Shareholders' Agreement

Parties Name [insert name] (Company) ACN [insert ACN] Address [insert address]

Name The parties set out in Schedule 1.

Background A As at the date of this agreement, the Shares in the Company are held in the manner set out in Schedule 1. B All parties have agreed to enter into this agreement for the purpose of recording the terms of this arrangement and their respective relationships with each other.

Operative provisions

1 Composition of the Board The Board

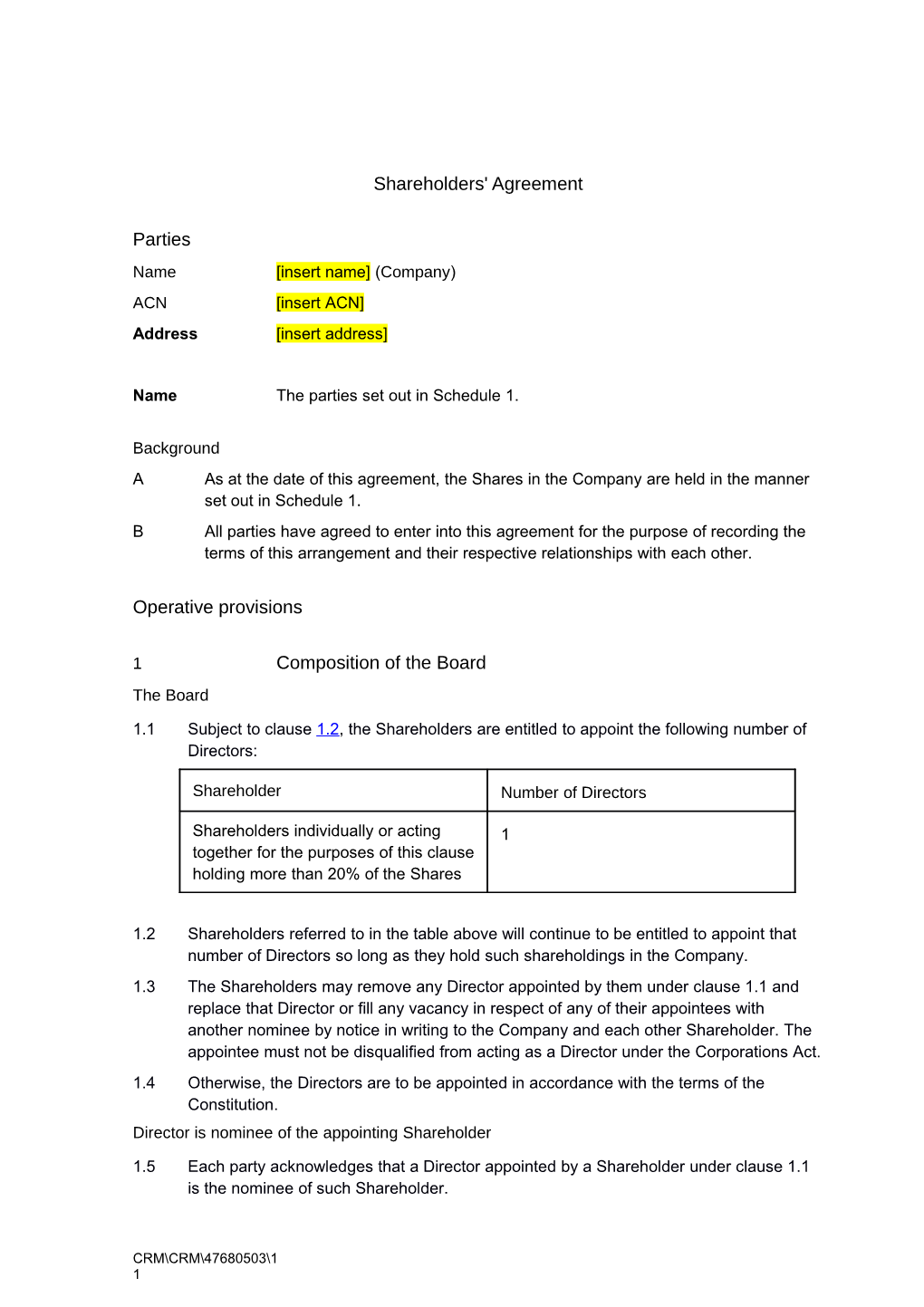

1.1 Subject to clause 1.2, the Shareholders are entitled to appoint the following number of Directors:

Shareholder Number of Directors

Shareholders individually or acting 1 together for the purposes of this clause holding more than 20% of the Shares

1.2 Shareholders referred to in the table above will continue to be entitled to appoint that number of Directors so long as they hold such shareholdings in the Company. 1.3 The Shareholders may remove any Director appointed by them under clause 1.1 and replace that Director or fill any vacancy in respect of any of their appointees with another nominee by notice in writing to the Company and each other Shareholder. The appointee must not be disqualified from acting as a Director under the Corporations Act. 1.4 Otherwise, the Directors are to be appointed in accordance with the terms of the Constitution. Director is nominee of the appointing Shareholder

1.5 Each party acknowledges that a Director appointed by a Shareholder under clause 1.1 is the nominee of such Shareholder.

CRM\CRM\47680503\1 1 1.6 So long as an honest and reasonable director can form the view that they are acting in good faith and in the best interests of the Company as a whole, a Director appointed by Shareholders under clause 1.1 may do each of the following: (6.i) have regard to and represent the interests of those Shareholders and (6.ii) act on the wishes of those Shareholders in performing any of the Director's duties or exercising any power, right or discretion as a Director. No removal of a party's appointee by the other parties

1.7 A Shareholder must not put forward or instigate a resolution for the removal from the Board of a Director appointed by other Shareholders. A Shareholder must vote against a resolution proposed at a meeting of the Shareholders for the removal of a Director appointed by other Shareholders. This does not apply if the appointee is disqualified from acting as a director under the Corporations Act or the Constitution.

2 Information Auditor Appointment

1.1 Before the end of the Financial Year in which this Agreement is executed and at all times thereafter, the Company must have an Auditor appointed. Basic financial information

2.1 By 25 September of each year, the Company must provide to each Major Investor: (1.i) annual audited financial statements for each Financial Year, including an audited balance sheet as of the end of such Financial Year, an audited statement of operations and an audited statement of cash flows of the Company for such year, all prepared in accordance with generally accepted accounting principles and practices; or (1.ii) a statement, prepared in accordance with accepted accounting principles and practices and audited by the Auditor, showing the total value of the Company’s current and non-current assets. 2.2 Upon request, the Company will provide promptly to each Major Investor quarterly unaudited financial statements for each quarter of a Financial Year of the Company (except the last quarter of the Company’s Financial Year), including an unaudited balance sheet as of the end of such quarter, an unaudited statement of operations and an unaudited statement of cash flows of the Company for such quarter, all prepared in accordance with generally accepted accounting principles and practices, subject to changes resulting from normal year-end audit adjustments. Confidential information

2.3 Notwithstanding anything in this agreement to the contrary, no Investor by reason of this agreement shall have access to any trade secrets or confidential information of the Company. Competitor

2.4 The Company shall not be required to comply with any information rights in respect of any Investor whom the Company reasonably determines to be a competitor or an officer, employee, director or holder of 10% or more of the equity of a competitor.

CRM\CRM\47680503\1 2 Investor obligations

2.5 Each Investor agrees that such Investor will keep confidential and will not disclose, divulge, or use for any purpose (other than to monitor its investment in the Company) any confidential information obtained from the Company pursuant to the terms of this agreement other than to any of the Investor’s legal advisers, accountants, consultants, and other professionals, to the extent necessary to obtain their services in connection with monitoring the Investor’s investment in the Company. Inspection rights

2.6 The Company shall permit each Major Investor to visit and inspect the Company’s properties, to examine its books of account and records and to discuss the Company’s affairs, finances and accounts with its officers, all at such reasonable times as may be requested by such Investor.

3 Powers of decision Decisions requiring special resolution of the Shareholders

3.1 An amendment to the Constitution can only be made by a special resolution of the Shareholders. Decisions requiring special majority resolution

3.2 The following matters can only be undertaken with prior approval given by passing a special majority resolution in accordance with clause 3.3: (2.i) any alteration of the rights of holders of Investor Shares; (2.ii) creation of any new class of Shares having rights senior to or on parity with the Investor Shares; (2.iii) redeem, buy back (other than in accordance with clause 5), cancel or undertake a capital reduction of any share capital or other securities of the Company; (2.iv) declare or pay any dividend; (2.v) issue any securities other than in accordance with clause 4; (2.vi) appoint any Directors other than in accordance with clause 1.1; (2.vii) apply for voluntary liquidation, winding-up or de-registration of the Company except as permitted under this agreement; (2.viii) make a material change in the nature of the Company's business; (2.ix) a Sale Event; (2.x) start or settle any legal or arbitration proceedings, except in the ordinary course of business. 3.3 For a resolution to be passed by a special majority it must satisfy both the following criteria: (3.i) it is passed by a majority of Directors; and (3.ii) it is approved by the Shareholders holding more than 50% of the Investor Shares. Sale Event

CRM\CRM\47680503\1 3 3.4 If a proposed Sale Event is approved in accordance with this agreement, each party to this agreement must: (4.i) give such co-operation and assistance, as the Company and the shareholders who proposed the Sale Event, may request; and (4.ii) exercise all such rights and powers each party has in relation to the Company and any of its subsidiaries, whether as shareholder or otherwise, so as to ensure that the Sale Event is achieved in accordance with the proposal. Subsidiaries

3.5 If the Company has any Subsidiaries then this clause will have application to each Subsidiary so that no Subsidiary may take an action specified in clause 3.2 unless there has been a special majority resolution in favour of it.

4 Issues of New Securities

4.1 If the Board resolves to make an issue of New Securities, it must give written notice of such intention to the Shareholders setting out the terms of the proposed issue of New Securities. 4.2 Within 10 Business Days, and subject to clause For the purposes of this clause Issues of New Securities:, each Shareholder may give written notice to the Company that it wishes to acquire its Respective Proportion of the New Securities on the same terms. 4.3 Within 120 days thereafter the Company may issue on the same terms as offered to the Shareholders any New Securities not acquired by the Shareholders pursuant to clause 4.2 to a third party. 4.4 In the event that the Company has not issued the New Securities within such one 120 day period, then the Company shall not thereafter issue or sell any New Securities without again first offering such New Securities to the Shareholders pursuant to this clause 4. 4.5 In the event that the Company issues New Securities to a third party under clause 4.3 and such New Securities have rights, preferences or privileges that are more favourable to the Shareholder than the terms of the Investor Shares, the Company shall take such action in accordance with all laws to provide substantially equivalent rights for the Investors in relation to the Investor Shares as are attached to the New Securities (with appropriate adjustment for economic terms or other contractual rights and subject to such Investor’s execution of any relevant documents executed by the holders of the New Securities in subscribing for the New Securities). 4.6 For the purposes of this clause Issues of New Securities: (6.i) an Investor Affiliate may subscribe for an Investor’s Respective Proportion; and / or (6.ii) an Investor Affiliate may subscribe for, in addition to the Respective Proportion of its related Investor (First Investor), the Respective Proportion entitlement of the other Investor (Other Investor) (for the avoidance of doubt the total number of New Shares that may be subscribed for in this clause For the purposes of this clause Issues of New Securities: is equal to the Respective Proportion of each relevant Investor). Blackbird or an Investor Affiliate of it may subscribe for the Respective Proportion entitlement of Startmate.

CRM\CRM\47680503\1 4 5 Share Vesting, Buy-Back Rights, Accelerated Release and Sale Preference Vesting of Unvested Shares

5.1 As at the date of this agreement, 100% of the Ordinary Shares held by a Founder or a Founder Nominee (together the Founder Group) are subject to the buy-back right of the Company set out in clauses Provided the Founder remains engaged by the Company, whether as an employee or contractor, the Ordinary Shares held by each member of the Founder Group will vest as follows: to If an Accelerated Vesting Event occurs, all remaining Unvested Shares of a Founder Group member shall immediately vest and the provisions of clauses Provided the Founder remains engaged by the Company, whether as an employee or contractor, the Ordinary Shares held by each member of the Founder Group will vest as follows: to In consideration of the Founder, the Founder Nominee (if relevant) and the Company entering into this agreement, each member of the Founder Group irrevocably appoints each Director for the time being of the Company to be his or her attorney for the purpose of executing and delivering to the Company, in the name of the Founder member and on its behalf, all documents required to be executed by the Founder Group under this clause 5. will cease to apply to those Ordinary Shares.. 5.2 Provided the Founder remains engaged by the Company, whether as an employee or contractor, the Ordinary Shares held by each member of the Founder Group will vest as follows: (2.i) 1/4 will vest immediately one year after the date of this agreement (One Year Anniversary); (2.ii) the remaining Ordinary Shares will vest at a rate of 1/36 monthly after the One Year Anniversary. 5.3 Any Ordinary Shares that have not vested pursuant to clause 5.2 or clause 5.11 shall be referred to in this agreement as "Unvested Shares". Buy-back right on Unvested Shares

5.4 If a Founder ceases to be engaged by the Company, whether as an employee or contractor and is a Bad Leaver or if a member of the Founder Group attempts to transfer any of its Unvested Shares (other than as permitted by this agreement), or if the Founder is a Good Leaver who holds Unvested Shares, the Company shall have the option to buy-back all of the Unvested Shares (as defined below) held by the Founder Group in accordance with the remaining terms of this clause 5. 5.5 A buy-back of Unvested Shares under this clause will be implemented by the Company and the Founder as a selective share buy-back of shares in accordance with Division 2.1 of Part 2J.1 of the Corporations Act. 5.6 Any fraction of an Unvested Share arising from the calculation set out in clause 5.2 shall be rounded up to the nearest whole number of shares. Exercise of buy-back by Company

5.7 The Company will exercise its share buy-back right under clause 5,4, by giving written notice to the Founder Group setting out: (7.i) the number of Unvested Shares of the Founder Group (Buy-Back Shares);

CRM\CRM\47680503\1 5 (7.ii) the purchase price for the Buy-Back Shares, which will be equal to $0.001 for each Buy-Back Share; and (7.iii) enclosing a share buy-back agreement for the purchase of the Buy-Back Shares executed by the Company (which shall be conditional on shareholder approval in accordance with section 257D of the Corporations Act) (Buy-Back Agreement). 5.8 The Founder (or Founder Nominee as the case may be) shall duly execute and return the Buy-Back Agreement to the Company within five Business Days of the date of the notice issued by the Company under clause 5.7. Completion of share buy-back

5.9 Subject to the Company having received shareholder approval in accordance with section 257D of the Corporations Act, on the date specified in the Buy-Back Agreement for completion of the share buy-back: (9.i) the Founder (or the Founder Nominee as the case may be) shall deliver a duly executed share transfer in favour of the Company of the Buy-Back Shares being acquired by the Company and the share certificates representing those shares; and (9.ii) upon completion of those matters, the Company shall pay the purchase price for the Buy-Back Shares being acquired by the Company to the Founder (or the Founder Nominee as the case may be). Power of Attorney

5.10 In consideration of the Founder, the Founder Nominee (if relevant) and the Company entering into this agreement, each member of the Founder Group irrevocably appoints each Director for the time being of the Company to be his or her attorney for the purpose of executing and delivering to the Company, in the name of the Founder member and on its behalf, all documents required to be executed by the Founder Group under this clause 5. Accelerated Vesting

5.11 If an Accelerated Vesting Event occurs, all remaining Unvested Shares of a Founder Group member shall immediately vest and the provisions of clauses Provided the Founder remains engaged by the Company, whether as an employee or contractor, the Ordinary Shares held by each member of the Founder Group will vest as follows: to In consideration of the Founder, the Founder Nominee (if relevant) and the Company entering into this agreement, each member of the Founder Group irrevocably appoints each Director for the time being of the Company to be his or her attorney for the purpose of executing and delivering to the Company, in the name of the Founder member and on its behalf, all documents required to be executed by the Founder Group under this clause 5. will cease to apply to those Ordinary Shares. Sale Preference

5.12 If there is a sale of all of the Shares to a third party, the Shareholders agree that they will take all necessary actions so that out of the proceeds of the purchase price for all of the Shares, the holders of the Investor Shares may elect by notice in writing to the other Shareholders to receive an amount, in priority to payments from such purchase price to any other Shareholders, equal to the aggregate of the following: (12.i) the amount paid up on the Investor Shares; and CRM\CRM\47680503\1 6 (12.ii) the amount of all dividends declared but unpaid in respect of the Investor Shares.

6 Issue of Employee Options 6.1 The Board may issue Employee Options up to the Employee Option Maximum on such terms as the Board approves from time to time.

7 Restrictions on transfer of Shares General

7.1 A Shareholder must not Dispose of any Shares, except: (1.i) in accordance with this agreement; or (1.ii) with the consent of each other Shareholder. 7.2 A Founder Group member must not transfer (nor take any action to transfer) any Unvested Share. 7.3 A Shareholder may transfer all of its Shares: (3.i) to another member of its Wholly-owned Group or to an incorporated trustee of a trust which it controls; or (3.ii) to a person approved in writing by all of the Founders and Major Investors. 7.4 If a Shareholder holding Shares transferred to it under clause 7.3.1 above is about to cease to be a member of the Wholly-owned Group which it currently belongs or is about to no longer control the corporate trustee of the trust holding the Shares, it shall without delay and prior to it so ceasing to be a member, or losing control, notify the Company, the Founders and the Major Investors that such event will occur and shall procure the transfer of those Shares to the Shareholder, a member of its current Wholly-owned Group or a new corporate trustee of a trust which it controls. 7.5 Any transfer not in accordance with this clause 7 has no effect. General pre-emptive rights

7.6 If this clause 7 applies, where a Shareholder (Selling Shareholder) seeks to Dispose of some or all of its Shares, it must first give to the Company written notice that it wishes to do so (Transfer Notice). 7.7 The Transfer Notice must state: (7.i) the total number of Shares for sale by the Selling Shareholder (Sale Shares); (7.ii) the price per Sale Share; (7.iii) whether the sale is conditional or not and, if conditional, the conditions; (7.iv) the period during which the invitation to the other Shareholders (Remaining Shareholders) to make an offer to purchase the Sale Shares is open (Offer Period), which (unless otherwise agreed by all Shareholders) must not be less than 20 Business Days; and (7.v) if applicable, the name of any proposed buyer of the Sale Shares and a statement that the proposed sale to the buyer is on an arm's length basis. 7.8 A Transfer Notice: CRM\CRM\47680503\1 7 (8.i) is an offer to the Remaining Shareholders to agree to buy the Sale Shares on the terms of the Transfer Notice; (8.ii) is irrevocable (unless otherwise agreed by all Shareholders); and (8.iii) constitutes the appointment of the Board as the agent of the Selling Shareholder for the transfer of the Sale Shares in accordance with this agreement. 7.9 When the Company receives a Transfer Notice, the Board must promptly give written notice (Board Offer Notice) to all other Shareholders offering the Sale Shares as follows: (9.i) if the Sale Shares comprise all the Shares in a Class, they must be offered to the holders of the Shares in all other Classes in proportion to their existing holdings in the other Class or Classes and in accordance with this clause 7; (9.ii) if the Sale Shares are only part of the Shares in a Class of Shares, they will first be offered to the holders of the remaining Shares in that Class in proportion to their existing holding in that Class. If any of the Sale Shares remain unallocated, they will be offered to the holders of Shares in all other Classes, in each case, in proportion to their existing holdings in the other Class or Classes and in accordance with this clause 7. 7.10 Any Board Offer Notice must include a copy of the Transfer Notice and must contain the following additional information: (10.i) the number of Sale Shares that the Shareholder is entitled to purchase; (10.ii) the date by which the Company requires a response, after which time the Board Offer Notice is automatically revoked; and (10.iii) if the Shareholder wishes to purchase Shares in excess of the Shareholder's entitlement, the Shareholder must, when accepting the offer, state the number of excess Shares that the Shareholder wishes to purchase. 7.11 The Remaining Shareholder may, during the Offer Period, accept the offer for it to buy some or all of the Sale Shares on the terms of the Board Offer Notice by giving to the Company, at its registered office, an acceptance notice (Acceptance Notice). 7.12 An Acceptance Notice given by the Remaining Shareholder constitutes an acceptance by the Remaining Shareholder of the offer by the Selling Shareholder to buy Sale Shares as set out in the Acceptance Notice. 7.13 The Board must allocate the Sale Shares in accordance with the principles set out in clause The Transfer Notice must state:. 7.14 If all the Remaining Shareholders do not claim their full entitlements, the unclaimed Sale Shares must first be used to satisfy any requests for excess Shares made by the accepting Remaining Shareholders in that Class. 7.15 If there are insufficient unclaimed Sale Shares to satisfy such requests, the unclaimed Sale Shares must be allocated to the accepting Remaining Shareholders in the Class who requested excess Shares in proportion to their existing holdings in the Class. However, no accepting Remaining Shareholder may be allocated more excess Shares than the number requested by that accepting Remaining Shareholder. 7.16 If any Sale Shares remain unallocated after this process, the remaining unclaimed Sale Shares must then be used to satisfy requests for excess Shares made by accepting Remaining Shareholders in the other Class or Classes. If there are insufficient

CRM\CRM\47680503\1 8 remaining Sale Shares to satisfy such requests, the unclaimed Shares must be allocated to the accepting Remaining Shareholders in the other Class or Classes in proportion to their existing holdings in the other Class or Classes. However, no accepting Remaining Shareholder may be allocated more excess Shares than the number requested by that accepting Remaining Shareholder. 7.17 The Shareholders and the Company must ensure that completion of the transfers of the Sale Shares takes place within 20 Business Days of the date of the Acceptance Notice. 7.18 On completion: (18.i) the Remaining Shareholders must buy their accepted Sale Shares and pay the price for those accepted Sale Shares in immediately available funds to the Selling Shareholder; (18.ii) the Selling Shareholder must transfer to the Remaining Shareholders their accepted Sale Shares free from any Encumbrances and with all rights, including dividend rights, attached or accruing to those Sale Shares as at the date of the Acceptance Notice, and deliver to the Remaining Shareholders executed transfers for their respective accepted Sale Shares; and (18.iii) the Company must register the Remaining Shareholder as the holder of its accepted Sale Shares. 7.19 If: (19.i) the Transfer Notice contains a condition that, unless all Sale Shares are sold, none of the Sale Shares will be sold (Condition); and (19.ii) the Condition is not satisfied, then the Company must inform the Selling Shareholder of this within 2 Business Days of the end of the Offer Period and the Selling Shareholder is not obliged to transfer any Sale Shares to the Remaining Shareholders. The Selling Shareholder may waive the Condition, provided the waiver is:

(19.iii) for the benefit of the Remaining Shareholders; and (19.iv) given to the Company. 7.20 If: (20.i) the Transfer Notice contains the Condition; and (20.ii) the Condition is not satisfied, then the Selling Shareholder may within 120 Business Days of the date of the Transfer Notice sell some or all of the Sale Shares (or of the remaining Sale Shares, if the Condition has been waived) to any person at a price not less than and on terms no more favourable to that person than the price or terms contained in the Transfer Notice.

7.21 If the Transfer Notice does not contain the Condition and the Remaining Shareholders have accepted less than all of the Sale Shares then the Selling Shareholder may within 120 Business Days of the date of the Transfer Notice sell some or all of the balance of the Sale Shares to any person at a price not less than and on terms no more favourable to that person than the price or terms contained in the Transfer Notice. 7.22 For the purpose of this clause Restrictions on transfer of Shares: (22.i) an Investor Affiliate may acquire an Investor’s Respective Proportion; and / or

CRM\CRM\47680503\1 9 (22.ii) an Investor Affiliate may acquire, in addition to the Respective Proportion of the related Investor, the Respective Proportion entitlement of the other Investor (for the avoidance of doubt, the total number of Sale Shares that may be acquired for under this clause 7.22 is equal to the Respective Proportion of each Investor). Blackbird or any on Investor Affiliate of it may acquire the Respective Proportion entitlement of Startmate. Tag Along Option

7.23 Each Shareholder may within 10 Business Days after receiving a Transfer Notice give notice (Tag Along Notice) to the Selling Shareholder of its wish to sell such number of Shares (of the same Class as the Sale Shares) as represents a percentage of the Shareholder’s total holding of Shares up to a percentage equal to the percentage that the Sale Shares offered for sale pursuant to the Transfer Notice represent of the Selling Shareholder's total holding of Shares, on the terms contained in the Transfer Notice (calculated in each case as at the date on which the Transfer Notice was served and on the basis and assumption that all Shares have been converted into Ordinary Shares in accordance with the terms of issue of those Shares). Restriction

7.24 If a Shareholder gives a Tag Along Notice to the Selling Shareholder, the Selling Shareholder must not sell any of the Sale Shares, unless contemporaneously with the sale of the Sale Shares or, all Shares specified in the Tag Along Notice (Tag Along Shares) are also sold at the specified price per Share and on the same terms and conditions as the Sale Shares are sold. Completion

7.25 At completion of the sale of any Shares under this clause Restrictions on transfer of Shares: (25.i) each buyer must pay the purchase price to each Selling Shareholder for the Shares that it has agreed to purchase from that Selling Shareholder; and (25.ii) each Selling Shareholder must transfer title to the Shares it is selling to the buyer free from all Encumbrances. No revocation

7.26 A Transfer Notice once given cannot be revoked or withdrawn unless a majority of Shareholders consent to the revocation or withdrawal in writing. Attorney

7.27 Each Shareholder hereby severally and irrevocably appoints the Company as its agent and attorney with power to complete a sale as contemplated in this clause Restrictions on transfer of Shares, (including the power to execute all necessary documentation to complete the sale on behalf of the Shareholder (as the case may be)). If the Company executes a document on behalf of a Shareholder under this clause Restrictions on transfer of Shares, the Company must provide a copy of that document to that Shareholder. Permitted Transfers

7.28 The provisions of this clause Restrictions on transfer of Shares do not apply to a transfer by a Shareholder that is approved in writing by the Shareholders.

CRM\CRM\47680503\1 10 8 Drag Along Drag Along Notice

8.1 Subject to clause [Alt 1] Each Investor must be a Dragging Shareholder. [Alt 2] If the Third Party Offer is received prior to the [insert] anniversary of the date on which the Investor Shares are issued to the Investors, an Investor may only be a issued with a Drag Along Notice if that Investor will receive cash consideration of an aggregate value of at least [insert] times the amount paid by the Investor for their Investor Shares. [end Alt 2], if the Company or any Shareholder receives a bona fide offer from a third party to purchase all of the Securities in the Company for a cash amount (Third Party Offer) and the holders of [insert]% or more of the issued Shares (calculated on the basis and assumption that all Securities as at the date of the Third Party Offer have been converted into Ordinary Shares) accept the Third Party Offer (Dragging Shareholders), any Dragging Shareholder is entitled to issue to some or all of the remaining Shareholders (Other Shareholders) a notice (Drag Along Notice) requiring each Other Shareholder to sell to the Third Party specified in the Drag Along Notice some or all of the Other Shareholders’ Securities upon the terms and conditions specified in the Drag Along Notice. 8.2 Despite any other provision of this agreement: (2.i) the Dragging Shareholders are not required to comply with the pre-emption procedure set out in clauses If this clause 7 applies, where a Shareholder (Selling Shareholder) seeks to Dispose of some or all of its Shares, it must first give to the Company written notice that it wishes to do so (Transfer Notice). to For the purpose of this clause Restrictions on transfer of Shares: prior to accepting a Third Party Offer or issuing the Other Shareholders a Drag Along Notice; and (2.ii) the pre-emption procedure set out in clauses If this clause 7 applies, where a Shareholder (Selling Shareholder) seeks to Dispose of some or all of its Shares, it must first give to the Company written notice that it wishes to do so (Transfer Notice). to For the purpose of this clause Restrictions on transfer of Shares: does not apply to the relevant Securities once a Drag Along Notice has been issued. Investor Drag Along

8.3 [Alt 1] Each Investor must be a Dragging Shareholder. [Alt 2] If the Third Party Offer is received prior to the [insert] anniversary of the date on which the Investor Shares are issued to the Investors, an Investor may only be a issued with a Drag Along Notice if that Investor will receive cash consideration of an aggregate value of at least [insert] times the amount paid by the Investor for their Investor Shares. [end Alt 2] Terms of Offer

8.4 The terms upon which the Dragging Shareholders require the Other Shareholders to sell their Securities must be no less favourable to the Other Shareholders than the terms on which the Dragging Shareholders are selling their Securities. 8.5 The Drag Along Notice must specify: (5.i) the details of the third party who provides the Third Party Offer; (5.ii) the consideration payable for each Security (which must be a cash amount); and

CRM\CRM\47680503\1 11 (5.iii) any other key terms and conditions upon which the Other Shareholders Securities will be purchased pursuant to the Drag Along Notice provided that the Other Shareholders cannot be required to give to the Dragging Shareholders or the Third Party any representations, warranties and/or indemnities relating to the Company or its business, except for title warranties in respect of its Securities. 8.6 Subject to clause The Other Shareholders are not obliged to sell their Securities in accordance with clause Subject to clause 8.7, each Other Shareholder must, within 10 Business Days of service of the Drag Along Notice, sell all of their Securities to the third party specified in the Drag Along Notice in accordance with the key terms and conditions of the Drag Along Notice., each Other Shareholder must, within 10 Business Days of service of the Drag Along Notice, sell all of their Securities to the third party specified in the Drag Along Notice in accordance with the key terms and conditions of the Drag Along Notice. 8.7 The Other Shareholders are not obliged to sell their Securities in accordance with clause Subject to clause The Other Shareholders are not obliged to sell their Securities in accordance with clause 8.6, each Other Shareholder must, within 10 Business Days of service of the Drag Along Notice, sell all of their Securities to the third party specified in the Drag Along Notice in accordance with the key terms and conditions of the Drag Along Notice. if the Dragging Shareholders do not complete the sale of all their Securities to the third party on the same terms and conditions as set out in the Drag Along Notice.

9 Deed of Accession

9.1 The Company must not allot or issue or register a transfer of any Shares to any person who is not a party to this agreement until that person has executed and delivered to the Company a Deed of Accession. 9.2 Any allotment, issue or transfer is void and of no effect unless and until the relevant Deed of Accession has been delivered.

10 Non-competition Enforceability and severance

10.1 This clause has effect as if it were separate and independent clauses, each one being severable from the others and consisting of the covenants set out in clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: combined with each separate period referred to in clause The undertakings in clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: begin on the date of this Agreement and end:, and each combination combined with each separate area referred to in clause The undertakings in clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: apply if the activity prohibited by clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: occurs in:. 10.2 If any of these separate clauses are void, invalid or unenforceable for any reason, it will be deemed to be severed to the extent that it is void or to the extent of voidability, invalidity or unenforceability and will not affect the validity or enforceability of any other

CRM\CRM\47680503\1 12 separate clause or other combinations of the separate provisions of clauses Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not:, The undertakings in clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: begin on the date of this Agreement and end: and The undertakings in clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: apply if the activity prohibited by clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: occurs in:. Prohibited activities

10.3 Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: (3.i) supply, canvass or solicit orders for Restricted Goods or Restricted Services from any person who, at any time in the last 12 months in which the Restrained Shareholder held Shares, transacted business with the Company or who was identified as a prospective customer or client of the Company with a view to obtaining their custom; (3.ii) use or register a name or trade mark which includes substantially all of any business name, trade mark or the name of the Company or any confusingly similar word or words in a way capable of or likely to be confused with a business name, trade mark or name of the Company; (3.iii) hinder, object to, resist or interfere in any way with the Company registering or using its intellectual property by using any name which is similar to intellectual property currently used or registered by the Company; (3.iv) solicit or persuade any person who is a customer, supplier, manufacturer or client of the Company, to cease doing business with the Company or to reduce the amount of business that the customer, supplier, manufacturer or client would normally do with the Company; (3.v) engage In a business or activity that is the same or similar to the Business or any material part of the Company’s business; (3.vi) employ, solicit or entice away from the Company an officer, manager, consultant or employee of the Company or a person who was an officer, manager, consultant or employee of the Company in the 12 months before the Restrained Shareholder ceased to hold Shares; or (3.vii) attempt, counsel, procure or otherwise assist a person to do any of the acts referred to in this clause. Duration of prohibition

10.4 The undertakings in clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: begin on the date of this Agreement and end: (4.i) 2 years after the date on which the Restrained Shareholder ceased to hold Shares; (4.ii) 1 year after the date on which the Restrained Shareholder ceased to hold Shares; and

CRM\CRM\47680503\1 13 (4.iii) 6 months after the date on which the Restrained Shareholder ceased to hold Shares. Geographic application of prohibition

10.5 The undertakings in clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: apply if the activity prohibited by clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: occurs in: (5.i) Australia, or if that area is unenforceable; then (5.ii) New South Wales, Victoria, South Australia and Queensland, or if that area is unenforceable; then (5.iii) New South Wales and Victoria, or if that area is unenforceable; then (5.iv) New South Wales, during the periods set out in clause The undertakings in clause Each member of the Founder Group (Restrained Shareholders) undertakes to the Company and all other Shareholder that it will not: begin on the date of this Agreement and end:. 10.6 Nothing in this clause prevents a Restrained Shareholder from: (6.i) performing any employment or consulting agreement with the Company; (6.ii) directly or indirectly holding Shares in the Company; or (6.iii) holding in aggregate less than 5% of the issued shares of a body corporate listed on a recognised stock exchange. Restraints are reasonable

10.7 The Restrained Shareholders acknowledge that the covenants given in this clause are: (7.i) material to the Company’s decision and each Shareholders’ decisions to enter into this agreement; (7.ii) fair and reasonable as to period, territorial limitation and subject matter recognising the markets in which the business of the Company operates and the geographic spread of the Company’s customer base; and (7.iii) necessary for the maintenance and protection of the goodwill of the business, financial and proprietary interests of the Company and the business of the Company and the value of the Shareholders’ Shares. Legal advice

10.8 Each Restrained Shareholder acknowledges that in relation to this agreement and in particular this clause, the Restrained Shareholder has received independent legal advice or has had the opportunity to obtain independent legal advice. Injunction

10.9 Each Restrained Shareholder acknowledges and agrees that monetary damages alone are not an adequate remedy if the Restrained Shareholder breaches this clause and that any other party to this agreement is entitled to seek injunctive relief from a court of competent jurisdiction if: (9.i) a Restrained Shareholder fails to comply with any obligation under this clause or threatens to do so; or CRM\CRM\47680503\1 14 (9.ii) it is reasonable to suspect that a Restrained Shareholder will not comply with any obligation under this clause.

11 Confidential Information Confidentiality

11.1 Each party must keep confidential the terms of this agreement, the contents of all negotiations leading to its preparation and any other information relating to the Company or to another Shareholder that it obtains as a result of this agreement or anything done under it (Confidential Information), and must not disclose or permit the disclosure of such Confidential Information to any other person. If a party becomes aware of a breach of this obligation, that party will immediately notify the other parties. Further permitted use and disclosure

11.2 This agreement does not prohibit the disclosure of Confidential Information by a party in the following circumstances: (2.i) the other parties have consented to the disclosure of the relevant Confidential Information; (2.ii) the disclosure is to a professional adviser in order for it to provide advice in relation to matters arising under or in connection with this agreement and the party disclosing the Confidential Information ensures that the professional adviser complies with the terms of this clause; or (2.iii) the disclosure is required by applicable law or regulation. Obligations to continue after agreement ends

11.3 All obligations of confidence set out in this agreement continue in full force and effect after this agreement ends.

12 Notices Giving notices

12.1 Any notice or communication given to a party under this agreement is only given if it is in writing and in English and sent in one of the following ways: (1.i) delivered to the street address of the addressee; (1.ii) sent by prepaid ordinary post (airmail if outside Australia) to the street address of the addressee; or (1.iii) sent by email to the email address of the addressee, in each case marked for the attention of the relevant department or officer (if any) set out below, or in the case of the Shareholders or Investors, as set out in Schedule 1. Company

Name: [insert name] ACN [insert ACN] Address [insert] :

CRM\CRM\47680503\1 15 Email [insert] address : Attentio [insert name] n:

Change of address or email address

12.2 If a party gives the other party three Business Days' notice of a change of its address or email address, any notice or communication is only given by that other party if it is delivered, posted or emailed to the latest address or email address. Time notice is given

12.3 Any notice or communication is to be treated as given at the following time: (3.i) if it is delivered, when it is left at the relevant address; (3.ii) if it is sent by post, two (or, in the case of a notice or communication posted to another country, nine) Business Days after it is posted; or (3.iii) if it is sent by email, on the day and at the time that the recipient confirms the email is received. 12.4 However, if any notice or communication is given on a day that is not a Business Day or after 5pm on a Business Day, it is to be treated as having been delivered at the beginning of the next Business Day.

13 Miscellaneous Approvals and consents

13.1 Unless this agreement expressly provides otherwise, a party may give or withhold an approval or consent in that party's absolute discretion and subject to any conditions determined by the party. A party is not obliged to give its reasons for giving or withholding a consent or approval or for giving a consent or approval subject to conditions. Assignments and transfers

13.2 A party must not assign or transfer any of its rights or obligations under this agreement without the prior written consent of each of the other parties. Costs

13.3 Except as otherwise set out in this agreement, each party must pay its own costs and expenses in relation to preparing, negotiating, executing and completing this agreement and any document related to this agreement. Entire agreement

13.4 This agreement contains everything the parties have agreed in relation to the subject matter it deals with. No party can rely on an earlier written document or anything said or done by or on behalf of another party before this agreement was executed.

CRM\CRM\47680503\1 16 Execution of separate documents

13.5 This agreement is properly executed if each party executes either this document or an identical document. In the latter case, this agreement takes effect when the separately executed documents are exchanged between the parties. Further acts

13.6 Each party must at its own expense promptly execute all documents and do or use reasonable endeavours to cause a third party to do all things that another party from time to time may reasonably request in order to give effect to, perfect or complete this agreement and all transactions incidental to it (including, without limitation, voting in favour of any resolution to approve a buy-back of Ordinary Shares under clause 5). Governing law and jurisdiction

13.7 This agreement is governed by the law of New South Wales, Australia. The parties submit to the non-exclusive jurisdiction of its courts and courts of appeal from them. The parties will not object to the exercise of jurisdiction by those courts on any basis. Inconsistency with Constitution

13.8 If there is any inconsistency between this agreement and the Constitution then the parties agree to abide by this agreement and to do everything required to change the Constitution so that it is consistent with this agreement. No partnership or agency

13.9 Nothing contained or implied in this agreement will create or constitute, or be deemed to create or constitute, a partnership between the parties. A party must not act, represent or hold itself out as having authority to act as the agent of or in any way bind or commit the other parties to any obligation. Variation

13.10 No variation of this agreement will be of any force or effect unless it is in writing and signed by the parties to this agreement. Waivers

13.11 A waiver of any right, power or remedy under this agreement must be in writing signed by the party granting it. A waiver is only effective in relation to the particular obligation or breach in respect of which it is given. It is not to be taken as an implied waiver of any other obligation or breach or as an implied waiver of that obligation or breach in relation to any other occasion. 13.12 The fact that a party fails to do, or delays in doing, something the party is entitled to do under this agreement does not amount to a waiver.

14 Definitions and interpretation Definitions

14.1 In this agreement the following definitions apply: Accelerated Vesting Event means a Sale Event. Affiliate means any fund or vehicle managed or advised by a party to this agreement or any Related Body Corporate of that party.

CRM\CRM\47680503\1 17 ASX means ASX Limited (ACN 008 624 691) or the market it operates (as the context requires). Bad Leaver is a person who is not a Good Leaver. Board means the board of directors for the time being of the Company.

Auditor means: a) a person registered as an auditor under a law in force in a State or a Territory; or b) if the Company is no longer an Australian resident—a person registered as an auditor under a law in force in the country of which the company is a resident. who is appointed to act as the Company’s auditor pursuant to clause Before the end of the Financial Year in which this Agreement is executed and at all times thereafter, the Company must have an Auditor appointed. Business Day means a day on which banks are open for general banking business in Sydney, NSW, excluding Saturdays and Sundays. Business Sale means the completion of a sale or series of sales by the Company (or any Subsidiary) of all or substantially all of the business and assets of the Company and its Subsidiaries to one or more third parties. Class means a class of Shares having attached to them identical rights, privileges, limitations and conditions. Confidential Information has the meaning set out in clause Each party must keep confidential the terms of this agreement, the contents of all negotiations leading to its preparation and any other information relating to the Company or to another Shareholder that it obtains as a result of this agreement or anything done under it (Confidential Information), and must not disclose or permit the disclosure of such Confidential Information to any other person. If a party becomes aware of a breach of this obligation, that party will immediately notify the other parties.. Constitution means the constitution of the Company. Corporations Act means the Corporations Act 2001 (Cth). Deed of Accession means a deed of accession in the agreed form pursuant to which a person who acquires Shares agrees to be bound by the terms of this agreement. Directors means the directors for the time being of the Company. Dispose means any dealing with a Share or with any interest in or rights attaching to a Share including rights to grant options or rights of pre-emption over, sell, transfer, assign, part with the benefit of, declare a trust over, or deal with an ownership interest in a Share.

Employee Options means Ordinary Shares or options to acquire Ordinary Shares granted or issued after the date of this agreement to employees, officers, directors, contractors, consultants or advisers to the Company or any Subsidiary of the Company pursuant to incentive agreements, share purchase or share option plans, or similar arrangements that are approved by the Board, the number of which Ordinary Shares or options to acquire Ordinary Shares shall not exceed the Employee Option Maximum.

Employee Option Maximum means the number which is equal to [fifteen] per cent of the issued Shares in the Company.

CRM\CRM\47680503\1 18 Encumbrance means any mortgage, lien, charge, pledge, assignment by way of security, security interest, title retention, preferential right or trust arrangement, claim, covenant, easement or any other security arrangement or any other arrangement having the same effect.

Founder Group means, in relation to a Founder, the Founder and its Nominee. Financial Year means the period of 12 months ending on 30 June in each year. Good Leaver means any Founder who ceases to be engaged by the Company, whether as an employee or contractor, for any of the following reasons:

14.2 death; 14.3 compulsory retirement; 14.4 becoming permanently incapable of discharging efficiently the duties of his engagement or any other comparable engagement with the Company or a Subsidiary by reason of ill health or infirmity of mind or body, injury or disability (evidenced to the satisfaction of the Board); 14.5 Redundancy; or 14.6 dismissal in circumstances which have resulted in a claim against the Company for unfair dismissal where the claim is successful on the grounds that the dismissal was unfair pursuant to Chapter 3, Part 3-2, Divisions 2 and 3 of the Fair Work Act 2009 (Cth). Investor means each of Startmate and Blackbird or any other person designated as an investor at the date on which they subscribe for Shares (in accordance with the procedure set out in clause Issues of New Securities). Investor Affiliate means, in relation to an Investor, any fund or vehicle managed or advised by that Investor or any Related Body Corporate of that Investor. Investor Share means an "A" Preference Share in the Company. IPO means the admission of all or any of the Company's Shares (or any holding company's shares) to trading on ASX, NASDAQ or any other major exchange. Major Investor means a holder of Investor Shares who has paid at least $[15,000] as the total issue price for all of their Shares. New Securities means any securities (including convertible securities) in the Company unissued at the date of this agreement but excluding: (1.1.a.a) Securities issued as part of an IPO; (1.1.a.b) Shares issued or issuable upon conversion of Investor Shares to Ordinary Shares; (1.1.a.c) Shares issuable upon exercise of any options or rights to purchase any Securities outstanding as of the date of this agreement and any Securities issuable upon the conversion thereof (including, for the avoidance of doubt, any Employee Options up to the Employee Option Maximum); or (1.1.a.d) Shares issued pursuant to a share split. Nominee means, in relation to a Shareholder, such person or entity nominated by that Shareholder to hold Shares on their behalf and, as at the date of this agreement, in

CRM\CRM\47680503\1 19 relation to each Founder, means the entity listed opposite the respective Founder’s name in column 1 of the table in Schedule 1. Ordinary Share means an ordinary share in the Company. Redundancy means in respect of a Founder the termination of the Founder’s employment with the Company or any Subsidiary by reason of a restructure or a state of affairs within the Company or the Subsidiary whereby the position previously occupied by that person no longer exists within the Company or the Subsidiary and where the Board in its absolute discretion determines that such an event qualifies as a redundancy for the purposes of determining whether a Founder is a Good Leaver. Related Body Corporate has the meaning given to that term in the Corporations Act. Respective Proportion means the number of Shares held by a Shareholder divided by the total number of Shares in the Company.

Restricted Goods means any goods that compete or may compete with any goods developed, manufactured or supplied by the Company. Restricted Services means any services that compete or may compete with any services provided or supplied by the Company Sale Event means a Share Sale, a Business Sale or an IPO. Sale Shares has the meaning given to that term in clause The Transfer Notice must state:. Security means a security of the Company and includes the Shares, options, any convertible notes, warrants or other securities capable of conversion into Shares. Selling Shareholder has the meaning given to that term in clause If this clause 7 applies, where a Shareholder (Selling Shareholder) seeks to Dispose of some or all of its Shares, it must first give to the Company written notice that it wishes to do so (Transfer Notice).. Shareholders means the shareholders in the Company and includes any person who subsequently becomes a shareholder and who adheres to this agreement. Shares means shares in the Company, including the Ordinary Shares and the Investor Shares. Share Sale means an acquisition of Shares by way of transfer which results in one or more third parties holding Shares having a right to exercise more than 50% of the votes which may be cast on a poll at a general meeting of the Company on all, or substantially all, matters. Subsidiary has the meaning given to that term in the Corporations Act but also includes an entity that would be considered a subsidiary under generally accepted accounting principles. Unvested Shares has the meaning set out in clause 5.3. Wholly-owned Group means a person's ultimate holding company and each wholly- owned Subsidiary of that person's ultimate holding company. Interpretation

14.7 In the interpretation of this agreement, the following provisions apply unless the context otherwise requires:

CRM\CRM\47680503\1 20 (7.i) Headings are inserted for convenience only and do not affect the interpretation of this agreement. (7.ii) A reference in this agreement to a Business Day means a day other than a Saturday or Sunday on which banks are open for business generally in Sydney. (7.iii) If the day on which any act, matter or thing is to be done under this agreement is not a Business Day, the act, matter or thing must be done on the next Business Day. (7.iv) A reference in this agreement to dollars or $ means Australian dollars and all amounts payable under this agreement are payable in Australian dollars. (7.v) A reference in this agreement to any law, legislation or legislative provision includes any statutory modification, amendment or re-enactment, and any subordinate legislation or regulations issued under that legislation or legislative provision. (7.vi) A reference in this agreement to any agreement or document is to that agreement or document as amended, novated, supplemented or replaced. (7.vii) A reference to a clause, part, schedule or attachment is a reference to a clause, part, schedule or attachment of or to this agreement. (7.viii) An expression importing a natural person includes any company, trust, partnership, joint venture, association, body corporate or governmental agency. (7.ix) Where a word or phrase is given a defined meaning, another part of speech or other grammatical form in respect of that word or phrase has a corresponding meaning. (7.x) A word which denotes the singular denotes the plural, a word which denotes the plural denotes the singular, and a reference to any gender denotes the other genders. (7.xi) References to the word 'include' or 'including' are to be construed without limitation. (7.xii) Any schedules and attachments form part of this agreement. (7.xiii) Neither this agreement nor any part of it is to be construed against a party on the basis that the party or its lawyers were responsible for its drafting.

CRM\CRM\47680503\1 21 Schedule 1 Parties

Column 1 Column 2 Column 3 Column 4 Column 5 Column 7

Name of Founder Contact Details Class of Number of Shareholding Shareholder Share Shares Percentage

Startmate Pty Ltd N/A 240 Riley Street, “A” [insert] [ ]% ACN 146 852 511 Surry Hills NSW Preference as trustee for the 2010 Shares Startmate Exploration Holdings Fund (Startmate) Blackbird N/A 240 Riley Street, “A” [insert] [ ]% Ventures 2015, Surry Hills NSW Preference LP, a NSW limited 2010 Shares partnership Registration Number ILP0000141 (Blackbird) [insert] [insert] [insert] [insert] [insert] [insert]

CRM\CRM\47680503\1 22 Execution and date Executed as an agreement. Date:

Executed by [Company] ACN [insert] in accordance with s127 of the Corporations Act 2001:

......

Signature of director Signature of director/company secretary

......

Name of director (print) Name of director/company secretary (print)

Executed by Startmate Pty Ltd ACN 146 852 511 as trustee for the Startmate Exploration Holdings Fund in accordance with s127 of the Corporations Act 2001:

......

Signature of director Signature of director/company secretary

......

Name of director (print) Name of director/company secretary (print)

CRM\CRM\47680503\1 23 Executed by Blackbird Ventures 2015, LP, a NSW limited partnership Registration Number ILP0000141 in accordance with s127 of the Corporations Act 2001:

......

Signature of director Signature of director/company secretary

......

Name of director (print) Name of director/company secretary (print)

Executed by [insert] ACN [insert] in accordance with s127 of the Corporations Act 2001:

......

Signature of director Signature of director/company secretary

......

Name of director (print) Name of director/company secretary (print)

CRM\CRM\47680503\1 24