit points by joining the Finance Association. (Only for one of my classes).

WITHDRAWAL POLICY: Conforms to University Withdrawal Policy.

ACADEMIC DISHONESTY: The Department of Finance requires that students engaging in academic dishonesty receive a grade of F. In addition, department policy requires that all individuals engaging in academic dishonesty be reported to the Vice President, Student Affairs.

Academic dishonesty takes place whenever a student attempts to take credit for work that is not his/her own or violates test-taking rules. Examples of academic dishonesty during test taking include looking at other students work, passing answers among students or using unauthorized notes. When students sitting next to each other have identical answers, especially the same mistakes, this may indicate academic dishonesty. Examples of academic dishonesty on out-of-class projects include submitting the work of others or quoting directly from published material without footnoting the source. If you have any questions about the proper use of outside sources, please consult with your professor.

PROJECT:

To develop a financial plan for yourself, your parents, a friend or relative. It will be a continuing project from day one of the class, based on real information, solving real problems. It is to be developed as we progress, section-by-section, area-by-area, through the class. Time will be set aside to answer questions about the plans you are developing (related to that week's information) and its value to your client. The project begins with specification of objectives and data gathering (the development of a data-.gathering package) and finishes with recommendations and implementation procedures (the final comprehensive plan should be suitable for presentation to a paying client). The complete plan is to be turned in at the semester's end with the understanding that packaging and presentation are also important in the planning process. You must find a person to do the plan on or drop immediately. 3

There are three steps in the project: (1) Data Gathering, (2) Data Analysis, and (3) Data presentation. The project takes 150 to 200 hours. The project is a word processing challenge. The final plan (presentation of data, information, and analysis) should include a pre- and post- recommendation balance sheet, budget, cash flow statement, and tax projections. It should also include pre- and post- summaries, section by section, (i.e. insurance, investments), with recommendations for change and the reasoning sandwiched in between. Specific recommendations are required and the costs as well as the benefits included where appropriate.

Data Gathering Package: The development of a 15 to 25 page data gathering package to obtain the personal financial information from any and all clients you may encounter. The package should ask for information about goals, objectives, attitudes, priorities, etc. The package should be simple to read, understand and complete (although it may be time consuming). It should avoid jargon, technical language and ambiguity.

It should use large print, open space and avoid being too cute. It should request raw data (copies of important papers) rather than ask the client to dig out numbers or technical information.

COURSE EXAMINATIONS:

1. True-False, multiple choice and problems. 2. There may be take-home exams as well. 3. 90,80,70,60 or curve for letter grades. 4. No make-up exams. +/- will be used. 5. Final is comprehensive, weighted more heavily on last part (60-40; 70-30).

COURSE OUTLINE: 4

Week Week of of 1 1/31 Role of Planner (MR, 1) (RAT, 1) (CFP® Code) 2 2/7 Process of Planning (MR, 2) (RAT, 2) (CFP® Code) 3 2/14 Insurance (MR, 4) (RAT 3) 4 2/21 No Class 5 2/28 Insurance (MR, 5) (RAT 4) 6 3/7 Cash & Liquidity (MR, 7 & 12)Management, Investments (RAT, 5) 7 3/14 Investment Models and Planning (MR, 13 & 14) 8 3/21 (RAT 6, 7, & 8), Mutual Funds MIDTERM EXAM 9 3/28 No Class 10 4/4 Tax Planning (MR, 15) (RAT, 9) 11 4/11 Tax Planning (MR, 16) (RAT, Appendix) 12 4/18 Retirement Plans (MR, 10) 13 4/25 IRA’s (MR, 10) 14 5/2 Retirement Income, Needs & Planning (MR, 11) 15 5/9 (MR, 9) Estate Planning 16 5/16 Estate Planning 17 5/23 FINAL EXAM – Monday, May 23, 2005, 7:00 p.m.

TERM PROJECT DATES:

Client Information Package Due Week 5 Client Information Revised Package Due Week 6 Insurance Recommendations Due Week 7 Investment Recommendations Due Week 10 Tax Recommendations Due Week 12 Retirement and Estate Planning Recommendations Week 14 (to be turned in as part of the complete plan) Estate Planning Recommendations Week 16 (to be turned in as part of the complete plan)

Complete Plan is Due Wednesday, May 25, 2005 1:30 P.M.