1989 (Paper 1)

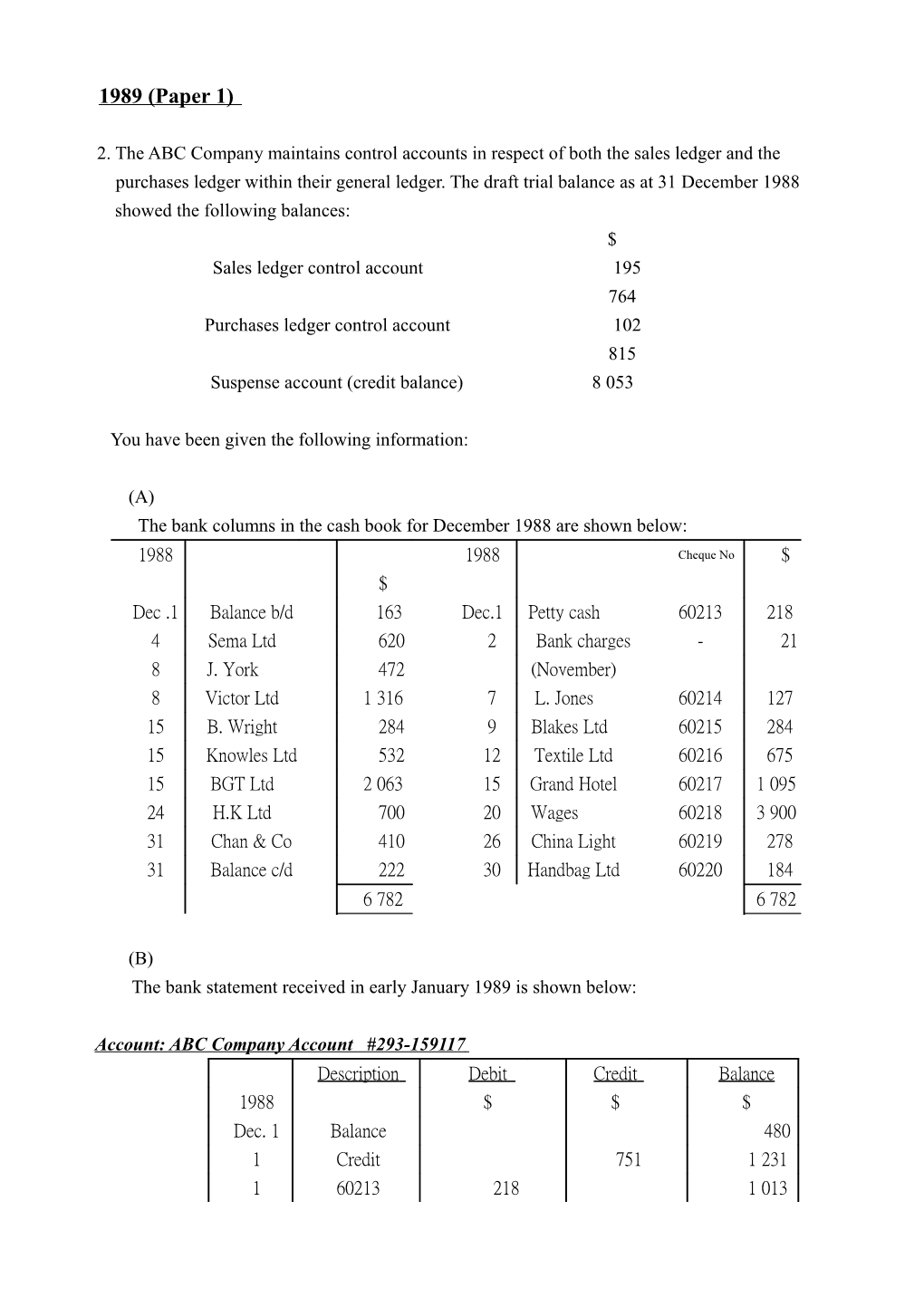

2. The ABC Company maintains control accounts in respect of both the sales ledger and the purchases ledger within their general ledger. The draft trial balance as at 31 December 1988 showed the following balances: $ Sales ledger control account 195 764 Purchases ledger control account 102 815 Suspense account (credit balance) 8 053

You have been given the following information:

(A) The bank columns in the cash book for December 1988 are shown below: 1988 1988 Cheque No $ $ Dec .1 Balance b/d 163 Dec.1 Petty cash 60213 218 4 Sema Ltd 620 2 Bank charges - 21 8 J. York 472 (November) 8 Victor Ltd 1 316 7 L. Jones 60214 127 15 B. Wright 284 9 Blakes Ltd 60215 284 15 Knowles Ltd 532 12 Textile Ltd 60216 675 15 BGT Ltd 2 063 15 Grand Hotel 60217 1 095 24 H.K Ltd 700 20 Wages 60218 3 900 31 Chan & Co 410 26 China Light 60219 278 31 Balance c/d 222 30 Handbag Ltd 60220 184 6 782 6 782

(B) The bank statement received in early January 1989 is shown below:

Account: ABC Company Account #293-159117 Description Debit Credit Balance 1988 $ $ $ Dec. 1 Balance 480 1 Credit 751 1 231 1 60213 218 1 013 2 60211 269 744 4 60212 472 272 4 Credit 620 892 8 Credit 1 788 2 680 9 60208 348 2 332 9 Interest 30 2 302 15 Credit 2 879 5 181 16 60217 1 095 4 086 20 60218 3 900 186 21 14873 10 460 10 274 O/D 21 60214 217 10 491 O/D 21 Adjustment 10 460 31 O/D 24 Credit 670 639 28 Charges 50 589 31 Standing order 540 49

(C) Additional information (i) Totals extracted from the sales ledger and the purchases ledger were $194 260 and $109 600 respectively. (ii) The bank overdraft of $222 has been included in the trial balance as a debit balance. (iii) On 24 December 1988, H.K .Ltd paid its account of $700 by cheque and a discount of $30 was allowed. The gross amount was wrongly recorded in the cash bank. (iv) Cheque No. 60214 paid to L. Jones for goods supplied was wrongly recorded in the cash book as $127 instead of $217. (v) A credit entry of $200 was made in R. Smith’s account in the sales ledger. However it was found that no such cheque had been received. (vi) The standing order of $540 in respect of the hire purchase of a copying machine included interest charges of $40. The hire purchase creditor in the purchases ledger was recorded at the cash price of the copying machine. (vii) A debt balance o 4240 in the sales ledger has been extracted as a credit balance. (viii) The sales ledger included a debt balance of $1200 for Wong & Co, and the purchases ledger included a balance of $900 standing to the credit of Wong & Co’s account. Only the net amount will be eventually paid or received. (ix) A balance of $824 owed by Brown has been written off in bad debts as irrecoverable but no entry has been made in the control account. (x) An invoice for $648 has been entered in the purchase day book as $846. (xi) The total of $6785 in the purchases day book for December 1988 has been omitted from the control, although posted correctly in the purchases account. You are required to: (a) prepare the journal entries to rectify any errors and, if no journal entry is necessary, state how the errors should be a rectified. (15 marks) (b) prepare a bank reconciliation statement as at 31 December 1988, showing the adjusted cash book balance; and (8 marks) (c) prepare the statements showing the corrections to be made in the balances extracted from the sales ledger and the purchases ledger. (7 marks)

3. Chan, Lee and Wong have been in partnership sharing profits and losses in the ratio of 5:3:2 after allowing salaries of $20 000 to Chan and $16 000 to Lee. On 30 September 1988, Wong retired from the partnership. Chan and Lee decided to carry on the business sharing profits and losses equally. No salaries were to be paid to the partner in the new partnership On the retirement of Wong, the partners agreed to the following: (i) premises to be valued at $640 000 and all other assets to remain at their book values. (ii) goodwill to be valued at $12 000. No goodwill account is to remain open in the books and all necessary adjustment are to be made through the partners’ capital accounts. (iii) The amount due to Wong to be left on a loan account, and credited with interest at 6% per annum. The partner continued to use the books of the business and no entries have been made in respect of the retirement of Wong. The trial balance of the partnership at 31 December 1988 was as follow: Dr. Cr. $ $ Capital accounts Chan 210 000 Lee 240 000 Wong 160 000 Current account Chan 10 000 Lee 22 000 Wong 6 000 Premises, cost 500 000 Motor vehicles, net book value 125 000 Stock 60 000 Debtors 40 000 Cash 13 000 Creditors 30 000 Net profit for the year before partners salaries and interest 60 000 738 000 738 000 On 1 January 1989, Chan and Lee agreed to form a limited company – CL Ltd to take over all the assets and liabilities of the partnership, excluding cash balance, on the following terms. (i) The company to issue 600 000 ordinary shares of $1.00 each to the partners at as a premium of $0.20. (ii) The company to issue 8% debentures at par to Wong in settlement of the amount due from the partnership.

Chan and Lee agreed to allot the shares in CL Ltd equally. For the purpose of the take over, the company revalued premises at $700 000 and motor vehicles at $100 000. At the same time the company issued 100 000 ordinary shares of $1.00 each to an outsider at a premium of $0.20

You are required to prepare: (a) the appropriation account of the partnership for the year ended 31 December 1988, assuming revenues and expenses accrued evenly over the year; (6 marks) (b) the partners’ capital accounts and current accounts; (9 marks) (c) the partnership realization account; (5 marks) (d) the opening entries for CL Ltd; and (6 marks) (e) the opening balance sheet of CL Ltd as at 1 January 1989 (4 marks)

4. The sunshine Club prepares its accounts to 31 December annually. On the evening of 31 December 1988, the treasurer disappeared and was suspected of misappropriation of cash. An examination of the records showed that the books had not been written up of for a considerable time. From an analysis of the bank statements, the following for the year ended 31 December 1988 was obtained: $ Subscriptions received for 1987 420 For 1988 16 200 For 1989 640 Interest received 340 Bar wages 14 000 Secretary’s honorarium 4 800 Repairs to equipment 510 General expenses 2 500 Premium paid for the lease of the club premises for 2 years commencing from 1.1. 1988 20 000 Purchases of equipment 5 000 The following balances at 31 December 1988 were ascertained: $ Bar creditors 14 900 Bar stock 3 600 Cash and bank balances 580 Members’ subscriptions due 320 General expenses owing 450 Bar sales were always made on a cash basis. The barman had handed over the takings daily to the treasurer. It was found, however, that on one occasion the barman had extracted credit to a member for $150. This amount was still outstanding at the end of 1988. The bar maintained a strict control on prices to ensure a mark up of 50%. Bar purchases were on a credit basis and totaled $47 800 for the year 1988.

The balance sheet as at 31 December 1987 included the following balances: $ Cash and bank balances 6 140 Bar creditors 13 200 Bar stock 3 800 Members’ subscription in advance 360 Members’ subscription due 420 Fixtures & equipment, net book value 12 000

The barman is entitled to a commission of 10% on the profit made by the bar after charging such commission. Depreciation is to be provided for fixtures and equipment in existence at the year end at 20% per annum on reducing balance.

You are required to prepare: (a) the bar trading and profit and loss account for the year ended 31 December 1988; (4 marks) (b) a cash and bank summary to ascertain the extent of misappropriation; (5 marks) (c) the income and expenditure account for the year ended 31 December 1988; and (5 marks) (d) the balance sheet as at 31 December 1988. (6 marks)

6. (a) N. Ltd sells two products A and B. Stock at 1 January 1989 was as follow: A B Units 500 800 Unit cost $12 each $8 each

During January 1989, the following transactions occurred: A B Jan. 10 Purchases 800 units 600 units at $13 each at $6 each Jan. 20 Purchases 600 units 400 units at $14 each at $4 each Jan. 28 Sales 500 units 900 units at $20 each at $7 each On 31 January 1989 N. Ltd sent 100 units of product A invoiced at $21 each to an agent on consignment. Delivery and insurance expenses incurred were $140. The spent paid $60 for unloading the goods. Note of the goods had been sold out at the end of January 1989. On 31 January 1989 the replacement cost of product A dropped to $10 each. The company expected that the selling price of $20 could be maintained. However, the demand for product B dropped substantially and the remaining stock could be sold at only $5 each. You are required to compute the stock valuation at 31 January 1989 based on each of the following methods: (i) first-in, first out; (ii) last-in, first out. (8 marks)

(b) The general ledger of Ruth Ltd as at 31 December 1988 included the following balances: $ (i) Deposits with advertising agency for seasonal 12 000 promotion campaign in 1989 (ii) Discounts on issue of debentures 46 000 (iii) A franchise fee paid on signing an agreement to operate as a franchises for 4 years 150 (iv) Periodic payments to the franchisor under the 000 agreement based on 5% of the revenue from the franchise 30 000

Required: In the preparation of Ruth Ltd’s balance sheet as at 31 December 1988, which of the above should be shown as intangible assets Explain. (4 marks)

1989 (Paper 2)

2. The following are the summarized profit and loss account and balance sheets of Hop Woo Limited: Summarized Profit and Loss Accounts for the years ended 31 December 1987 1988 $ $ $ $ Sales 2 000 2 750 000 000 Less: Cost of goods sold Opening stock 275 000 325 000 Cost of production 1 250 1 750 000 000 1 525 2 075 000 000 Closing stock (325 1 200 (425 1 650 000) 000 000) 000 800 000 1 100 000

Less: Expenses (including interest charges) 650 000 905 000 Net profit 150 000 195 000 Proposed dividend - 100 000 Retained profit 150 000 95 000

Summarized Balance Sheets as at 31 December 1987 1988 $ $ $ $ $ $ Fixed Assets 845 000

Current Assets 325 425 000 Stock 000 300 400 000 Debtors 000 - 75 000 Bank 625 900 000 000

Less : Current Assets Bank overdraft 25 000 - Dividend - 100 000 payable Creditors 275 000 300 300 000 400 000 000 Net Current Assets 325 000 500 000 750 000 1 345 000 Financed by: 500 000 $1 ordinary shares (issued 1 Jan 1985) 500 000 500 000 Unappropriated 250 000 345 000 profits 750 000 845 000 Long Term Liabilities 12% debentures (issued 1 Jan 1988) - 500 000 750 000 1 345 000

You are required to: (a) calculate the following accounting ratios for 1987 and 1988:

(i) liquid ratio, (ii) average stock turnover rate, (iii) gearing, (iv) earning as a percentage capital employed, (v) ratio of sales to average capital employed; and (20 marks)

(b) Based on the ratios calculated in (a), comment on the liquidity, profitability and gearing position of the company over the two years. (10 marks)

1989 - No.4 The directors of XYZ Ltd have received the draft annual accounts for 1988, and a meeting has been called to discuss the company’s performance and results as revealed by the accounts. The following matters have been raised by various directors during the meeting. 1996 “ The exterior of the company’s premises is being repaired. The contractors started work in November 1988, and are unlikely to complete the work before the end of March 1989. The total cost will not be known until after completion, but the cost of work carried out to 31 December 1988 is estimated at $95,000” 1997 “ The company’s $ 5 ordinary shares, which were originally issued at par, currently have a market price of $ 7.50 per share, and this price is likely to be maintained. We can credit the surplus of $ 2.50 per share in the 1988 profit and loss account.” 1998 “ The company’s net profit for the year can be improved if the provision for bad debts is reduced to only a small proportion of debtors, even though most of the debts are long outstanding.” 1999 “ A small stock of stationery has not been included in the balance sheet.” 2000 “ As there is a credit balance of $200,000 on the general reserve account, we can transfer some of this to the profit and loss account to increase the profit for 1988.

You are required to explain to the directors the nature of the above matters and the accounting treatment which is to be accorded to each of them in the profit and loss account for the year ended 31 December 1988 and the balance sheet as at that date. <20 marks>

1989 - No.6 “ When preparing the final accounts of a company, accountants rely on a number of conventions.” Explain the meaning of, outline the purpose of, and illustrate each of the following: (a) consistency convention, <7 marks> (b) prudence convention, and <7 marks> (c) materiality convention. <6 marks>