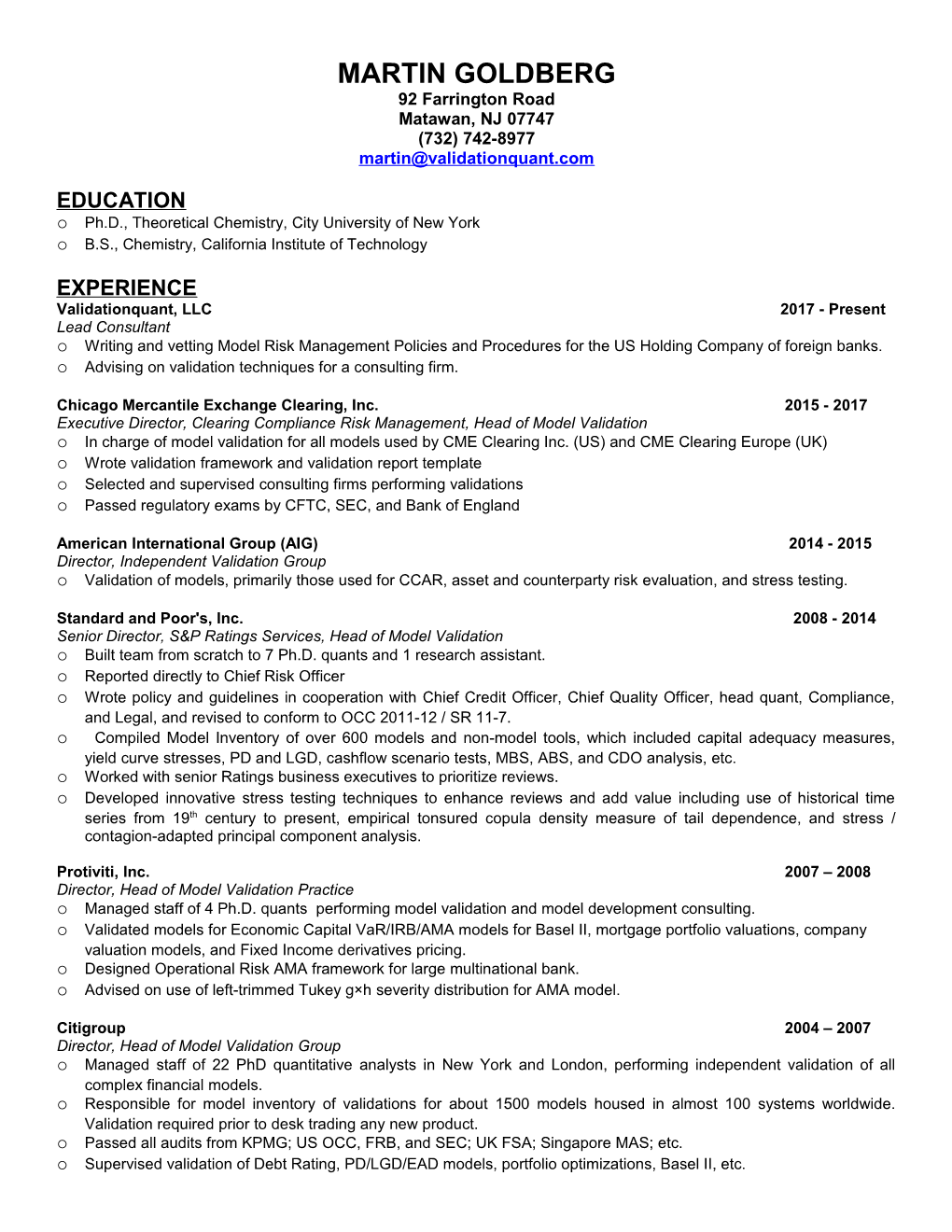

MARTIN GOLDBERG 92 Farrington Road Matawan, NJ 07747 (732) 742-8977 [email protected]

EDUCATION o Ph.D., Theoretical Chemistry, City University of New York o B.S., Chemistry, California Institute of Technology

EXPERIENCE Validationquant, LLC 2017 - Present Lead Consultant o Writing and vetting Model Risk Management Policies and Procedures for the US Holding Company of foreign banks. o Advising on validation techniques for a consulting firm.

Chicago Mercantile Exchange Clearing, Inc. 2015 - 2017 Executive Director, Clearing Compliance Risk Management, Head of Model Validation o In charge of model validation for all models used by CME Clearing Inc. (US) and CME Clearing Europe (UK) o Wrote validation framework and validation report template o Selected and supervised consulting firms performing validations o Passed regulatory exams by CFTC, SEC, and Bank of England

American International Group (AIG) 2014 - 2015 Director, Independent Validation Group o Validation of models, primarily those used for CCAR, asset and counterparty risk evaluation, and stress testing.

Standard and Poor's, Inc. 2008 - 2014 Senior Director, S&P Ratings Services, Head of Model Validation o Built team from scratch to 7 Ph.D. quants and 1 research assistant. o Reported directly to Chief Risk Officer o Wrote policy and guidelines in cooperation with Chief Credit Officer, Chief Quality Officer, head quant, Compliance, and Legal, and revised to conform to OCC 2011-12 / SR 11-7. o Compiled Model Inventory of over 600 models and non-model tools, which included capital adequacy measures, yield curve stresses, PD and LGD, cashflow scenario tests, MBS, ABS, and CDO analysis, etc. o Worked with senior Ratings business executives to prioritize reviews. o Developed innovative stress testing techniques to enhance reviews and add value including use of historical time series from 19th century to present, empirical tonsured copula density measure of tail dependence, and stress / contagion-adapted principal component analysis.

Protiviti, Inc. 2007 – 2008 Director, Head of Model Validation Practice o Managed staff of 4 Ph.D. quants performing model validation and model development consulting. o Validated models for Economic Capital VaR/IRB/AMA models for Basel II, mortgage portfolio valuations, company valuation models, and Fixed Income derivatives pricing. o Designed Operational Risk AMA framework for large multinational bank. o Advised on use of left-trimmed Tukey g×h severity distribution for AMA model.

Citigroup 2004 – 2007 Director, Head of Model Validation Group o Managed staff of 22 PhD quantitative analysts in New York and London, performing independent validation of all complex financial models. o Responsible for model inventory of validations for about 1500 models housed in almost 100 systems worldwide. Validation required prior to desk trading any new product. o Passed all audits from KPMG; US OCC, FRB, and SEC; UK FSA; Singapore MAS; etc. o Supervised validation of Debt Rating, PD/LGD/EAD models, portfolio optimizations, Basel II, etc. o Updated Model Control Policy and set new guidelines for parser frameworks. . Citigroup 2001 – 2004 Vice President, Market Risk Analytics o Obtained regulatory approvals for Value-at-Risk (VaR) of certain SSB desks. o Incorporated new VaR measures, such as cross-gamma and Recovery Rate delta. o Designed Jacobian transforms to convert Greeks. o Led research on improved VaR methodologies, including copulas and rank correlations, optimal index mapping, index cluster analysis, fat tail modeling and Incremental Event Risk.

Chase Manhattan Bank (now J.P.Morgan) 1996 – 2001 Vice President, Market Risk Management o Designed and led implementation team for CEDAR (Chase Event / Default Analysis of Risk) add-on to VaR (Value at Risk). This was the Basel I version of Incremental Risk Charge (IRC). Chase was the only US bank to model event risk in the 1990s, and thus its VaR capital multiplier was 3 instead of 4. CEDAR was used by JP Morgan Chase until 2007. CEDAR was based on discrete non-parametric statistics and full valuation of all ratings transition scenarios. o Freed up $30 billion dollars of risk-weighted assets by CEDAR raising Tier 1 Ratio from 7.4 to 8.3. o Architected and led development team for Loan Mark-to-Market system that priced corporate bonds, loans, and credit derivatives consistently, calibrated to individual corporate yield spread curves.

Chase Manhattan Bank (now J.P.Morgan) 1991 – 1996 Vice President, Head Quantitative Analyst, Product Analysis Group o Supervised team of 8 quants and 10 programmers. o Responsible for developing trading analytics and hedging systems, validating models developed elsewhere, providing numerical and programming expertise to desks, and explaining our models at OCC audits. o Designed and led development team for Emerging Markets Bond Options SubSystem(EMBOSS) - a real-time, GUI- based system for pricing, market-making, scenario analysis, and risk management for portfolio of options and underlying Bradys o Headed team for Fixed Income Analytics System (FINALS) - pricing, scenario analysis, OAS (option-adjusted spread) modeling, and risk management for corporate bonds, based on a Black-Derman-Toy model, implemented with a trinomial tree with variable timesteps and gear-shifting. PRESENTATIONS o May 21, 2015 - "A Practitioner’s Short Course on Model Validation" (also November 30, 2015) o May 6, 2015 - "Validating Stress testing Models" o October 16, 2014 Risk Training – " Validating Counterparty Risk Models" o April 8, 2014 Marcus Evans workshop – “Model Validation: My Personal View” (also November 14, 2013 DTCC Model Validation workshop) o January 31, 2014 – Rutgers University - "Statistical Quirks, Subtleties, and Surprises in Financial Data" o March 12, 2013 IQPC Conference - “Hoist by Your Own Assumptions - Data vs. Predictions” o September 29, 2011 Risk Training – “Case Studies in Stress Testing for Model Validation” o September 21, 2011 Predictive Analytics for Banking – “The Future is Different: Non-Stationarity and Regime Change” (voted best presentation in conference) o March 16, 2011 Risk Training - “Model Pitfalls” (also June 2011) o July 11, 2007 Quant Congress USA - “Validation of Credit Derivative Models” o April 17, 2007 Risk Training - “Employing VaR to Measure Exposure Risk” o March 7, 2007 OCC Course for Examiners - “Validation of Credit Risk Models at Citigroup” o November 9, 2006 Risk Training – “Stress Testing for Market Risk” o June 29, 2006 Risk Training - “Economic Capital For Trading Market Risk” o May 11, 2006 Risk Training – “Model Risk of Correlation Products”

PUBLICATIONS o “Much Of Model Risk Does Not Come From Any Model” J. Structured Finance 23(1), Spring 2017, pages 32 - 37 o “Tonsured and Anti-Robust Statistics” http://arxiv.org/abs/1110.4648 o S&P RatingsDirect, December 2009, “On The Use Of Models By Standard & Poor's Ratings Services” ( http://img.en25.com/Web/StandardandPoors/On_The_Use_Of_Models.pdf ) o RMA Journal, February 2008, pages 20 - 29: "Identifying, Measuring, and Managing Model Risk" ( http://validationquant.com/uploads/3/3/7/0/3370893/model_risk_defined_-__rma_article.pdf )

OUTSIDE DIRECTORSHIP o Board of Directors, Rutgers University (Newark) Master of Quantitative Finance (MQF) Program