Teesside Pension Fund and Investment Panel 1 December 2010

TEESSIDE PENSION FUND AND INVESTMENT PANEL

A meeting of the Teesside Pension Fund and Investment Panel was held on 1 December 2010.

PRESENT: Councillor Bloundele (In the Chair); Councillors Brunton, Hubbard, Rostron, P Thompson, N Walker and Whatley.

District Council Members:

Councillor Rix – Stockton Borough Council Councillor Pickthall – Redcar and Cleveland Borough Council

Employers’ Representative:

Mr Peter Fleck

PRESENT BY INVITATION: Investment Advisors:

J Hemingway – Investment Advisor P Moon – Investment Advisor H Meaney – Property Advisor

OFFICERS: J Dixon, F Green, A Hill and M Hopwood.

**APOLOGIES FOR ABSENCE were submitted on behalf of Councillors Cole, Majid, Mawston and K Walker.

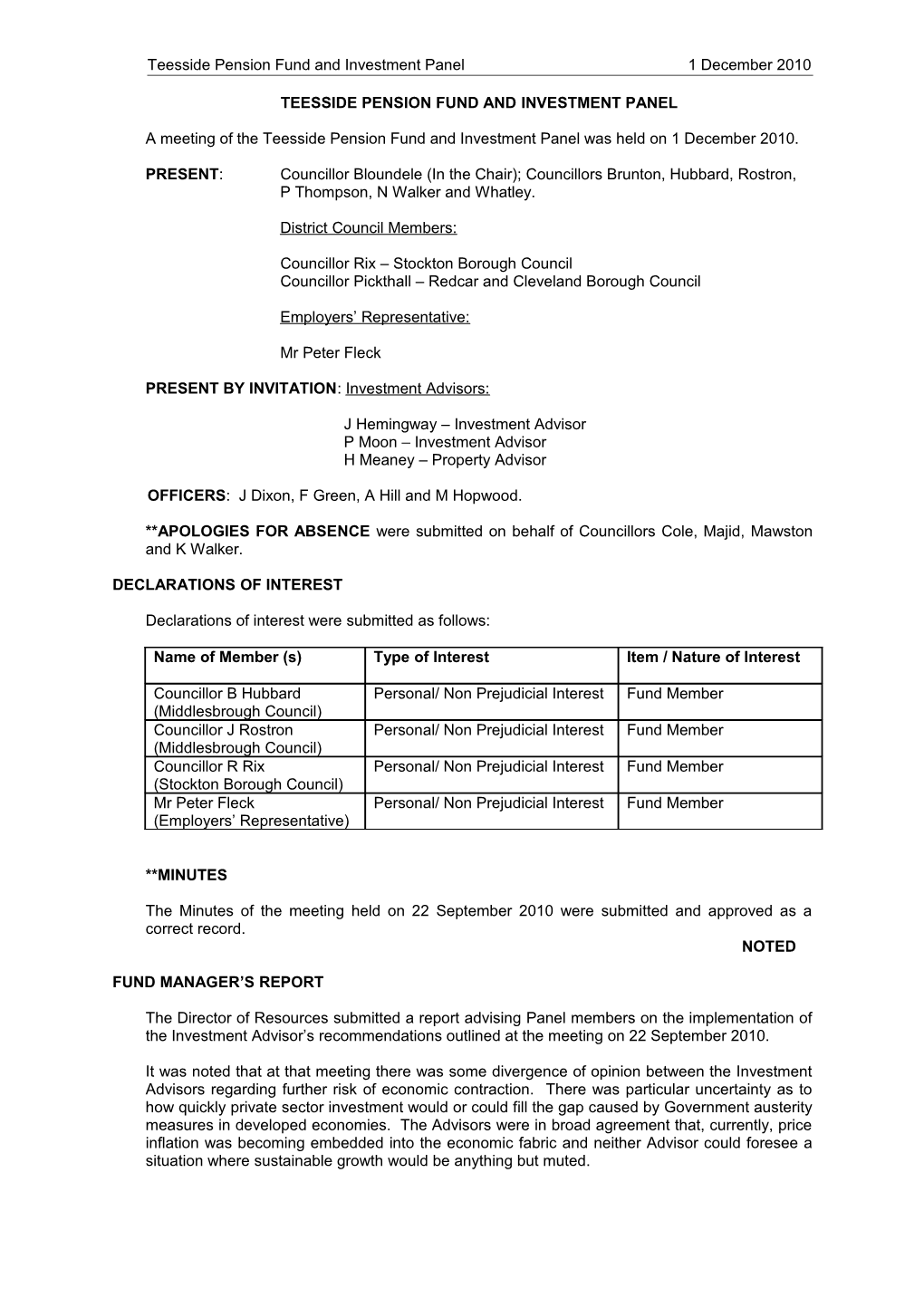

DECLARATIONS OF INTEREST

Declarations of interest were submitted as follows:

Name of Member (s) Type of Interest Item / Nature of Interest

Councillor B Hubbard Personal/ Non Prejudicial Interest Fund Member (Middlesbrough Council) Councillor J Rostron Personal/ Non Prejudicial Interest Fund Member (Middlesbrough Council) Councillor R Rix Personal/ Non Prejudicial Interest Fund Member (Stockton Borough Council) Mr Peter Fleck Personal/ Non Prejudicial Interest Fund Member (Employers’ Representative)

**MINUTES

The Minutes of the meeting held on 22 September 2010 were submitted and approved as a correct record. NOTED

FUND MANAGER’S REPORT

The Director of Resources submitted a report advising Panel members on the implementation of the Investment Advisor’s recommendations outlined at the meeting on 22 September 2010.

It was noted that at that meeting there was some divergence of opinion between the Investment Advisors regarding further risk of economic contraction. There was particular uncertainty as to how quickly private sector investment would or could fill the gap caused by Government austerity measures in developed economies. The Advisors were in broad agreement that, currently, price inflation was becoming embedded into the economic fabric and neither Advisor could foresee a situation where sustainable growth would be anything but muted. Teesside Pension Fund and Investment Panel 1 December 2010

Given the Fund position, the Advisors’ stance remained that the Fund should continue to increase exposure to growth assets at the expense of protection assets, favouring periods of relative weakness in equity markets to increase allocations with the possibility of some short-term range trading. The Advisors favoured investments in small companies and those with the capability to finance buybacks.

The Advisors considered Bond yields to be generally well below anything required to produce an acceptable return and that there may be opportunities to look for anomalous valuations in corporate bonds. In relation to other asset classes, the Advisors considered that there may be rotational opportunities in soft commodities and property on a highly selective basis.

The Fund Manager’s commentary, contained at 4.2 of the submitted report, made specific reference to, and provided details on, the following ‘bubble-based’ economies:-

1998-2001 – the dot.com bubble 2002-2006 – the refinancing bubble 2006-2008 – the real estate and banking bubble 2008-2010 – the printing press bubble

Details were also provided on transactions of the Fund undertaken in the period 1 August 2010 to 31 October 2010. There was a net investment of approximately £26 million in this period compared to £35 million for the previous reporting period. During this period of market weakness, investment activity resulted in cash balances decreasing from £122 million to £112 million. A copy of the Transaction report was attached at Appendix A.

Specific activities in the following categories were set out in paragraph 5.3 under the following headings:

UK Bonds Overseas Bonds UK Equity Overseas Equity – USA, Europe, Japan and Asia Pacific Alternative Investments

The Fund Valuation as at 31 October 2010 prepared by the Fund’s custodian, Northern Trust, including the total value of all investments including cash was valued at £2,428 million, compared to the last reported valuation of £2,246 million as at 31 July 2010. A copy of the monthly valuation report was attached at Appendix B.

An analysis of the summary valuation provided a comparison between the Fund’s weightings in the various asset classes, compared with the Fund’s customised benchmark and also the average of other funds, and was set out in a table in paragraph 6.2 of the report. NOTED

INVESTMENT ADVISOR’S REPORT

The Investment Advisors were present at the meeting and reviewed the Fund’s asset distribution in the light of current markets.

The Investment Advisors remained cautious about macro economic conditions. They anticipated continuing difficulties in the euro-zone economy, with no obvious solution to structural imbalances within a single currency system. Although they felt that a double dip recession was unlikely they did warn of a lengthy period of very slow growth. They also anticipated that Bond yields in the Developed World would have to rise and that this, coupled with rising inflation, would also impact on equity markets. The Advisors continued to favour Growth Assets, such as Equities and Property, over Protection Assets, such as Bonds and Cash. Bond markets continued to be overvalued and generally not reflecting risk.

The short-term recommendation was to allow cash balances to increase, while opportunities to take profits on equities, especially in smaller companies, and commodities should be taken in the short term. Property investment should be on a selective basis. Regarding alternative Teesside Pension Fund and Investment Panel 1 December 2010

investments, the Fund's position on certain types of investment vehicles was restated, but it was felt that some alternatives were suitable and areas such as farm land and gold may offer investment opportunities. NOTED

PROPERTY ADVISER’S REPORT

The Fund’s Property Advisor submitted a report, which provided an overview of the current property market and informed Members of individual property transactions relating to the Fund. The Panel was advised that the value of the Fund’s property portfolio as at 30 September 2010 had increased by approximately 2.2% on the previous quarter and was currently valued at £90,850,000. NOTED

PUBLIC SERVICE PENSIONS COMMISSION: INTERIM REPORT

The Director of Resources submitted a report to advise Members of Lord Hutton’s interim report published in relation to public sector pensions. The Hutton Report was commissioned on the basis that there was a perceived need to modernise public sector pensions to ensure that they were affordable, sustainable, adequate and fair to taxpayers and employees. The final report was expected in early 2011 prior to the Chancellor’s March budget.

The Executive Summary of the interim report, published on 7 October 2010, was attached at Appendix A.

The report covered all public sector schemes although it recognised the significant differences between them. All schemes had different employee contribution rates and a range of retirement ages.

It was highlighted that costs had significantly increased over the last decade in the public sector due to the expansion of the public sector workforce and increased longevity. This was recognised by the previous Government and a series of reforms were implemented, including changes to the LGPS such as requiring higher contribution rates from employees. More recently, the current Government changed the measure of annual benefit movements to the Consumer Price Index (CPI) from the Retail Price Index (RPI).

The reforms already implemented and proposed, together with the current pay freeze and planned workforce reductions across the public sector would reduce the future cost of pensions. It was expected that the gross cost of paying unfunded public sector pensions would fall from 1.9% of GDP in 2010/11 to 1.5% by 2060.

The Hutton report stated that the average pension payment from public sector schemes was £7,800 per annum, however this was much lower for the LGPS with the average from the Teesside Fund being £3,800 per annum.

The report set out four principles for public sector pension provision:-

Affordability and sustainability. Adequacy and fairness. Supporting productivity. Transparency and simplicity.

The Key findings of the Hutton report impacting on the LGPS were:-

Accrued rights preserved. LGPS to remain a funded scheme. Any changes in employee contribution rates to be phased in and managed to protect the low paid. The final report would consider moving the scheme to a hybrid Defined Benefit scheme with Defined Contribution top up above a salary limit set to protect the low paid. Teesside Pension Fund and Investment Panel 1 December 2010

The final report would consider bringing in a career average calculation to replace, wholly or in part, the final salary currently used in pension calculation.

During the course of discussion, the following issues were raised:-

A Panel Member stressed the importance of emphasising that the LGPS was a fully funded scheme and was pleased that the Hutton Report recognised this.

Clarification was provided regarding the difference between RPI and CPI and how it would affect a person’s pension.

In response to a query, it was confirmed that Pension Fund members would be written to in due course to advise of the change.

It was acknowledged that the percentage funding of the LGPS varied, for example some areas were 60% funded, the Teesside Pension fund was 90% funded. It was requested that this be reflected in the response to Government as part of the consultation process.

ORDERED as follows:-

1. That the contents of the submitted report be noted.

2. That the Head of Investments and Treasury Management draft a response to be submitted to Government by 17 December 2010 in relation to the Hutton Report recommendations.

SHAREHOLDER GOVERNANCE ANNUAL REPORT

The Director of Resources submitted a report to inform Members of action taken in implementing the Fund’s policy on Shareholder Governance.

The Fund’s Business Plan required that an Annual Report on Shareholder Governance be presented to the Panel and a copy was attached at Appendix A.

The report provided quantitative data on voting activity in the year and collective actions. This provided an annual opportunity to ensure the Fund’s Shareholder Governance Policy remained relevant and fit for purpose.

The Fund’s own Shareholder Governance Policy had remained unchanged since the 1990s but had been revised to take account of the following:-

Revised Turnbull Guidance of Annual Reports and Accounts. Companies Act 2006 – conflict of interests. The Walker Review – regarding scope of the remuneration committee. The Fund’s consideration of environmental and social issues as part of the investment process.

It was highlighted that voting volumes and outcomes for 2010 appeared to be similar to the previous year.

Appendix 1 covered the revised policies and the key changes were outlined by the Fund Manager.

The Proxy Voting Review, October 2009 – September 2010, produced by the Pensions and Investment Research Consultants Ltd (PIRC) was attached at Appendix 2.

ORDERED as follows:-

1. That the Fund’s Shareholder Governance Policy, attached at Appendix 2 to the submitted report, be noted. Teesside Pension Fund and Investment Panel 1 December 2010

2. That the changes to the Fund’s Shareholder Governance Policy, set out in Appendix A, be approved.

MYNERS PRINCIPLES: TRUSTEE SELF EVALUATION

The Director of Resources submitted a report advising Members of a framework to be produced to deliver a trustee self evaluation programme and to improve compliance with the Myners Principles regarding performance assessment.

In June 2009 trustees considered that the Fund was in full compliance with the principle in relation to effective decision making, however it was evident that there was no self evaluation mechanism.

In September 2010 CIPFA and Hymans Robertson launched a Knowledge and Skills Framework to enable trustees to evaluate their own capabilities. The framework was a chargeable service and detailed findings were set out in the submitted report. CIPFA had published the framework and member assessment was based on a training needs analysis derived from the new Knowledge Library.

CIPFA had released a sample of the Analysis and Library, attached at Appendix A, therefore a full assessment was not possible but it was noted that the service was annually chargeable, for which the Fund had not provision. There was no budget established for the actual assessment process, therefore, an in house approach was required as it was felt that any expenditure should be directed at providing training, not measuring it.

A copy of the Guidance Notes for Trustee Performance Self Evaluation was attached at Appendix B to the report and a copy of the specimen questions were attached at Appendix C.

The Panel was advised that any Trustee evaluation process must be kept confidential and be straight-forward, producing clear results. The programme would be offered to all attendees of the Investment Panel. Where a training need was identified, nominated Officers would provide Trustee support. The training need might be met by one-to-one briefings, informal discussion or formal training.

ORDERED that the Fund adopts a Trustee Self Assessment Programme developed in-house and does not adopt the CIPFA Knowledge and Skills Framework.

TREASURY MANAGEMENT REPORT

The Director of Resources submitted a report to inform Members of the treasury management of the Fund’s cash balances, including the methodology used. The Fund held cash balances made up from investment income and contributions from employers and employees, which were available for investment or to make pensions payments. The balance of cash held varied from time to time primarily as a result of Investment Advisors’ recommendations. Balances were managed as part of the Council’s treasury management operation.

The Chartered Institute of Public Finance and Accountancy (CIPFA) Code of Practice (the Code) set out how cash balances should be managed. The Code stated that the objective of treasury management was the management of the Authority’s cashflow, its borrowings and investments, in such a way as to control the associated risks and to achieve a level of performance or return consistent with those risks. Security of the cash invested was more important that the interest rate received.

Middlesbrough Council adopted the Code on its inception and determined that the cash balances held by the Fund should be managed using the same criteria. The Policy established a list of counterparties (banks, building societies and others to which the Council would lend) and set limits as to how much it would lend to each counterparty. The only difference when dealing with the Fund’s cash balances was that the limits were larger, reflecting the fact that the Fund had, in recent years, held much more cash than the Council. Teesside Pension Fund and Investment Panel 1 December 2010

It was accepted that there was no such thing as a risk-free counterparty and the policy had been successful in avoiding any capital loss through default. Most recently the Fund had no exposure to any of the Icelandic banks.

The counterparty list and associated limits as at 31 October 2010 was detailed at paragraph 6. of the submitted report. In order to keep abreast of the volatile market the policy could be changed at any time by the Director of Resources with subsequent reporting to the relevant committee. The Head of Investments or the Treasury Manager could delete names from the list but could not add them, and could reduce, but not increase limits.

As at 31 October 2010 the fund had £105.6 million invested with approved counterparties at an average rate of 1.10%.

Appendix A showed the maturity profile of cash invested and the average rate of interest obtained on investments for each period. NOTED