January 23, 2015

Johnson Controls Inc. (JCI-NYSE)

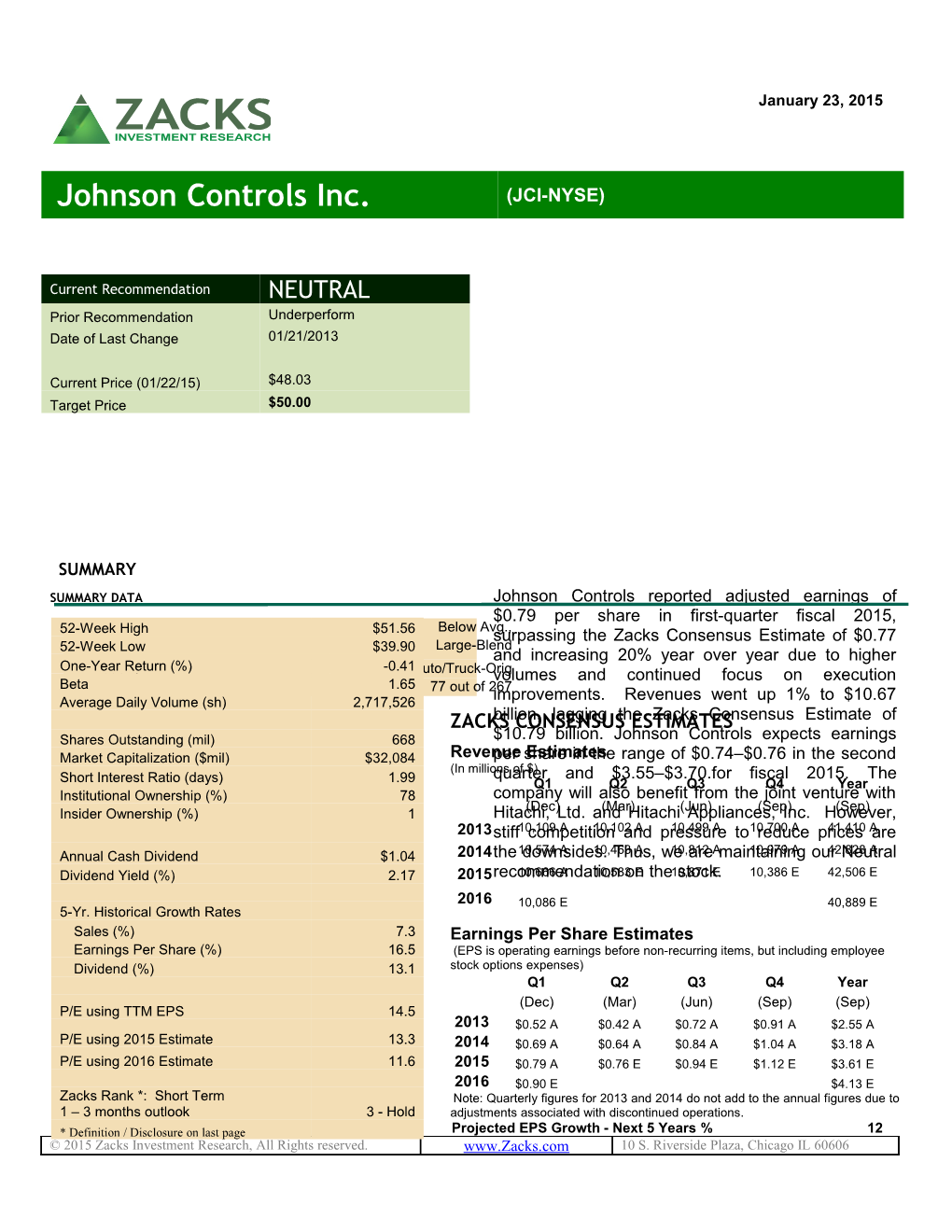

Current Recommendation NEUTRAL Prior Recommendation Underperform Date of Last Change 01/21/2013

Current Price (01/22/15) $48.03 Target Price $50.00

SUMMARY

SUMMARY DATA Johnson Controls reported adjusted earnings of $0.79 per share in first-quarter fiscal 2015, 52-WeekRisk HighLevel * $51.56 Below Avg.,surpassing the Zacks Consensus Estimate of $0.77 Type of Stock Large-Blend 52-Week Low $39.90 and increasing 20% year over year due to higher One-Year Return (%) -0.41 Industry Auto/Truck-Origvolumes and continued focus on execution Beta Zacks Industry Rank * 1.65 77 out of 267 Average Daily Volume (sh) 2,717,526 improvements. Revenues went up 1% to $10.67 ZACKSbillion, CONSENSUS lagging the ESTIMATES Zacks Consensus Estimate of Shares Outstanding (mil) 668 $10.79 billion. Johnson Controls expects earnings Market Capitalization ($mil) $32,084 Revenueper shareEstimates in the range of $0.74–$0.76 in the second (In millionsquarter of $) and $3.55–$3.70.for fiscal 2015. The Short Interest Ratio (days) 1.99 Q1 Q2 Q3 Q4 Year Institutional Ownership (%) 78 company will also benefit from the joint venture with (Dec) (Mar) (Jun) (Sep) (Sep) Insider Ownership (%) 1 Hitachi, Ltd. and Hitachi Appliances, Inc. However, 2013stiff10,109 competition A 10,102 and A pressure10,499 A to10,700 reduce A prices41,410 Aare Annual Cash Dividend $1.04 2014the 10,574downsides. A 10,463 Thus, A we10,812 are A maintaining10,979 A our42,828 Neutral A Dividend Yield (%) 2.17 2015recommendation10,666 A 10,583 on E the10,871 stock. E 10,386 E 42,506 E

2016 10,086 E 40,889 E 5-Yr. Historical Growth Rates Sales (%) 7.3 Earnings Per Share Estimates Earnings Per Share (%) 16.5 (EPS is operating earnings before non-recurring items, but including employee Dividend (%) 13.1 stock options expenses) Q1 Q2 Q3 Q4 Year (Dec) (Mar) (Jun) (Sep) (Sep) P/E using TTM EPS 14.5 2013 $0.52 A $0.42 A $0.72 A $0.91 A $2.55 A P/E using 2015 Estimate 13.3 2014 $0.69 A $0.64 A $0.84 A $1.04 A $3.18 A P/E using 2016 Estimate 11.6 2015 $0.79 A $0.76 E $0.94 E $1.12 E $3.61 E 2016 $0.90 E $4.13 E Zacks Rank *: Short Term Note: Quarterly figures for 2013 and 2014 do not add to the annual figures due to 1 – 3 months outlook 3 - Hold adjustments associated with discontinued operations. * Definition / Disclosure on last page Projected EPS Growth - Next 5 Years % 12 © 2015 Zacks Investment Research, All Rights reserved. www.Zacks.com 10 S. Riverside Plaza, Chicago IL 60606 RECENT NEWS mainly due to higher profit from both its Seating and Interiors business. The segment results also benefited from higher Chinese joint venture Johnson Controls Tops Q1 Earnings, income and higher volumes. Upbeat 2015 Outlook – Jan 22, 2015 Building Efficiency: In this segment, revenues Johnson Controls, Inc. reported adjusted increased 5% year over year to $3.5 billion due earnings of $0.79 per share in first-quarter fiscal to higher revenues in North America, partially 2015 (ended Dec 31, 2014), surpassing the offset by lower revenues in Latin America and Zacks Consensus Estimate of $0.77. Earnings in the Global Work Place Solutions business. also increased 20% year over year due to The quarter-end backlog decreased 4% to $4.6 increased volumes and continued focus on billion. execution improvements. Notably, the financial details of last year have been revised as the Orders were flat year over year. Adjusted company classified its Automotive Electronics segmental income increased 38% in the business as a discontinued operation. reported quarter to $201 million from $146 million in the comparable quarter last year, with Including transaction and integration-related significant improvements in North America, costs, Johnson Controls’ net income in first- Europe and Global Workplace Solutions. This quarter fiscal 2015 amounted to $507 million or was partially offset by slightly lower results in $0.76 per share, compared with $451 million or Asia. The segment also benefited from the $0.66 per share in the year-ago quarter. acquisition of Air Distribution Technologies (“ADT”) in the third quarter of fiscal 2014. Revenues in the reported quarter went up 1% year over year to $10.67 billion, lagging the Power Solutions: Revenues in the Power Zacks Consensus Estimate of $10.79 billion. Solutions segment increased 4% to $1.84 Excluding the effect of currency translation, billion from $1.77 billion a year ago. Adjusted sales increased 5%. segment income was $318 million, up 4% from $307 million in the year-ago period. Cost of sales decreased year over year to $8.99 billion from $9 billion in the year-ago Financial Position period. Gross profit increased 6.6% year over year to $1.7 billion. Johnson Controls had cash and cash equivalents of $168 million as of Dec 31, 2014, Selling, general and administrative expenses in indicating a decrease from $245 million as of the first quarter totaled $1.03 billion, almost in Dec 31, 2013. Total debt rose to $7.54 billion as line with the prior-year quarter figure. The of Dec 31, 2014 from $6.67 billion as of Dec 31, company reported business segment income of 2013. Consequently, the debt-to-capitalization $768 million, up 18% year over year. ratio stood at 41% as of Dec 31, 2014 versus 36.6% as of Dec 31, 2013. Segment Results In the first quarter of fiscal 2015, Johnson Automotive Experience: Revenues in this Controls’ operating cash outflow was $142 segment declined 3% year over year to $5.3 million as against $281 million in the year-ago billion on the back of a strengthening U.S. dollar period. Meanwhile, capital expenditures versus the euro. Excluding the impact of foreign decreased to $280 million from $345 million in exchange, revenues increased 2%. Production the prior-year period. in North America improved 5% while it declined 2% in Europe. Revenues from China improved Joint Venture 15% to $2.1 billion, driven by a 6% rise in industry production. On Jan 21, 2015, Johnson Controls, Hitachi, Ltd. and Hitachi Appliances, Inc. signed an Adjusted segment income surged 26% to $249 agreement to form a global joint venture. The million from $197 million in the year-ago period,

Equity Research JCI | Page 2 joint venture will be producing the variable refrigerant flow (VRF) technology, room air conditioners and absorption chillers to satisfy the rising demand for energy-efficient air conditioners. This joint venture is expected to record sales of $3 billion in 2016.

Johnson Controls will obtain 60% ownership in Hitachi Appliances' global air conditioning business. With this new joint venture, the company expects to have the most solid technology portfolio in the heating, ventilation, air conditioning and refrigeration industry.

Outlook

For fiscal 2015, Johnson Controls expects better results than fiscal 2014 based on higher profitability in all three businesses. The company believes that its strategic and financial plans will lead to better performance and higher operating margins. Johnson Controls expects earnings per share in the second quarter to be in the range of $0.74–$0.76 and in the band of $3.55–$3.70 for fiscal 2015.

Further, Johnson Controls anticipates significant growth opportunities in China, which generated more than $8 billion of annual revenues in fiscal 2014. As a result, the company will be investing in the Chinese market this year. Johnson Controls has also started the construction of a new Asia Pacific headquarters building in Shanghai.

Equity Research JCI | Page 3 VALUATION

Currently, shares of Johnson Controls are trading at 13.3x our 2015 EPS estimate of $3.61. The company’s current trailing 12-month earnings multiple is 14.5x, compared with the 16.7x average for the peer group and 18.7x for the S&P 500. Over the last five years, shares have traded in a range of 9.8x to 31.4x trailing 12-month earnings. The stock is trading at a discount to the peer group, based on forward earnings estimates. The current P/E, which is closer to the lower-end of the historical range, is at a 5% discount to the peer group for 2015. Our long-term Neutral recommendation indicates that it will perform in line with the overall market. Our target price of $50.00, which is 13.9x our 2015 EPS estimate, reflects this view.

Key Indicators

P/E P/E 5-Yr 5-Yr P/E P/E Est. 5-Yr P/CF P/E High Low F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) Johnson Controls Inc. (JCI) 13.3 11.6 12.0 9.9 14.5 31.4 9.8

Industry Average 14.0 19.7 13.6 10.2 16.7 122.9 12.4 S&P 500 16.2 15.2 10.7 15.9 18.7 19.4 12.0

OBSIDIAN ENTERPRISE (OBDE) N/A N/A N/A N/A N/A N/A N/A Hastings Manufacturing Company (HGMG) N/A N/A N/A N/A N/A N/A N/A Denso Corp. (DNZOY) 15.8 14.0 N/A 8.4 14.4 41.8 11.6 Magna International, Inc. (MGA) 9.4 8.0 12.7 12.6 10.8 70.3 7.4 TTM is trailing 12 months; F1 is 2015 and F2 is 2016, CF is operating cash flow

P/B Last P/B P/B ROE D/E Div Yield EV/EBITDA Qtr. 5-Yr High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) Johnson Controls Inc. (JCI) 2.8 2.9 1.4 18.2 0.5 2.2 11.3

Industry Average 2.6 2.6 2.6 19.9 0.9 0.6 10.3 S&P 500 5.1 9.8 3.2 24.8 N/A 2.0 N/A

Equity Research JCI | Page 4 Earnings Surprise and Estimate Revision NOTE – THIS IS A NEWS-ONLY UPDATE; THE History REST OF THIS REPORT HAS NOT BEEN UPDATED YET.

OVERVIEW

Wisconsin-based Johnson Controls Inc. (JCI) is a supplier of automotive interiors, batteries, and other control equipment. The company functions through three segments: Automotive Experience, Building Efficiency and Power Solutions.

Building Efficiency: This segment provides facility systems and services including comfort, energy and security management for the residential and non-residential building markets. About 45% of Building Efficiency’s sales were derived from Heating, Ventilating and Air Conditioning products and installed control systems for construction and retrofit markets in fiscal 2014. The remaining 55% were derived from its service offerings, including global workplace solutions that provide on-site staff for complete real estate services, facility operation and management to improve the comfort, productivity, energy efficiency and cost effectiveness of building systems. The segment contributed 33.1% of the total revenue in fiscal 2014.

Automotive Experience: This segment produces automotive interior systems for original equipment manufacturers (OEMs). Notably, 79.6% of the revenues generated by this segment came from the Seating business, while 20.4% came from the Interiors business. The company generated 51.4% of the total revenue in fiscal 2014 from this segment.

Power Solutions: Globally, the Power Solutions segment is the largest manufacturer of lead acid automotive batteries and the most prominent developer of advanced battery chemistries. The segment constituted 15.5% of the total sales in fiscal 2014.

REASONS TO BUY

Equity Research JCI | Page 5 Johnson Controls projects better results in manufacturing plant in the Fuling District of fiscal 2015 compared to fiscal 2014, based Chongqing, Western China. The plant has on higher profitability expectation for all a production capacity of six million three businesses. The company believes automotive batteries per year and will offer that its strategic and financial plans will state-of-the-art technology and services to lead to better performance and higher customers. In May 2014, the company operating margins. Johnson Controls signed a deal with SAIC Motor Corporation expects earnings per share in the band of Limited to supply Absorbent Glass Mat $3.55 to $3.70 for fiscal 2015, compared batteries to power the latter’s Start-Stop with $3.18 per share earned in fiscal 2014. vehicles. In the same month, Johnson The company anticipates earnings in the Controls announced its plans to expand range of $0.74–$0.77 in the first quarter of the manufacturing and research and fiscal 2015. Revenues in 2015 will be development center in Wuxi, China by benefiting from the improvement in results investing $35 million. This expansion will in the Building Efficiency and Power increase the company’s manufacturing Solutions segments. Revenues will have a capacity globally by three-fold, which will favorable impact from higher automotive help meet the rising demand for energy- production in all its locations compared to efficient buildings. the fiscal 2014 level, with a 10% improvement expected in China, 2% in Johnson Controls actively undertakes North America and 2% in Europe. Johnson acquisitions and mergers in order to Controls plans capital expenditures of $1.3 provide its customers with world-class billion in fiscal 2015, which is $100 million technologies through strong higher than the fiscal 2014 level. The complementary brands and channels. In company predicts free cash flow Jun 2014, the company completed the Air generation of about $1.5 billion, which will Distribution Technologies acquisition for provide opportunities for future capital $1.6 billion. With this, Johnson Controls expenditures, strategic acquisitions, share now has 48 locations that produce a broad repurchases and dividend payouts. range of air distribution products under well-known brands such as Ruskin, Titus, Johnson Controls is focusing on market Hart & Cooley, Krueger, PennBarry, Tuttle expansion in China since its foray into the & Bailey among others. In Dec 2013, nation in 2005. The company supplies Johnson Controls signed a deal with advanced technologies and technical Hitachi Ltd. and Hitachi Appliances, Inc. to capabilities to China. Johnson Controls acquire 60% ownership stake in Hitachi anticipates significant growth opportunities Appliances' global air conditioning in China, which generated more than $8 business excluding the Japanese sales billion of annual revenues in fiscal 2014. As and service operations and some other a result, the company will be investing in assets of Hitachi. The joint venture (JV) the Chinese market next year. Johnson produces variable refrigerant flow and Controls has also started the construction inverter technologies for both the of a new Asia-Pacific headquarters building commercial and residential markets. This in Shanghai, expected to be completed by partnership will help Johnson Controls late 2016. In Nov 2014, Johnson Controls become the world's largest commercial air introduced a new technology – The York conditioning provider. Dual Steam Turbine (YDST) technology – in China which will fulfill the growing Johnson Controls is gaining strategic demand for central heating. The contracts which are aiding its business technology converts the wasted heat into expansion. On Jul 23, 2014, the company clean fuel, thus reducing coal consumption signed an agreement with Shanghai by 30% compared to traditional boiler Yanfeng Industry and Commerce Co., Ltd., heating. In Jun 2014, Johnson Controls and Anhui Yansheng Automotive Trim Co., opened a new automotive battery Ltd. to form a fabrics JV in China. Through

Equity Research JCI | Page 6 this JV, which will operate under the name On Sep 30, Johnson Controls announced of Anhui New Nangang Johnson Controls plan to divest its Global Workplace Automotive Trim Co., Ltd., the company Solutions (GWS) business. The company will provide Chinese automakers with a is undertaking this strategy in order to variety of services including fabric focus on businesses that are essential for designing, engineering and manufacturing its long-term growth and multi-industrial of trim products. In May 2014, the portfolio. However, GWS is a strong company signed an agreement to form a business segment and a leader in the JV with a Chinese company – Yanfeng market with tremendous grow potential. Automotive Trim Systems Co., Ltd. Johnson Controls completed the divestiture Johnson Controls will have a 30% share in of its automotive electronics business to the JV while the remaining 70% share will Visteon Corporation for $265 million in Jan be owned by Yanfeng Automotive. The 2014. However, the automotive electronics new company will manufacture instrument division was a highly profitable segment of panels, interior systems, door panels and the company. In 2013, the business floor consoles and is expected to generate generated profits of around $585 million $7.5 billion of annual sales. This joint entity compared with $129 million in 2012 and is expected to enjoy a leading market $144 million in 2011. In Sep 2013, Johnson position and achieve sustained global Controls completed the divestiture of its growth. It will also support Johnson HomeLink business to Gentex Corp. The Controls’ expansion plans in China, which divestiture of these profitable businesses is a rapidly growing automotive market. In will negatively affect the bottom line of Mar 2014, Johnson Controls signed an Johnson Controls. agreement with Fraunhofer Gesellschaft to develop energy-efficient, cost-effective Johnson Controls faces strong competition cooling systems for vehicle batteries. In from major domestic and international Jan 2014, the company decided to manufacturers and distributors of lead-acid collaborate with Lawrence Technological batteries, particularly in North America, University in Southfield, MI., to identify new Europe and Asia. The manufacturers in energy storage technologies for vehicle these markets compete on price, quality, systems. This new technology will enhance technical innovation, service and warranty. fuel efficiency and provide better emissions standards. Johnson Controls’ results could be adversely affected if there is sluggish Johnson Controls regularly increases its demand for automobiles. This will result in dividend to boost shareholder value. The reduction in orders from OEMs, which company has raised its dividend in 34 of accounted for 26% of the revenues the last 36 years. It had only stalled the generated from the Power Solutions dividend increases in 2008 and 2009 due business in fiscal 2014. to the global recession. Moreover, the company has regularly paid dividends OEMs are continuously pressurizing since 1887. In Nov 2014, Johnson Controls suppliers such as Johnson Controls to raised its quarterly dividend by 18% to reduce prices. If the company is unable to $0.26 per share from $0.22 paid earlier. offset the pricing reductions through The new dividend implies an annual yield improved operating efficiencies and of 2.1% based on the closing share price of reduced expenditures, it will adversely $50.19 as of Nov 19, up from the yield of affect the results. Furthermore, volatility in 1.8% based on the old dividend. commodity costs could hurt the company’s profitability. Commodities with highly volatile prices include steel, aluminum, REASONS TO SELL copper and fuel in the Building Efficiency business and lead in the Power Solutions business.

Equity Research JCI | Page 7 Reason for Update Analyst Note Johnson Controls expects revenues to decline to $42.3 billion in fiscal 2015 from $42.8 billion reported in fiscal 2014.

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of JCI. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1114 companies covered: Outperform - 15.7%, Neutral - 77.7%, Underperform – 6.0%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Analyst Kamalika Sinha Copy Editor Content Ed. Lead Analyst Sweta Goenka QCA Anindya Barman

Equity Research JCI | Page 8