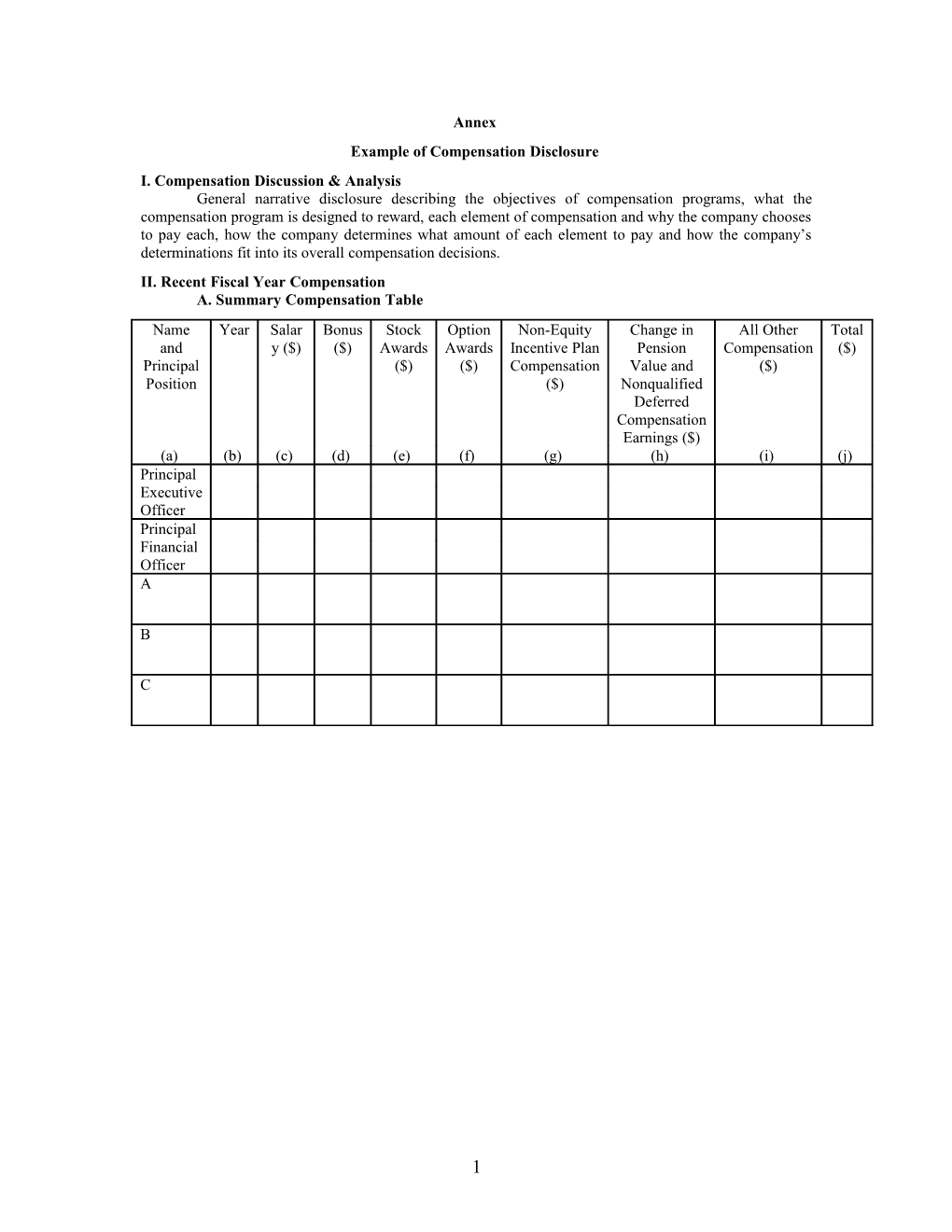

Annex Example of Compensation Disclosure I. Compensation Discussion & Analysis General narrative disclosure describing the objectives of compensation programs, what the compensation program is designed to reward, each element of compensation and why the company chooses to pay each, how the company determines what amount of each element to pay and how the company’s determinations fit into its overall compensation decisions. II. Recent Fiscal Year Compensation A. Summary Compensation Table Name Year Salar Bonus Stock Option Non-Equity Change in All Other Total and y ($) ($) Awards Awards Incentive Plan Pension Compensation ($) Principal ($) ($) Compensation Value and ($) Position ($) Nonqualified Deferred Compensation Earnings ($) (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) Principal Executive Officer Principal Financial Officer A

B

C

1 B. Grants of Plan-Based Awards

Name Grant Estimated Future Payouts Estimated Future Payouts All Other All Other Exercise Date Under Non-Equity Under Equity Incentive Stock Option or Base Incentive Plan Awards Awards: Awards: Price of Plan Awards Number Number of Option of Securities Awards Shares of Underlying ($/sh) Thres- Target Maxi- Thres- Target Maxi- Stock or Options hold ($) mum hold ($) mum Units (#) (#) ($) ($) ($) ($)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) Principal Executive Officer Principal Financial Officer A

B

C

C. Narrative Disclosure Narrative disclosure describing any material factors necessary to understand the tables above, including the material terms of each named executive officer’s employment agreement, a description of any repricing or modification of equity awards over the year, the material terms of any plan-based awards and an explanation of the amount of salary and bonus in proportion to total compensation.

2 III. Equity Holdings and Value Realization A. Outstanding Equity Awards at Fiscal Year-End

Option Awards Stock Awards Name Number of Number of Equity Option Option Number Market Equity Equity Securities Securities Incentive Exercise Expiration of Value Incentive Incentive Underlying Underlying Plan Price ($) Date Shares of Plan Plan Unexercised Unexercised Awards: or Units Shares Awards: Awards: Options (#) Options (#) Number of of Stock or Number Market or Exercisable Unexercisable Securities That Units of Payout Underlying Have of Unearned Value of Unexer- Not Stock Shares, Unearned cised Vested That Units or Shares, Unearned (#) Have Other Units or Options (#) Not Rights Other Vested That Rights ($) Have Not That Vested Have (#) Not Vested ($) (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) Principal Executive Officer Principal Financial Officer A B C

B. Option Exercises and Stock Vested

Option Awards Stock Awards Name Number of Value Number of Value Shares Realized on Shares Realized Acquired on Exercise ($) Acquired on on Vesting ($) Exercise (#) Vesting (#) (a) (b) (c) (d) (e) Principal Executive Officer Principal Financial Officer A B C

3 IV. Post-Employment Benefits A. Pension Benefits Name Plan Name Number of Present Value of Payments Years Accumulated During Last Credited Benefit ($) Fiscal Year ($) Service (#) (a) (b) (c) (d) (e) Principal Executive Officer Principal Financial Officer A B C

B. Nonqualified Deferred Compensation Name Executive Registrant Aggregat Aggregate Aggregate Contributions Contributions e Withdrawals/ Balance at in last FY ($) in last FY ($) Earnings Distributions Last FYE in Last ($) ($) (f) (a) (b) (c) FY ($) (e) (d) Principal Executive Officer Principal Financial Officer A B C

C. Potential Payments on Termination or Change in Control Narrative and quantitative disclosure of termination and change-in-control arrangements with named executive officers, including quantification of estimated payments and benefits and an explanation of the circumstances giving rise to payments, factors used to determine the appropriate amount of payments and benefits and the material conditions to the named executive officers’ receipt of such payments.

4 V. Director Compensation A. Director Compensation Name Fees Stock Option Non-Equity Change in All Other Total Earned Awards Awards Incentive Plan Pension Compensation ($) or ($) ($) Compensation Value and ($) Paid in ($) Nonqualified Cash Deferred ($) Compensation Earnings ($) (a) (b) (c) (d) (e) (f) (g) (h) A B C D E

B. Narrative Disclosure Narrative disclosure of any material factors necessary to understand the director compensation disclosed in the table, including a description of standard arrangements and whether any director has a different arrangement.

Merrill Corporation products and services are designed to provide accurate and current information with regard to the subject matter covered. Products and services are provided with the understanding that neither the Corporation, any affiliate company, nor the editors/content authors are engaged in rendering legal, accounting, or other professional or business advice. If legal advice or other expert assistance is required, the personalized service of a competent professional should be sought. Persons using these products when dealing with specific legal matters should also research original sources of authority.

5