Finance Quiz #1 with answers 27 Sep 06 see also calculations in Fin/quiz1answ.xls 1. The financial objective of the firm should be to maximize the stock price. 2. The DJIA closed Friday at 11,533.23 with a divisor of .12493117. The average price per share is $48.03 3. The US Treasury Yield curve in the WSJ shows a 3-month T-bill yielding 5 %. The actual yield for the actual life of that 3-month T-bill is 3 mos/12 mos of the annual yield, or about 1.25%

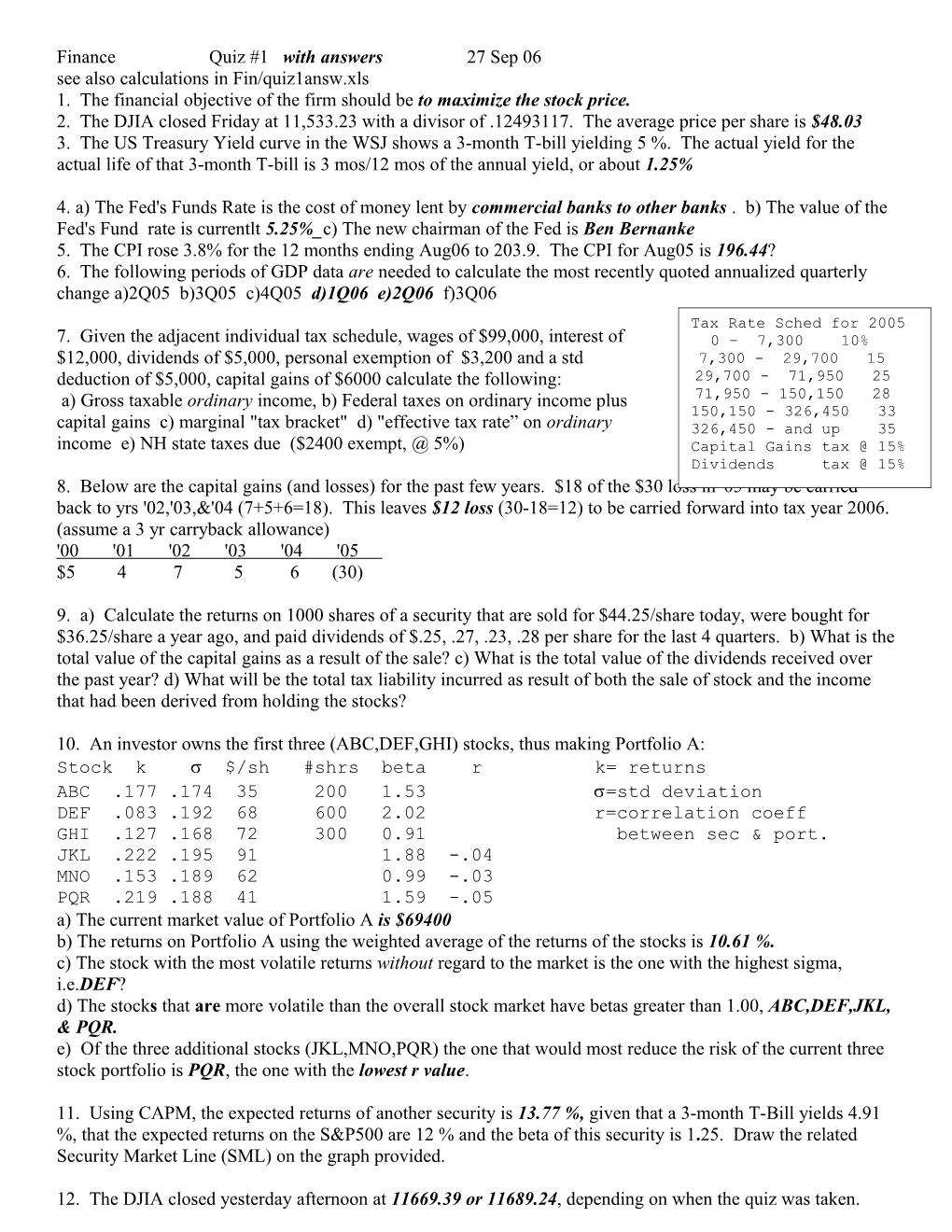

4. a) The Fed's Funds Rate is the cost of money lent by commercial banks to other banks . b) The value of the Fed's Fund rate is currentlt 5.25%_c) The new chairman of the Fed is Ben Bernanke 5. The CPI rose 3.8% for the 12 months ending Aug06 to 203.9. The CPI for Aug05 is 196.44? 6. The following periods of GDP data are needed to calculate the most recently quoted annualized quarterly change a)2Q05 b)3Q05 c)4Q05 d)1Q06 e)2Q06 f)3Q06 Tax Rate Sched for 2005 7. Given the adjacent individual tax schedule, wages of $99,000, interest of 0 – 7,300 10% $12,000, dividends of $5,000, personal exemption of $3,200 and a std 7,300 - 29,700 15 deduction of $5,000, capital gains of $6000 calculate the following: 29,700 - 71,950 25 a) Gross taxable ordinary income, b) Federal taxes on ordinary income plus 71,950 - 150,150 28 150,150 - 326,450 33 capital gains c) marginal "tax bracket" d) "effective tax rate” on ordinary 326,450 - and up 35 income e) NH state taxes due ($2400 exempt, @ 5%) Capital Gains tax @ 15% Dividends tax @ 15% 8. Below are the capital gains (and losses) for the past few years. $18 of the $30 loss in '05 may be carried back to yrs '02,'03,&'04 (7+5+6=18). This leaves $12 loss (30-18=12) to be carried forward into tax year 2006. (assume a 3 yr carryback allowance) '00 '01 '02 '03 '04 '05 $5 4 7 5 6 (30)

9. a) Calculate the returns on 1000 shares of a security that are sold for $44.25/share today, were bought for $36.25/share a year ago, and paid dividends of $.25, .27, .23, .28 per share for the last 4 quarters. b) What is the total value of the capital gains as a result of the sale? c) What is the total value of the dividends received over the past year? d) What will be the total tax liability incurred as result of both the sale of stock and the income that had been derived from holding the stocks?

10. An investor owns the first three (ABC,DEF,GHI) stocks, thus making Portfolio A: Stock k $/sh #shrs beta r k= returns ABC .177 .174 35 200 1.53 =std deviation DEF .083 .192 68 600 2.02 r=correlation coeff GHI .127 .168 72 300 0.91 between sec & port. JKL .222 .195 91 1.88 -.04 MNO .153 .189 62 0.99 -.03 PQR .219 .188 41 1.59 -.05 a) The current market value of Portfolio A is $69400 b) The returns on Portfolio A using the weighted average of the returns of the stocks is 10.61 %. c) The stock with the most volatile returns without regard to the market is the one with the highest sigma, i.e.DEF? d) The stocks that are more volatile than the overall stock market have betas greater than 1.00, ABC,DEF,JKL, & PQR. e) Of the three additional stocks (JKL,MNO,PQR) the one that would most reduce the risk of the current three stock portfolio is PQR, the one with the lowest r value.

11. Using CAPM, the expected returns of another security is 13.77 %, given that a 3-month T-Bill yields 4.91 %, that the expected returns on the S&P500 are 12 % and the beta of this security is 1.25. Draw the related Security Market Line (SML) on the graph provided.

12. The DJIA closed yesterday afternoon at 11669.39 or 11689.24, depending on when the quiz was taken.