Contingent Valuation Data Analysis and Hypothesis Testing Assignment

Due 4/28 (end of class)

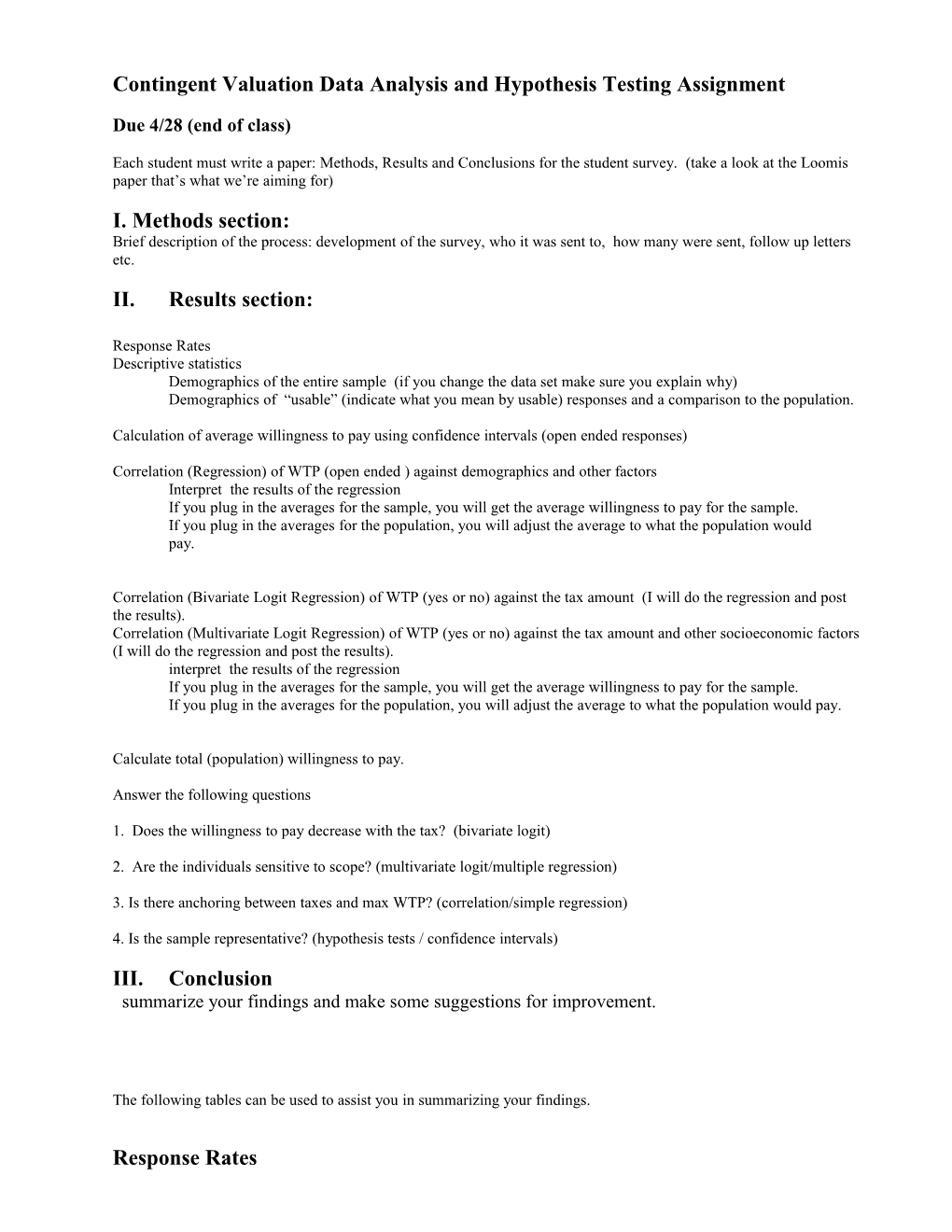

Each student must write a paper: Methods, Results and Conclusions for the student survey. (take a look at the Loomis paper that’s what we’re aiming for) I. Methods section: Brief description of the process: development of the survey, who it was sent to, how many were sent, follow up letters etc. II. Results section:

Response Rates Descriptive statistics Demographics of the entire sample (if you change the data set make sure you explain why) Demographics of “usable” (indicate what you mean by usable) responses and a comparison to the population.

Calculation of average willingness to pay using confidence intervals (open ended responses)

Correlation (Regression) of WTP (open ended ) against demographics and other factors Interpret the results of the regression If you plug in the averages for the sample, you will get the average willingness to pay for the sample. If you plug in the averages for the population, you will adjust the average to what the population would pay.

Correlation (Bivariate Logit Regression) of WTP (yes or no) against the tax amount (I will do the regression and post the results). Correlation (Multivariate Logit Regression) of WTP (yes or no) against the tax amount and other socioeconomic factors (I will do the regression and post the results). interpret the results of the regression If you plug in the averages for the sample, you will get the average willingness to pay for the sample. If you plug in the averages for the population, you will adjust the average to what the population would pay.

Calculate total (population) willingness to pay.

Answer the following questions

1. Does the willingness to pay decrease with the tax? (bivariate logit)

2. Are the individuals sensitive to scope? (multivariate logit/multiple regression)

3. Is there anchoring between taxes and max WTP? (correlation/simple regression)

4. Is the sample representative? (hypothesis tests / confidence intervals) III. Conclusion summarize your findings and make some suggestions for improvement.

The following tables can be used to assist you in summarizing your findings.

Response Rates Version A 5/25/50 Version B 3/10/25 Total Mailed Responded Undeliverable 6 7 13 Response Rate Demographics Respondents Statistic Male % Average Age Average Residency Home owners % Registered Voter Visits to Brandywine 0 visits 1-10 visits over 10 visits E-groups Education Elementary High School Some College College Degree Household Income under 17,500 17,500- 30,000 30,000 – 42,500 42,500 – 60,000 over 60,000

Willingness to pay (both versions with protests) Responses Percent yes no unanswered Why Yes program is important responsibility to protect tothe contribute water to a good othercause Why no? not important limited budget not effective not responsible status quo is adequate do not support new govt other

Average Max WTP Standard Deviation WTP

WTP (non-protest) Version A (5/25/50) Version B (3/10/25) Total

percent yes percent no unanswered Why Yes program is important responsibility to protect the water to contribute to a good cause other Why no? not important limited budget not effective not responsible status quo is adequate do not support new govt other

Average Max WTP

90% Confidence interval for average Max WTP

Demographics (combined versions / non-protesters) Sample statistic 90 percent Confidence Population representat interval Parameter ive? Age Gender (% male)

income under 17,500 17,500 - 30,000 30,000 42,500 42,000- 60,000 over 60,000 Education elementary Highschool some college College degree Home Ownership %