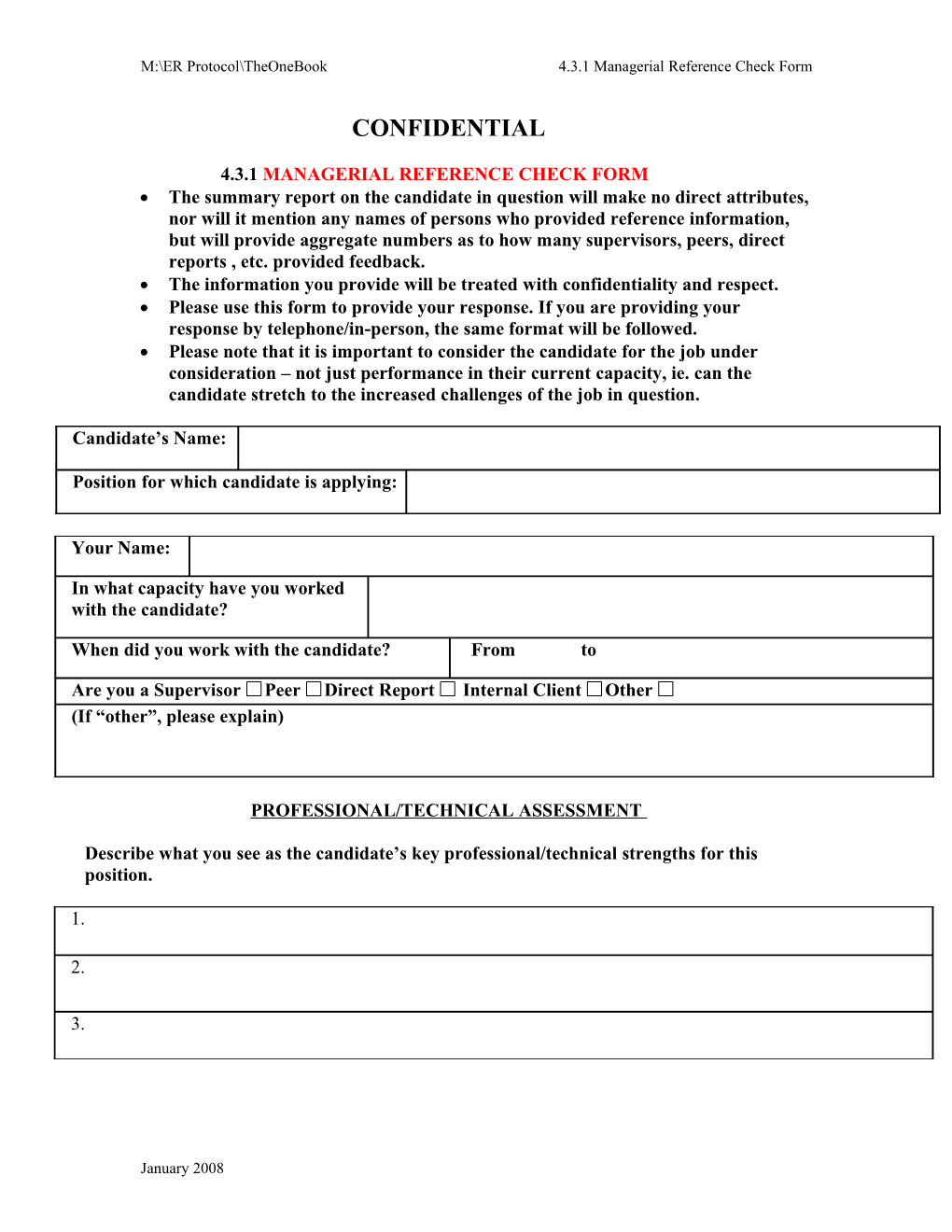

M:\ER Protocol\TheOneBook 4.3.1 Managerial Reference Check Form

CONFIDENTIAL

4.3.1 MANAGERIAL REFERENCE CHECK FORM The summary report on the candidate in question will make no direct attributes, nor will it mention any names of persons who provided reference information, but will provide aggregate numbers as to how many supervisors, peers, direct reports , etc. provided feedback. The information you provide will be treated with confidentiality and respect. Please use this form to provide your response. If you are providing your response by telephone/in-person, the same format will be followed. Please note that it is important to consider the candidate for the job under consideration – not just performance in their current capacity, ie. can the candidate stretch to the increased challenges of the job in question.

Candidate’s Name:

Position for which candidate is applying:

Your Name:

In what capacity have you worked with the candidate?

When did you work with the candidate? From to

Are you a Supervisor Peer Direct Report Internal Client Other (If “other”, please explain)

PROFESSIONAL/TECHNICAL ASSESSMENT

Describe what you see as the candidate’s key professional/technical strengths for this position.

1.

2.

3.

January 2008 M:\ER Protocol\TheOneBook 4.3.1 Managerial Reference Check Form

Describe those areas where you see the candidate has need for further development Indicate whether these development areas are required for the candidate’s growth in general or are particular requirements for the job for which the candidate has applied.

1.

2.

3.

MANAGEMENT ASSESSMENT

Please rate the candidate using the scales provided for each of the behaviors listed under each category below. Within each category there are lists of attributes that together make up the overall behavior.

Please rate candidate by comparing him/her to World Bank colleagues operating at a similar grade level to the advertised position , using the following scale:

0: candidate rates below Bank standards 1: candidate rates in the bottom third of current staff at this level 2: candidate rates in the middle third of current staff at this level 3: candidate rates in the top third of current staff at this level

1. CLIENT ORIENTATION

Balances a responsive and proactive approach to meeting the needs of clients and those of the institution Encourages staff to understand client needs and concerns Provides customized services and products as appropriate

Comments:

Overall Rating: Please select

January 2008 M:\ER Protocol\TheOneBook 4.3.1 Managerial Reference Check Form

2. INSPIRING PASSION IN OWN WORK AND IN THE BANK’S MISSION

Demonstrates a belief in the Bank’s mission and objectives Demonstrates a strong drive to achieve the mission and objectives Inspires others to achieve the mission and objectives in partnership with clients

Comments:

Overall Rating: Please Select

3. FOCUSING ON THE BIG PICTURE AND OVERALL STRATEGIC FRAMEWORK FOR DEVELOPMENT

Identifies and pursues strategic initiatives which provide the greatest value and sustainable impact Has conveyed a clear strategic direction in all work programs and or roles Balances long and short term trade-offs Identifies problems and solutions within bigger picture Has combined problem solving with results orientation and stakeholder buy-in

Comments:

Overall Rating: Please Select

4. MANAGING INDIVIDUAL STAFF - this can include your observations of the candidate’s interactions with staff on teams, short term work groups, missions, etc. Strategic Staffing Attracts highly effective staff Selects highly effective staff Builds teams diverse in gender and nationality

Comments:

January 2008 M:\ER Protocol\TheOneBook 4.3.1 Managerial Reference Check Form

Performance & Development Appraises an individual’s ability and potential Provides candid and constructive feedback Rewards desirable behaviors Provides support for professional development efforts linked to business objectives

Comments:

Overall Rating: Please Select

5. PLANNING AND MANAGING TO ACHIEVE QUALITY RESULTS

Planning Develops work plans that are realistic given the resources available Demonstrates resource management skills by delivering on time and within budget Comments:

Managing Establishes high standards of performance for staff Demonstrates a commitment to excellence Demonstrates decision making skills Takes accountability – accepts responsibility for successes and failures Comments:

Results & Output Focuses on results Delivers a high quality work program and delivers what is promised Demonstrates organizational skills Comments:

Overall Rating: Please Select

January 2008 M:\ER Protocol\TheOneBook 4.3.1 Managerial Reference Check Form

6. DEVELOPING EFFECTIVE AND PRODUCTIVE TEAMS

Creates an environment conducive to teamwork Supports continuous learning Encourages effective innovation and knowledge sharing in a team based environment Builds alliances (within the team, between teams, across different areas of the Bank and outside) to achieve joint objectives

Comments:

Overall Rating: Please Select

7. PERSONAL INTEGRITY & INSPIRING TRUST

Maintains high standards of personal integrity Establishes straightforward and productive relationships Treats all individuals fairly and with respect

Comments:

Overall Rating:_ Please Select

8. INFLUENCING AND RESOLVING DIFFERENCES ACROSS BOUNDARIES

Influencing Gains support and commitment from others even without formal authority Uses business targets and objectives to support arguments Uses evidence (e.g. prior successes, facts, research) to present convincing arguments Comments:

January 2008 M:\ER Protocol\TheOneBook 4.3.1 Managerial Reference Check Form

Resolving Differences Resolves differences by assessing needs and forging solutions of benefit to all parties Promotes collaboration and facilitates teamwork across organizational boundaries or between teams within the Bank and external ones

Comments:

Overall Rating: Please Select

9. UNDERSTANDING THE BANK’S FINANCIAL STRUCTURE AND PRODUCTS

Understands financial statements Understands how the Bank is funded Understands the Bank’s lending products and how they are used Uses analytical tools to make effective business decisions

Comments:

Overall Rating: Please Select

January 2008 M:\ER Protocol\TheOneBook 4.3.1 Managerial Reference Check Form

Keeping in mind your ratings in the above categories, please comment on the following:

Managerial Strengths: What do you see as the candidate’s key strengths?

1.

2.

3.

4. 5.

Developmental Needs for managerial skills: What do you see as the areas where the candidate most needs to have stronger managerial skills or gain more experience?

1. 2. 3.

4.

5.

Do you recommend that the candidate should be selected for this position?

Your Overall Average Rating would be: Please Select This is a fair reflection when comparing this candidate to Peers and other staff working at this grade level.

January 2008