April 14, 2015

In the following pages we discuss the key issues that impacted your portfolio in the first quarter of 2015 as well as our current positioning. We hope you find it both helpful and interesting, and look forward to speaking with you soon.

Global macroeconomic policy divergence dominated the headlines in the first quarter of 2015. Two years after President Draghi pledged he would do whatever it takes to save the European Union, the ECB finally moved to enact an aggressive bond buying program that essentially follows the U.S. Federal Reserve’s QE playbook. On March 9th, the ECB began buying €60 billion of bonds per month. Conversely, Fed Chairman Yellen publicly discussed her strategy to begin taking interest rates higher. The combination of these events set the stage for one of the sharpest increases in the value of the U.S. dollar in history, rising a staggering 11.3% versus the Euro in Q1 and 21.6% since 06/30/14.

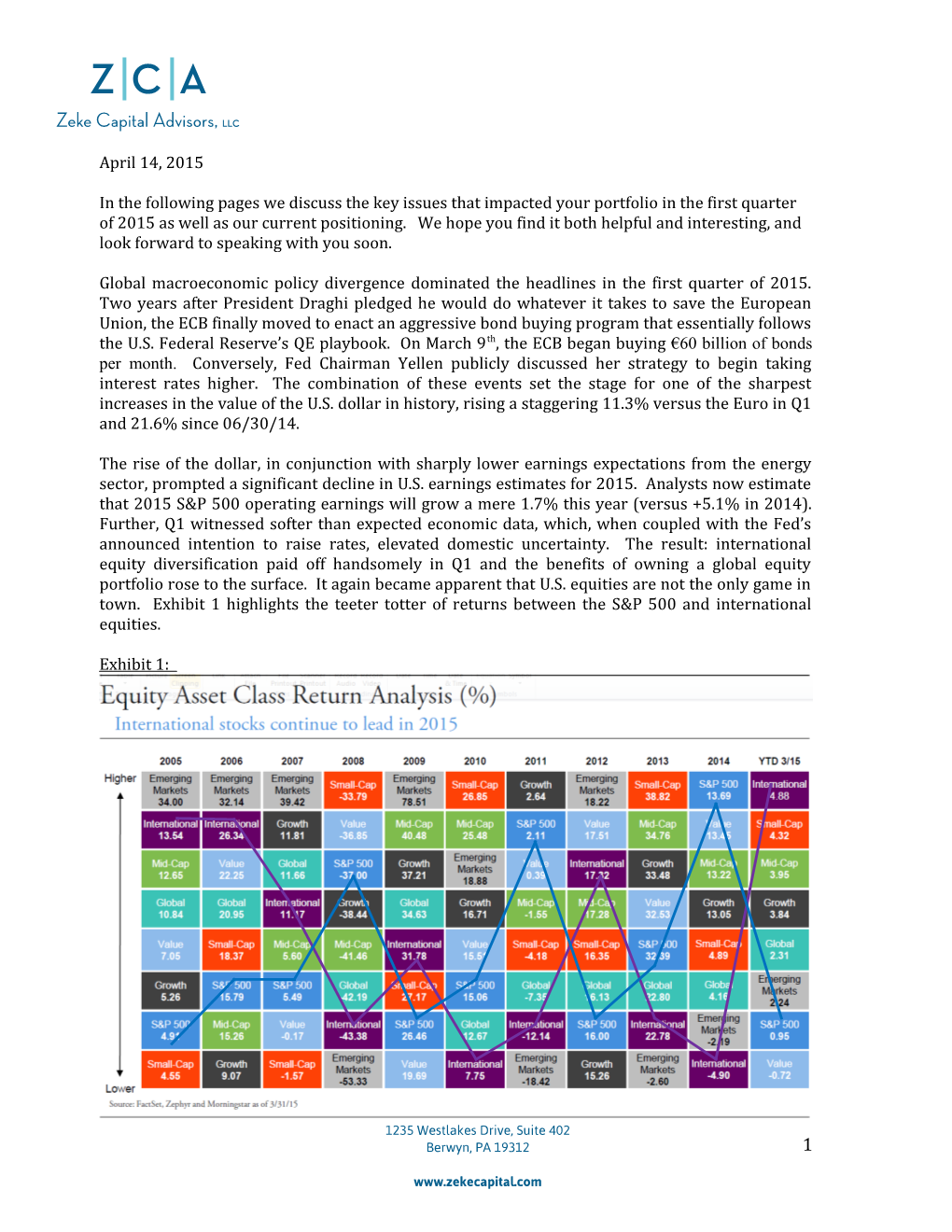

The rise of the dollar, in conjunction with sharply lower earnings expectations from the energy sector, prompted a significant decline in U.S. earnings estimates for 2015. Analysts now estimate that 2015 S&P 500 operating earnings will grow a mere 1.7% this year (versus +5.1% in 2014). Further, Q1 witnessed softer than expected economic data, which, when coupled with the Fed’s announced intention to raise rates, elevated domestic uncertainty. The result: international equity diversification paid off handsomely in Q1 and the benefits of owning a global equity portfolio rose to the surface. It again became apparent that U.S. equities are not the only game in town. Exhibit 1 highlights the teeter totter of returns between the S&P 500 and international equities.

Exhibit 1:

1 Let’s take a more detailed look at each asset class and discuss our current positioning.

Fixed Income

Our fixed income portfolio remains conservatively positioned. We are both underweight the asset class and short duration as the odds of rates significantly declining from current levels seem low. We remain overweight credit in our fixed income allocation and will continue to look to offset our short duration bet with credit opportunistically.

With respect to our position on rates, it would be fair to point out that we have been saying the same thing for several years. Our conservative positioning in fixed income has impacted overall returns. The labor market continues to improve, which will lead to higher wages and increased spending on goods and services. While the market tries to handicap which month the Fed will “liftoff”, we remain comfortable that the trajectory isn’t down from here.

Exhibit 2:

2 Despite the weaker economic data we experienced in the first quarter, which was negatively impacted by harsh weather conditions and California port shutdown, the underlying strength of the economy warrants a shift away from extreme accommodation. Exhibit 2 (above) depicts both FOMC and market expectation for the Fed Funds rate as of March 31, 2015 as well as the expected price impact of a 1% rise/fall in interest rates.

Our first quarter fixed income performance experienced some ups and downs as short-term interest rate volatility picked up. The ten year treasury ended 2014 at 2.17%. It plummeted in January to 1.64%, peaked in March at 2.25%, and finished the quarter at 1.92%. In summary, with respect to fixed income, we had a poor January, a strong February, and an okay quarter overall. All told, given our exposure to credit, our conservative positioning did not hurt us in Q1.

Equities

We manage our equity portfolio against a blended world equity benchmark: 65% S&P 500 and 35% MSCI All Country World Index ex-U.S. We believe, and history has shown, that having a mix of domestic and international equities provides better returns and less risk over time. Additionally, more than 50% of the market capitalization for the world’s companies resides outside of the U.S., and we do not think it prudent to ignore this opportunity set.

In 2014 diversification with international equities simply did not add value. U.S. equities outperformed international equities, and the S&P 500 (U.S. equities) outperformed almost every other asset class! As illustrated in Exhibit 1, this all changed in Q1 2015.

U.S. Equities: All things considered, in the face of weak economic data and sharply negative revisions to 2015 earnings, the U.S. equity market held up fairly well. Large cap stocks as measured by the S&P 500 finished the quarter +0.95%, while small cap stocks finished the quarter +4.32%. We decreased our large cap weighting and added to small cap late in 2014, a well-timed trade. With the rally in the dollar, it stands to reason that large cap stocks, having more exposure to non-dollar revenue, would underperform.

It’s notable that U.S. stocks deviated from the economy in Q1 (see Exhibit 3). It seems the market is willing to look through the weak reports, and has dismissed the data as related to transitory issues (weather and port shutdowns). While that may prove wise, if we fail to see a resumption of positive trends, we would not be surprised to see a negative market reaction (and persistently low interest rates).

3 Exhibit 3:

*The Citi Economic Surprise Index measures data surprises relative to market expectations

European Equities: In stark contrast to the U.S., the European economic data was strong in Q1 and there are clear signs that the recovery is beginning to take hold. The European economy has just begun to experience the benefit of a weaker Euro. As a result, we may be at the front-end of a nice run-up in European markets. As U.S. dollar investors, we recognize the negative impact a strong dollar has on our USD returns. Therefore, in early January we hedged the currency risk on nearly half of our international equity position. To put numbers around this, in local currency terms, European equities as measured by the MSCI Europe were +11.7% in Q1, while up a mere 3.4% in U.S. dollar terms. Germany led the region, +22.0%, while Italy and France were up an impressive 20.4% and 18.0%, respectively.

Exhibit 4:

We remain mindful of the longer-term challenges in the Eurozone. It has structural issues to sort out, but we are comfortable with this exposure in the near-term.

4 Emerging Market Equities: After two consecutive years of negative returns, emerging markets kicked off 2015 on a positive note, +2.24%. The real story, however, has been the divergence of performance among the group and the emergence of clear winners and losers. Variance in performance can be boiled down to the impact of the following: the collapse in the price of oil, and extreme volatility in the currency market. Emerging markets and commodity prices have historically been positively correlated, but this relationship has begun to break down. Oil importers, China and India for example, stand to benefit from lower energy prices, while Brazil and Russia, who depend on oil exports to drive their economy, will suffer.

We remain overweight emerging market equities, specifically China which, +8.1% in Q1, broadly outperformed emerging markets. We continue to like China as it remains cheap relative to its own history as well as global markets in general, as illustrated in Exhibit 5. We also remain bullish on long-term fundamentals related to the Chinese personal consumption and believe, as a major importer of energy, consumption trends should improve in the near-term.

Exhibit 5:

Real Assets

It was a rough quarter for commodities in general, -5.94% as measured by the Bloomberg Commodity Index. Oil remained a major drag on the group, off another 10.64% in Q1. This negatively impacted our position in MLPs, which were down approximately 4.00%. Nevertheless, our MLP portfolio outperformed the Alerian MLP Infrastructure index by 100bps in Q1. Since adding MLPs to our strategic allocation in 2010, we have remained focused on building a portfolio of companies that produce consistent income and distribution growth. Our portfolio consists of companies whose cash flows are less dependent on commodity prices. As you can see in Exhibit 6, MLPs, and even to some extent our portfolio, have become more correlated to oil prices. In early January we made slight changes to our portfolio that reduced exposure to MLP sub- segments that are more exposed to the downdraft in oil prices.

MLPs have correlated with energy-related equities and now have lower expectations built into current valuations. Looking forward, we continue to believe that the secular trend behind growing domestic production will drive demand for energy infrastructure and distribution growth for our midstream MLPs.

Exhibit 6:

5 Correlation of Master Limited Partnerships and Oil Prices

The remainder of our real asset portfolio is comprised of CatchMark Timber Trust (CTT), a Timber REIT with all of its assets in the U.S. South. CTT was a bright spot in the quarter, +4.35%. Thus far, CTT remains a mildly disappointing investment. However, we remain confident that their timberland assets remain undervalued by the market. Increased productivity of their existing assets (via higher timber prices) along with accretive acquisitions could substantially increase cash available for distribution to equity holders over time. A recovery in housing starts, which remain well below historical trends, would meaningfully increase the value of their timberland assets.

Hedge Funds

6 Hedge funds began the year on a positive note as most strategies delivered positive returns in the 1% - 3% range. Macro and equity managers led industry gains. The HFRX Global index, a broad measure of all hedge fund strategies, was up 2.06% in Q1, outpacing the S&P 500 which posted a 0.95% gain. HFRX reported that equity long/short managers were up 2.2% on average while credit arbitrage (+0.66%) and distressed credit (+0.60%) strategies posted more modest gains.

Our ZCA Partners Long/Short fund gained 2.11% in the quarter, a good result that exceeded the S&P 500 return and was in line with relevant equity hedge fund indices. Our long/short equity portfolio achieved this performance while maintaining approximately 35% net market exposure. Our ZCA Partners Absolute Return strategy returned 0.55% in Q1.

Q1 2015 Summary Points

Global macro policy divergence led to one of the sharpest increases in the value of the dollar in memory. The benefits of owning a global equity portfolio came back in focus as the S&P 500, after a long run of outperformance, significantly lagged the global equity market averages. The short-end of the rate curve remains stubbornly low and continues to react wildly to economic news flow. We expect this to persist until the market gets more clarity from the Fed regarding the future path of rates. There are clear signs that the economic recovery in Europe is beginning to take hold.

Thank You!

We are sincerely appreciative of our relationship with you and your family. We expect 2015 to be a good year for our portfolio and a good year for your family office. We look forward to seeing you in the next few weeks, and we welcome your input and comments.

“Manager views expressed herein were current as of the date indicated above and are subject to change. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities or indices in this commentary. A copy of the full list of recommendations made in the preceding year is available upon request. Any performance data quoted represents past performance and does not guarantee future results.”

7