1

Real Estate Finance and Investments Solution to Exam 1 Fall 2005 Professor Thibodeau

1. You are considering the purchase of an office property for $54,000,000 today. Annual first year rents are estimated to be $25 per square foot triple-net. You expect to lease 90% of the space for the duration of a five year holding period. In addition, this property has parking spaces for 700 cars. You expect to lease 400 spaces at $100 per month. In addition, you expect to lease 200 of the remaining 300 spaces at an average daily rent of $10.08 per work-day (assume 250 work-days per year). You expect gross rental income to increase 3% per year and parking revenue to increase 2% per year. This triple net lease requires tenants to pay all fixed and variable expenses (e.g. property taxes, insurance, utilities, etc.) but requires you pay the property management expenses. You expect to pay a property management company 4% of effective gross income to manage the property (including the parking structure). In addition, you plan to set aside $16,000 in reserves at the end of year 1. Reserves will increase 3% per year. You can obtain a constant monthly payment mortgage for 70 percent of the purchase price at 5.75% annual interest with monthly payments for 30 years, a 1% loan origination fee, and a 3% prepayment penalty. You estimate the future selling price by capitalizing NOI at 8.5%. You expect to pay a 2% selling commission when you sell the property at the end of the five year holding period. You are in the 36% tax bracket for ordinary income and capital gains are taxed at 15%. For tax purposes, assume land value is 15% of the purchase price and the building will be depreciated over 39 years. Exhibit 1 on page 3 provides expected cash flows for this property.

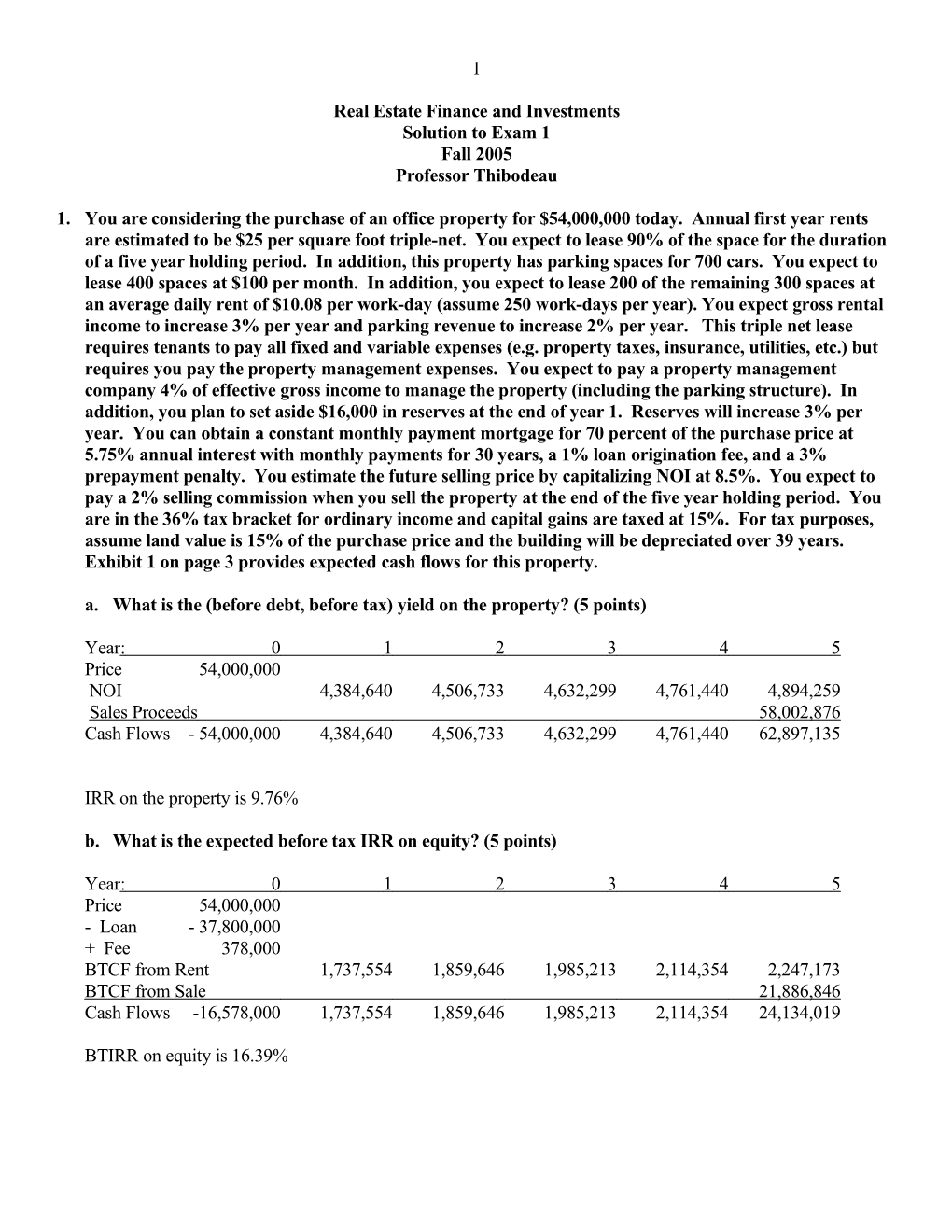

a. What is the (before debt, before tax) yield on the property? (5 points)

Year : 0 1 2 3 4 5 Price 54,000,000 NOI 4,384,640 4,506,733 4,632,299 4,761,440 4,894,259 Sales Proceeds 58,002,876 Cash Flows - 54,000,000 4,384,640 4,506,733 4,632,299 4,761,440 62,897,135

IRR on the property is 9.76%

b. What is the expected before tax IRR on equity? (5 points)

Year : 0 1 2 3 4 5 Price 54,000,000 - Loan - 37,800,000 + Fee 378,000 BTCF from Rent 1,737,554 1,859,646 1,985,213 2,114,354 2,247,173 BTCF from Sale 21,886,846 Cash Flows -16,578,000 1,737,554 1,859,646 1,985,213 2,114,354 24,134,019

BTIRR on equity is 16.39% 2 c. Should you purchase the property if you discount expected after tax cash flows at 12%? Why or why not? (5 points)

Year : 0 1 2 3 4 5 Price 54,000,000 - Loan - 37,800,000 + Fee 378,000 ATCF from Rent 1,365,206 1,433,010 1,502,427 1,573,485 1,646,213 ATCF from Sale 20,895,815 Cash Flows -16,578,000 1,365,206 1,433,010 1,502,427 1,573,485 22,542,028

Expected ATNPV = + $ 643,649. Purchase the property since the expected ATNPV > 0. Expected ATIRR = 12.99%. Purchase the property since the expected ATIRR > 12%. d. What is the lenders expected yield on the loan (use monthly before tax cash flows)? (5 points)

Month(s) : 0 1-60 60 - Loan - 37,800,000 + Fee 378,000 Monthly Payment 220,590.54 Mortgage Balance 35,064,106.63 Prepayment Penalty 1,051,923.20 Cash Flow -37,422,000 220,590.54 36,116,029.83

The lenders yield is 6.48%. e. Suppose the lender requires a 1.4 Debt Service Coverage ratio for year 1 (DSC = NOI/Debt Service). What is the most you can borrow (assuming a 5.75% annual rate, 30 year, monthly payment loan)?

(5 points)

DSC = NOI/DS

1.4 = $4,384,640/DS

DS = $4,384,640/1.4

= $3,131,885.71

PMT = DS/12

= $ 260,990.48

So the maximum loan is the present value of $260,990.48 discounted monthly at an annual rate of 5.75% for 360 months. The maximum loan amount is $44,722,861. 3

Exhibit 1

70% Loan-to-Value Ratio, 5.75% Annual Interest, 30 Years, 1% Fee, 3% Prepay Penalty

PRO-FORMA OPERATING STATEMENTS AND REVERSION ESTIMATES

Year: 1 2 3 4 5

Gross Rental Income 4000000 4120000 4243600 4370908 4502035 less Vacancy/Collection -400000 -412000 -424360 -437091 -450204 plus Parking Revenue 984000 1003680 1023754 1044229 1065113 Effective Gross Income 4584000 4711680 4842994 4978046 5116945 less Management Fees -183360 -188467 -193720 -199122 -204678 less Reserves -16000 -16480 -16974 -17484 -18008 Net Operating Income 4384640 4506733 4632299 4761440 4894259 less Debt Service -2647086 -2647086 -2647086 -2647086 -2647086 Before Tax Cash Flow 1737554 1859646 1985213 2114354 2247173

Net Operating Income 4384640 4506733 4632299 4761440 4894259 less Interest -2160818 -2132108 -2101704 -2069505 -2035404 Depreciation -1176923 -1176923 -1176923 -1176923 -1176923 Amortization -12600 -12600 -12600 -12600 -12600 Taxable Earnings 1034299 1185101 1341072 1502413 1669332

Federal Income Tax -372348 -426637 -482786 -540869 -600959

Before Tax Cash Flow 1737554 1859646 1985213 2114354 2247173 less Federal Income Tax -372348 -426637 -482786 -540869 -600959 After Tax Cash Flow 1365206 1433010 1502427 1573485 1646213

Estimated Selling Price 59186608 less Selling Costs -1183732 Net Sales Proceeds 58002876 less Mortgage Balance -35064107 Prepayment Penalty -1051923 BTCF from Reversion 21886846

Net Sales Proceeds 58002876 less Original Cost -54000000 plus Accum. Depreciation 5884615 Total Gain 9887492 less Recapture 0 Capital Gain 9887492 Capital Gain Tax Liability -1483124

Ordinary Income Tax Items from Sale (excluding Recapture) Unamortized Fee -315000 Prepayment Penalty -1051923 Ordinary Income Tax 492092

BTCF from Reversion 21886846 less Ordinary Income Tax 492092 Tax on Recapture 0 Capital Gain Tax -1483124 ATCF from Reversion 20895815 4

2. Assume you have decided to purchase the property described in Problem #1 but you want to finance 85% of the purchase price instead of 70%. You are evaluating three alternatives. The first alternative is to obtain an 85% loan-to-value ratio loan at 6.5% annual interest with monthly payments for 30 years, a 2% loan fee and a 3% prepayment penalty. Exhibit 2 on page 7 provides the expected cash flows for this alternative. The second alternative is to finance 85% of the purchase price with a participation loan. The participation lender is willing to provide a 6% annual interest rate, 30 year, monthly payment loan with a 2% loan fee but no prepayment penalty in exchange for 20% of the before tax cash flows from operations and 10% of the before tax cash flows from the sale. Exhibit 3 on page 8 provides the expected cash flows for this alternative. The third alternative is to finance the acquisition of the property with the 70% loan-to-value ratio loan described in problem #1 and to obtain the additional $8.1M debt with an accrual rate loan. The accrual rate loan requires monthly payments for 25 years, has a 6% pay rate and a 9% accrual rate. This loan has a 2% loan fee but no prepayment penalty.

a. Is this acquisition still feasible with the 6.5% fixed rate first mortgage? Your required return for expected after tax cash flows is 14% with the additional debt. (5 points)

Year : 0 1 2 3 4 5 Price 54,000,000 - Loan - 45,900,000 + Fee 918,000 ATCF from Rent 828,069 893,839 961,005 1,029,573 1,099,553 ATCF from Sale 13,002,739 Cash Flows -9,018,000 828,069 893,839 961,005 1,029,573 14,102,292

Expected ATNPV = + $ 978,686. Purchase the property since the expected ATNPV > 0. Expected ATIRR = 16.77%. Purchase the property since the expected ATIRR > 14%.

b. What is the expected borrowing cost for the 6.5% fixed rate first? Use monthly cash flows to compute payments and mortgage balances but annual cash flows to compute expected yields. (5 points)

Year(s) : 0 1-5 5 - Loan - 45,900,000 + Fee 918,000 Annual Debt Service 3,481,431 Mortgage Balance 42,967,439 Prepayment Penalty 1,289,023 Cash Flow -44,982,000 3,481,431 44,256,462

The expected borrowing cost is 7.46%.

c. Is marginal leverage positive, negative or neutral? Why? (5 points)

Marginal leverage is positive because the ATNPV for the 85% loan exceeds the ATNPV for the 70% loan. That is, marginal leverage is positive because $978,686 > $643,649. 5 d. What is the marginal cost of obtaining the additional debt with the 6.5% fixed-rate first (compared to the 70% loan-to-value ratio loan described in Problem #1)? Use monthly cash flows. (5 points)

Loan Option Net Loan Amount Monthly Payment Future Value for 60 months

85% $ 44,982,000 $ 290,119.25 $ 44,256,462

70% $ 37,422,000 $ 220,590.54 $ 36,116,030

Difference 7,560,000 69,528.71 8,140,432

The expected yield on the marginal cash flows: 12.16%

e. What is the expected borrowing cost for the participation loan? Use annual before tax cash flows. (5 points)

Year(s) : 0 1 2 3 4 5 - Loan - 45,900,000 + Fee 918,000 Annual Debt Service 3,302,324 3,302,324 3,302,324 3,302,324 3,302,324 Participation in BTCFO 216,463 240,882 265,995 291,823 318,387 Mortgage Balance 42,711,950 Participation in BTCFR 1,529,093 Cash Flow -44,982,000 3,518,787 3,543,206 3,568,319 3,594,147 47,861,754

The expected yield to the lender (or borrowing cost for the borrower) on the participation loan is 7.64%.

f. What is the marginal cost of obtaining the additional debt with the participation loan (compared to the 70% loan-to-value ratio loan described in Problem #1)? Use annual before tax cash flows. (5 points) Year

Loan Option Net Loan 1 2 3 4 5

Participation 44,982,000 3,518,787 3,543,206 3,568,319 3,594,147 47,861,754

70% L/V 37,422,000 2,647,086 2,647,086 2,647,086 2,647,086 38,763,116

Difference 7,560,000 871,701 896,120 921,233 947,061 9,098,638

The expected marginal cost of borrowing is 13.26% 6 g. What is the expected borrowing cost for the entire loan if you finance the acquisition with the 70% first mortgage described in Problem #1 and the $8.1M accrual rate second mortgage? Use monthly cash flows to compute mortgage payments and outstanding balances but annual cash flows to compute yields. (5 points)

Years

Loan Option Net Loan Amount 1-5 5

70% First 37,422,000 - 2,647,086 - 36,116,030

Accrual 7,938,000 - 626,216 - 8,745,750

Total 45,360,000 - 3,273,347 - 44,861,780

The total borrowing cost for the 70% first plus the accrual second is 7.03%. h. What is the marginal borrowing cost for the accrual rate second mortgage? Use monthly before tax cash flows. (5 points)

The marginal borrowing cost for the accrual loan is simply the expected yield on the debt.

Loan Option Net Loan Amount Monthly Payment Mortgage Balance for 60 months

Accrual $ 7,938,000 $ 52,188.41 $ 8,745,750

The expected yield on the accrual loan is 9.48%.

i. Would you select any of the three 85% loan-to-value ratio loan alternatives? Which one? Why? (Ignore risk differences for the three 85% loan-to-value ratio alternatives)? (10 points)

Alternative Expected Borrowing Cost

85% L/V; Fixed 6.5% Rate 7.46%

Participation 7.64%

70% L/V; Fixed 5.75% Rate First + 9% Accrual Second 7.03%

Take the accrual—it’s the cheapest of the three alternatives. 7

Exhibit 2

85% Loan-to-Value Ratio, 6.50% Annual Interest, 30 Years, 2% Fee, 3% Prepay Penalty

PRO-FORMA OPERATING STATEMENTS AND REVERSION ESTIMATES

Year: 1 2 3 4 5

Gross Rental Income 4000000 4120000 4243600 4370908 4502035 less Vacancy/Collection -400000 -412000 -424360 -437091 -450204 plus Parking Revenue 984000 1003680 1023754 1044229 1065113 Effective Gross Income 4584000 4711680 4842994 4978046 5116945 less Management Fees -183360 -188467 -193720 -199122 -204678 less Reserves -16000 -16480 -16974 -17484 -18008 Net Operating Income 4384640 4506733 4632299 4761440 4894259 less Debt Service -3481431 -3481431 -3481431 -3481431 -3481431 Before Tax Cash Flow 903209 1025302 1150869 1280010 1412828

Net Operating Income 4384640 4506733 4632299 4761440 4894259 less Interest -2968395 -2934036 -2897376 -2858260 -2816526 Depreciation -1176923 -1176923 -1176923 -1176923 -1176923 Amortization -30600 -30600 -30600 -30600 -30600 Taxable Earnings 208722 365174 527401 695657 870210

Federal Income Tax -75140 -131463 -189864 -250436 -313276

Before Tax Cash Flow 903209 1025302 1150869 1280010 1412828 less Federal Income Tax -75140 -131463 -189864 -250436 -313276 After Tax Cash Flow 828069 893839 961005 1029573 1099553

Estimated Selling Price 59186608 less Selling Costs -1183732 Net Sales Proceeds 58002876 less Mortgage Balance -42967439 Prepayment Penalty -1289023 BTCF from Reversion 13746414

Net Sales Proceeds 58002876 less Original Cost -54000000 plus Accum. Depreciation 5884615 Total Gain 9887492 less Recapture 0 Capital Gain 9887492 Capital Gain Tax Liability -1483124

Ordinary Income Tax Items from Sale Unamortized Fee -765000 Prepayment Penalty -1289023 Ordinary Income Tax 739448

BTCF from Reversion 13746414 less Ordinary Income Tax 739448 Tax on Recapture 0 Capital Gain Tax -1483124 ATCF from Reversion 13002739 8

Exhibit 3

85% Loan-to-Value Ratio, 6.00% Annual Interest Participation, 30 Years, 2% Fee, No Prepay Penalty

Year: 1 2 3 4 5

Net Operating Income 4384640 4506733 4632299 4761440 4894259 less Debt Service -3302324 -3302324 -3302324 -3302324 -3302324 BTCF Before Participation 1082316 1204409 1329975 1459116 1591935 less Participation -216463 -240882 -265995 -291823 -318387 BTCF After Participation 865853 963527 1063980 1167293 1273548

Net Operating Income 4384640 4506733 4632299 4761440 4894259 less Interest -2738667 -2703902 -2666992 -2627806 -2586204 Participation -216463 -240882 -265995 -291823 -318387 Depreciation -1176923 -1176923 -1176923 -1176923 -1176923 Amortization -30600 -30600 -30600 -30600 -30600 Taxable Earnings 221987 354426 491789 634288 782145 Federal Income Tax -79915 -127593 -177044 -228344 -281572

Before Tax Cash Flow 865853 963527 1063980 1167293 1273548 less Federal Income Tax -79915 -127593 -177044 -228344 -281572 After Tax Cash Flow 785937 835934 886936 938949 991975

Estimated Selling Price 59186608 less Selling Costs -1183732 Net Sales Proceeds 58002876 less Mortgage Balance -42711950 Prepayment Pen. 0 BTCF from Reversion Before Particiption 15290926 less Participation -1529093 BTCF from Reversion After Participation 13761834

Net Sales Proceeds 58002876 less Original Cost -54000000 plus Accum. Depr. 5884615 Total Gain 9887492

Ordinary Income Tax Items from Sale Unamortized Fee -765000 Prepayment Penalty 0 Participation -1529093 Ordinary Income Tax 825873

Total Gain 9887492 less Recapture 0 Capital Gain 9887492 Capital Gain Tax -1483124

BTCF from Reversion 13761834 less Ordinary Income Tax 825873 Capital Gain Tax -1483124 ATCF from Reversion 13104583 9

3. Three years ago you financed the acquisition of a $50,000,000 office property with a 75%, 30 year, 7.75% annual fixed interest rate, interest-only, monthly payment loan. The loan has yield maintenance fee that requires you to pay the difference between the contract rate and the yield on US Treasuries plus 150 basis points if you repay the loan within ten years. The current market annual interest rate for 30-year fixed rate interest only commercial loans has dropped to 6.00% with a 1% loan origination fee and a ten- year lock out provision. The lock-out prohibits you from prepaying the loan for ten years. There is no prepayment penalty if you prepay the new loan after the ten year lock-out period. If you refinance, you also have to pay $150,000 in additional closing costs. Your lender will let you refinance the outstanding mortgage balance on the existing mortgage (including the yield maintenance fee), the $150,000 in closing costs, but requires that you pay the 1% loan origination fee out of pocket. Compute the before tax net present value of refinancing if you discount future expected before tax cash flows at 7% and you expect to sell the property ten years from today. The current yield on ten-year US Treasuries is 4.75%. The expected yield on US Treasuries ten years from now is 6%. Should you refinance? Why or why not?

Three Years Ago Loan Amount $ 37,500,000 Loan Term 30 years IO Rate 7.75% Monthly Payment $ 242,187.50

Today Mortgage Balance $ 37,500,000 Yield on US Treasuries 4.75% + Margin 1.50% New IO Rate 6.25% Spread 1.50% Monthly Payment for YMF: (((0.0775 – 0.0625)/12) x $ 37,500.000) $ 46,875 YMF: PV of $46,875/month for 7 years discounted at 7.75% $ 3,031,635

New Loan Amount: ($ 37,500,000 + $ 3,031,635 + $150,000) $ 40,681,635 Monthly Payment on New Loan @ 6.25% $ 203,408.18 Monthly Savings: $ 38,779.32

Balance on New Loan: $ 40,681,635 Balance on Existing Loan: $ 37,500,000 Additional Lump Sum Payment in Ten Years $ 3,181,635

Cash flows:

Loan Fee Monthly Savings Lump Sum Payment for 120 months in 120 Months

- $ 406,816.35 $ 38,779.32 - $ 3,181,635

(BT)NPV of cash flows discounted at 7%: + $ 1,349,936. DO IT!