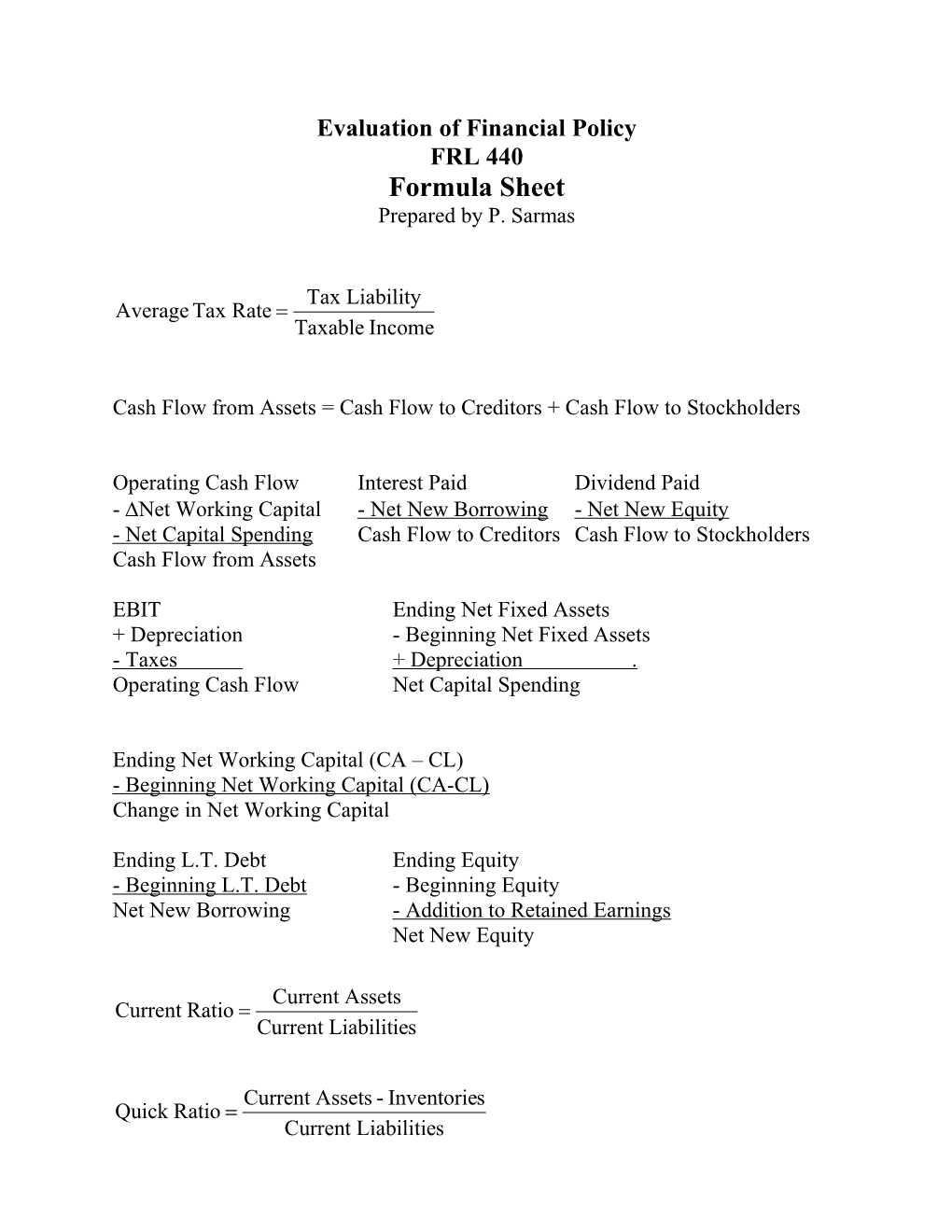

Evaluation of Financial Policy FRL 440 Formula Sheet Prepared by P. Sarmas

Tax Liability Average Tax Rate Taxable Income

Cash Flow from Assets = Cash Flow to Creditors + Cash Flow to Stockholders

Operating Cash Flow Interest Paid Dividend Paid - Net Working Capital - Net New Borrowing - Net New Equity - Net Capital Spending Cash Flow to Creditors Cash Flow to Stockholders Cash Flow from Assets

EBIT Ending Net Fixed Assets + Depreciation - Beginning Net Fixed Assets - Taxes + Depreciation . Operating Cash Flow Net Capital Spending

Ending Net Working Capital (CA – CL) - Beginning Net Working Capital (CA-CL) Change in Net Working Capital

Ending L.T. Debt Ending Equity - Beginning L.T. Debt - Beginning Equity Net New Borrowing - Addition to Retained Earnings Net New Equity

Current Assets Current Ratio Current Liabilities

Current Assets - Inventories Quick Ratio Current Liabilities Cash Cash Ratio Current Liabilities

Total Debt Total Assets - Total Equity Total Debt Ratio Total Assets Total Assets

Total Debt Debt - to - Equity Ratio Total Equity

EBIT Time Interest Earned Interest

EBIT Depreciation Cash Coverage Ratio Interest

EBIT Lease Pmt. Fixed Charge Coverage Ratio Sinking Funds Interest Lease Pmt. 1 T

Total Assets D 1 Equity Multiplier or EM 1 Equity E D 1 TA

Sales Total Assets Turnover Total Assets

Sales Fixed Assets Turnover Net Fixed Assets Sales Cost of Goods Sold Inventory Turnover OR Inventory Inventory

Receivables ACP or DSO Sales 365

Net Income Profit Margin (ROS) Sales

Net Income ROA Total Assets

Net Income ROE Common Equity

Net Income Interest Preferred Dividnd Return on Capital Debt Common Equity Preferred Stock

EBIT Basic Earnings Power Total Assets

Net Income Earnings per Share No. Shares Outstanding Market Price per Share Price - Earnings Ratio EPS

Dividend Payout Ratio = Dividends Net Income

ROADuPont = Profit Margin * Total Assets t/o

Market Price per Share Market Value - Book Value Ratio Book Value per Share

ROEDuPont = Profit Margin * Total Assets t/o * Equity Multiplier

ROA * b Internal Growth Rate 1- (ROA * b)

ROE * b Sustainable Growth Rate 1- (ROE * b)

Earnings Retention Ratio = b = 1 – Dividend Payout Ratio = 1- DIV/NI

t FV PV (1 r) PV * FVIFr,t

FV PV FV * PVIFr,t (1 r)t

r m*t FV PV (1 ) PV * FVIFr m ,mt m

FV PV FV * PVIFr r m*t ,mt (1 ) m m r EAR (1 )m 1 m

FV PV * er*t

PV FV * er*t

(1 r)t 1 FVA C * C * FVIFAr,t r

1 1 PVA C * C * PVIFA t r,t r r * (1 r)

C PV Perpetuity r

(1 r)t 1 FVA Cdue * * (1 r) Cdue * FVIFAr,t * (1 r) r

1 1 PVA C * * (1 r) C * PVIFA * (1 r) due t due r,t r r * (1 r)

Reminder: In the case of frequent compounding or discounting, divide the nominal rate (APR) by “m” and multiply period by “m”. “m” is number of times interest is compounded/discounted in one period. Also, annuity interval must match the frequency (m) of compounding or discounting. 1 1 FV Bond Value C * t t r r * (1 r) (1 r)

(1+R) = (1+r)*(1+h)

Coupon Coupon Rate FV Coupon Current Yield VB 1 1 FV V C * B t t YTM YTM * (1 YTM ) (1 YTM )

D1 D2 D3 P0 ...... (1 r)1 (1 r)2 (1 r)3 D D D D D 1 P 1 2 3 ..... n n1 * 0 1 2 t n n (1 r) (1 r) (1 r) (1 r) r gc (1 r)

D P 0 r D P 1 0 r g D r 1 g P0 n Dn D0 * (1 g) n CF NPV t (CF ) t 0 t1 (1 r)

n CF t (CF ) 0 t 0 t1 (1 IRR)

Last Negative Cum. CF PBP t CFt1

n CFt (1 r)t PI t1 CF0

n Net Incomet t1 ARR n Beginning Value Investment Ending Value Ivestment 2

n CIF *(1 r) nt n COF t t t1 t n to (1 r) (1 MIRR)

Operating Cycle = Inventory Period + Accounts Receivable Period

Cash Cycle = Operating Cycle – Accounts Payable Period Cost of Goods Sold Inventory Turnover Average Inventory

365 Inventory Period Inventory Turnover

Credit Sales Receivable Turnover Average Accounts Receivable

365 Receivable Period Receivable Turnover

Cost of Goods Sold Payable Turnover Average Payable

365 Payable Period Payable Turnover

Beginning End Average 2

Operating Cash Flow = EBIT + Depreciation – Taxes

Operating Cash Flow = (Sales – OC – Depreciation)*(1-T) + Depreciation

Operating Cash Flow = Net Income + Depreciation

Operating Cash Flow = (Sales – OC)*(1 – T) + T*Depreciation

Book Value of Asset = Original Cost – Accumulated Depreciation

Original Cost Salvage Value Straight Line Depreciation n

VC = Q*v TC = VC + FC NI = (S – FC – VC – D)*(1-T) FC OCF Q general P v FC D Q Accounting BEP P v FC Q Cash BEP P v FC OCF * Q Financial BEP P v FC DOL 1 OCF

Q(P v) DOL Q(P v) FC Q(P v) FC EBIT DFL Q(P v) FC Int EBIT Int Q(P v) DTL DCL DOL * DFL Q(P v) FC Int

P P Capital Gain Yield t1 t Pt

T R t R t1 T 1 2 2 2 VAR(R) (R R) (R R) ...... (R R) T 1 1 2 T Standard Deviation or SD(R) VAR(R)

n E(R) Pr.s * Rs s1 n 2 2 Pr.s *[Rs E(R)] s1 n 2 2 Prs *[Rs E(R)] s1

E(Rp) = WA*E(RA) + WB*E(RB) R = E(R) + U

n p W j * j j1

WA WB ..... WN 1

E(RA) = Rf + [E(RM) – Rf]*A

E(R ) R Slope j f j

D1 D0 *(1 g) RE g g P0 P0

RE R f E *(RM R f ) D RP P0 E P D WACC * RE * RP * RD *(1 tc ) V V V V E P D

WACC = WE*RE + WP*RP + WD*RD*(1-tc)

WE + WP + WD = 1

FV P Coupon 0 n YTM approximate FV 2P0 3

(Revenue- Total Variable Costs - Fixed Costs - Interest)*(1- t) (EBIT Interest)*(1 t) EPS Number of Shares Outstanding Number of Shares Outstanding

(Revenue- Total Variable Costs - Fixed Costs - Interest)*(1- t) (EBIT Interest)*(1 t) ROE Equity Equity EBIT(1 T ) Vu Ru (EBIT Int)(1 T ) V l WACC

VL VU

VL VU Tc * D

RE RA (RA RD ) * D / E D L U 1 (1 T ) E

EBIT K D(1 T) S d K s V S D V D P 0 n0 D n n 1 0 P

(1 Tc )(1 Ts ) Vl Vu 1 D (1 Td )

DPO = Dividend ÷ Net Income

Dividend Yield = Dividend per share ÷ Price per share

Modified Accelerated Cost Recovery System

Property Class Year 3-Year 5-Year 7-Year 1 33.33% 20.00% 14.29% 2 44.44% 32.00% 24.49% 3 14.82% 19.20% 17.49% 4 7.41% 11.52% 12.49% 5 11.52% 8.93% 6 5.76% 8.93% 7 8.93% 8 4.45%