February 6, 2018

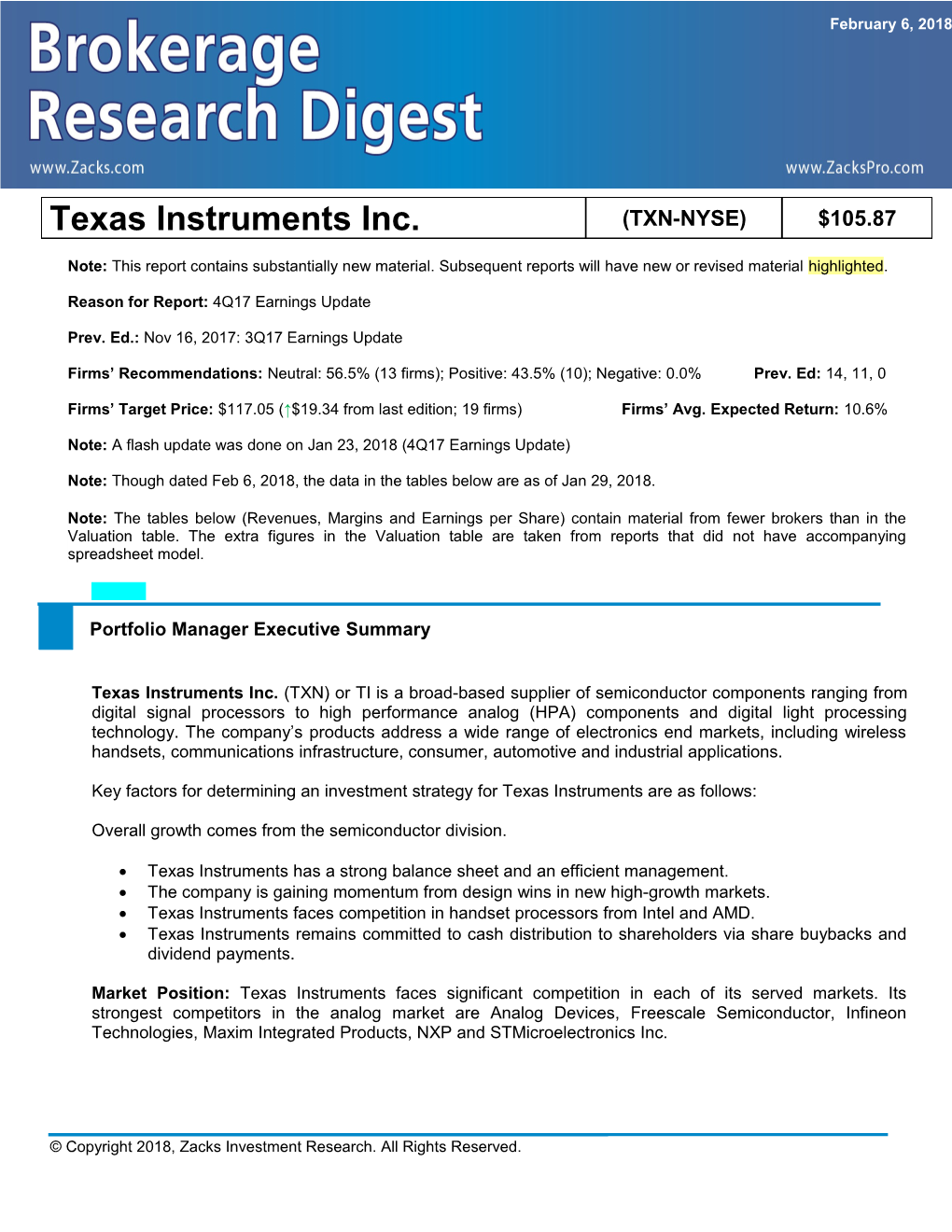

Texas Instruments Inc. (TXN-NYSE) $105.87

Note: This report contains substantially new material. Subsequent reports will have new or revised material highlighted.

Reason for Report: 4Q17 Earnings Update

Prev. Ed.: Nov 16, 2017: 3Q17 Earnings Update

Firms’ Recommendations: Neutral: 56.5% (13 firms); Positive: 43.5% (10); Negative: 0.0% Prev. Ed: 14, 11, 0

Firms’ Target Price: $117.05 (↑$19.34 from last edition; 19 firms) Firms’ Avg. Expected Return: 10.6%

Note: A flash update was done on Jan 23, 2018 (4Q17 Earnings Update)

Note: Though dated Feb 6, 2018, the data in the tables below are as of Jan 29, 2018.

Note: The tables below (Revenues, Margins and Earnings per Share) contain material from fewer brokers than in the Valuation table. The extra figures in the Valuation table are taken from reports that did not have accompanying spreadsheet model.

Portfolio Manager Executive Summary

Texas Instruments Inc. (TXN) or TI is a broad-based supplier of semiconductor components ranging from digital signal processors to high performance analog (HPA) components and digital light processing technology. The company’s products address a wide range of electronics end markets, including wireless handsets, communications infrastructure, consumer, automotive and industrial applications.

Key factors for determining an investment strategy for Texas Instruments are as follows:

Overall growth comes from the semiconductor division.

Texas Instruments has a strong balance sheet and an efficient management. The company is gaining momentum from design wins in new high-growth markets. Texas Instruments faces competition in handset processors from Intel and AMD. Texas Instruments remains committed to cash distribution to shareholders via share buybacks and dividend payments.

Market Position: Texas Instruments faces significant competition in each of its served markets. Its strongest competitors in the analog market are Analog Devices, Freescale Semiconductor, Infineon Technologies, Maxim Integrated Products, NXP and STMicroelectronics Inc.

© Copyright 2018, Zacks Investment Research. All Rights Reserved. Firms’ sentiment is mixed, with 56.5% covering the stock giving it a neutral rating, while 43.5% issuing a positive rating. According to the Digest Zacks model, target prices range from a low of $95.00 to a high of $150.00, with the average being $117.05.

Cautious (Neutral or equivalent ratings) – 13 firms or 56.5% – Texas instruments is already a market leader in the global analog industry and has been improving on its market share in the last few years. However, these firms are doubtful about the company’s ability to further enhance its market share without compromising on prices. They believe that TXN is not immune to the wireless market segment inventory correction. They are also concerned about revenue downside due to the inability of the company in converting design wins into product volume growth. They fear growing competition in Analog and DSP markets that might slow down the company’s growth in the future.

Bullish (Buy or equivalent ratings) – 10 firms or 43.5% – These firms believe that Texas Instruments is poised to grow, given the large and growing analog market. The $40 billion market is expected to grow 9% annually through 2019. They believe that growth will be aided by increasing demand for analog content in the Internet of Things (IoT) space. The firms are positive about Texas Instruments’ increased focus on analog and believe that the company’s efforts in applying advanced manufacturing technology to analog with its 300-mm foundry assets will be a long-term tailwind to analog manufacturing cost leadership.

February 6, 2018

Overview

Key investment considerations as identified by the firms are as follows:

Key Positive Arguments Key Negative Arguments Competitive Position: Texas Instruments has a High Dependence: Texas Instruments is exposed to competitive advantage over its peers and is the leading customer concentration risk. supplier of DSPs, analog and signal processing circuits. External Factors: There is weak end-market demand for a broad range of electronic devices including Compelling Fundamentals: Texas Instruments is wireless handsets, telecom equipment and well positioned across all its end markets and is computer/peripherals. Slower-than-expected traction in experiencing traction in high-growth and high-margin advanced phones and heightened competition from low- businesses. The high performance analog (HPA) is cost providers of low-end phones and broadband & improving, DLP remains steady while new areas like communication analog areas remain the causes of VoIP are performing well. concern. Texas Instruments is also being plagued by back-end capacity constraints, competition and pricing Financial Position: Texas Instruments is expected to pressure. achieve high gross and operating margin expansion based on strong demand and cost-cutting efforts over Growth: Slower-than-expected uptake of 4G services the long run. on a global basis will affect wireless revenue growth. Potential fluctuations in DLP adoption rate may hinder Other Positives: Texas Instruments is seeing growth. Texas Instruments’ top line is exposed to particular success in growing markets like cyclical variations in the semiconductor industry. The automotive and industrial. The company is also analog cycle can also slow down, going forward. doing well in the Internet of Things (IoT) market.

Cost Advantage: Texas Instruments aims at applying advanced manufacturing technology to analog and produce them at a competitive cost.

Zacks Investment Research Page 2 www.zackspro.com Dallas-based, Texas Instruments (TXN) is one of the leading semiconductor manufacturers in the world and the largest global supplier of communication chips. The company also designs and manufactures standard logic, application-specific integrated circuits (ASIC), reduced instruction set computers (RISC), microprocessors, microcontrollers, and digital light processing (DLP) products. End-market exposure is spread across the wireless, broadband, consumer electronics, PC peripheral and industrial sectors. The company reports its revenues in three segments comprising: Analog, Embedded Processing and Other. For more information on the company, please visit the company’s website www.ti.com.

Note: The company’s fiscal year coincides with the calendar year. February 6, 2018

Long-Term Growth

Texas Instruments intends to make analog the most important growth engine through continued momentum in high-performance analog, accelerated growth in application-specific analog, use of process technology to differentiate, and capitalization of strong manufacturing capability. The analog industry offers ample opportunities for these as well, exhibiting more stable economic characteristics.

Firms believe that Texas Instruments is poised to grow, given the large and growing analog market. The company also strives to grow in embedded processing markets, to widen its leadership in applications processors for the wireless market — OMAP; and to initiate new opportunities in areas like medical electronics, energy efficiency, low power and safety. The company’s strategy is to drive significant growth while generating high returns on investments. Opportunistic purchases of manufacturing assets with long productive lives at low prices are important to the company’s growth strategy.

In the long term, Texas Instruments’ competitive position remains strong and management remains committed to allocating appropriate resources in order to improve the analog business. The analysts believe that the company is prudently investing its R&D dollars into several high-margin, high-growth areas of the analog and embedded processing markets. This is gradually increasing its exposure to the industrial and automotive markets, while reducing its exposure to the volatile consumer/computing markets. These would boost the company’s long-term growth and stabilize margins with incremental sales and share gains in end markets like industrial and automotive.

Internet of Things (IoT) will continue to offer significant opportunity for the company. According to IDC, the worldwide IoT market is expected to grow roughly 13% annually through 2020. The scope of IoT is tremendous for semiconductor companies, since it connects every conceivable electronic device. We believe this market will experience widespread adoption in the coming years as a result of cost savings from increased automation and the promise of greater productivity. Higher analog content will be needed to support the IoT trend, which will be a big positive for Texas Instruments in the near future.

February 6, 2018

Zacks Investment Research Page 3 www.zackspro.com Target Price/Valuation

Given below is a summary of target price and rating as compiled by Zacks Research Digest:

Rating Distribution Positive 43.5%↓ Neutral 56.5%↑ Negative 0.0% Digest High $150.00↑ Digest Low $95.00↑ Avg. Target Price $116.00↑ No. of Analysts with Target Price/ Total 19/23

According to the firms covering the stock, risks to the price objective include but are not limited to the following:

Disruption in the semiconductor industry recovery, including inventory corrections, economic slowdown, and pricing pressure. Design wins from major handset makers by competitors. Unexpected fluctuations in end-market demand, particularly in the wireless handset end market.

Recent Events

On Feb 6, 2018, Texas Instruments launched the industry's smallest operational amplifier (op amp) and low- power comparators. These will help in reducing system size and cost, while maintaining high performance in a variety of IoT devices, personal electronics and industrial systems.

On Jan 23, 2018, Texas Instruments announced 4Q17 financial results. Highlights are as follows:

. Total revenues were $3.75 billion, increasing 9.8% year-over-year but down 9.8% sequentially

Zacks Investment Research Page 4 www.zackspro.com . Non-GAAP EPS increased 24% y/y to $1.09.

Revenues

According to the press release, the company reported revenues of $3.75 billion, up 9.8% on a year-over- year basis but down 9.8% sequentially. However, it came ahead of the guided range of $3.57-$3.87 billion.

The robust results were primarily driven by strength in auto and industrial markets.

Segment wise, growth of analog and embedded processing applications business was strong. These typically yield a more stable business as well as strong margins. The Other segment declined year over year.

Segment Revenues

Provided below is a summary of revenues as compiled by Zacks Research Digest:

Total Revenues 4Q16A 3Q17A 4Q17A 1Q18E 2016A 2017A 2018E 2019E ($ in million) Digest Average $3,414.0 $4,116.0 $3,750.0 $3,653.4 $13,370.0 $14,961.0 $15,697.5 $16,452.3 Digest High $3,414.0 $4,116.0 $3,750.0 $3,715.0 $13,370.0 $14,961.0 $16,090.0 $17,329.0 Digest Low $3,414.0 $4,116.0 $3,750.0 $3,640.0 $13,370.0 $14,961.0 $15,440.0 $15,775.0 Y/Y Growth 7.1% 12.0% 9.8% 7.4% 0.0% 11.9% 4.9% 4.8% Q/Q Growth -7.1% 11.5% -8.9% -11.2%

Analog, Embedded Processing and Other segments generated 68%, 24% and 8% of quarterly revenues, respectively.

Analog, which includes Power, Signal Chain and High Volume products, was up 11% from the year-ago quarter to $2.5 billion. The year-over-year growth was driven by strong performance in product lines — power and signal chain.

The Embedded Processing segment, which includes Connected Microcontrollers and Processors, was up 20% year over year to $896 million. The year-over-year growth was driven by stronger sales across both the product lines — processors and connected microcontrollers.

The Other segment, which includes DLPs, custom ASICs and calculators, was down 16% year over year to $319 million. The decline was primarily due to custom ASIC and royalties moving to other income and expenses beginning in the first quarter of 2017.

Provided below is a summary of segmental revenues as compiled by Zacks Research Digest:

Segmental Revenues ($ in 4Q16A 3Q17A 4Q17A 1Q18E 2016A 2017A 2018E 2019E million) Analog $2,290.0 $2,698.0 $2,535.0 $2,431.0 $8,536.0 $9,900.0 $10,513.0 $11,160.0 Zacks Investment Research Page 5 www.zackspro.com Embedded Processing $744.0 $931.0 $896.0 $906.0 $3,023.0 $3,498.1 $3,810.5 $4,022.0 Other $380.0 $487.0 $319.0 $304.0 $1,810.9 $1,563.0 $1,372.0 $1,286.0 Total revenues $3,414.0 $4,116.0 $3,750.0 $3,653.4 $13,370.0 $14,961.0 $15,697.5 $16,452.3

Outlook

For the first quarter of 2018, the chipmaker expects sales between $3.49 billion and $3.79 billion (down 3% sequentially at the mid-point).

The majority of the firms are positive about Texas Instrument’s strong position in the Industrial and Automotive markets, with strong sequential growth in both analog and embedded processing revenues. They believe that this will reduce the company’s exposure to the volatile consumer/computing markets, thus bringing in more stable revenues in the future. They are also positive about the company’s focus on more specialized analog chips, which is expected to drive revenues, going forward.

Additionally, the firms contend that Texas Instruments will continue to gain traction in the IoT, analog and embedded solutions market with good engineering design depth, high-volume, cost-effective analog manufacturing and a broad combined product portfolio.

On the contrary, other firms believe that the inventory correction in the wireless smartphone sector will continue to weigh on sales in the near term. Also, they believe that weak PC demand remains a concern and will likely impact revenues. They also expect foreign currency headwinds to continue impacting revenues in the upcoming quarter.

Please refer to the Zacks Research Digest spreadsheet on TXN for detailed revenue estimates.

Margins

According to the press release, Texas Instruments’ gross margin of 65.1% was up 54 basis points (bps) sequentially and 259 bps from the year-ago quarter.

The company’s gross margin has been improving consistently, as more production shifts to its 300 mm line.

Operating expenses of $877 million were up 1.0% sequentially and 8.9% from last year. Operating margin was 41.7%, down 176 bps sequentially and 278 bps from the year-ago quarter.

Provided below is a summary of margins as compiled by Zacks Research Digest:

Margins 4Q16A 3Q17A 4Q17A 1Q18E 2016A 2017A 2018E 2019E Gross 62.5% 64.5% 65.1% 64.3% 61.6% 64.3% 65.0% 65.6% Operating 40.4% 45.4% 43.9% 40.6% 38.2% 42.9% 43.1% 43.6% Pre-tax 45.0% 45.4% 43.5% 40.8% 39.0% 42.8% 43.3% 44.4% Net 32.0% 32.5% 21.7% 31.4% 27.9% 29.0% 32.7% 34.7%

Outlook Zacks Investment Research Page 6 www.zackspro.com The majority of the analysts expect gross margins to improve in the upcoming quarter as the company continues with its transition to analog. They contend that a richer product mix, which includes a higher mix of analog and embedded processing, will aid gross margin expansion in the long term.

Few analysts believe that benefits of restructuring actions, greater 300-mm volumes, lower depreciation, practiced execution increasing growth from the automotive and industrial end markets and strong cost cutting measures will aid gross margin expansion.

Additionally, some analysts contend that the Analog segment will continue to be the biggest driver of Texas Instruments’ growth, and will aid its overall margin structure. They believe that the entry of new designs (analog and embedded processing products) into volume production should help gross margin move toward the long-term target of 60%. Further, they believe that the company will likely outgrow the overall industry largely supported by market share gains in Analog and increasing silicon content in mobile marketing.

Please refer to the Zacks Research Digest spreadsheet on TXN for detailed margin estimates.

Earnings per Share

According to the press release, proforma EPS was $1.09 compared, up 24% year over year but down 14% sequentially.

Provided below is a summary of EPS as compiled by Zacks Research Digest:

EPS 4Q16A 3Q17A 4Q17A 1Q18E 2016A 2017A 2018E 2019E Digest High $1.09 $1.34 $1.15 $1.14 $3.66 $4.63 $5.15 $5.79 Digest Low $1.06 $1.32 $0.39 $1.14 $3.75 $3.77 $5.09 $5.74 Digest Average $1.07 $1.33 $0.81 $1.14 $3.59 $4.29 $5.12 $5.76 Y/Y Growth 30.2% 29.9% -24.6% 9.8% 0.0% 17.2% 19.4% 12.5% Q/Q Growth 5.0% 21.4% -39.1% 40.9%

Note: The EPS data mentioned in the text of this section differs from the rest of report due to the difference in calculation or consideration of one-time items

Outlook

For the first quarter, management expects EPS in the range of $1.01-$1.17.

Zacks Investment Research Page 7 www.zackspro.com Majority of the firms increased their estimates for the upcoming quarter, driven by sales contribution from its 300mm fabs, new tax reform policies, continuous strength from industrial and automotive markets, practiced execution, differentiation in its business, expectations of higher revenues and higher gross margins.

On the contrary, a few firms lowered their EPS estimates due to weakness in the company’s wireless market smartphone market and foreign currency headwinds.

Please refer to the Zacks Research Digest spreadsheet on TXN for detailed EPS estimates

Research Analyst Shalu Saraf Copy Editor Ritujay Ghosh Content Ed. QCA / Lead Analyst Aniruddha Ganguly No. of brokers reported/Total 19/23 brokers Reason for Update 4Q17 Earnings Update

Zacks Investment Research Page 8 www.zackspro.com