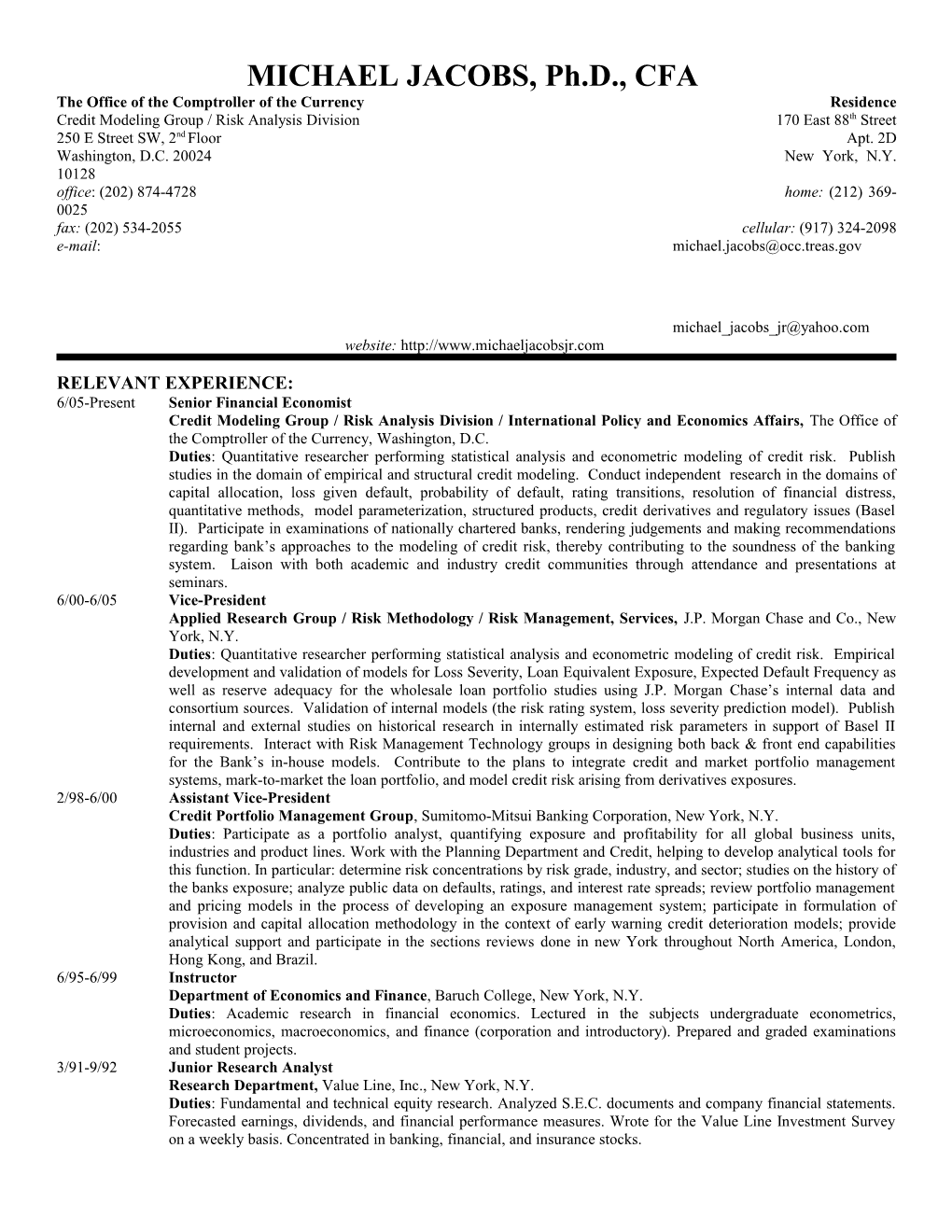

MICHAEL JACOBS, Ph.D., CFA The Office of the Comptroller of the Currency Residence Credit Modeling Group / Risk Analysis Division 170 East 88th Street 250 E Street SW, 2nd Floor Apt. 2D Washington, D.C. 20024 New York, N.Y. 10128 office: (202) 874-4728 home: (212) 369- 0025 fax: (202) 534-2055 cellular: (917) 324-2098 e-mail: [email protected]

[email protected] website: http://www.michaeljacobsjr.com

RELEVANT EXPERIENCE: 6/05-Present Senior Financial Economist Credit Modeling Group / Risk Analysis Division / International Policy and Economics Affairs, The Office of the Comptroller of the Currency, Washington, D.C. Duties: Quantitative researcher performing statistical analysis and econometric modeling of credit risk. Publish studies in the domain of empirical and structural credit modeling. Conduct independent research in the domains of capital allocation, loss given default, probability of default, rating transitions, resolution of financial distress, quantitative methods, model parameterization, structured products, credit derivatives and regulatory issues (Basel II). Participate in examinations of nationally chartered banks, rendering judgements and making recommendations regarding bank’s approaches to the modeling of credit risk, thereby contributing to the soundness of the banking system. Laison with both academic and industry credit communities through attendance and presentations at seminars. 6/00-6/05 Vice-President Applied Research Group / Risk Methodology / Risk Management, Services, J.P. Morgan Chase and Co., New York, N.Y. Duties: Quantitative researcher performing statistical analysis and econometric modeling of credit risk. Empirical development and validation of models for Loss Severity, Loan Equivalent Exposure, Expected Default Frequency as well as reserve adequacy for the wholesale loan portfolio studies using J.P. Morgan Chase’s internal data and consortium sources. Validation of internal models (the risk rating system, loss severity prediction model). Publish internal and external studies on historical research in internally estimated risk parameters in support of Basel II requirements. Interact with Risk Management Technology groups in designing both back & front end capabilities for the Bank’s in-house models. Contribute to the plans to integrate credit and market portfolio management systems, mark-to-market the loan portfolio, and model credit risk arising from derivatives exposures. 2/98-6/00 Assistant Vice-President Credit Portfolio Management Group, Sumitomo-Mitsui Banking Corporation, New York, N.Y. Duties: Participate as a portfolio analyst, quantifying exposure and profitability for all global business units, industries and product lines. Work with the Planning Department and Credit, helping to develop analytical tools for this function. In particular: determine risk concentrations by risk grade, industry, and sector; studies on the history of the banks exposure; analyze public data on defaults, ratings, and interest rate spreads; review portfolio management and pricing models in the process of developing an exposure management system; participate in formulation of provision and capital allocation methodology in the context of early warning credit deterioration models; provide analytical support and participate in the sections reviews done in new York throughout North America, London, Hong Kong, and Brazil. 6/95-6/99 Instructor Department of Economics and Finance, Baruch College, New York, N.Y. Duties: Academic research in financial economics. Lectured in the subjects undergraduate econometrics, microeconomics, macroeconomics, and finance (corporation and introductory). Prepared and graded examinations and student projects. 3/91-9/92 Junior Research Analyst Research Department, Value Line, Inc., New York, N.Y. Duties: Fundamental and technical equity research. Analyzed S.E.C. documents and company financial statements. Forecasted earnings, dividends, and financial performance measures. Wrote for the Value Line Investment Survey on a weekly basis. Concentrated in banking, financial, and insurance stocks. PROFESSIONAL CERTIFICATION: Chartered Financial Analyst, Granted by the CFA™ Institute, September 2003

EDUCATION: 9/94-5/01 Ph.D. in Finance, November 2001 M.Ph. in Business, May 1997 Graduate School and University Center of the City University of New York, Program in Economics and Finance Major Fields: Derivative Asset Pricing and the Econometrics of Financial Markets 9/92-5/94 M.A. in Economics, May 1994 State University of New York at Stony Brook, Department of Economics, School of the Arts Major Fields: Applied Econometrics and Economic Demography Advanced to Ph.D. Candidacy 09/86-12/90 B.S. in Engineering Science, December 1990 State University of New York at Stony Brook, School of Engineering and the Applied Sciences Major: Applied Mathematics & Statistics Minors: Operations Research and Economics Graduated Cum Laude 09/82-6/86 Regents Diploma, June 1986 Stuyvesant High School, NYC

WORKING PAPERS AND PUBLICATIONS:

Jacobs, Jr., M., Karagozoglu, A. and Dina Layish, Understanding and Predicting the Resolution of Financial Distress, June 2005. Currently under review for Journal of Financial Economics.

Jacobs, Jr., M., Understanding and Predicting Ultimate Recoveries and Time-to-Resolution for Defaulted Bonds and Loans, June 2005. Currently under review for Journal of Banking and Finance.

Araten, M., Jacobs, Jr., M., P. Varshney and C.R. Pellegrino, An Internal Ratings Migration Study, The Journal of the Risk Management Association. April 2004, 92-97.

Araten, M., Jacobs, Jr., and P. Varshney, Measuring LGD on Commercial Loans: An 18-Year internal Study, The Journal of the Risk Management Association. May 2004, 28-35.

Araten, M., Jacobs, Jr., M. and Peeyush Varshney, Default Rates for Borrowers Rated 8 & 9, JP Morgan Chase Memorandum, Risk Capital and Research Group. March 2002.

Araten, M. and Jacobs, Jr., M, Analysis of Charge-offs for Reserve Adequacys, JP Morgan Chase Memorandum, Risk Capital and Research Group. November 2001.

Araten, M. and Jacobs, Jr., M, Loan Equivalents for Defaulted Revolving Credit and Advised Lines, The Journal of the Risk Management Association. May 2001, 34-39.

Jacobs, Jr., M. and Kishore Tandon, Term Structure of Interest Rate Models: International Empirical Evidence, Zicklin School Working Paper. Accepted for Presentation at the Financial Management Association Annual Meeting, Toronto, October 2001.

Jacobs, Jr., Michael, A Comparison of Fixed Income Valuation Models: Pricing and Econometric Analysis of Interest Rate Derivatives, Unpublished Doctoral Dissertation, The Graduate School and University Center of the City University of New York, 2001.

Jacobs, Jr., M., A Comparison of Bond Option Valuation Models: An Econometric Analysis of Interest Rate Derivatives, December 2000, Zicklin School Working Paper. Submitted to the Journal of Derivatives

Jacobs, Jr., Michael, Onochie, Joseph A Bivariate G.A.R.C.H.-in-Mean Study of the Relationship Between Return Variability and Trading Volume in International Futures Markets, The Journal of Futures Markets, May 1998. Vol. 18. No. 2. Jacobs, Jr., Michael, Sumitomo Bank. The Return on Risk Adjusted Capital Model for the Wholesale Bank, Credit and Portfolio Management Review Group, Special Review Report FY98-#10.

Jacobs, Jr., Michael, Sumitomo Bank Capital Markets Credit Risk Simulation Model: Analysis and Commentary, Credit and Portfolio Management Review Group, Addendum to Portfolio and Credit Review Report FY98-#7.

Jacobs, Jr., Michael, The Impact of the Asian Crisis on the Japanese Corporate Department Credits, Credit and Portfolio Management Review Group, Special Review Report FY98-#19.

Jacobs, Jr., Michael, Onochie, Joseph, Testing of the Random Walk Hypothesis in International Futures Markets, Unpublished Working Paper, Baruch College, January 1996.

Jacobs, Jr., Michael, The Valuation of Interest Rate Dependent Derivatives and the Market Price of Risk, Unpublished Working Paper, Baruch College, January 1996.

Jacobs, Jr., Michael, Cointegration Methodology and its Empirical Application in International Finance, Unpublished Working Paper, Baruch College, December 1996.

Jacobs, Jr., Michael, An Empirical Study of the Relationship between Insider Ownership and the Value of the Firm, Unpublished Working Paper, Baruch College, May 1995.

PROFESSIONAL ORGANIZATIONS:

American Finance Association (AFA) CFA™ Institute Financial Management Association (AMA) International Association of Financial Engineers (IAFE) Fixed Income Analysts Society International (FIASI) American Economic Association (AEA)

COMPUTER LANGUAGES AND APPLICATIONS:

Development: Visual C++, Visual Basic for Applications. Mathematical/Scientific: Matlab-Symbolic, PDE & Optimization Toolboxes Statistical: S+-Finmetrics; Matlab-Statistics & Neural Networks Toolboxes Financial: Matlab-Financial Toolbox; KMV Credit Monitor & Portfolio Manager Miscellaneous: VB for Excel & Access