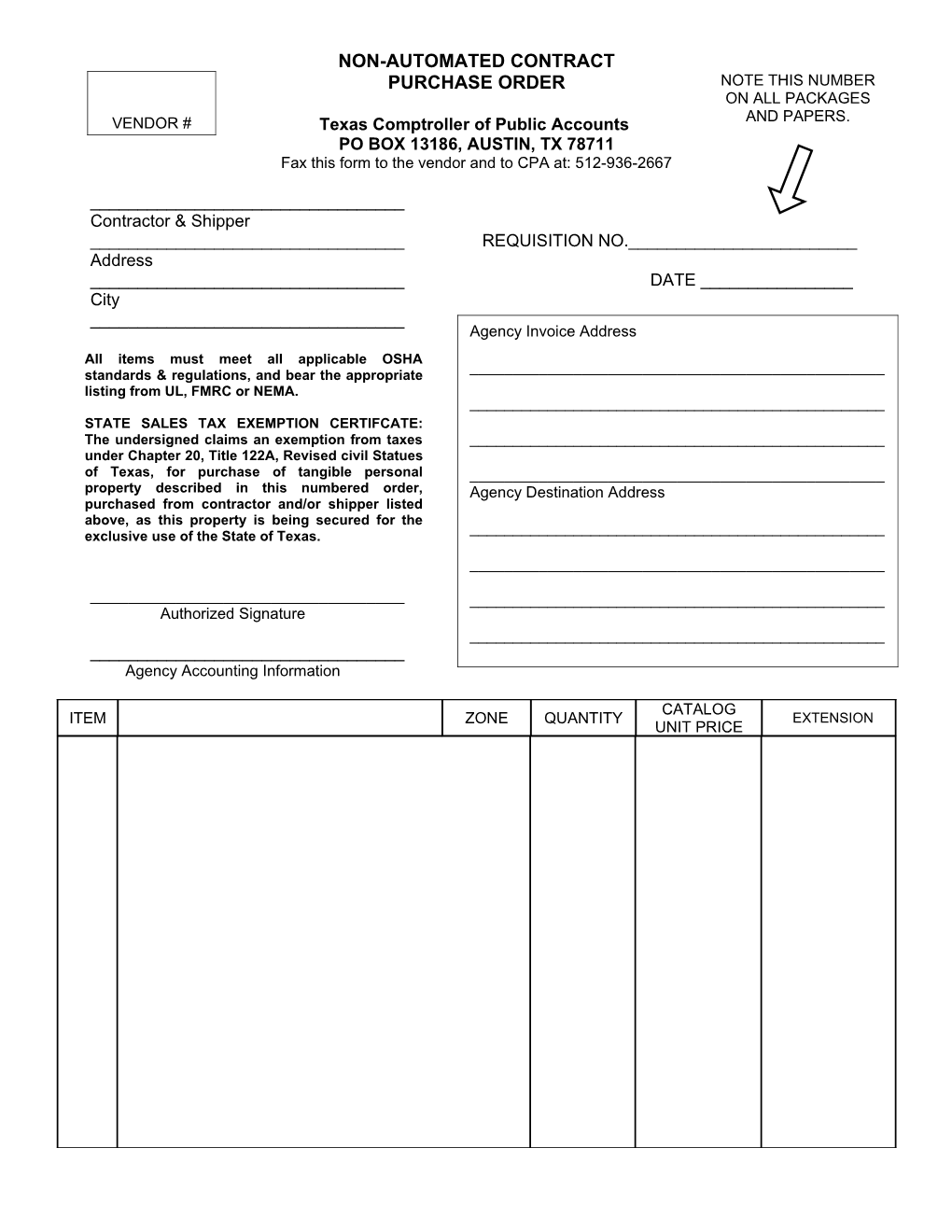

NON-AUTOMATED CONTRACT PURCHASE ORDER NOTE THIS NUMBER ON ALL PACKAGES VENDOR # Texas Comptroller of Public Accounts AND PAPERS. PO BOX 13186, AUSTIN, TX 78711 Fax this form to the vendor and to CPA at: 512-936-2667

______Contractor & Shipper ______REQUISITION NO.______Address ______DATE ______City ______Agency Invoice Address All items must meet all applicable OSHA ______standards & regulations, and bear the appropriate listing from UL, FMRC or NEMA. ______STATE SALES TAX EXEMPTION CERTIFCATE: The undersigned claims an exemption from taxes ______under Chapter 20, Title 122A, Revised civil Statues of Texas, for purchase of tangible personal ______property described in this numbered order, Agency Destination Address purchased from contractor and/or shipper listed above, as this property is being secured for the ______exclusive use of the State of Texas. ______

______Authorized Signature ______Agency Accounting Information

CATALOG ITEM ZONE QUANTITY EXTENSION UNIT PRICE NON-AUTOMATED CONTRACT Continuation PURCHASE ORDER Page

Texas Comptroller of Public Accounts PO BOX 13186, AUSTIN, TX 78711

REQUISITION NO.______

CATALOG ITEM ZONE QUANTITY EXTENSION UNIT PRICE NON-AUTOMATED PURCHASE ORDER INSTRUCTIONS

The Non-Automated Purchase Order form must be completed for items on non-automated term contracts. The ordering entity submits the original to the vendor and a copy to Texas Comptroller of Public Accounts (CPA. Send the CPA copy to:

Fax to: 512/936-2667 TEXAS COMPTROLLER OF PUBLIC ACCOUNTS Email to: [email protected] PO BOX 13186 AUSTIN, TEXAS 78711

A Non-Automated Purchase Order form must be completed for each individual vendor. The purchase order must be completed as follows: Item Explanation

1. Date of order Enter the date the order is prepared.

2. Name and address of contractor Found in the non-automated term contract.

3. Agency invoice address The vendor’s invoice will be mailed to this address.

4. Agency destination address Address to which the vendor will ship goods. If this is the same as Item 3, write “same.”

5. Requisition number Composed of entity’s account number, fiscal year designator and the ordering entity’s assigned number.

6. Commodity class, item and Found in the non-automated term contract. sub-item numbers

7. Description of material Include product code and brand. Must include name of price list and page number from which item was taken. (Example: Fall/Winter, 1995 Catalog, page 7, Kodak Ribbon #45FC98).

8. Quantity Enter the amount ordered and unit of measure (i.e., each, pkg., doz., etc).

9. Unit price Found in the non-automated term contract or in the price list referred to in the term contract.

10. Extensions Quantity multiplied by unit price.

11. Discounts Any applicable discount will be found in the non-automated term contract. Compute and deduct the discount and show the net amount for each item or sub-item.

12. Order Total Sum the net amounts, if more than one, and enter the grand total for the order.

13. Signature Orders must bear the signature of a person recognized by the CPA as being authorized to place orders.

14. Agency accounting information For state agencies, this line may bear the information required by TPFA.

15. Zone Enter the zone to which the materials are being shipped. (see Zone section)

16. Vendor # 5-digit number in the vendor list on last page of the non-automated term contract. DELIVERY In general, delivery of the ordered material should occur within twenty (20) days of the date the vendor receives the non-automated purchase order. If this is not the case, the non-automated term contract will indicate the delivery terms.

PRICE LISTS Vendors are obligated to furnish standard current price lists to using entities on the discount-from-list contracts. Entities must request these price lists from the vendors listed in the non-automated term contracts. These price lists should be properly identified and dated. Any items on the price list which are not under any contract or any columns, which are not to be used, are to be marked out by the vendor.

PRICE CHANGES Discount-from-list contracts are subject to price changes. A vendor requests a price change by submitting evidence of an industry wide price change to CPA. The vendors are obligated to furnish copies of the new price lists to users after CPA has approved the change.

EXPIRATION DATE In general, term contracts expire at the end of a month. Expiration dates for each term contract class are staggered throughout the year and are shown in the “General Contract Information” pages for each class.

Vendors are obligated to accept purchase orders and confirmation orders through the last day of the term contract period.

CANCELLATIONS Notify the vendor by telephone of intent to cancel. Cancellation of purchase orders should be requested on a “Purchase Order Change Notice” (see Forms section). The reason for the cancellation must be stated. If the vendor is not in default, the cancellation request must indicate that the vendor has agreed to the cancellation.

CORRECTIONS If the correction could result in an incorrect delivery of merchandise, notify the vendor and CPA immediately of the intended correction. After an order has been issued, any correction must be requested on a “Purchase Order Change Notice” (see Forms section). The reason for the correction request must be state.