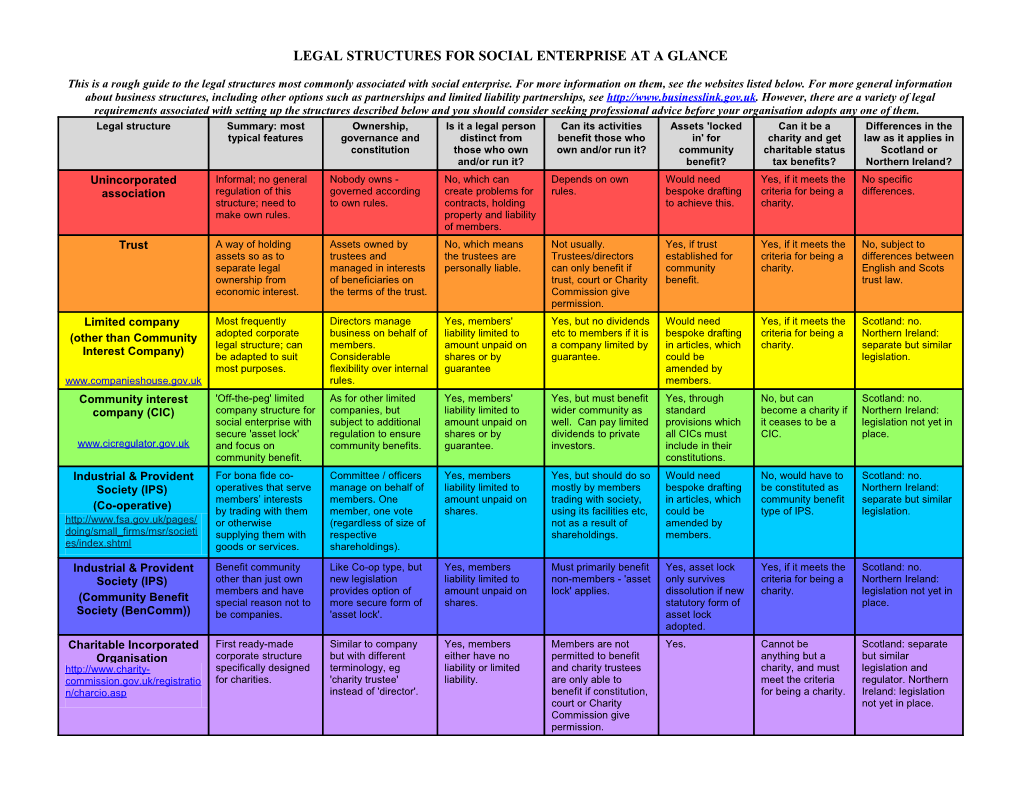

LEGAL STRUCTURES FOR SOCIAL ENTERPRISE AT A GLANCE

This is a rough guide to the legal structures most commonly associated with social enterprise. For more information on them, see the websites listed below. For more general information about business structures, including other options such as partnerships and limited liability partnerships, see http://www.businesslink.gov.uk. However, there are a variety of legal requirements associated with setting up the structures described below and you should consider seeking professional advice before your organisation adopts any one of them. Legal structure Summary: most Ownership, Is it a legal person Can its activities Assets 'locked Can it be a Differences in the typical features governance and distinct from benefit those who in' for charity and get law as it applies in constitution those who own own and/or run it? community charitable status Scotland or and/or run it? benefit? tax benefits? Northern Ireland? Unincorporated Informal; no general Nobody owns - No, which can Depends on own Would need Yes, if it meets the No specific association regulation of this governed according create problems for rules. bespoke drafting criteria for being a differences. structure; need to to own rules. contracts, holding to achieve this. charity. make own rules. property and liability of members. Trust A way of holding Assets owned by No, which means Not usually. Yes, if trust Yes, if it meets the No, subject to assets so as to trustees and the trustees are Trustees/directors established for criteria for being a differences between separate legal managed in interests personally liable. can only benefit if community charity. English and Scots ownership from of beneficiaries on trust, court or Charity benefit. trust law. economic interest. the terms of the trust. Commission give permission. Limited company Most frequently Directors manage Yes, members' Yes, but no dividends Would need Yes, if it meets the Scotland: no. (other than Community adopted corporate business on behalf of liability limited to etc to members if it is bespoke drafting criteria for being a Northern Ireland: legal structure; can members. amount unpaid on a company limited by in articles, which charity. separate but similar Interest Company) be adapted to suit Considerable shares or by guarantee. could be legislation. most purposes. flexibility over internal guarantee amended by www.companieshouse.gov.uk rules. members. Community interest 'Off-the-peg' limited As for other limited Yes, members' Yes, but must benefit Yes, through No, but can Scotland: no. company (CIC) company structure for companies, but liability limited to wider community as standard become a charity if Northern Ireland: social enterprise with subject to additional amount unpaid on well. Can pay limited provisions which it ceases to be a legislation not yet in secure 'asset lock' regulation to ensure shares or by dividends to private all CICs must CIC. place. www.cicregulator.gov.uk and focus on community benefits. guarantee. investors. include in their community benefit. constitutions. Industrial & Provident For bona fide co- Committee / officers Yes, members Yes, but should do so Would need No, would have to Scotland: no. Society (IPS) operatives that serve manage on behalf of liability limited to mostly by members bespoke drafting be constituted as Northern Ireland: members’ interests members. One amount unpaid on trading with society, in articles, which community benefit separate but similar (Co-operative) by trading with them member, one vote shares. using its facilities etc, could be type of IPS. legislation. http://www.fsa.gov.uk/pages/ or otherwise (regardless of size of not as a result of amended by doing/small_firms/msr/societi supplying them with respective shareholdings. members. es/index.shtml goods or services. shareholdings). Industrial & Provident Benefit community Like Co-op type, but Yes, members Must primarily benefit Yes, asset lock Yes, if it meets the Scotland: no. Society (IPS) other than just own new legislation liability limited to non-members - 'asset only survives criteria for being a Northern Ireland: members and have provides option of amount unpaid on lock' applies. dissolution if new charity. legislation not yet in (Community Benefit special reason not to more secure form of shares. statutory form of place. Society (BenComm)) be companies. 'asset lock'. asset lock adopted. Charitable Incorporated First ready-made Similar to company Yes, members Members are not Yes. Cannot be Scotland: separate Organisation corporate structure but with different either have no permitted to benefit anything but a but similar http://www.charity- specifically designed terminology, eg liability or limited and charity trustees charity, and must legislation and commission.gov.uk/registratio for charities. 'charity trustee' liability. are only able to meet the criteria regulator. Northern n/charcio.asp instead of 'director'. benefit if constitution, for being a charity. Ireland: legislation court or Charity not yet in place. Commission give permission.