March 06, 2015

Ralph Lauren Corporation (RL-NYSE)

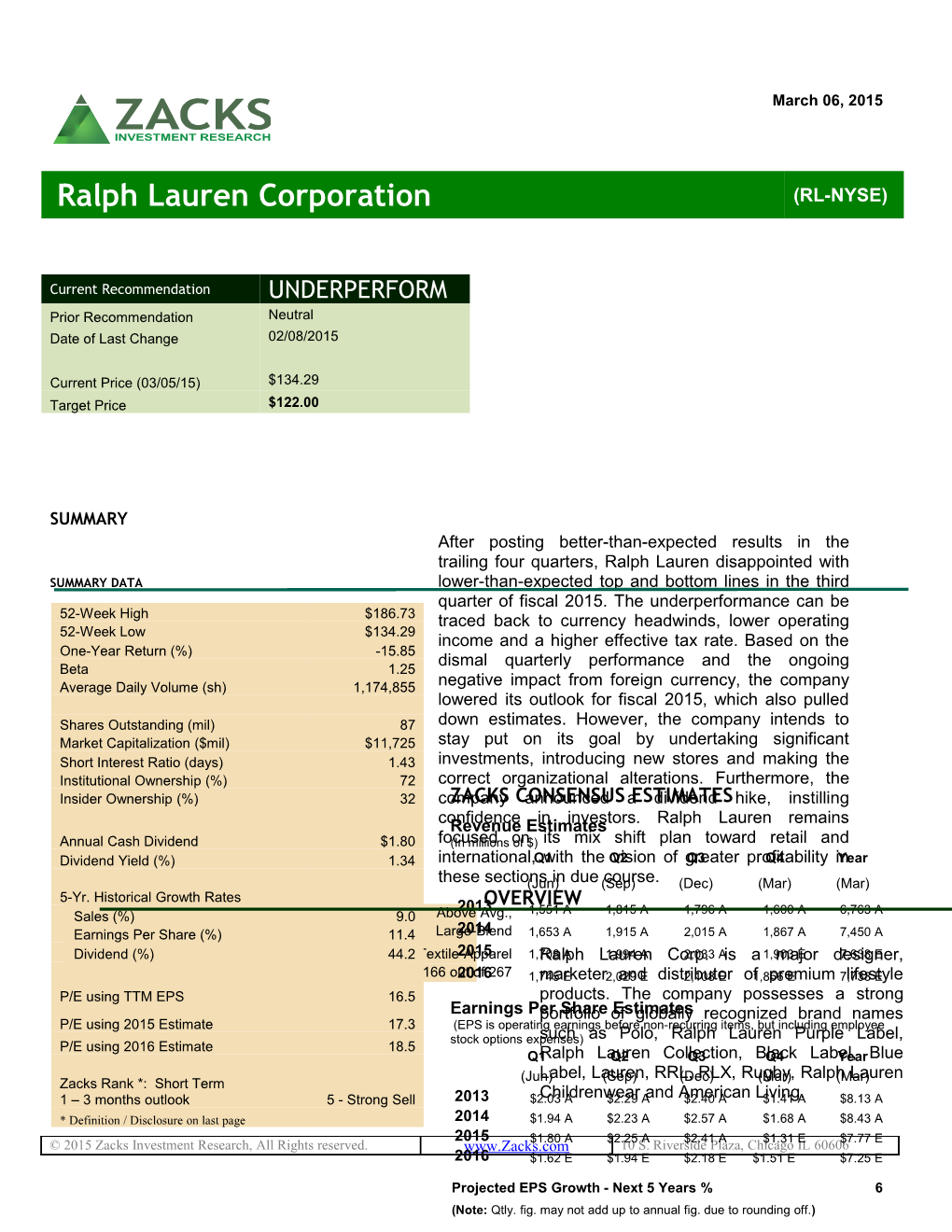

Current Recommendation UNDERPERFORM Prior Recommendation Neutral Date of Last Change 02/08/2015

Current Price (03/05/15) $134.29 Target Price $122.00

SUMMARY After posting better-than-expected results in the trailing four quarters, Ralph Lauren disappointed with SUMMARY DATA lower-than-expected top and bottom lines in the third quarter of fiscal 2015. The underperformance can be 52-Week High $186.73 traced back to currency headwinds, lower operating 52-Week Low $134.29 income and a higher effective tax rate. Based on the One-Year Return (%) -15.85 dismal quarterly performance and the ongoing Beta 1.25 Average Daily Volume (sh) 1,174,855 negative impact from foreign currency, the company lowered its outlook for fiscal 2015, which also pulled Shares Outstanding (mil) 87 down estimates. However, the company intends to Market Capitalization ($mil) $11,725 stay put on its goal by undertaking significant Short Interest Ratio (days) 1.43 investments, introducing new stores and making the Institutional Ownership (%) 72 correct organizational alterations. Furthermore, the Insider Ownership (%) 32 companyZACKS CONSENSUS announced aESTIMATES dividend hike, instilling confidenceRevenue Estimates in investors. Ralph Lauren remains Annual Cash Dividend $1.80 focused(In millions onof $) its mix shift plan toward retail and Dividend Yield (%) 1.34 international,Q1 with the Q2vision of greaterQ3 profitabilityQ4 inYear these sections(Jun) in due (Sep)course. (Dec) (Mar) (Mar) 5-Yr. Historical Growth Rates OVERVIEW 2013 1,551 A 1,815 A 1,796 A 1,600 A 6,763 A SalesRisk (%) Level * 9.0 Above Avg., EarningsType of Per Stock Share (%) 11.4 Large-Blend2014 1,653 A 1,915 A 2,015 A 1,867 A 7,450 A DividendIndustry (%) 44.2 Textile-Apparel2015 1,708Ralph A Lauren1,994 A Corp.2,033 A is a1,903 major E designer,7,638 E Zacks Industry Rank * 166 out2016 of 267 1,745marketer E 2,029 and E distributor2,108 E of1,856 premium E 7,738 lifestyle E P/E using TTM EPS 16.5 products. The company possesses a strong Earnings Perportfolio Share ofEstimates globally recognized brand names P/E using 2015 Estimate 17.3 (EPS is operating earnings before non-recurring items, but including employee stock options expenses)such as Polo, Ralph Lauren Purple Label, P/E using 2016 Estimate 18.5 Q1Ralph LaurenQ2 Collection,Q3 BlackQ4 Label,Year Blue (Jun)Label, Lauren,(Sep) RRL,(Dec) RLX, Rugby,(Mar) Ralph(Mar) Lauren Zacks Rank *: Short Term 1 – 3 months outlook 5 - Strong Sell 2013 $2.03Childrenwear A $2.29 Aand American$2.40 A Living.$1.41 A $8.13 A * Definition / Disclosure on last page 2014 $1.94 A $2.23 A $2.57 A $1.68 A $8.43 A 2015 © 2015 Zacks Investment Research, All Rights reserved. www.Zacks.com$1.80 A $2.2510 S.A Riverside$2.41 Plaza, A Chicago$1.31 ILE 60606$7.77 E 2016 $1.62 E $1.94 E $2.18 E $1.51 E $7.25 E

Projected EPS Growth - Next 5 Years % 6 (Note: Qtly. fig. may not add up to annual fig. due to rounding off.) The company offers lifestyle product collections quarter, fiscal 2015 and 2016 witnessed in 4 categories – Apparel, which includes sharp downward revisions. men's, women's, and children's clothing; Home, which includes bedding and bath products, Macroeconomic Headwinds May furniture, fabric and wallpaper, paint, tabletop Dampen Operating Performance: and giftware; Accessories, comprising Consumer confidence and spending footwear, eyewear, jewelry and leather goods; behavior may dampen due to and Fragrance and skin care products sold macroeconomic factors including increase under the Glamorous, Romance, Polo, Lauren, in fuel and energy costs, credit availability, Safari, and Polo Sport brands. high unemployment levels, and high household debt levels, which may The New York-based company currently reports negatively impact disposable income of its operating results under the following consumers. This in turn, could affect the segments: company’s growth and profitability. Currently, Ralph Lauren’s operating Wholesale segment includes wholesale- performance has a major threat from the channel sales used principally for major prevailing weak macroeconomic conditions department stores, specialty stores, and golf in Europe, which contributes significantly to and pro shops located throughout the U.S., its wholesale revenues. Europe and Asia. High Dependence on Outside Suppliers: Retail business consists of retail-channel Ralph Lauren does not own or operate any sales directly to consumers through full- manufacturing facility and therefore price and factory retail stores spread across purchases all its merchandise requirements the U.S., Canada, Europe, South America from outside. The company’s operations and Asia, as well as sales through the might get adversely affected if these Internet. manufacturers fail to either ship orders on time or meet its standards. Licensing business includes revenues from royalty-based arrangements, under which Competitive Pressure: The company the company provides license to third operates in a highly fragmented market and parties for the use of various trademarks competes with a number of well-established related to the manufacture and sale of players such as Estee Lauder, Coach, V.F. certain products. Corp., Phillips-Van Heusen, Jones Apparel, Liz Claiborne and Kenneth Cole Productions. The company primarily REASONS TO SELL competes on the basis of fashion, quality and service. Failure to offer high-quality distinguished products at a competitive Dismal Q3 Performance and Lowered price may hamper Ralph Lauren’s market Guidance Weigh on Estimates: After share, consequently resulting in reduced top posting better-than-expected results in the and bottom lines. trailing four quarters, Ralph Lauren disappointed with lower-than-expected top and bottom lines in the third quarter of fiscal RISKS 2015. The company’s quarterly earnings declined owing to currency headwinds, lower operating income and a higher Strong Brand Portfolio Keeps Ralph effective tax rate. Based on the dismal third- Lauren on Top: Ralph Lauren is a major quarter performance and the ongoing specialty retailer of premium lifestyle negative impact of foreign currency merchandise in the U.S. commanding a translations, the company lowered its stellar portfolio of globally recognized outlook for fiscal 2015. As a result, the brands that provide it an edge over its Zacks Consensus Estimate for the fourth peers. The company has been able to

Equity Research RL | Page 2 strengthen its position in the market based Net revenue inched up 0.9% year over year to on these premium brands, while many other $2,033 million. This improvement was backed retailers have struggled to retain consumers by enhanced performance across the amid the recession and changing fashion company’s retail segment and higher licensing trends. revenues. However, the company’s net revenues fell short of the Zacks Consensus Focus on Mix Shift to Drive Long-Term Estimate of $2,107 million. Growth: Ralph Lauren continues to progress with its mix shift plan toward retail Overall, retail revenue grew 2% year over year and international, with the vision of greater to $1,149 million, licensing revenues increased profitability in these sections than the 6% to $47 million, while wholesale revenues wholesale and domestic businesses. The remained almost flat at $837 million. company also remains focused on building its brand image which is essential for luxury Improvement at the retail segment was mainly retailers. In the retail segment, the company driven by double-digit growth in the international continues to invest in Polo, Ralph Lauren eCommerce business and the addition of new and D&S stores along with growing its e- stores. On a currency neutral basis, sales at the Commerce and omni-channel presence. retail segment increased 5% year over year. Further, the company now intends to Moreover, on a constant currency basis, employ more focus on expanding its consolidated comparable-store sales (comps) accessories business, which constitutes at the retail division dipped 2%. less than 10% of its global sales, as fashion trends in this product line changes less On the other hand, at the wholesale segment, frequently than in the apparel business. the favorable impact of improved wholesale Other categories that the company intends shipments from Europe was completely offset to focus on include women’s, activewear, by lesser American shipments and a negative luxury and denim. While the company impact from currency translations. Excluding recently launched its “Polo for Women” this negative currency impact, sales rose 2%. brands across the globe, it is also set to venture into the activewear segment with Licensing revenues benefited from higher the launch of Polo Sport with the first men’s royalties as Ralph Lauren, Lauren and Polo collection going live in fall 2015. Relating to products saw increased sales globally. its international venture, the company has identified significant potential for expansion Ralph Lauren's gross profit in the quarter fell in Europe and China. 1% year over year to $1,159 million, with the gross margin contracting 120 basis points (bps) to 57%, owing to an unfavorable mix, heavy RECENT NEWS promotions and currency effects.

Total operating expenses rose 1% year over Ralph Lauren Misses on Q3 Earnings & year to $844 million, while as a percentage of Revenues – Feb 4, 2015 sales, it contracted 10 bps to 41.5%. The improvement in operating expenses as a Ralph Lauren’s third quarter of fiscal 2015 percentage of net revenues was mainly due to earnings of $2.41 per share missed the Zacks efficient operational management and lower Consensus Estimate of $2.52 and decreased restructuring expenses, which were partly offset 6.2% from the year-ago quarter figure of $2.57. by to increased investments in global retail The underperformance can be traced back to development, advertising, and marketing and lower operating income and a higher effective infrastructure. tax rate. Ralph Lauren's operating income decreased Quarterly Highlights 6% year over year to $315 million, while operating margin contracted 15.5% to 110 bps,

Equity Research RL | Page 3 in line with management’s projection of a 100– 150 bps contraction. The decline in operating Following the third-quarter results, Ralph margin was mainly due to higher operating Lauren lowered its constant dollar outlook for expenses related to increased investments to fiscal 2015. The company now expects revenue support the company’s long-term growth growth of about 4% against 5%–7% growth strategies. anticipated earlier.

In spite of a not so impressive quarter, Ralph Further, the company expects operating margin Lauren remains confident of its future for fiscal 2015 to fall 170–190 bps from fiscal performance. Management believes that its 2014. results so far this year highlight its focus on long-term objectives. The company intends to For the fourth quarter of fiscal 2015, the stay fixed on its goal by undertaking significant company expects net revenue to grow at a mid investments, introducing new stores and single-digit rate, on a constant currency basis. making the correct organizational alterations. This includes a 550 bps negative impact from currency translations. Operating margin is Encouraged by its long-term focus, anticipated to contract in the range of 250–300 management hiked its quarterly dividend to bps from the year-ago level. The effective tax $0.50 a share, payable on Apr 10, 2015 to rate for the quarter is projected at 31%–32%. stockholders of record as of Mar 27.

Further, during the quarter, Ralph Lauren VALUATION bought back nearly 0.5 million of its Class A common stock and in turn used up $100 million of its repurchase authorization. This brings the Ralph Lauren’s current trailing 12-month company’s year-to-date share repurchase to earnings multiple is 16.5x compared with the $350 million, with nearly $230 million remaining 25.0x industry average and 18.3x for the S&P under its ongoing share repurchase program. 500. Moreover, the stock is trading at a discount to the industry average, based on Balance Sheet forward earnings estimates. Over the last 5 years, Ralph Lauren’s shares have traded in Ralph Lauren ended the quarter with cash and the range of 13.9x to 25.2x trailing 12-month investments of $1,407 million compared with earnings. Our target price of $122.00, 16.8x $1,415 million in the year-ago quarter. During 2016 EPS, reflects this view. the quarter, the company deployed $124 million toward capital expenditure. Moreover, inventory levels stood at $1,211 million, up 8.4% from Key Indicators $1,117 million in the comparable quarter last year. P/E P/E 5-Yr 5-Yr P/E P/E Est. 5-Yr P/CF P/E High Low Store Update F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) Ralph Lauren Corporation (RL) 17.3 18.5 8.5 11.6 16.5 25.2 13.9 Ralph Lauren exited the quarter with 470 Industry Average 23.8 20.7 15.9 15.3 25.0 86.2 13.8 directly operatedS&P 500 stores and 504 concession 16.7 15.6 10.7 14.9 18.3 18.4 12.0 shops across the globe. The directly operated stores includeTeijin Ltd. 148 (TINLY) Ralph Lauren, 65 Club N/A 19.4 N/A 5.6 21.3 94.8 8.1 Monaco PVH and Corporation 257 Polo(PVH) factory stores. 13.6 11.8 13.4 9.6 15.2 20.3 12.2 Hanesbrands Inc. (HBI) 19.9 17.6 13.0 18.9 22.8 22.5 8.2 Additionally,Grasim Ralph Industries Lauren’s Limited (GRSXY) global licensing N/A N/A N/A 7.4 13.4 16.8 9.5 partners operated 71 RalphTTM Lauren is trailing stores, 12 months; 23 F1 is 2015 and F2 is 2016, CF is operating cash flow dedicated shops as well as 114 Club Monaco stores and shops. P/B Last P/B P/B ROE D/E Div Yield EV/EBITDA Qtr. 5-Yr High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) GuidanceRalph Lauren Corporation (RL) 2.9 4.5 2.4 18.2 0.1 1.3 7.8 Equity Research RL | Page 4 Industry Average 3.5 3.5 3.5 9.7 0.2 0.6 8.4 S&P 500 6.2 9.8 3.2 25.4 N/A 2.0 N/A Equity Research RL | Page 5 Earnings Surprise and Estimate Revision History DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of RL. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1128 companies covered: Outperform - 15.5%, Neutral - 75.4%, Underperform – 8.3%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Equity Research RL | Page 6