Chapter 11 Sales / collection process

When you finish studying this chapter, you should be able to:

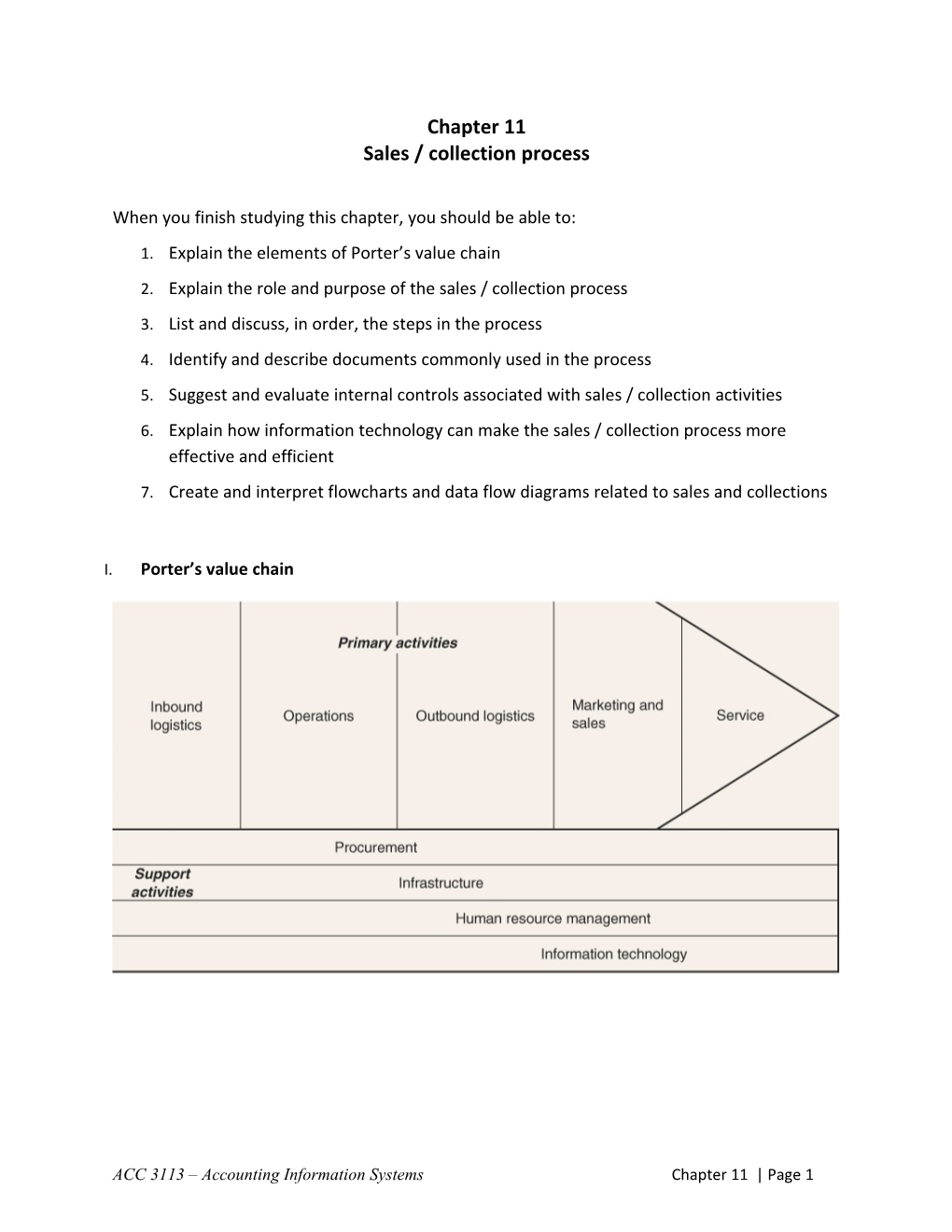

1. Explain the elements of Porter’s value chain

2. Explain the role and purpose of the sales / collection process

3. List and discuss, in order, the steps in the process

4. Identify and describe documents commonly used in the process

5. Suggest and evaluate internal controls associated with sales / collection activities

6. Explain how information technology can make the sales / collection process more effective and efficient

7. Create and interpret flowcharts and data flow diagrams related to sales and collections

I. Porter’s value chain

ACC 3113 – Accounting Information Systems Chapter 11 | Page 1 II. Steps in the sales / collection process

1. Take customer order

2. Approve customer credit

3. Fill the order based on approved credit

4. Ship the product

5. Bill the customer

6. Collect payment

7. Process uncollectible receivables as necessary

Sales/Collection DFD:

III. Documents

1. Customer order

a. Summarizes items ordered and prices

b. Originates in sales department

c. Terminates in warehouse

2. Picking list

a. Guides selection of items from warehouse

b. Originates in warehouse

c. Terminates in shipping department

ACC 3113 – Accounting Information Systems Chapter 11 | Page 2 3. Packing list

a. Specifies contents of shipment

b. Originates in shipping department

c. Terminates with customer

4. Bill of lading

a. Specifies freight terms

• FOB destination or shipping point

• Freight prepaid or collect

b. Originates in shipping department

c. Terminates with common carrier

5. Customer invoice

a. Bills client

b. Originates in billing department

c. Terminates with customer

6. Customer check

a. Remits payment

b. Originates with customer

c. Terminates with cash receipts department

7. Remittance advice

a. Provides source document for AIS

b. Originates with customer

c. Terminates with accounting

8. Deposit slip

ACC 3113 – Accounting Information Systems Chapter 11 | Page 3 a. Transmits cash receipts to bank

b. Originates with cash receipts department

c. Terminates with bank

IV. Internal controls

1. Establishing a formal credit approval process

2. Maintaining adequate inventory

3. Incorporating independent order checking

4. Insuring goods in transit

9. Matching documents prior to billing

10. Separating duties: authorization, custody, recordkeeping

11. Endorsing checks restrictively

12. Reconciling the bank statement

V. Information technology

1. Maintain customer lists

2. Generate sequentially-numbered forms

3. Look up inventory status

4. Identify unpaid and past-due invoices

5. Record transactions in the accounting information system

ACC 3113 – Accounting Information Systems Chapter 11 | Page 4