November 16, 2009

Research Associate: Soumyajit Das, MBA

Zacks Research Digest Editor: Jewel Saha, ACS.

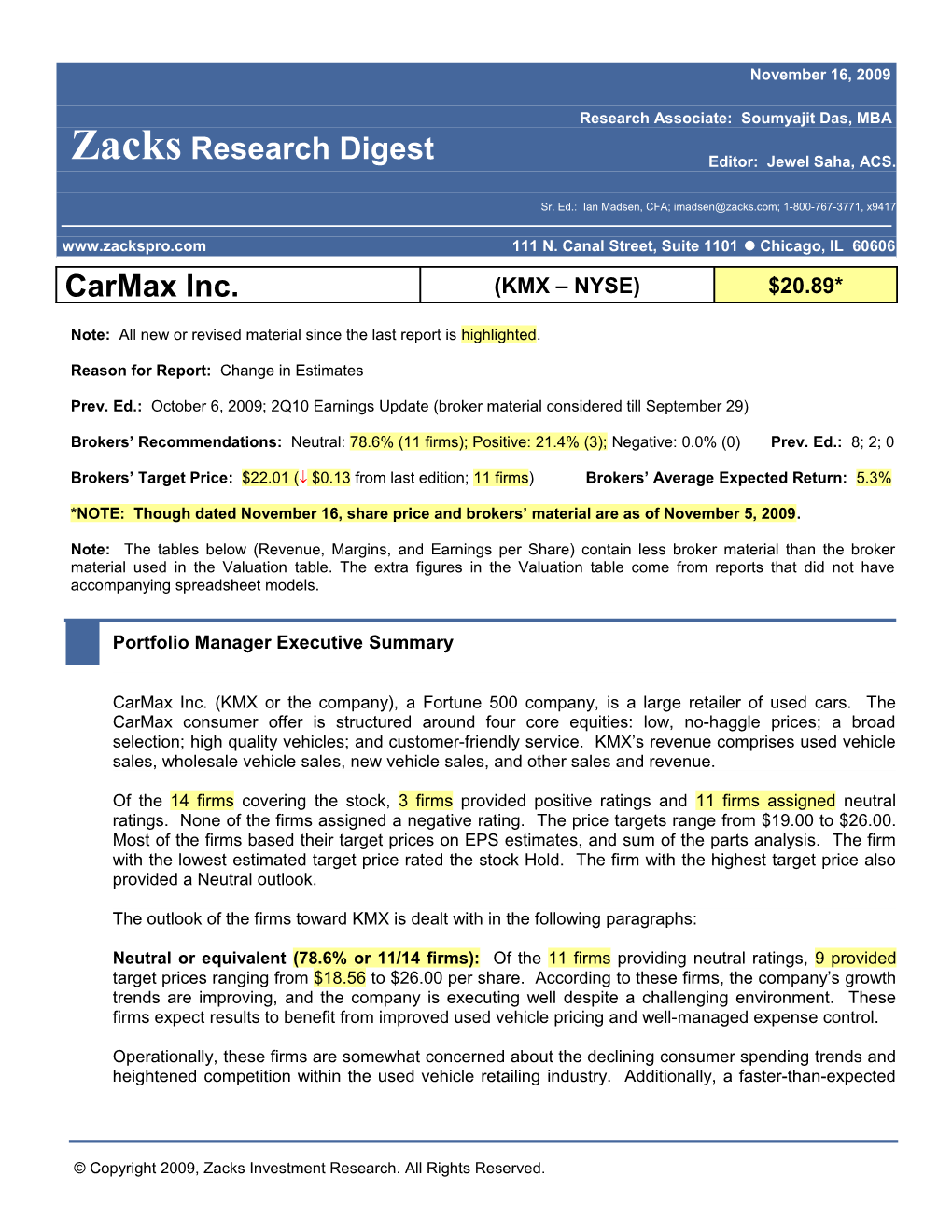

Sr. Ed.: Ian Madsen, CFA; [email protected]; 1-800-767-3771, x9417 www.zackspro.com 111 N. Canal Street, Suite 1101 Chicago, IL 60606 CarMax Inc. (KMX – NYSE) $20.89*

Note: All new or revised material since the last report is highlighted.

Reason for Report: Change in Estimates

Prev. Ed.: October 6, 2009; 2Q10 Earnings Update (broker material considered till September 29)

Brokers’ Recommendations: Neutral: 78.6% (11 firms); Positive: 21.4% (3); Negative: 0.0% (0) Prev. Ed.: 8; 2; 0

Brokers’ Target Price: $22.01 ( $0.13 from last edition; 11 firms) Brokers’ Average Expected Return: 5.3%

*NOTE: Though dated November 16, share price and brokers’ material are as of November 5, 2009.

Note: The tables below (Revenue, Margins, and Earnings per Share) contain less broker material than the broker material used in the Valuation table. The extra figures in the Valuation table come from reports that did not have accompanying spreadsheet models.

Portfolio Manager Executive Summary

CarMax Inc. (KMX or the company), a Fortune 500 company, is a large retailer of used cars. The CarMax consumer offer is structured around four core equities: low, no-haggle prices; a broad selection; high quality vehicles; and customer-friendly service. KMX’s revenue comprises used vehicle sales, wholesale vehicle sales, new vehicle sales, and other sales and revenue.

Of the 14 firms covering the stock, 3 firms provided positive ratings and 11 firms assigned neutral ratings. None of the firms assigned a negative rating. The price targets range from $19.00 to $26.00. Most of the firms based their target prices on EPS estimates, and sum of the parts analysis. The firm with the lowest estimated target price rated the stock Hold. The firm with the highest target price also provided a Neutral outlook.

The outlook of the firms toward KMX is dealt with in the following paragraphs:

Neutral or equivalent (78.6% or 11/14 firms): Of the 11 firms providing neutral ratings, 9 provided target prices ranging from $18.56 to $26.00 per share. According to these firms, the company’s growth trends are improving, and the company is executing well despite a challenging environment. These firms expect results to benefit from improved used vehicle pricing and well-managed expense control.

Operationally, these firms are somewhat concerned about the declining consumer spending trends and heightened competition within the used vehicle retailing industry. Additionally, a faster-than-expected

© Copyright 2009, Zacks Investment Research. All Rights Reserved. rise in unemployment and a decline in used vehicle prices along with market shrinkage will likely hamper growth prospects of the company.

Positive or equivalent (21.4% or 3/14 firms): Two firms provided target prices of $25.00 per share. The firms are impressed by improving comp trends and the company’s excellent execution during the economic downturn. Moreover, CarMax’s competitive environment is expected to become increasingly favorable as many new car dealers are exiting the market. These firms believe that long-term growth prospects are undiminished, and may actually be even stronger due to closures of franchised new car dealers, who are KMX’s main competitors. Further, KMX used the hiatus in store openings to strengthen its operations, and appears likely to emerge from the recent downturn as a more efficient organization.

Additionally, these firms believe that the company’s primary competitors are the nation’s roughly 21,700 franchised new car dealers, who sell the majority of late-model used vehicles. In the new-vehicle market, CarMax competes with franchised dealers, offering vehicles produced by the same and/or other manufacturers, with auto brokers and leasing companies. November 16, 2009

Recent Events

On September 22, 2009, KMX reported its 2Q10 financial results. The highlights are as follows:

Total sales were $2,076.7 million versus $1,839.1 million in 2Q09. Net income was $102.9 million, or $0.46 per share, compared with $14.0 million, or $0.06 per share, in 2Q09.

Overview

The firms identified the following factors for evaluating the investment merits of the company:

Key Positive Arguments Key Negative Arguments KMX has impressive long-term growth prospects. The company’s profitability is highly susceptible Stability in new car pricing from reduced, to the ongoing rising interest rates (which reduce distressed selling by GM and Ford as a result of the demand for used cars, and make car loans successful restructuring will likely be a positive more expensive). In such a scenario, CarMax for used car demand. Auto Finance’s income is expected to decrease. Improved market conditions and scope for Increased promotions by carmakers act as a geographical expansion offer substantial growth constant headwind for KMX. opportunities. High advertising and corporate overhead costs Initiatives such as entry into smaller markets, will continue to make it difficult for KMX to increased Internet advertising, and a new leverage expenses. financing scorecard will help drive sales. The Internet or some other distribution method The company has an impressive low debt/equity may allow consumers to trade vehicles without a ratio relative to its peer group. dealer.

Based in Richmond, Virginia, CarMax Inc. (KMX or the company) operates as a specialty retailer of used cars and light trucks. It purchases, reconditions, and sells used vehicles. The company offers its customers a selection of designs and models of used vehicles, including both domestic and imported

Zacks Investment Research Page 2 www.zackspro.com cars and light trucks. KMX also sells new vehicles under various franchise agreements. In addition, the company offers its customers a range of related services, including the financing of vehicle purchases through CarMax Auto Finance (CAF) and third-party lenders, the sale of extended warranties, and vehicle repair service. During the twelve months ended February 28, 2009, KMX retailed 345,465 used cars and sold 194,081 wholesale vehicles at in-store auctions.

The company’s primary competitors are the nation’s roughly 21,700 franchised new car dealers, selling the majority of late-model used vehicles. In addition, KMX also competes with independent dealers, rental companies, and private parties. In the new vehicle market, KMX competes with franchised dealers, offering vehicles produced by the same and/or other manufacturers, with auto brokers and leasing companies. The company’s website is http://www.carmax.com. Its fiscal year ends on February 28.

October 6, 2009

Revenue

According to the Zacks Digest model, total revenue was $2,076.7 million in 2Q10, up 12.9% from $1,839.1 million in 2Q09, and 13.2% from $1,834.3 million in 1Q10. The upside was driven by better- than-expected used unit comps swinging to strongly positive territory, impressive gross profit per vehicle trends, and a healthy improvement in CarMax Auto Finance (CAF) profits.

Provided below is a summary of quarterly and forward revenue estimates:

Revenue ($M) 2Q09A 1Q10A 2Q10A 3Q10E 2009A 2010E 2011E 2012E Used Vehicle Sales $1,476.3 $1,549.3 $1,706.6 $1,351.5 $5,690.7 $6,049.2 $6,646.0 $7,779.2 New Vehicle Sales $77.8 $48.6 $63.2 $53.7 $261.9 $211.8 $221.0 $243.7 Wholesale Sales $223.3 $171.5 $237.0 $187.9 $779.8 $766.0 $849.2 $962.5 Other Sales and $61.7 $65.0 $69.9 $58.0 $241.6 $254.6 $272.8 $297.3 Revenue Total Revenue $1,839.1 $1,834.3 $2,076.7 $1,638.4 $6,974.0 $7,255.2 $7,933.6 $9,090.8 Digest High $1,839.1 $1,834.3 $2,076.7 $1,815.0 $6,974.0 $7,750.5 $8,834.8 $10,899.5 Digest low $1,839.0 $1,834.3 $2,076.6 $1,493.9 $6,973.9 $6,959.4 $7,276.0 $8,323.5 Y-o-Y Growth -13.4% -17.0% 12.9% 12.6% -14.9% 4.0% 9.4% 14.6% Q-o-Q Growth -16.7% 24.7% 13.2% -21.1%

As per management, comparable store used unit sales increased 8% in the quarter and total used unit sales increased 10% in the quarter.

Segment Details

Used vehicle sales in 2Q10 increased 15.6% y-o-y and 10.2% q-o-q to $1,706.6 million, according to the Zacks Digest model. Comparable store sales (comps) for the used car segment increased by 8% y-o-y in the quarter, while used vehicle dollar comps were up 13% y-o-y, as the average selling price increased 5.6% y-o-y to $17,185. 2Q10 used retail unit sales increased by 9.6% y-o-y to 98,260 vehicles.

New vehicle unit sales declined 18.8% y-o-y and improved 30.1% q-o-q to $63.2 million in 2Q10, according to the Zacks Digest model. New vehicle comps as well as new vehicle dollar comps were

Zacks Investment Research Page 3 www.zackspro.com down 19% y-o-y in 2Q10. Total new unit sales decreased 18.5% y-o-y to 2,689 vehicles while average selling price decreased slightly to $23,373.

Wholesale unit sales increased 6.1% y-o-y and 38.2% q-o-q to $237.0 million in 2Q10, according to the Zacks Digest model. Wholesale unit sales increased 4.8% to 57,790 vehicles, reflecting higher retail volume and a higher buy rate of the company’s appraisal offers. Higher wholesale prices enabled CarMax to offer more to consumers for their old cars.

Other sales, revenue (including extended warranty, service, and third-party finance fees) increased 13.3% y-o-y, and 7.5% q-o-q to $69.9 million in 2Q10, according to the Zacks Digest model.

A graphical representation of revenue segments as per the Zacks Digest Model is given below:

Revenue Segm ents (2009A)

11% 3% Used Vehicle Sales 4% New Vehicle Sales Wholesale Sales Other Sales 82% and Revenue

Revenue Segments (2010E)

11% 3% Used Vehicle Sales 3% New Vehicle Sales Wholesale Sales Other Sales 83% and Revenue

Zacks Investment Research Page 4 www.zackspro.com Re venue Segm ents (2012E)

10% 3% Used Vehicle 3% Sales New Vehicle Sales Wholesale Sales Other Sales 84% and Revenue

Revenue Segments (2011E)

11% 3% Used Vehicle 3% Sales New Vehicle Sales Wholesale Sales Other Sales 83% and Revenue

CarMax Auto Finance (CAF): CarMax Auto Finance posted income of $72.1 million versus a $7.1 million loss in 2Q09, inclusive of $36.2 million in favorable adjustments related to $28.5 million of mark- to-market write-ups on retained subordinated bonds, $5.6 million from favorable variance in funding terms versus expectations in the renewal of the warehouse facility, and $2 million in other net favorable adjustments inclusive of decreases in prepayment speed assumptions, partly offset by a modest change in net loss rate assumptions on select pools.

CAF’s spread increased to 4.2% of loans originated and sold, up from 1.8% in the year-ago period and within management’s long-held goal of 3.5% to 4.5%. CAF completed a $500 million securitization in July, 2009, that was eligible for funding under the Fed’s Term Asset-Backed Securities Loan Facility (TALF).

Outlook

The Zacks Digest model forecasts total revenue of $7,255.2 million for FY10, $7,933.6 million for FY11, and $9,090.8 million for FY12, with a y-o-y growth of 4.0% in FY10, 9.4% in FY11, and 14.6% in FY12. The 3-year compound annual growth rate (CAGR) realized on FY09 revenue is 9.2%.

Please refer to the separately published spreadsheet on KMX for additional details & updated forecasts.

Margins

Zacks Investment Research Page 5 www.zackspro.com Provided below is a summary of quarterly and forward margin estimates:

Margins 2Q09A 1Q10A 2Q10A 3Q10E 2009A 2010E 2011E 2012E Gross 13.9% 15.0% 15.1% 14.7% 13.9% 15.0% 14.4% 14.2% Operating 1.3% 2.4% 8.1% 3.4% 1.5% 4.7% 4.7% 5.1% Pretax 1.2% 2.3% 8.1% 3.3% 1.4% 4.6% 4.6% 5.0% Net 0.8% 1.4% 4.8% 2.0% 0.9% 2.8% 2.8% 3.1%

As per the Zacks Digest model, gross margin in 2Q10 was 15.1% versus 13.9% in 2Q09 and flat sequentially. Gross profit increased 23.3% y-o-y and 14.7% q-o-q to $314.5 million in the quarter.

According to the company, total gross profit increased 23% to $314.5 million from $255.9 million in 2Q09, reflecting the combination of the increase in unit sales plus an improvement in total gross profit dollars per retail unit, which increased $363 per unit to $3,116 in the current quarter from $2,753 in the corresponding prior-year quarter.

Gross Profit by Segment as per the company

Gross profit in the Used vehicle segment was $208.3 million versus $167.7 million in 2Q09. New vehicle gross profit decreased to $2.9 million from $3.0 million in 2Q09. Wholesale vehicle gross profit decreased to $47.7 million in 2Q10, compared with $49.5 million in 2Q09. Other gross profit increased to $55.6 million from $35.8 million in 2Q09.

Gross profit in the Used vehicle segment was $2,120 per unit versus $1,870 per unit in 2Q09. New vehicle gross profit increased to $1,060 per unit from $909 per unit in 2Q09. Wholesale vehicle gross profit increased to $826 per unit in 2Q10 compared with $897 per unit in 2Q09. Other gross profit per unit increased to $551 from $385 in 2Q09.

In 2Q10, selling, general, and administrative (SG&A) expenses were reduced to $218.1 million from $225.2 million in the prior year’s quarter, despite the increase in unit sales. The decline was primarily the result of lower levels of advertising spending and decreases in growth-related costs. The SG&A expenses, as a percentage of revenue, improved to 10.5% in 2Q10 compared with 12.2% in the prior year quarter, due to both the reduction in absolute SG&A spending and the leverage associated with increases in used unit sales and average selling prices.

The Zacks Digest model operating income in the quarter was $168.6 million, up 612.4% y-o-y and 284.6% q-o-q. Operating margin in the quarter was 8.1% versus 1.3% in 2Q09 and 2.4% in 1Q10.

Pre-tax margin in the quarter was 8.1% versus 1.2% in 2Q09 and 2.3% in 1Q10 and net margin was 4.8% in 2Q10, up from 0.8% in 2Q09 and 1.4% in 1Q10, according to the Zacks Digest model.

Outlook

As per the Zacks Digest model, the firms expect cost of goods sold (COGS) to grow slower than total revenue in FY10, and is expected to increase at a faster rate than total revenue in FY11 and FY12, on a y-o-y basis. SG&A expense is expected to decrease versus total revenue increase in FY10, on a y-o- y basis. In FY11 and FY12, SG&A is expected to increase at a slower pace than total revenue, respectively, on a y-o-y basis.

Zacks Investment Research Page 6 www.zackspro.com The Digest model forecasts operating income of $338.6 million for FY10, $369.0 million for FY11, and $459.9 million for FY12, which reflects a y-o-y growth of 228.3% in FY10, 9.0% in FY11, and 24.6% in FY12. The 3-year CAGR on realized FY09 operating income is projected at 64.6%.

Please refer to the separately published spreadsheet on KMX for additional details & updated forecasts.

Earnings per Share

According to the Zacks Digest model, EPS in 2Q10 was $0.46, up 632.6% from $0.06 in 2Q09 and 306.4% from $0.11 in 1Q10. The improvement was attributed to higher-than-expected sales, gross margins, and CAF income expansions.

According to the company, in 2Q10, net earnings increased to $103.0 million, or $0.46 per diluted share, from $14.0 million, or $0.06 per diluted share, earned in 2Q09. In 2Q10, net income increased by $0.10 per share for CarMax Auto Finance (CAF) favorable adjustments, primarily related to an increase in the fair value of retained subordinated bonds.

As per the Zacks Digest model, net income was $100.5 million in 2Q10, up 616.0% from $14.0 million in 2Q09 and 281.1% from $26.4 million in 1Q10.

Shares outstanding increased 0.3% to 221.4 million in 2Q10 from 220.7 million in 2Q09 and 1.2% from 218.8 million in 1Q10.

Provided below is a summary of quarterly and forward EPS estimates:

EPS in US $ 2Q09A 1Q10A 2Q10A 3Q10E 2009A 2010E 2011E 2012E Zacks Consensus $0.12 $0.84 $0.91 Digest High $0.10 $0.13 $0.47 $0.26 $0.30 $1.17 $1.41 $1.84 Digest Low $0.06 $0.10 $0.46 $0.09 $0.27 $0.81 $0.70 $0.95 Digest Average $0.06 $0.11 $0.46 $0.15 $0.28 $0.93 $0.98 $1.26 Y-o-Y Growth -78.3% -14.0% 632.6% 252.9% -66.6% 239.2% 4.7% 29.2% Q-o-Q Growth -52.3% -33.7% 306.4% -67.9%

Outlook

The Zacks Digest model projects an average EPS of $0.93 for FY10, $0.98 for FY11, and $1.26 for FY12, which represents a y-o-y growth of 239.2% in FY10, 4.7% in FY11, and 29.2% in FY12. The 3- year CAGR realized on FY09 earnings is projected at 66.2%.

The highlights from the above EPS table are as follows:

FY10 forecasts (10 firms) range from $0.81 to $1.17; the average is $0.93.

FY11 forecasts (10 firms) range from $0.70 to $1.41; the average is $0.98.

Zacks Investment Research Page 7 www.zackspro.com FY12 forecasts (5 firms) range from $0.95 to $1.84; the average is $1.26.

The Digest model forecasts a net income of $203.2 million for FY10, $224.7 million for FY11, and $281.8 million for FY12, which reflects a y-o-y growth of 242.2% in FY10, 10.6% in FY11, and 25.4% in FY12. The 3-year CAGR on realized FY09 net income is 68.1%.

The Zacks Digest model projects shares outstanding to be 221.0 million for FY10, 222.5 million for FY11, and 222.9 million for FY12, with y-o-y increases of 0.3% in FY10, 0.7% in FY11, and 0.2% in FY12. This represents a 3-year CAGR realized on FY09 shares outstanding of 0.4%.

The firms forecast an increase in EPS for FY10, FY11, and FY12 based on the expected increase in net income, on a y-o-y basis.

Please refer to the separately published spreadsheet on KMX for additional details and updated forecasts.

Target Price/Valuation

Of the 14 firms covering the stock, 3 firms provided positive ratings and 11 firms assigned neutral ratings. None of the firms assigned a negative rating. The Zacks Digest average price target is $22.01 ( $0.13 from the previous target price; 5.3% upside from the current price). The price targets range from $18.56 (11.2% downside from the current price) (ValuEngine) to $26.00 (24.5% upside from the current price) (R W. Baird). Most of the firms based their target prices on EPS estimates, and sum of the parts analysis.

The firm with the lowest estimated target price rated the stock neutral. The firm with the highest target price also provided a neutral outlook.

Rating Distribution Positive 21.4% Neutral 78.6% Negative 0.0% Average Target Price $22.01 Digest High $26.00 Digest Low $18.56 No. of Firms with Target Price/Total 10/13

The primary risks to the target price include heightened competition within the used vehicle retailing industry, highly volatile new car retail promotions impacting the used car retail market, declining consumer spending trends, rising interest rates, which are likely to dampen finance income, higher funding costs due to further asset-backed securities (ABS) market weakness, and potentially weakening macroeconomic conditions.

Metrics detailing current management effectiveness are as follows:

Metrics (TTM) company Industry S&P 500 Return on Assets (ROA) 6.1% 0.8% 3.6% Return on Investment (ROI) 7.5% 1.2% 4.9% Return on Equity (ROE) 8.8% 1.1% 8.7%

Zacks Investment Research Page 8 www.zackspro.com The company’s ROA, ROI, and ROE are higher than the industry averages and the market averages (as measured by S&P 500).

Capital Structure/Solvency/Cash Flow/Governance/Other

Balance Sheet

Cash and cash equivalents were $122.3 million in 2Q10 versus $10.9 million in 2Q09. Inventories were $790.1 million in 2Q10 versus $736.1 million in 2Q09. Long-term debt, excluding current portion, was $177.7 million versus $176.9 million in 2Q09. Shareholders’ equity increased to $1,744.2 million from $1,560.9 million in 2Q09.

Cash Flow

Net cash (used in) provided by operating activities was ($51.3) million 1H10 versus $218.9 million in 1H09. Net cash used in investing activities was $13.8 million in 1H10 compared to $140.3 million in 1H09. Net cash provided by (used in) financing activities was $46.9 million in 1H10 versus ($80.7) million in 1H09.

Capital expenditures (capex) decreased to $14.3 million in 1H10 from $137.5 million in 1H09.

Superstore Openings

The company has no plans to open new stores in 2009. The construction of three stores has been completed, but they will not open until market conditions improve. At quarter end, KMX operated 100 used car superstores, compared with 98 a year earlier.

Credit Facilities

As of August 31, 2009, the company had net debt of $257.2 million, consisting of $351.1 million outstanding under the revolving credit facility and $28.4 million of capitalized leases, net of $122.3 million in cash and cash equivalents. Based on then-current inventory levels, the company had additional borrowing capacity of $245.6 million under the revolving credit facility, which expires in December 2011.

As of August 31, 2009, $575.0 million of auto loan receivables were outstanding in the warehouse facility and unused warehouse capacity totaled $625.0 million. The company renewed warehouse facility, which has a 364-day term. The size of the warehouse facility was reduced to $1.2 billion from the previous $1.4 billion. October 6, 2009

Potentially Severe Problems

Zacks Investment Research Page 9 www.zackspro.com The used car marketplace is competitive. Sales trends at CarMax can be impacted by price promotional activities of new car manufacturers so that new car pricing/marketing by motor companies may remain aggressive, causing sales of late-model used cars at KMX to suffer. October 6, 2009

Long-Term Growth

The estimated long-term growth rates range from 18.0% (William Blair) to 21.0% (Wells Fargo Securities). The average long-term growth rate is 19.7%.

Management believes the company has a superior business model for automotive retailing and it plans to continue investing in order to support its long-term growth initiatives.

CarMax remains more focused on the Web versus print media due to increased customer awareness. The company plans to increase its Internet advertising investment while significantly reducing print media, as newspaper readership trends are declining (especially among younger, higher income consumers that KMX targets). The move is in keeping with trends in the overall industry, as the Internet outstripped newspapers as a vehicle search method. The company’s website, carmax.com, allows car shoppers to search for specific vehicle options that match their lifestyle, including price, mileage, type, popular features, and other options. The site offers access to CarMax inventory throughout U.S., and allows customers to personalize their search, creating a fresh list of prospective buyers. This is a significant improvement over most existing vehicle search websites.

The firms believe that investors will likely take a long-term outlook on CarMax as the near-term challenges of the credit market are likely to be transitory.

The firms believe KMX shares will likely not be overlooked by investors with an investment horizon beyond a year. The firms expect used car comps to improve over the next few quarters, allowing management to rekindle new store growth. KMX’s customer-friendly approach to all aspects of used vehicle retail and finance significantly provides the company an edge over competitors and will drive growth over the long term. November 16, 2009

Upcoming Events

On December 18, 2009, KMX is scheduled to release its 3Q10 financial results.

Individual Firm Opinions

POSITIVE RATINGS (21.4%)

BGB Securities − Buy ($25.00 - target price) − (10/15/2009): The firm maintained a Buy rating and a target price of $25.00 per share, reflecting increased optimism about KMX’s near-term earnings potential and continued strong belief in the company’s long-term growth opportunities. INVESTMENT SUMMARY: The firm remains optimistic about the company’s expansion potential, given an unrivaled consumer offering, superior inventory and cost management systems, and a proven ability to grow profitably.

Zacks Investment Research Page 10 www.zackspro.com Rochdale Research − Buy ($25.00 - target price) − (10/29/2009): The firm maintained a Buy rating and a target price of $25.00 per share. INVESTMENT SUMMARY: The firm is optimistic about KMX’s earnings potential as the Company generates impressive cash profitability at or near the bottom of the worst automotive downturn.

William Blair – Outperform – (10/28/09) – The firm maintained an Outperform rating. INVESTMENT SUMMARY: The firm applauds the company’s management for its strong execution in a difficult environment, with the company’s ability to post solid earnings in a recovering economic environment. The firm believes that CarMax remains a growth story, and expects an eventual reacceleration in store expansion to enhance the earnings power of the company. The firm also believes that the stock multiple is sustainable as comps accelerate, particularly given the scarcity premium associated with the relatively few remaining high-growth stories in the retail space.

NEUTRAL RATINGS (78.6%)

CL King – Neutral – (10/08/09) – The firm maintained a Neutral rating.

Pali Research – Neutral – (09/22/09) – The firm upgraded the rating to Neutral from Sell.

ValuEngine – Hold ($18.56) – (11/05/09) – The firm maintained a Hold rating and a target price of $18.56 per share.

Wells Fargo Securities – Market Perform ($21.50) – (10/06/09) – The firm initiated coverage with a Market Perform rating and a target price range between $21.00 to $22.00 per share (average is $21.50 per share). INVESTMENT SUMMARY: The firm is optimistic about KMX’s business model, which has unique competitive advantages in procuring its inventory and merchandising its vehicles off and on-line. The firm believes that the company is positioned for potential acceleration in topline growth, operating margin and favorable financing conditions. The firm expects that new store growth will drive up the gross margin levers.

Deutsche Bank – Hold ($19) – (9/22/09) – The firm maintained a Hold rating and a target price of $19.00 per share. INVESTMENT SUMMARY: The firm believes that the company has the potential for long-term organic growth through expansion of its regional presence.

Goldman – Neutral ($22) – (10/16/09) – The firm maintained a Neutral rating and a target price of $22.00 per share. INVESTMENT SUMMARY: The firm remains positive on the stock based on KMX’s organic growth opportunity, with virtually no used car competition, and the scarcity of growth stories in retail. However, the firm expects accelerating unit growth to weigh on margins in the near term.

J.P. Morgan − Neutral ($22) − (10/22/09): The firm reiterated a Neutral rating and a target price of $22.00 per share. INVESTMENT SUMMARY: The firm considers KMX as a growth company despite temporary cessation of store growth, given the attractiveness of its consumer approach.

Oppenheimer – Perform ($19) – (09/22/09) – The firm maintained a Perform rating and the target price of $19.00 per share.

R W. Baird − Neutral ($26) − (09/22/09): The firm reiterated a Neutral rating and increased the target price to $26.00 from $24.00 per share. INVESTMENT SUMMARY: The firm remains optimistic on the long-term opportunities of KMX but expects discretionary consumer spending to remain weak as the economy absorbs the impact of the credit bubble, weak housing market, and broader recessionary trends.

RBC Cap. – Sector Perform ($22) – (09/22/09) – The firm maintained a Sector Perform rating and raised the target price to $22.00 from $16.00 per share. INVESTMENT SUMMARY: The firm believes

Zacks Investment Research Page 11 www.zackspro.com that CarMax's longer-term growth opportunity continues to gain share in a large and highly fragmented market and has significant store growth potential. However, current industry trends continue to appear volatile and the lack of consistency makes the firm maintain a cautious outlook.

UnionBankSwitz. – Neutral ($22) – (11/02/09) – The firm initiated coverage with a Neutral rating and a target price of $22.00 per share. INVESTMENT SUMMARY: The firm believes that CarMax is a company with a unique business model and it is well positioned in the current economic scenario. According to the firm, the stock can appeal to the long-term investors but the stock is currently overvalued.

Research Associate Soumyajit Das Copy Editor Pushpanjali B. Content Ed. Jewel Saha No. of brokers reported/Total 9/13 brokers Reason for Update Daily

Zacks Investment Research Page 12 www.zackspro.com