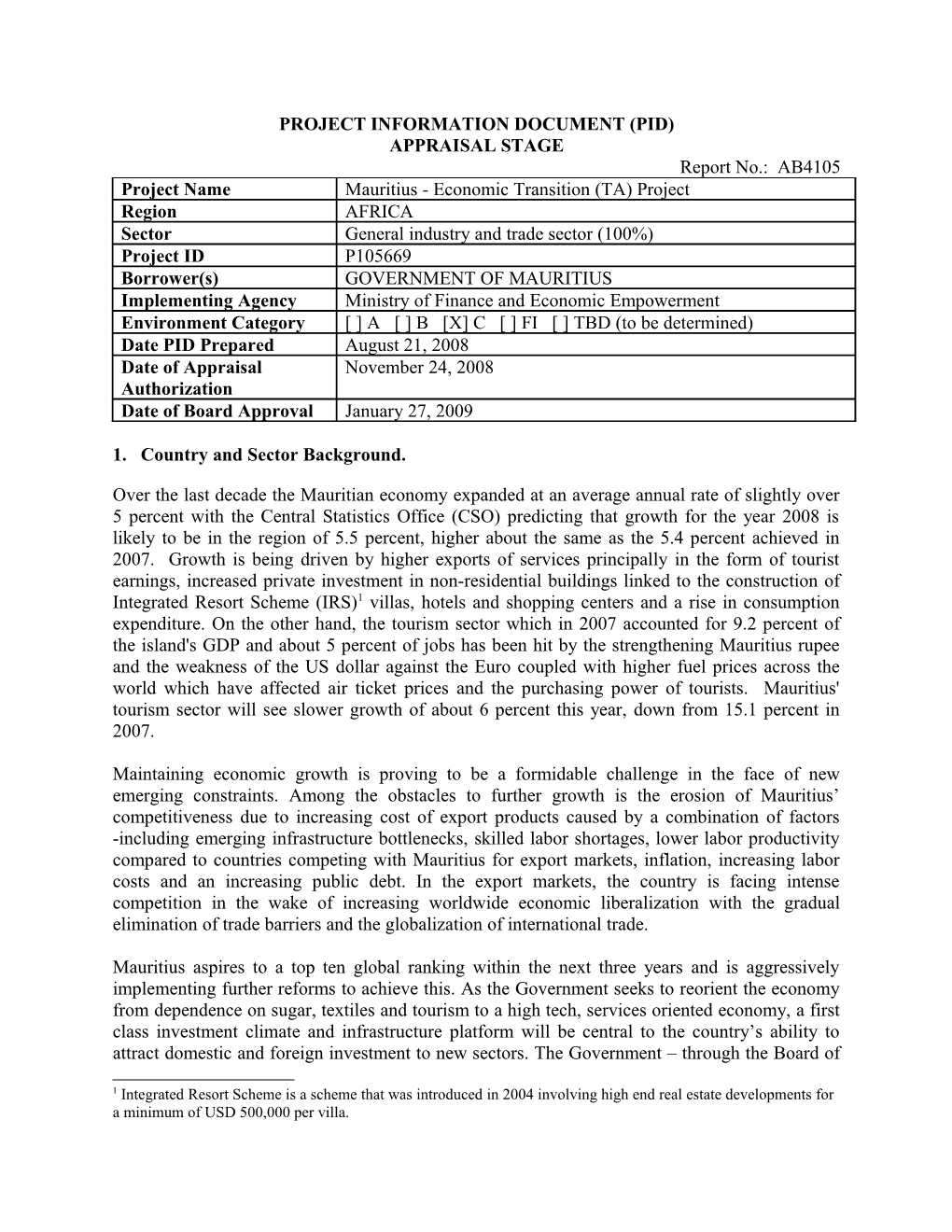

PROJECT INFORMATION DOCUMENT (PID) APPRAISAL STAGE Report No.: AB4105 Project Name Mauritius - Economic Transition (TA) Project Region AFRICA Sector General industry and trade sector (100%) Project ID P105669 Borrower(s) GOVERNMENT OF MAURITIUS Implementing Agency Ministry of Finance and Economic Empowerment Environment Category [ ] A [ ] B [X] C [ ] FI [ ] TBD (to be determined) Date PID Prepared August 21, 2008 Date of Appraisal November 24, 2008 Authorization Date of Board Approval January 27, 2009

1. Country and Sector Background.

Over the last decade the Mauritian economy expanded at an average annual rate of slightly over 5 percent with the Central Statistics Office (CSO) predicting that growth for the year 2008 is likely to be in the region of 5.5 percent, higher about the same as the 5.4 percent achieved in 2007. Growth is being driven by higher exports of services principally in the form of tourist earnings, increased private investment in non-residential buildings linked to the construction of Integrated Resort Scheme (IRS)1 villas, hotels and shopping centers and a rise in consumption expenditure. On the other hand, the tourism sector which in 2007 accounted for 9.2 percent of the island's GDP and about 5 percent of jobs has been hit by the strengthening Mauritius rupee and the weakness of the US dollar against the Euro coupled with higher fuel prices across the world which have affected air ticket prices and the purchasing power of tourists. Mauritius' tourism sector will see slower growth of about 6 percent this year, down from 15.1 percent in 2007.

Maintaining economic growth is proving to be a formidable challenge in the face of new emerging constraints. Among the obstacles to further growth is the erosion of Mauritius’ competitiveness due to increasing cost of export products caused by a combination of factors -including emerging infrastructure bottlenecks, skilled labor shortages, lower labor productivity compared to countries competing with Mauritius for export markets, inflation, increasing labor costs and an increasing public debt. In the export markets, the country is facing intense competition in the wake of increasing worldwide economic liberalization with the gradual elimination of trade barriers and the globalization of international trade.

Mauritius aspires to a top ten global ranking within the next three years and is aggressively implementing further reforms to achieve this. As the Government seeks to reorient the economy from dependence on sugar, textiles and tourism to a high tech, services oriented economy, a first class investment climate and infrastructure platform will be central to the country’s ability to attract domestic and foreign investment to new sectors. The Government – through the Board of

1 Integrated Resort Scheme is a scheme that was introduced in 2004 involving high end real estate developments for a minimum of USD 500,000 per villa. Investment - is leading a PSD reform program that seeks to further energize the private sector as the engine of growth. The Government’s PSD reform program draws upon the Bank’s ICA and Doing Business surveys as the analytical foundations and as the basis for monitoring the progress of reforms in key areas affecting Mauritius’ business environment.

Currently, the government is seeking to promote the transition of the economy to a high-tech and services oriented base. The success of this transition requires Government to attract significant new flows of private investment locally and from abroad into new market segments for which world demand is likely to grow in the near future. The ease of doing business and its associated costs are key determinants of the level of both domestic and foreign investment that a country can generate. Thus, to diversify the economy beyond sugar, textiles and tourism, Mauritius needs a first class investment climate that can induce supply side investment responses into new, non- traditional sources of growth.

2. Objective The Project is designed to strengthen investment climate and public enterprise reforms in order to induce supply-side investment responses.

3. Rationale for Bank Involvement The Investment Climate Assessment and Doing Business reports have identified key constraints on the growth of the private sector in Mauritius. The Government’s reform program seeks to address most of these constraints through a combination of different programs. METAP is one such and supports part of Mauritius’ broader and longer-term economic reform program. This Project does not seek to address all the constraints on private sector growth or public enterprise efficiency in Mauritius. Within the IBRD portfolio for Mauritius and the Country Partnership Strategy (CPS) other instruments addressing the broader reform program include the Development Policy Loan series and the Urban Infrastructure and SME Development Projects (both still under preparation).

Other donor-funded Projects as well as the Government’s own Public Sector Investment Program are also contributing to the broader PSD program. This Project will contribute to: reducing the cost of doing business; greater fiscal discipline and efficiency improvements in the public enterprise sector, improving the delivery of key infrastructure services to the private sector and facilitating private investment in key infrastructure sectors on public-private partnership terms. These goals will be achieved by reducing the regulatory burden and costs of doing business; re- engineering key parastatals for enhanced operational efficiencies and service delivery; and strengthening support for public private partnership transactions thereby improving competitiveness at the firm level.

Government of Mauritius introduced a new program based approach to national budgeting which is being supported by the World Bank and by other donors. The program based budgeting approach requires all parastatals to prepare reform action plans. So far, only five parastatals have prepared such reform action plans2. Of these five, only three have passed the test of an adequate

2 These are Central Electricity Board, Central Water Authority, Waste Water Management Authority, Agricultural Marketing Board and Sugar Planters’ Mechanical Pool Corporation. plan with clear objectives, proposed interventions and expected results3. This project will support further preparation and implementation of such reform action plans. Despite an aggressive and generally successful economic reform program, the parastatal sector is still large for an economy the size of Mauritius and there have not been any meaningful reforms in this sector recently.

Other development partners welcome the Bank’s involvement in addressing important gaps in private sector development and parastatal reform in Mauritius. Because of the Bank’s expertise in areas such as improving business environment, public enterprise reform, and increasing access to finance and public private partnerships, they view the World Bank’s participation as crucial for the program’s success. Bank support will focus on areas where: a) the Bank has a comparative advantage; b) it leverages private sector as well as other development partners’ participation; c) it supports the emergence of a broad-based entrepreneurship culture; and d) public sector institutions can be transformed to enhance fiscal discipline, private sector and SME growth.

1. World Bank participation in the Project will enable the Government to draw from best practices developed in other regions in a variety of fields. For instance, the Project will support the introduction of innovative approaches to enhance enterprise creation and competitiveness through support to public-private partnerships, dialogue, and enhancement of firm level competitiveness through infrastructure development. An added advantage of the World Bank’s involvement is the cross sector and agency experience it can draw upon, both within Southern Africa and from other regions.

4. Description Within the Government’s broader reform program, the Project will address a subset of key activities to support and help keep up the momentum for reform. The Project will be structured around the following three pillars: Component One: Business facilitation; Component Two: Public Enterprise Reform; Component Three: Utility Regulation & Public Private Partnerships

5. Financing Source: (US$m.) Borrower 0 International Bank for Reconstruction and Development 18 Total 18

6. Implementation The Project will be overseen by the Public Enterprises Reform Unit (PERU) which is already in existence and has supported the development of the Project from the beginning. This Unit is in the Ministry of Finance and Economic Empowerment (MoFEE). A Project Coordinating Committee (PCC) chaired by a Director in MoFEE has been established with representation from the private sector and Project beneficiaries. Membership of the PCC includes: State Law Office, Board of Investment and Ministry of Public Utilities. The PCC has the role of: (i) providing strategic guidance and oversight of the overall reform process being undertaken by the

3 These are Central Electricity Board, Central Water Authority and Waste Water Management Authority. Government under this Project, including public enterprise reform, (ii) approving annual work programs and budgets; (iii) reviewing progress reports prepared by PERU, clearing and forwarding periodic reports to the World Bank; (iv) proactively addressing any major problems affecting Project implementation; and (v) reviewing key reports including the audit, mid-term review and implementation completion report.

The overall coordination and implementation of the project will be undertaken by PERU. The responsibilities of PERU are the following: (i) preparation/consolidation of the work programs and budgets; (ii) maintenance of records and accounts for all transactions related to the project; (iii) timely preparation of quarterly IFRs and annual project financial statements in close collaboration with the Treasury Department; (iv)monitoring and evaluation of the various activities supported under the project. The Treasury Department will be in charge of cash management and replenishment applications for the Designated Account. PERU will be headed by a Project Coordinator nominated by MoFEE and will include specialists in accounting, procurement and monitoring and evaluation. PERU will also provide procurement functions and directly manage the public enterprise reform component and beneficiary agencies themselves will be directly responsible for implementation of project activities under their respective components. These agencies will work closely with PERU on a day-to-day basis and submit regular reports to PERU, who will consolidate these reports for the PCC and the Bank.

7. Sustainability The key sustainability issue relates to ensuring that sufficient skills are developed in regulation and sufficient financing is available for the newly created regulatory agency. Once the reforms are completed, there should be no need for continuing assistance in this regard. Many of the constraints to PSD do not require large expenditures, merely the diagnosis of policy, legal and administrative reforms, and technical support in implementing such changes. Therefore, the cost of such actions is quite low, while the impact can be high. However, while many aspects of reducing the cost of doing business can be tackled with low-cost solutions, others require resources well beyond the scope of this Project. Critical to the sustainability of growth is further investment in infrastructure, not just in transportation but also in power and water supply. The restructuring of public enterprises and the facilitation of public-private partnerships envisaged under this Project will play an important role in addressing these constraints, but additional public and private investment will be required to achieve real change.

The Government’s reform program clearly links the achievement of social outcomes and poverty reduction to raising the rate of economic growth. The reform program was launched as a Government initiative, with full national ownership and was initially conceived without donor assistance. The Bank was invited to provide technical and financial support to implement the reform program. As the reforms cut across many areas of national policy, a prerequisite to achieving the growth objectives is mainstreaming of PSD issues and performance improvements across the public sector and this will also help ensure the sustained impact of this Project.

Another factor critical to sustainability is achieving a change in attitude of key public service agencies and their staff, which are now being increasingly viewed as service providers rather than civil service gatekeepers. While the Project can support Government in the diagnosis and implementation of economic and policy reforms, in the end it is on-the-ground implementation of such policies that has the greatest impact on the private sector. Equally, while the Project can channel supplemental resources to key institutions that serve the private sector, attitudes will remain important in determining how effectively such additional resources are deployed. In light of the above, a major cross-cutting emphasis of the Project will be on changing the mindset and attitudes of the public sector through periodic seminars and workshops on appropriate themes.

8. Lessons Learned from Past Operations in the Country/Sector This Project has been designed drawing upon the World Bank Group’s experience in Sub- Saharan Africa and other regions and has benefited from the utilization of a strong in-country design team. Specifically the Project draws upon the large amount of analytical work carried out by the World Bank Group and the Government of Mauritius in recent years, including the 2006 Aid for Trade Report, the 2006 Investment Climate Assessment, the annual Doing Business surveys, the 2006 Governance and Anticorruption Report (GAC). Lessons have also been learned from the experiences of Projects supported by other development partners in the sector and from the experiences of Mauritius Chambers of Commerce and Industry (MCCI), the Joint Economic Council (JEC) and the Board of Investment in promoting a competitive business environment in Mauritius. The Project design reflects the following key lessons learned:

Building strong public-private dialogue and buy-in: Effective private-public dialogue is important as experience has demonstrated the difficulties in implementing reforms without ownership by the public and private sector. The Project design draws on this lesson and makes the public-private interface a feature of the Project implementation arrangements. To ensure that there is buy-in to the Project by the Government and private sector, the Project team has carried out extensive consultations during Project preparation, including establishment of several working groups comprised of public and private sector members under each component. The Project provides for a significant role for the private sector during implementation. Also, the team coordinated with other development partners during Project preparation to minimize the possibility of overlapping or duplication, and to benefit from synergies where possible.

Simplicity of design: Experience has shown that even for Middle Income Countries (MIC) like Mauritius, Project implementation capacity can be limited and ensuring that the design of the Project is simple with clear actions, objectives and expected results is essential. In relation to this Project, the Project team has attempted to incorporate simple designs and implementation arrangements, and adequate M&E systems agreed upfront with Government counterparts. The Project team has selected priority interventions (from a large number of potential interventions) based on a careful assessment of the likelihood of successful implementation and achieving demonstrable improvements in Mauritius’ business enabling environment.

Ownership: The objectives of the Project will include implementation of a series of policy, legal and administrative reforms. Such reforms can only be achieved if there is significant commitment to the objectives of the Project, and most importantly a belief in, and appreciation of the importance of this Project that is both broad and deep across Mauritius’ public sector. The fact that this Project was conceived as a technical and financial support measure to an existing Government reform program helps to ensure that national ownership remains strong. While appetite for reform across Government is not even, the Project has strong champions at the political and technical levels in key Government agencies. Experience shows that institutional reforms can succeed when there is committed leadership and where Bank programs work closely with champions of reform in Government, and in collaboration with a broad range of stakeholders.

9. Safeguard Policies (including public consultation) Safeguard Policies Triggered by the Project Yes No Environmental Assessment (OP/BP 4.01) [ ] [X ] Natural Habitats (OP/BP 4.04) [ ] [ X] Pest Management (OP 4.09) [ ] [ X] Physical Cultural Resources (OP/BP 4.11) [ ] [ X] Involuntary Resettlement (OP/BP 4.12) [ ] [ X] Indigenous Peoples (OP/BP 4.10) [ ] [X ] Forests (OP/BP 4.36) [ ] [ X] Safety of Dams (OP/BP 4.37) [ ] [X ] Projects in Disputed Areas (OP/BP 7.60)* [ ] [ X] Projects on International Waterways (OP/BP 7.50) [ ] [X ]

10. List of Factual Technical Documents: Mauritius Investment Climate Assessment (World Bank, 2006) Feasibility Assessment of Expansion of the Credit Reporting Infrastructure (International Finance Corporation, 2007) Implementation Completion Report – Mauritius Environmental Sewerage and Sanitation Project (World Bank, 2007) Mauritius – From Preferences to Global Competitiveness (World Bank, 2006) Assessment of Institutional and Governance Framework for Waste Water Management Authority (European Union, 2007) Energy Sector and Water Sector Policies (Government of Mauritius, 2008) Strategic Options for Private Sector Participation (PSP) in the Water and Sanitation Sectors in Mauritius (International Finance Corporation, 2006) Code of Corporate Governance for Mauritius – Guidance Notes for State-Owned Enterprises Aide Memoirs for Project Identification and Preparation Missions (World Bank, 2007) Budget Speeches (Government of Mauritius – 2006/ 2007/ 2008) Pepping up Public Infrastructure for Enhanced Economic Activity (MCB - Occasional Paper No. 39, 2008) Infrastructure and Growth in Africa (César Calderón, 2008) Doing Business Report (World Bank – 2007/ 2008/ 2009) Multi-Annual Adaptation Strategy for the Sugar Industry (Ministry of Agro-industry and Fisheries 2006) Review of Cess-Funded Service Providing Institutions (KPMG – 2007/8) White Paper on Price Control (Ministry of Industry, Small and Medium Enterprises, Commerce and Cooperatives - 2006) Masterplan for the Development of a Sustainable Potable Water Supply in Mauritius (Central Water Authority – 2007)

Draft Energy Policy for the Republic of Mauritius (2008)

* By supporting the proposed project, the Bank does not intend to prejudice the final determination of the parties' claims on the disputed areas 11. Contact point Contact: Constantine Chikosi Title: Senior Operations Officer Tel: +230-203-12500 Fax: +230-208-0502 Email: [email protected] Location: Port Louis, Mauritius (IBRD)

12. For more information contact: The InfoShop The World Bank 1818 H Street, NW Washington, D.C. 20433 Telephone: (202) 458-4500 Fax: (202) 522-1500 Email: [email protected] Web: http://www.worldbank.org/infoshop