Name______Perm #______

Econ 134A John Hartman Test 3, Form A December 16, 2014

Instructions:

YOU WILL TURN IN YOUR SCANTRON AND THE PROBLEMS PAGE. MAKE SURE ALL WORK AND ANSWERS ARE PROVIDED ON THESE.

You have 160 minutes to complete this test, unless you arrive late. Late arrival will lower the time available to you, and you must finish at the same time as all other students.

Cheating will not be tolerated during any test. Any suspected cheating will be reported to the relevant authorities on this issue.

You are allowed to use a nonprogrammable four-function or scientific calculator that is NOT a communication device. You are NOT allowed to have a calculator that stores formulas, buttons that automatically calculate IRR, NPV, or any other concept covered in this class. You are NOT allowed to have a calculator that has the ability to produce graphs. If you use a calculator that does not meet these requirements, you will be assumed to be cheating.

Unless otherwise specified, you can assume the following: Negative internal rates of return are not possible. Equivalent annual cost problems are in real dollars.

You are allowed to turn in your test early if there are at least 10 minutes remaining. As a courtesy to your classmates, you will not be allowed to leave during the final 10 minutes of the test.

Your test should have 10 multiple choice questions (20 points) and 7 problems (49 points). The maximum possible point total is 70 points. If your test is incomplete, it is your responsibility to notify a proctor to get a new test.

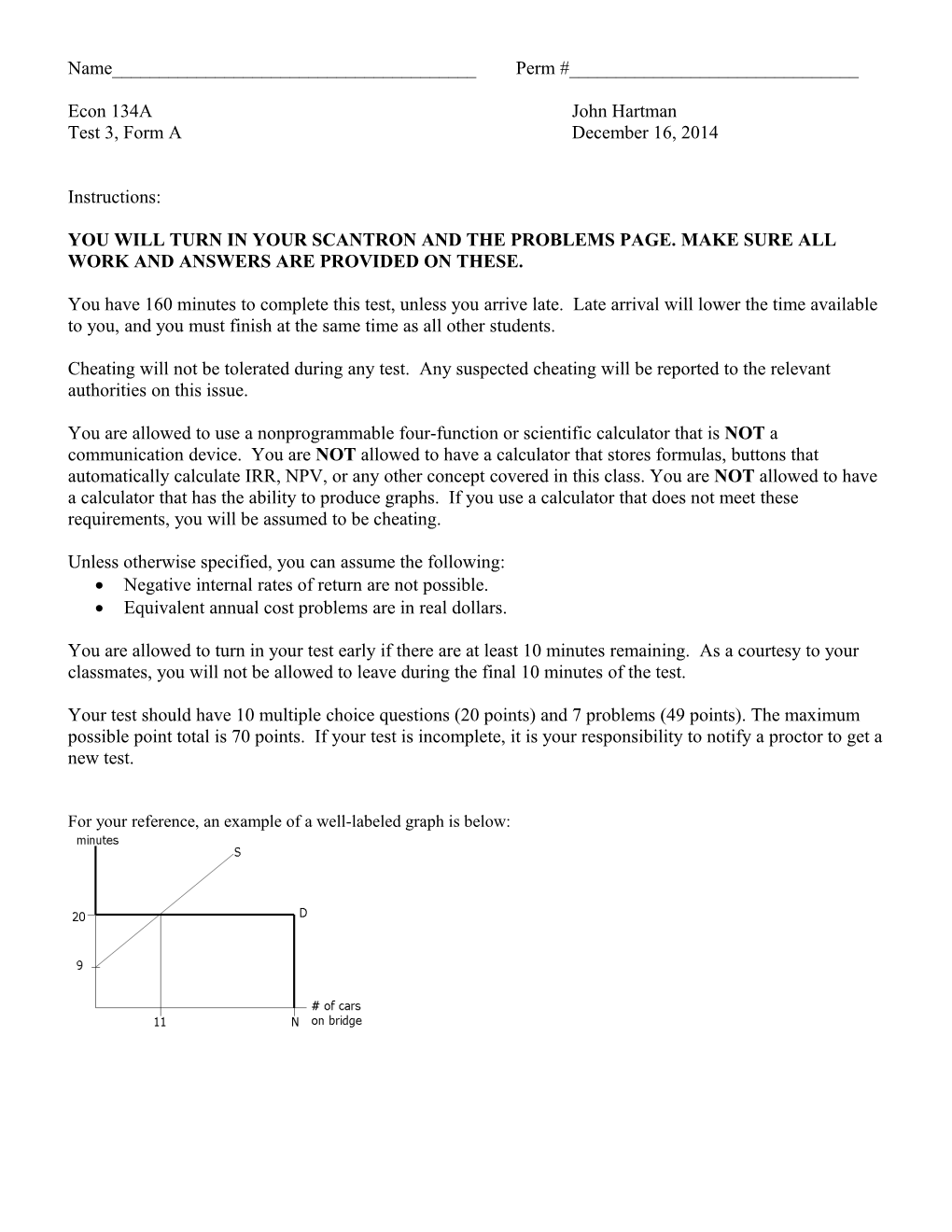

For your reference, an example of a well-labeled graph is below: MULTIPLE CHOICE: Answer the following questions on your scantron. Each correct answer is worth 2 points. All incorrect or blank answers are worth 0 points. If there is an answer that does not exactly match the correct answer, choose the closest answer.

1. A stated annual interest of 8.76%, compounded every hour, is equivalent to an equivalent annual interest rate of _____. (Assume 365 days in a year.) A. 8.4% B. 8.6% C. 8.8% D. 9.0% E. 9.2%

2. An asset’s expected return is 12%. The risk-free rate is 2%. The market rate of return is 6%. What is the beta value for this asset? A. 2.5 B. 2 C. 1.5 D. 1.5 E. 1

3. Steven owns a European put option for Stock XYZ. The option has an exercise price of $60, with an expiration date one year from today. If Steve assumes that Stock XYZ’s value on the expiration date comes from a uniform distribution, with all prices between $58-$68 equally likely, what is his perceived expected present value of the option? Assume Steven is risk neutral, and assume an effective annual discount rate of 25%. A. $0.16 B. $0.20 C. $0.80 D. $1 E. $2 4. Suzanne owns an asset that pays as follows: She will receive payments of $370 every six months, starting 24 months from today. She will receive these payments forever. If her effective annual discount rate is 4%, what is the present value of the annuity? A. $17,300 B. $17,600 C. $18,000 D. $18,300 E. $18,600

5. Summer is set to receive a nominal payment of $60,000 five years from now. She assumes no inflation over each of the next two years, followed by 10% inflation each of the subsequent three years. The real payment five years from now is _____. A. $55,000 B. $46,000 C. $45,000 D. $40,000 E. $37,000

6. Tyler invests $5,000 in a project today, and receives $3,000 one year from today, $2,000 two years from today, and a final payment five years from today. (No other cash flows occur.) The NPV from his investment is $0. If his effective annual interest rate is 15%, then the final payment is _____. A. $900 B. $1000 C. $1300 D. $1500 E. $1800

7. The original Batmobile sold for $137,000 at auction this year. Fifty years ago, it sold for $200. What is the geometric average rate of return over the last 50 years? A. 10% B. 12% C. 14% D. 16% E. Unable to determine the geometric average from the information given 8. A zero-coupon bond has a face value of $800, to be paid 8 months from today. If the yield to maturity is 8%, what is the current value of the bond? A. $730 B. $740 C. $750 D. $760 E. $770

9. A stock is currently valued at $50. Each year, the value of the stock goes up by 10% with 50% probability, or down by 8% with 50% probability. Any year’s change is independent of any other year’s change. If Bubba owns a European call option with a $60 exercise price and an expiration date two years from now, what is the present value of the option? Assume an effective annual discount rate of 5%. A. $0 B. $0.12 C. $0.25 D. $0.50 E. $1

10. Justin just purchased an asset. He paid $10,000 today, and will receive $1,000 every year, forever, starting six months from today. What is the profitability index of this asset if his effective annual discount rate is 10%? A. Infinity B. 2.1 C. 1.1 D. 1.05 E. 0.95

For the following problems, you will need to write out the solution. You must show all work to receive credit. Each problem (or part of problem) shows the maximum point value. Provide at least four significant digits to each answer or you may not receive full credit for a correct solution. Show all work in order to receive credit. You will receive partial credit for incorrect solutions in some instances. Clearly circle your answer(s) or else you may not receive full credit for a complete and correct solution.

11. (5 points) 95.44% of the probability distribution is within 2 standard errors of the mean of a normal distribution. Assume the historical equity risk premium is 11.3%, and the standard deviation of the equity risk premium is 13.2%. 144 years of data were used to make these estimates. Find a 95.44% confidence interval of the historical equity risk premium. 12. (6 points) There are 3 states of the world, each with one-third probability of occurring: H, J, and P. In the H state of the world, Stock A has a return of 10% and stock B has a return of 5%. In the J state of the world, stock A has a return of 14% and stock B has a return of 12%. In the P state of the world, stock A has a return of 3% and stock B has a return of 10%. What is the correlation coefficient of stocks A and B? 13. (7 points) Jack and Joe Wacky, Inc. sells CDs of old radio shows. They pay out dividends every 4 months, with the next dividend payment 4 months from now. The next 3 dividend payments will be $0.60 each per share. After the next year, each dividend payment will be 9% higher than the dividend payment made one year before. If we assume that this company will pay dividends forever, what is the present value of this stock if the effective annual discount rate is 20%? 14. (8 points) There are 3 known states of the world, A, B, and C, each with one-third probability. Super Quad Supplies has a rate of return of 6% in state A, 10% in state B, and 8% in state C. Mini Bicycle Supplies has a rate of return of 1% in state A, 9% in State B, and 17% in state C. What is the standard deviation of a portfolio that consists of 40% of Super Quad Supplies and 60% of Mini Bicycle Supplies? (Note: This requires many steps. So please make sure it is clear to the grader each step of your work.) 15. (7 points) Ali is interested in receiving a $100,000 loan today in order to open a music store. He can afford to make $2,000 payments each of the next 36 months. He will also make three payments of $X, 48 months from today, 60 months from today, and 72 months from today. What is X if the 39 payments completely pay back the loan. Assume a stated annual interest rate of 12%, compounded monthly. 16. Answer each of the following:

(a) (3 points) What is the weighted average cost of capital for a company that has 45% of its value in stocks, 55% of its value in bonds, the rate of return of stocks is 10%, and the rate of return of bonds is 1%?

(b) (4 points) A stock is currently priced at $75. The stock’s price will change by $3 per year every year, starting 8 months from today. The stock’s price will go up with 60% probability each time, and down with 40% probability. Each change in the stock’s price is independent of all other price changes. Sonia buys a European call option with an exercise price of $80. The expiration date of this option is four years from today. What is the probability that the option will have a positive value on the expiration date? (c) (3 points) When the interest rate goes up, explain what happens to the present value of an American call option’s value. Limit your explanation to 50 words or less.

(d) (3 points) Draw a graph showing the security market line. Make sure to clearly label the points which have the risk-free rate of return, the market rate of return, and a beta value equal to 1. 17. (3 points) From the efficiency lecture we had in Unit 4 of this course, which of the three forms of efficiency do you believe applies to financial markets in the United States? Justify your answer in 80 words or less, and make sure to explain at least one concept from the form you choose that applies to your answer. This page is intentionally left blank for scratch work. Any work shown on this page will not be graded. This page is intentionally left blank for scratch work. Any work shown on this page will not be graded.