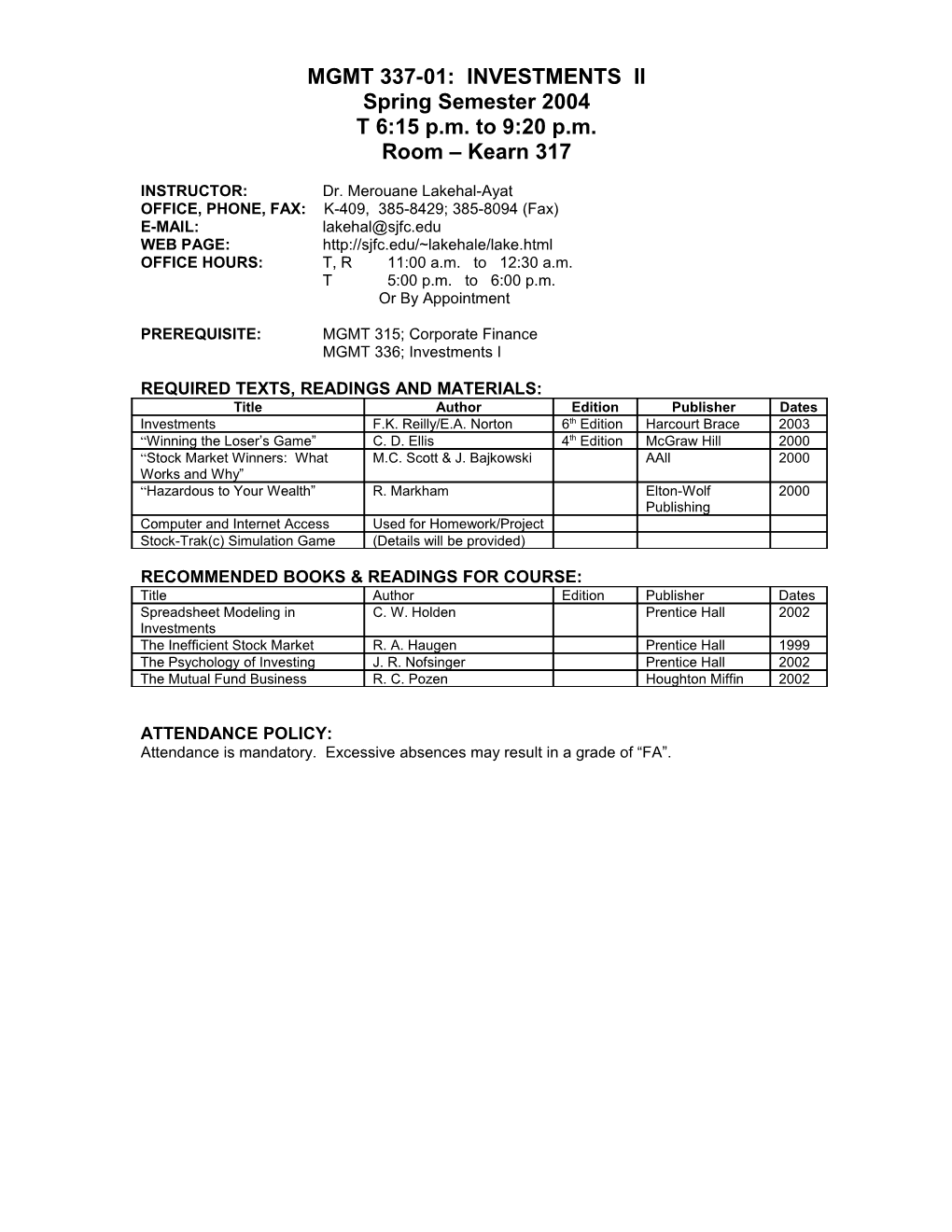

MGMT 337-01: INVESTMENTS II Spring Semester 2004 T 6:15 p.m. to 9:20 p.m. Room – Kearn 317

INSTRUCTOR: Dr. Merouane Lakehal-Ayat OFFICE, PHONE, FAX: K-409, 385-8429; 385-8094 (Fax) E-MAIL: [email protected] WEB PAGE: http://sjfc.edu/~lakehale/lake.html OFFICE HOURS: T, R 11:00 a.m. to 12:30 a.m. T 5:00 p.m. to 6:00 p.m. Or By Appointment

PREREQUISITE: MGMT 315; Corporate Finance MGMT 336; Investments I

REQUIRED TEXTS, READINGS AND MATERIALS: Title Author Edition Publisher Dates Investments F.K. Reilly/E.A. Norton 6th Edition Harcourt Brace 2003 “Winning the Loser’s Game” C. D. Ellis 4th Edition McGraw Hill 2000 “Stock Market Winners: What M.C. Scott & J. Bajkowski AAll 2000 Works and Why” “Hazardous to Your Wealth” R. Markham Elton-Wolf 2000 Publishing Computer and Internet Access Used for Homework/Project Stock-Trak(c) Simulation Game (Details will be provided)

RECOMMENDED BOOKS & READINGS FOR COURSE: Title Author Edition Publisher Dates Spreadsheet Modeling in C. W. Holden Prentice Hall 2002 Investments The Inefficient Stock Market R. A. Haugen Prentice Hall 1999 The Psychology of Investing J. R. Nofsinger Prentice Hall 2002 The Mutual Fund Business R. C. Pozen Houghton Miffin 2002

ATTENDANCE POLICY: Attendance is mandatory. Excessive absences may result in a grade of “FA”. LEARNING OBJECTIVES OF THE BITTNER SCHOOL OF BUSINESS:

COURSE DESCRIPTION: This is a three (3) credit intermediate course in investments and is intended to further the understanding obtained in the introduction to investments course. It is intended to provide students with a framework where by they will be able to analyze and evaluate the theories, principals, tools and techniques behind the management of securities portfolios within a fast changing global financial and economic environment. A Mutual Fund project will be used to implement and apply the concepts and issues under evaluation. The case study approach will be used extensively in the course to further enhance knowledge.

COURSE OBJECTIVES: Understand the fundamentals of successful investing. Review the different approaches to portfolio management. Summarize the motives and various approaches involved in using the asset allocation scheme to construct an investment portfolio consistent with the investor’s objectives. Relate investor objectives to the asset allocation and risk-return profiles reflected in various types of portfolios. Describe the techniques used to measure the performance individual investment vehicles and compare performance to investment goals. Understand and use the techniques and measurements to compare a portfolio’s return with risk-adjusted, market-adjusted rates of return. Discuss portfolio control and revision. Practice portfolio management through case studies, Stock-Trak(c) simulation game and Mutual Fund design and marketing.

COVERAGE OF LEARNING OBJECTIVES WITHIN THIS COURSE: Upon completion of this undergraduate Business Division degree program, students will:

Build upon a broad-based foundation of knowledge in the Liberal Arts to prepare for lifelong leaning in an ever-changing work environment. Utilize the discipline-specific knowledge necessary for successful careers in business. Demonstrate the communication skills necessary to convey concepts, strategies, ideas and opinions. Use current computer technologies. Work productively with colleagues and team members from diverse backgrounds. Make effective business decisions which integrate various functional areas. Incorporate the ethical, legal and global contexts of business.

SPECIFIC COVERAGE OF LEARING OBJECTIVES WITHIN THIS COURSE: Objective #1: Students are required to integrate throughout the course their prior exposure to corporate finance, economics, accounting, statistics, mathematics and psychology. Objective #2: Students are required to understand the concepts, issues and techniques associated with investment decision making. Objective #3: Students are required to complete a Mutual Fund project with a formal submission to the instructor. Objective #4: Microsoft Excel and Internet access will be used in conjunction with the calculator throughout the course. Objective #5: Students will have the opportunity to analyze and solve problems through the case study approach. Objective #6 The ethical, legal and global issues are addressed throughout the textbook (insider trading, market regulations and global performances, etc). These issues will be reviewed when judged appropriate. GRADING: Tests (2)……………………………………………..…..…..30% Final Exam ……………………..…………………………20% Mutual Fund / Stock-Trak Project ……………………….20% Valuation Project ………………………………………..15% Book Reports………………………………………………...5% Assigned Homework & Participation…………………… 10% 100% 2 ASSIGNMENTS:

Completing assigned homework and readings is critical to your success in this course and must be completed. With the exception of the Valuation Project and Stock-Trak report, all outstanding homework and assignments are due the Tuesday of the week before Finals (12/2/2003). No credit will be given after this date! Valuation project is due on Tuesday 3/23/2004. Stock Trak project is due on Tuesday 4/20/2004. No credit will be given for projects turned in after this date.

Text Book Assignments: Are outlined in the Syllabus and are to be completed and turned in the week following the appropriate lecture. Late homework or not showing all work will result in a lowered grade as to be determined by the instructor. Book Reports: Must be typed, 3 to 4 pages in length and are due by the end of the week following the full discussion of the book.

CASE STUDY: (Outlines will be provided) Comparison Valuation: [Written report minimum 8 pages in length] Students will be required to complete a comparative financial analysis of two companies within the same sector. Students will be required to calculate key ratios using the company’s most recent annual report to determine the financial health of the company and indicate which is the better investment and why. Students will also be required to use the concepts presented in Chapter 15 of the text and from an article handed out. Each student will be required to submit a written report due on the date outlined in the Syllabus.

STOCK-TRAK / MUTUAL FUND PROJECT Jan. 19TH – Apr. 13TH Website: www.stocktrak.com Stock-Trak is a mock brokerage service through which students gain exposure to portfolio management. Each student who registers with Stock-Trak will be able to open a brokerage account with up to $500,000.00 in imaginary cash and 12 weeks to buy, sell, buy on margin, sell short and write options and trade any of the following investment vehicles: Stocks, bonds, stock options, index options and futures, commodity futures, foreign currency options and futures and Mutual Funds. Students will be required to design and market a Mutual Fund using the philosophy from “Stock Market Winners: What Works and Why”. Students must identify worthy investment candidates within their assigned sector and develop a Mutual Fund using the Stock-Trak simulation game. At the end of the semester, each person will submit a written report identifying the outcomes of using the particular philosophy chosen.

TESTS: There will be two (2) tests and a non-cumulative final exam. No make-up exams will be allowed. In case of an emergency, students are encouraged to schedule an early sitting for that exam.

College Policy Concerning Students with Disabilities

In compliance with St. John Fisher College policy and applicable laws, appropriate academic accommodations are available to you if you are a student with a disability. All requests for accommodations must be supported by appropriate documentation/diagnosis and determined reasonable by St. John Fisher College. Students with documented disabilities (physical, learning, psychological) who may need academic accommodations are advised to make an appointment with the Coordinator of Services for Students with Disabilities in the Academic Support Center, K202. Late notification will delay requested accommodations.

3 College Policy toward Academic Dishonesty

Academic dishonesty is addressed in the St. John Fisher College Student Handbook. It includes, but is not limited to cheating in a test situation and plagiarism. The initial sanctions, which are within the discretion of the professor, are: Warning, repeating the examination/paper/project, “F” for the examination/paper/project, removal from the course and “F” from the course. In addition, the Academic Honesty Board and the Dean of Students may impose academic probation, suspension or dismissal from the college.

College Policy Toward Research of Human Subjects

Any course with a research component, and/or faculty involved in research, should review the following statement. This wording should be included in syllabi as appropriate.

Learning about the research process includes learning about the protection of the rights of human subjects (participants). Students in courses which include the collection of data from human subjects must comply with Institutional Review Board policies and procedures which protect the rights of human subjects. This protection includes informed consent, as well as measures to promote the confidentiality of the data which is collected. Students involved with course related data collection should speak with course faculty to learn about Institutional Review Board policies relevant to the course project. Copies of the St. John Fisher Institutional Review Board Policies and Procedures are available in the Office of Academic Affairs, in the Kearney Building room 202, or on the IRB web page at http://home.sjfc.edu/institutionalreviewboard.

Institutional Review Board members:

Dr. Monica Cherry 385-8101 Kearney 419 Dr. Valerie Cole 385-8440 Pioch 03F Dr. Susan Constable 385-5211 Wilson 210 Dr. Tim Franz, Chair 385-8170 Pioch 103I Ms. Barbara Henrichon 385-5217 Pioch 112 Dr. Eileen Lynd-Balta 385-7368 Skalny 235A Dr. Laura Phelan 385-8115 Pioch 103H Mr. Michael J. Sullivan (outside consultant) Dr. Marilyle Sweet Page 256-1290 (outside consultant) Dr. Zinaida Taran 385-8219 Kearney 306C Dr. Deborah Vanderbilt 385-8193 Basil 109

4 COURSE OUTLINE (May be subject to adjustments):

Date Lecture/Class Activities Assignment(s) 1/20 Review Course Outline, Start reading “Stock Markets: What Works and Why”. Content Overview of Mutual Fund Project and Review of Valuation Project. 1/27 Discuss Chapters 1-6 of the Read Chapter 8 (text); Pbs. 1-3 and 5 (pgs 269 – 270) “Stock Market” Book Start Reading “Winning the Loser’s Game”. 2/3 Discuss Chapter 8 (text) Read Chapter 10 (text); Question 27; Pbs. 1-2 (pg. 335) Discuss and debate chapters 7- Registration and outlined plan for Stock-Trak should be 12 of the “Stock Market” book. completed by the end of this week. 2/10 Discuss Chapter 10 (text) Read Chapter 15 (text); Pbs. 15-16 (pg. 577) Discuss and debate chapters Book Report on “Winning the Loser’s Game” due by end of 13-16 of the “Stock Market” the week book. 2/17 Discuss Chapter 15 (text) Prepare for Test #1 Review for Test #1 2/24 Test #1 Discuss Chapter 13 Read Chapter 13 (text); Pbs. 1-2, 5 (pg. 460) Discuss and debate chapters 1- Start Valuation Project. 6 of the “Winning” book Read Chapter 16 (text) Pbs. 5-6 (pg. 610) 3/2 Discuss Chapter 16 Read Chapter 11; Question 14 (pg. 372); Discuss and debate chapters 7- Pbs. 1-2, 6 (pgs 373, 374) 12 of the “Winning” book 3/16 Discuss Chapter 11 Prepare for Test #2 Discuss and debate chapters 13-16 of the “Winning” book Review for Test #2 3/23 Test #2 Read Chapter 12; Pbs. 8, 15-16 (pgs 408 - 409) Start reading “Hazardous to Your Wealth” Valuation Project due at end of the week. 3/30 Discuss Chapter 12 (text) Read Chapter 17; Pbs. 1-2, 7 (pgs 646, 647) Discuss chapters 1-4 of the Read Chapter 18; Pbs. 1-2, 5 (pg. 695) “Hazardous” book 4/6 Discuss Chapters 17 & 18 (text) Read Chapter 19; Question 14 (pg. 730); Discuss chapters 5-8 of the Pbs. 1-3 (pgs 731 – 732) “Hazardous” book 4/13 Discuss Chapter 19 (text) “Hazardous to Your Wealth” Book Report due at the end of Discuss chapters 9-11 of the the week. “Hazardous” book 4/20 Review for Final Exam Stock-Trak report due at end of the week. 4/24 – 5/1 FINAL EXAM Exact Day and Classroom TBA

5 Goal Statement for Stock-Trak

Goal: What are you attempting to do with this money? How will you do it? What type of risk are you willing to accept? (Make sure to include risk tolerance test from homework assignment with this report). Methodology to be used: How will you make your selections (i.e. what criteria will be used? Will you use financial ratios, recommendations of analysts? Some evidence must be provided to support your selections). How will you allocate your resources and why? What will you do with your portfolio over the twelve weeks? (Note: Active participation is required and will be monitored).

STOCK-TRAK Outline for Final Written Report (This report should be a minimum of 8 pages in length)

I. Objective (Time Frame): This simulation is set up for the 12 weeks of class. Did you attempt to build you portfolio under this time horizon or did you choose to use a longer time horizon. X X II. Philosophy: How did you choose your stocks? Did you employ fundamental or technical analysis? What financial ratios did you use? Why? (evidence must be provided to support your decisions) X X III. Methodology: What were the deciding factors that made you choose your stocks? What were your rules for engagement and exit (i.e. Why did you choose to buy or sell?) X X IV. Portfolio Structure: What did your portfolio consist of (i.e. identify specific sectors, industries, etc)? What happened to your portfolio over the course of twelve weeks? Be sure to give specific examples. X X V. Outcomes: What did you achieve and how? (i.e. What are you most proud of, least proud of and why? Were there other factors that contributed to success or failure of your selection? Why did you sell when you did or buy when you bought?) X X VI. Evaluation or Analysis of Outcomes: This section is to include a summary of your strengths, weaknesses, what you learned. It also should contain detailed spreadsheet(s) showing capital gains, return percentages and other measures learned in the course. X X VII. Concluding Remarks: What did you like? What didn’t you like? Why? What would you do differently if you could? Would you do anything the same?

6