University of Kentucky Von Allmen School of Accountancy Gatton College of Business and Economics

ACC700 – Behavioral Accounting Seminar Spring 2003

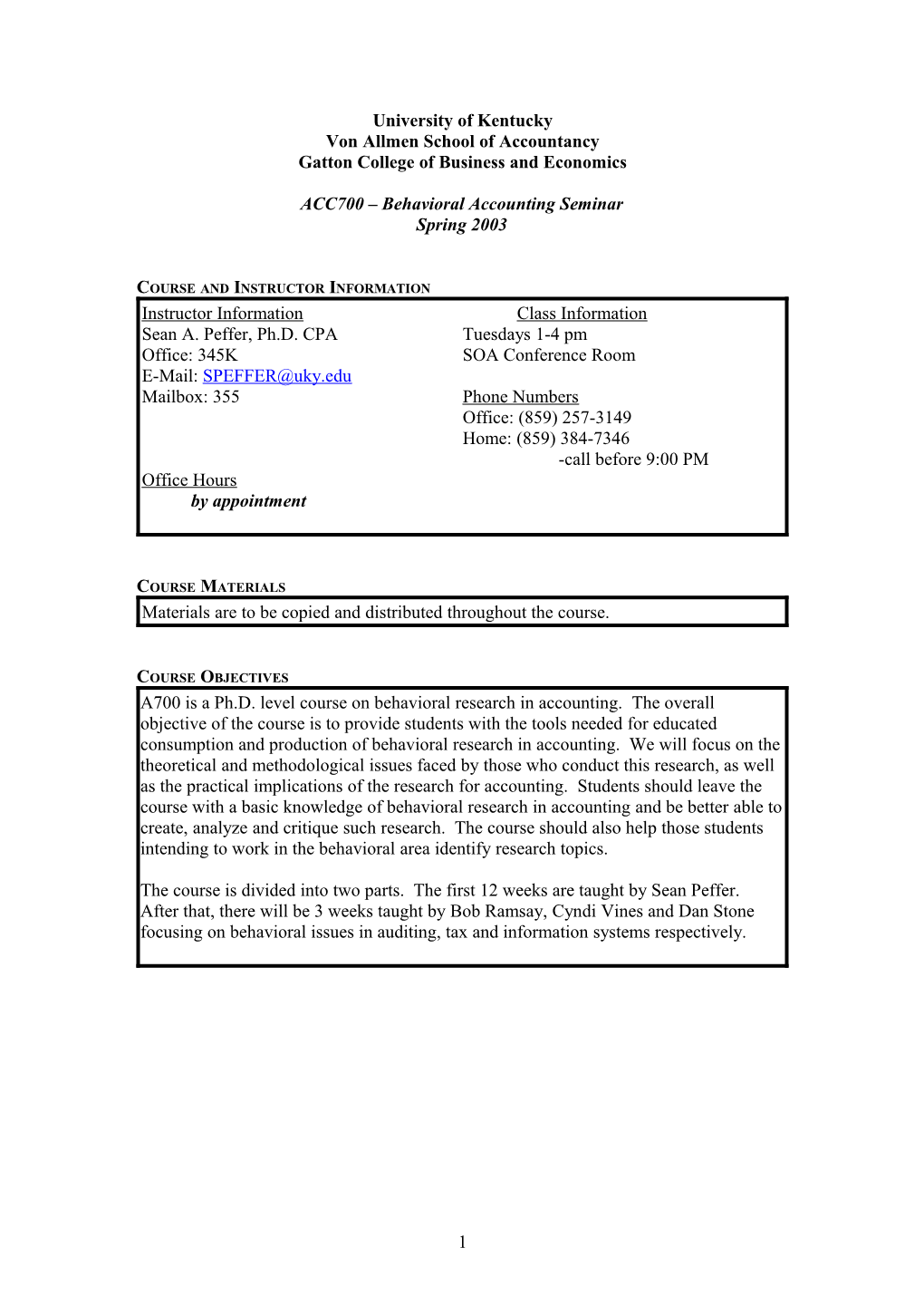

COURSE AND INSTRUCTOR INFORMATION Instructor Information Class Information Sean A. Peffer, Ph.D. CPA Tuesdays 1-4 pm Office: 345K SOA Conference Room E-Mail: [email protected] Mailbox: 355 Phone Numbers Office: (859) 257-3149 Home: (859) 384-7346 -call before 9:00 PM Office Hours by appointment

COURSE MATERIALS Materials are to be copied and distributed throughout the course.

COURSE OBJECTIVES A700 is a Ph.D. level course on behavioral research in accounting. The overall objective of the course is to provide students with the tools needed for educated consumption and production of behavioral research in accounting. We will focus on the theoretical and methodological issues faced by those who conduct this research, as well as the practical implications of the research for accounting. Students should leave the course with a basic knowledge of behavioral research in accounting and be better able to create, analyze and critique such research. The course should also help those students intending to work in the behavioral area identify research topics.

The course is divided into two parts. The first 12 weeks are taught by Sean Peffer. After that, there will be 3 weeks taught by Bob Ramsay, Cyndi Vines and Dan Stone focusing on behavioral issues in auditing, tax and information systems respectively.

1 PARTICIPATION AND PAPER SUMMARIES In general, each class period will focus on discussion of two or three papers. I believe that the best approach to understanding the experimental literature in accounting is to analyze thoroughly papers in the area. In addition to the two or three papers per session, there can be background readings for some sessions (denoted “B” in the list of readings). These readings are mandatory (i.e. can show up on the final), but typically will not be discussed in depth in the class.

Throughout your career as an academic research colleague, you will be asked to read and critique many papers, both in private and public settings. As such, this course is going to focus on sharpening the skills necessary to both present your work and to provide valuable feedback to others.

For the two or three primary papers, one student will be assigned as the primary discussant and all other students will be assigned the role of workshop participants. The job of the primary discussant is to present each paper as if it was his or her own paper. The job of the workshop participants is to critically evaluate the primary discussant’s paper. If this responsibility is not shared equally by the secondary discussants, the job of secondary discussant may be assigned to one person.

This will prepare you to analyze and discuss research papers.

PAPER REVIEW You are required to perform a formal review of a working paper, i.e., a review similar to those you will be doing for journals in the future. I will give you the paper on 3/7 and the review will be due on 3/24. I will provide you with guidelines from The Accounting Review to help you in the review process.

This will help prepare you for your role as journal reviewer.

WORKSHOP CRITIQUES We will have speakers (both visiting and in-house) presenting papers in SOA workshops throughout the semester. You will be required to write a critique for each of these papers. The critiques are to point out 2 substantive workshop comments for the paper. These are to be submitted on the Wednesday before the seminar and picked up the Friday morning before the workshop. This feedback should help guide you on what to ask in workshop that afternoon. Your performance in asking pointed, clear workshop questions will factor into this part of your seminar grade.

This will improve your ability to generate good workshop comments and deliver them in an effective manner in the workshop setting.

2 BEHAVIORAL PAPER You will research and produce a behavioral research paper on a topic of your choice. The paper will be in the form to be published in The Accounting Review. It will have an introduction, hypothesis development, and methodology section. The methodology section will be a ‘proposed’ methodology as you are not required to actually collect data. It will then have results and conclusions sections assuming that the results were as expected. A proposed abstract is due on 2/3, a draft is due 3/3 and the final paper is due 4/14.

This will improve your ability to develop and write research papers and could, potentially, lead to a publication.

FINAL EXAM The final exam will be similar in scope and difficulty to the comprehensive examination you will take at the end of your second year, except it will cover only the contents of this course. The exam will be 3 hours in length and will be closed book. We will arrange for a mutually convenient time during final exam week.

This should help solidify the knowledge gained in class and prepare you to take the BAR portion of the comprehensive examination.

GRADING Exercise Points Participation and Paper Summaries 30 Behavioral Paper 30 Paper Review 10 Workshop Critiques / Performance 10 Final Exam 20 Total Points 100

OBLIGATORY SMALL PRINT A major theme of this syllabus was blatantly borrowed from the Indiana University Behavioral Accounting Syllabus which, in turn, thanks Mike Bamber, Stan Biggs, Sarah Bonner, Vicky Hoffman, Jane Kenedy, Lisa Koonce, Bob Libby, Marlys Lipe, Don Moser and Rick Tubbs for aiding in the construction of that syllabus.

3 READING / ASSIGNMENT SCHEDULE Week Topic Readings Prof. Behavioral Research Jan Syllabus / Introduction to Ashton and Ashton 1995 (B) Dr. Peffer 21 Behavioral Accounting Bazerman 1998 (B) Research / Review / Organization

Jan Evaluating Experimental Kinney 1986 Dr. Peffer 28 Research in Accounting Bonner 1999 Libby 1981, Chapter 1 Runkel and McGrath, chapter 3

JDM in BAR Feb JDM – what the person Libby and Luft 1993 (B) Dr. Peffer 4 brings to the task – Bonner and Lewis 1990 experience, knowledge, Solomon, Shields and Whittington 1999 abilities Tan and Libby 1997

Feb JDM – what the person Ricchuite 1992 Dr. Peffer 11 brings to the task – Cuccia and McGill 2000 ______processing Hunton and McEwen 1997

Feb Variables that affect JDM Kahneman, Slovic and Tversky (1982) Dr. Peffer 18 – Heuristics and Biases Tversky and Kahneman 1974 (B) ______Smith and Kida 1991 (B) Kennedy, Mitchell and Sefcik 1998 Cloyd and Spilker 1999

Feb Task Variables that affect Hirst, Koonce, and Miller 1999 Dr. Peffer 25 JDM – Characteristics of Sprinkle and Tubbs 1998 ______Information Bonner 1994 (B) Maines and Hand 1996 ++

March Environmental Variables Kennedy 1993 Dr. Peffer 4 that affect JDM – Kennedy 1995 ______accountability Peecher 1996

March Environmental Variables Bazerman (B) Dr. Peffer 11 that affect JDM – Libby Trotman, Zimmer (1987) ______multiperson environment Cote and Sanders (1996) Chalos and Poon (2000)

Spring Break Whew!

March Solving JDM problems by Arkes 1991 (B) Dr. Peffer 25 changing person or Payne, Bettman, Johnson (1993) (B) providing decision aids Bonner and Walker (1994) Bonner Libby and Nelson (1996)

4 BAR Managerial April Cool Stuff in Managerial – Bonner, Hastie, Sprinkle, and Young Dr. Peffer 1 Incentives (2000) (B) Fisher, Maines, Peffer, Sprinkle (2002) Fisher, Peffer, Sprinkle (2003) Fisher, Maines, Peffer, Sprinkle (working paper) BAR Financial April Behavioral Research in Maines (handout) Dr. Peffer 8 Financial Accounting Libby, Tan, Hunton 2002 Libby, Tan, Hunton (working paper)

BAR Auditing April Behavioral Research in TBA Dr. Ramsay 15 Auditing

BAR I/S and Knowledge Management April Behavioral Research in TBA Dr. Stone 22 Information Systems

BAR Tax April Experimental Economic TBA Dr. Vines 29 Methodology

5/5 Week of Finals

This syllabus is subject to change.

5 Readings

BOOKS

Ashton, R. H. and Ashton, A. H. Judgment and Decision-Making Research in Accounting and Auditing, Cambridge University Press, 1995.

Bazerman, M. Judgment in Managerial Decision Making, John Wiley & Sons, 1998.

Kahneman, D., P. Slovic, and A. Tversky. Judgment Under Uncertainty: Heuristics and Biases. Cambridge University Press, 1982. Libby, R., Accounting and Human Information Processing: Theory and Applications. Prentice-Hall, 1981. Payne, Bettman, Johnson, The Adaptive Decision Maker, 1993. Runkel, P. and McGrath, J., Research on Human Behavior: A Systematic Guide to Method., Holt, Rinehart and Winston, Inc., 1972.

ARTICLES

Arkes, H. (1991). Costs and benefits of judgment errors: Implications for debiasing. Psychological Bulletin, 110 (3): 486-498.

Bonner, S. (1994). A model of the effects of audit task complexity. Accounting, Organizations, and Society. 19 (3): 213-234.

Bonner, S. (1999). Judgment and decision-making research in accounting. Accounting Horizons 13 (December): 385-398.

Bonner, S., R. Hastie, G. Sprinkle, and M. Young. (2000) A review of the effects of financial incentives on performance in laboratory tasks: Implications for management accounting. Journal of Management Accounting Research, 19-64.

Bonner, S. and B. Lewis. (1990). Determinants of auditor expertise. Journal of Accounting Research, 28 (Supplement): 1-20.

Bonner, S, R. Libby and M. Nelson. (1996) Using decision aids to improve auditors’ conditional probability judgments. The Accounting Review, (April)

Bonner, S. and P. Walker. (1994) The effects of instruction and experience on the acquisition of auditing knowledge. The Accounting Review (January)

Chalos, P., and M. Poon. (2000) Participation and Performance in Capital Budgeting Teams. Behavioral Research in Accounting, 12: 199-230.

Cloyd, C. B. and B. C. Spilker. (1999). The influence of client preferences on tax professionals’ search for judicial precedents, subsequent judgments and recommendations. The Accounting Review 74 (July): 299-322.

6 Cote, J. and D. Sanders (1996). Herding behavior: Explanations and implications. Behavioral Research in Accounting, 9: 20-45.

Cuccia, A. D. and G. A. McGill. (2000). The role of decision strategies in understanding professionals’ susceptibility to judgment biases. Journal of Accounting Research. (Autumn): 419-435. Fisher, J., L. Maines, S. Peffer, and G. Sprinkle (2002). Using budgets for performance evaluation: Effects of resource allocation and horizontal information asymmetry on budget proposals, budget slack and performance. The Accounting Review (77) 847-866. Fisher, J., L. Maines, S. Peffer, and G. Sprinkle (2003). working paper to be handed out in class. Frederickson, J., S. Peffer, and J. Pratt (1999). Performance Evaluation Judgments: Effects of Prior Experience under Different Performance Evaluation Schemes and Feedback Frequencies, Journal of Accounting Research, 37(1): 151-166.

Fisher, J., S. Peffer, and G. Sprinkle (2003) –not out in JMAR yet, so..to be given out in working paper form.

Hirst, D.E., L. Koonce, and J. Miller. (1999). The joint effect of management’s prior forecast accuracy and the form of its financial forecasts on investor judgment. Journal of Accounting Research. 37 (Supplement): 101-134.

Hunton, J. and R. McEwen. (1997). An assessment of the relation between analysts’ earnings forecast accuracy, motivational incentives, and cognitive information search strategy. The Accounting Review, 72 (4): 497-515.

Kennedy, J. (1993). Debiasing audit judgment with accountability: A framework and experimental results. Journal of Accounting Research 31 (Autumn): 231-245.

Kennedy, J. (1995). Debiasing the curse of knowledge in audit judgment. The Accounting Review, 70 (2): 249-273.

Kennedy, J, T. Mitchell, and S. E. Sefcik. (1998). Disclosure of contingent environmental liabilities: Some unintended consequences? Journal of Accounting Research 36 (Autumn): 257-277.

Kinney, W.R. (1986). Empirical accounting research design for Ph.D. students. The Accounting Review. 61(2): 338-350.

Libby, R. and J. Luft. (1993). Determinants of judgment performance in accounting settings: Ability, knowledge, motivation, and environment. Accounting, Organizations and Society, 18 (5): 425-450.

Libby, R., H. Tan and J. Hunton. (2002). Analysts’ Reactions to Earnings Preannouncement Strategies, The Accounting Review, (40) 223-

Libby, R., H. Tan and J. Hunton. working paper to be handed out in class.

Libby, R., K. Trotman, and I. Zimmer. (1987). Member variation, recognition of expertise, and group performance. Journal of Applied Psychology, 72 ( ): 81-87.

7 Maines, L.A. (1990). The Effect of Forecast Redundancy on Judgments of a Conensus Forecast’s Expected Accuracy. Journal of Accounting Research, 28 (supplement): 29-47.

Maines, L. A. and J.R.M. Hand (1996). Individuals’ perceptions and misperceptions of the time series properties of quarterly earnings. The Accounting Review. 71 (3): 317- 336.

Peecher, M. (1996). The influence of auditors’ justification processes on their decisions: A cognitive model and experimental evidence. Journal of Accounting Research, 34 (1): 125-140.

Ricchiute, D. N. (1992). Working-paper order effects and auditors' going-concern decisions. The Accounting Review, 67 (1): 46-58.

Smith, J. and T. Kida (1991). Heuristics and biases: Expertise and task realism in auditing. Psychological Bulletin. 109 (3): 472-489.

Solomon, Shields, and Whittington. (1999). What do industry-specialist auditors know? Journal of Accounting Research. 37(Spring): 191-207.

Sprinkle, G. B. and R. M. Tubbs. (1998). The effect of audit risk and information importance on auditor memory during working paper review. The Accounting Review. 73 (October): 475-502.

Tan, H., and R. Libby. (1997). Tacit managerial versus technical knowledge as determinants of audit expertise in the field. Journal of Accounting Research, 35 (1): 97-113.

Tan, H. and M. Lipe. (1997). Outcome effects: The impact of decision process and outcome controllability. Journal of Behavioral Decision Making, 10: 315-325.

Tversky, A., and D. Kahneman. (1974). Judgment under uncertainty: Heuristics and Biases. Science, 185: 1124-1131.

8 Many Other Good Reference Sources (Mostly Books)

The Society for Judgment and Decision Making Web Site (including membership information): http://www.sjdm.org/ Advances in Behavioral Finance. R. Thaler. Russell Sage Foundation, 1993. Communication and Persuasion: Central and Peripheral Routes to Attitude Change. R. Petty and J. Cacioppo, 1986. Design and Analysis: A Researchers’ Handbook. G. Keppel. Prentice-Hall, Latest Edition. Decision Research. J. Carroll, and E. Johnson. Sage Publications, 1990. Decision Sciences: An Integrative Perspective. P. Kleindorfer, H. Kunreuther, and P. Schoemaker. Cambridge University Press, 1993. Experimental Design: Procedures for the Behavioral Sciences. R. Kirk. Brooks/Cole Publishing Company, Latest Edition. Foundations of Behavioral Research. F. Kerlinger, Latest Edition. Human Inference: Strategies and Shortcomings of Social Judgment. R. Nisbett and L. Ross. Englewood Cliffs, 1980. Induction: Processes of Inference, Learning and Discovery. J. Holland, K. Holyoak, R. Nisbett, and P. Thagard. MIT Press, 1989. Inside the Juror: The Psychology of Juror Decision Making. R. Hastie. Cambridge University Press, 1993. Judgment and Choice. R. Hogarth. John Wiley and Sons, 1987. Judgment and Decision Making: An Interdisciplinary Reader. H. Arkes and K. Hammond, Cambridge University Press, 1986. Judgment and Decision Making. F. Yates. Prentice-Hall, 1990. Judgment Under Uncertainty: Heuristics and Biases. D. Kahneman, P. Slovic, and A. Tversky. Cambridge University Press, 1982. Mental Leaps: Analogy in Creative Thought. K. Holyoak and P. Thagard. The MIT Press, 1995. Mental Models. D. Gentner and A. Stevens. Lawrence Erlbaum Associates, 1983. Multiple Regression in Behavioral Research. E. Pedhazur. Holt, Rinehart, and Winston, 1982. The Nature of Expertise. M. Chi, R. Glaser, and M. Farr. Lawrence Erlbaum Associates, 1988. Nonparametric Statistics. S. Siegel and J. Castellan. McGraw-Hill, 1988. The Psychology of Judgment and Decision Making. Plous, S. McGraw-Hill, 1993.

9 Protocol Analysis: Verbal Reports as Data. K. Ericsson and H. Simon. MIT Press, 1993. The Psychology of Attitudes. A. Eagly and S. Chaiken. Harcourt, Brace, Javanovich College Publishers, 1993. Research on Judgment and Decision Making: Currents, Connections, and Controversies. W. Goldstein and R. Hogarth. Cambridge University Press, 1997. Rules for Reasoning. R. Nisbett. Lawrence Erlbaum Associates, 1993. The Sciences of the Artificial. H. Simon, The MIT Press, 1996.

Social Cognition, Fiske, S., and S. Taylor , McGraw-Hill, 1991. Social Influence: The Ontario Symposium, Volume 1. T. Higgins, P. Herman, and M. Zanna. Lawrence Erlbaum Associates, 1981. Social Influence: The Ontario Symposium, Volume 5. M. Zanna, J. Olson, and P. Herman. Lawrence Erlbaum Associates, 1987. Statistics. W. Hays. Holt, Rinehart, and Winston, Latest Edition. Tacit Knowledge in Professional Practice. R. Sternberg and J. Horvath. Lawrence Erlbaum Associates, in press. Thinking, Problem Solving, Cognition. R. Mayer. W. H. Freeman and Company, Second Edition.

OTHER ARTICLES

Abdolmohammadi, M.J. and A. Wright. (1987) An examination of the effects of experience and task complexity on audit judgments. The Accounting Review. 62: 1-13.

Ackert, L, B. Church, and M. Shehata. (1997). An experimental examination of the effects of forecast bias on individuals’ use of forecasted information. Journal of Accounting Research, 35 (1): 25-42.

Anderson, U., G. Marchant, and J. Robinson. (1989). Instructional strategies and the development of tax expertise. Journal of the American Taxation Association, 10 (1): 7-23.

Anderson, M. (1985). Some evidence on the effect of verbalization on process: A methodological note. Journal of Accounting Research, 23 (2): 843-852.

Anderson, M. (1988). A comparative analysis of information and evaluation behavior of professional and Anderson, U., and W. Wright. (1988). Expertise and the explanation effect. Organizational Behavior and Human Decision Processes, 42: 250-269.

Ashton, A. (1982). An empirical study of budget-related predictions of corporate executives. Journal of Accounting Research. 20 (2): 440-449.

Ashton, A. (1985). Does consensus imply accuracy in accounting studies of decision making? The Accounting Review 60 (2): 173-185.

10 Ashton, R. (1990). Pressure and performance in accounting decision settings: Paradoxical effects of incentives, feedback and justification. Journal of Accounting Research. 28 (Supplement): 148-180.

Ashton, R. (1974). An experimental study of internal control judgments. Journal of Accounting Research, 12 (1): 143-157.

Ashton, R.H. and A.H. Ashton. (1995). Perspectives on judgment and decision-making research in accounting and auditing. In A.H. Ashton and R.H. Ashton.(Eds.) Judgment and Decision–Making Research in Accounting and Auditing. Cambridge University Press. 102-136.

Berg, J., Dickhaut, J. and K. McCabe (1995). The individual versus the aggregate. In A.H. Ashton and R.H. Ashton.(Eds.) Judgment and Decision–Making Research in Accounting and Auditing. Cambridge University Press. 102-136.

Beresford, D. (1994). A request for more research to support financial accounting standard setting. Behavioral Research in Accounting 6: 190-203.

Bernard, V., and K. Schipper. (1994). Recognition and Disclosure in Financial Reporting. Working paper, University of Chicago.

Biggs, S. An empirical investigation of the information processes underlying four models of choice behavior. In Thomas Burns (Ed.) Behavioral Experiments in Accounting II, Ohio State University, 1978, 35-81.

Bloomfield, R. and T. J. Wilks (2000). Disclosure effects in the laboratory: Liquity, depth, and the cost of capital. The Accounting Review. 75 (January): 13-41.

Bonner, S. (1990). Experience effects in auditing: The role of task-specific knowledge. The Accounting Review, 65 (1): 72-92.

Bonner, S., and N. Pennington. (1991). Cognitive processes and knowledge as determinants of auditor expertise. Journal of Accounting Literature 10: 1-50.

Bouwman, M. (1984). Expert vs. novice decision making in accounting: A summary. Accounting, Organizations and Society, 9 (3/4): 325-327.

Butt, J. (1988). Frequency judgments in an auditing-related task. Journal of Accounting Research, 26 (2): 315-330.

Camerer, C. (1987). Do biases in probability judgments matter in markets? Experimental evidence. American Economic Review, 77 (5): 981-997.

Camerer, C., G. Lowenstein, and M. Weber (1989). The curse of knowledge in economic settings: An experimental analysis. Journal of Political Economy 97 (5): 1232- 1254.

Cuccia A., Hackenbrack, K. and M. Nelson (1995). The ability of professional standards to mitigate aggressive reporting. The Accounting Review. 70 (2): 227-248.

Davis, E., Kennedy, J., and L. Maines. (2000) The relation between consensus and accuracy in low-to-moderate accuracy tasks: An auditing example. Auditing: A Journal of Practice and Theory 19 (Spring): 101-121.

11 Davis, J., and I. Solomon. (1989). Experience, expertise, and expert-performance research in public accounting. Journal of Accounting Literature, 8: 150-164.

DeBondt, W., and R. Thaler. (1990). Do security analysts overreact? American Economic Review, 80 (2): 52-57.

DeBondt, W., and R. Thaler. (1987). Further evidence on investor overreaction and stock market seasonality. The Journal of Finance, 42 (3): 557-581.

Dietrich, J., S. Kachelmeier, D. Kleinmuntz, and T. Linsmeier. (1997). An experimental investigation of forward-looking non-financial performance disclosures. Working paper.

Ericsson, K. And H. Simon. (1980). Verbal reports as data. Psychological Review, 87 (3): 215-251.

Frederick, D. and R. Libby. (1986). Expertise and auditors’ judgments of conjunctive events. Journal of Accounting Research, 24 (2): 270-290.

Frederick, D. (1991). Auditors’ representation and retrieval of internal control knowledge. The Accounting Review. 66 (2): 240-258.

Fuerbringer, J. (1997). Why both bulls and bears can act so bird-brained: Quirky behavior is becoming a realm of economics. The New York Times, p. F-1.

Ganguly, A., J. Kagel, and D. Moser. (1994). The effects of biases in probability judgments on market prices. Accounting, Organizations, and Society, 19 (8): 675-700.

Gibbins, M. and R. Swieringa. (1995). Twenty years of judgment research in accounting and auditing. In A.H. Ashton and R.H. Ashton.(Eds.) Judgment and Decision– Making Research in Accounting and Auditing. Cambridge University Press. 231- 250. Haynes, C. M. and S. J. Kachelmeier. (1998). The effects of accounting contexts on accounting decisions: A synthesis of cognitive and economic perspectives in accounting experimentation. Journal of Accounting Literature 17: 91-136. Heiman, V. (1990). Auditors' assessments of the likelihood of error explanations in analytical review. The Accounting Review, 65 (4): 875-890.

Hirst, D.E., (1994). Auditors’ sensitivity to source reliability. Journal of Accounting Research. 32 (1): 113-126. Hirst, D.E., and P. Hopkins. (1998). Comprehensive income reporting and analysts’ valuation judgments. Journal of Accounting Research. 36 (Supplement): 47-75. Hirst, D.E., P. Hopkins, and J. Wahlen. (2001). Fair value accounting and natural hedging in commercial banks. Working paper, Indiana University. Hirst, D.E., L. Koonce, and P. Simko. (1995). Investor reactions to financial analysts’ research reports. Journal of Accounting Research, 33 (2): 335-351.

Hopkins, P. (1996). The effect of financial statement classification of hybrid financial instruments on financial analysts’ stock price judgments. Journal of Accounting Research, 34 (Supplement): 33-50.

12 Hopkins, P., R. Houston, and M. Peters. (2000). Purchase, pooling, and equity analysts’ valuation judgments. The Accounting Review 75 (July): 257-287.

Jeffrey, C. (1992). The relation of judgment, personal involvement, and experience in the audit of bank loans. The Accounting Review, 67 (4): 802-820.

Joyce, E. (1989). Discussant’s remarks on Robert Libby’s paper: “Experimental research and the distinctive features of accounting settings. In T.J. Frecka (Ed.) The State of Accounting Research as We Enter the 1990s, University of Illinois, 148-152.

Joyce. E. and G. Biddle (1981a). Anchoring and adjustment in probabilistic inference in auditing. Journal of Accounting Research. 19 (1): 120-145.

Joyce. E. and G. Biddle (1981b). Are auditors’ judgments sufficiently regressive? Journal of Accounting Research. 19(2): 323-349.

Kachelmeier, S. (1996). Do cosmetic reporting variations affect market behavior? A laboratory study of the accounting emphasis on unavoidable costs. Review of Accounting Studies, 1: 115-140.

Kahneman, D. and A. Tversky (1979). Prospect theory: An analysis of decisions under risk. Econometrica. 47: 263-291.

Kennedy, J., and M Peecher. (1997). Judging auditors’ technical knowledge. Journal of Accounting Research, 35 (2): 279-294.

Kinney, W.R. and W.C. Uecker. (1982) Mitigating the consequences of anchoring in auditor judgments. The Accounting Review. 57: 55-69.

Koehler, D. (1991). Explanation, imagination, and confidence in judgment. Psychological Bulletin, 110 (3): 499-519.

Kolodner, J. (1997). Educational implications of analogy. American Psychologist, 52 (1): 57-66.

Koonce, L. (1992). Explanation and counterexplanation during audit analytical review. The Accounting Review 67 (1): 59-76.

Libby, R. (1975). Accounting ratios and the prediction of failure: Some behavioral evidence. Journal of Accounting Research, 13 (1): 150-161.

Libby, R. (1989). Experimental research and the distinctive features of accounting settings. In T.J. Frecka (Ed.) The State of Accounting Research as We Enter the 1990s, University of Illinois, 126-147.

Libby, R. (1985). Availability and the generation of hypotheses in analytical review. Journal of Accounting Research. 23 (2): 648-667.

Libby, R. (1995). The role of knowledge and memory in audit judgment. In Ashton and Ashton (Ed.) Judgment and Decision-Making Research in Accounting and Auditing, Cambridge University Press, 176-206.

13 Libby, R. and M. Lipe. (1992). Incentives, effort, and the cognitive processes involved in accounting-related judgments. Journal of Accounting Research, 30: 249-273.

Libby, R. and H. Tan. (1994). Modeling the determinants of audit expertise. Accounting, Organizations and Society, 19 (8): 701-716.

Libby, R. and H. Tan. (1998). Analysts’ reactions to warnings of negative earning surprises. Journal of Accounting Research. 37 (Autumn): 415-436.

Lipe, M. (1993). Analyzing the variance investigation decision: The effects of outcomes, mental accounting, and framing. The Accounting Review, 68 (4): 748- 764.

Lipe, M. and S. Salterio (2000). The balanced scorecard: Judgmental effects of information volume, diversity, and organization, The Accounting Review. 75 (July): 288-

Luft, J. (1994). Bonus and penalty incentives contract choice by employees. Journal of Accounting & Economics, 18: 181-206.

Lundholm, R. (1991) What affects the efficiency of a market? Some answers from the laboratory. The Accounting Review. 66: 486-515.

Maines, L. A. and L. S. McDaniel. (2000). Effects of comprehensive-income characteristics on nonprofessional investors’ judgments: The role of financial- statement presentation format. The Accounting Review 75 (April): 179-207.

Maines, L., L. McDaniel, and M. Harris (1998). Implications of Proposed Segment Reporting Standards for Financial Analysts’ Investment Judgments, Journal of Accounting Research ( Supplement). 1-24.

Maines, L. (1995). Judgment and decision-making research in financial accounting: A review and analysis. In A.H. Ashton and R.H. Ashton.(Eds.) Judgment and Decision–Making Research in Accounting and Auditing. Cambridge University Press. 76-101.

Maines, L. (1996). An experimental examination of subjective forecast combination. International Journal of Forecasting. 12: 223-233.

Marchant, G. (1990). Discussion of determinants of auditor expertise. Journal of Accounting Research 28 (Supplement): 21-28.

McDaniel, L., and J. Hand. (1996). The value of experimental methods for practice- relevant accounting research. Contemporary Accounting Research, 13 (1): 339- 352.

Messier, W. (1995). Research in and development of audit decision aids. In R. Ashton and A. Ashton (Eds.) Judgment and Decision-Making Research in Accounting and Auditing, Cambridge University Press, pp. 207-228.

Moser, D. (1989). The effect of output interference, availability, and accounting information on investors’ predictive judgments. The Accounting Review, 64 (3): 433-448.

14 Nelson, M., R. Libby, and S. Bonner. (1995). Knowledge structure and the estimation of conditional probabilities in audit planning. The Accounting Review, 70 (1): 27- 47.

Pennington, N., and R. Hastie. (1988). Explanation-based decision making: Effects of memory structure on judgment. Journal of Experimental Psychology: Learning, Memory, and Cognition, 14 (3): 521-533.

Prawitt, D. (1995). Staffing assignments for judgment-oriented audit tasks: The effects of structured audit technology and environment. The Accounting Review, 70 (3): 443-465.

Russo, J., Johnson, E., and D. Stephens. (1989). The validity of verbal protocols. Memory and Cognition. 17 (6): 759-769.

Schadewald, M. (1989). Reference point effects in taxpayer decision making. Journal of the American Taxation Association, 10 (2): 68-84.

Schoemaker, P. (1982). The expected utility model: Its variants, purposes, evidence and limitations. Journal of Economic Literature. 20(2): 529-565.

Schum, D. (1989). Knowledge, probability, and credibility. Journal of Behavioral Decision Making. 2: 39-62Solomon, I., L. Tomassini, and A. Ariyo. 1985. Contextual effects on the calibration of probabilistic judgments. Journal of Applied Psychology, 70 (3): 528-532.

Simon, H. (1995). The information-processing theory of mind. American Psychologist 50 (7): 507-508.

Simon, H., G. Dantzig, R. Hogarth, C. Plott, H. Raiffa, T. Schelling, K. Shepsle, R. Thaler, A. Tversky, S. Winter. (1987). Decision making and problem solving. Interfaces 17 (5): 11-31.

Solomon, I. (1987). Multi-auditor judgment/decision making research. Journal of Accounting Literature, 6: 1-25.

Spilker, B. (1995). The effects of time pressure and knowledge on key word selection behavior in tax research. The Accounting Review, 70 (1): 49-70.

Sternberg, R. (1997). Cognitive conceptions of expertise. In P. Feltovich, K. Ford, and R. Hoffman (Eds.) Expertise in Context, pp. 149-161.

Sternberg, R., R. Wagner, W. Williams, and J. Horvath. (1995). Testing common sense. American Psychologist, 50 (11): 912-927.

Tan, H., R. Libby, and J. Hunton. (2000). Analysts’ reaction to earnings preannouncement strategies. Working paper, Cornell University.

Tuttle, B., M. Coller, and F. G. Burton (1997). An examination of market efficiency: Information order effects in a laboratory market. Accounting, Organizations and Society, 22 (1): 89-103.

15 Tversky, A. (1995). The psychology of decision making. In A. Wood (Ed.) ICFA Continuing Education: Behavioral Finance and Decision Theory in Investment Management. Association for Investment Management and Research: 2-5.

Waller, W., and W. Felix. (1984). The auditor and learning from experience: Some conjectures. Accounting, Organizations, and Society, 9 (3/4): 383-406.

Vera-Munoz, S. (1998). The effects of accounting knowledge and context on the omission of opportunity costs in resource allocation decisions. The Accounting Review, 73 (January): 47-72..

Young, S.M. and B. Lewis. (1995). Experimental incentive-contracting research in management accounting. In A.H. Ashton and R.H. Ashton.(Eds.) Judgment and Decision–Making Research in Accounting and Auditing. Cambridge University Press. 55-75.

16