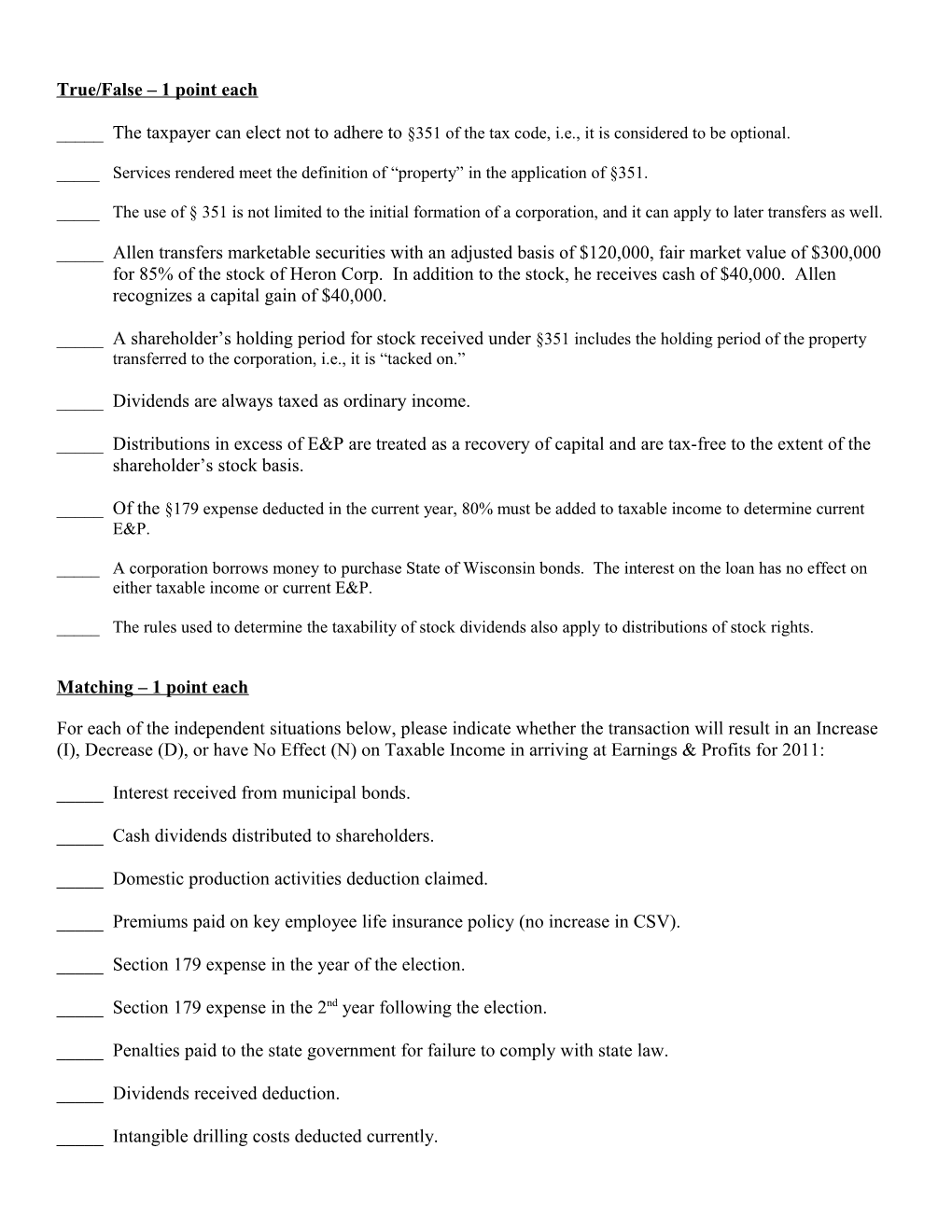

True/False – 1 point each

_____ The taxpayer can elect not to adhere to §351 of the tax code, i.e., it is considered to be optional.

_____ Services rendered meet the definition of “property” in the application of §351.

_____ The use of § 351 is not limited to the initial formation of a corporation, and it can apply to later transfers as well.

_____ Allen transfers marketable securities with an adjusted basis of $120,000, fair market value of $300,000 for 85% of the stock of Heron Corp. In addition to the stock, he receives cash of $40,000. Allen recognizes a capital gain of $40,000.

_____ A shareholder’s holding period for stock received under §351 includes the holding period of the property transferred to the corporation, i.e., it is “tacked on.”

_____ Dividends are always taxed as ordinary income.

_____ Distributions in excess of E&P are treated as a recovery of capital and are tax-free to the extent of the shareholder’s stock basis.

_____ Of the §179 expense deducted in the current year, 80% must be added to taxable income to determine current E&P.

_____ A corporation borrows money to purchase State of Wisconsin bonds. The interest on the loan has no effect on either taxable income or current E&P.

_____ The rules used to determine the taxability of stock dividends also apply to distributions of stock rights.

Matching – 1 point each

For each of the independent situations below, please indicate whether the transaction will result in an Increase (I), Decrease (D), or have No Effect (N) on Taxable Income in arriving at Earnings & Profits for 2011:

_____ Interest received from municipal bonds.

_____ Cash dividends distributed to shareholders.

_____ Domestic production activities deduction claimed.

_____ Premiums paid on key employee life insurance policy (no increase in CSV).

_____ Section 179 expense in the year of the election.

_____ Section 179 expense in the 2nd year following the election.

_____ Penalties paid to the state government for failure to comply with state law.

_____ Dividends received deduction.

_____ Intangible drilling costs deducted currently. _____ Proceeds of life insurance received upon the death of a key employee (no CSV on policy).

Problems – 5 points each

1. Julio exchanges property (basis of $100,000; fair market value of $1.8 million), for 75% of the stock of Lime Corporation. The other 25% of the stock is owned by Gloria who acquired it several years ago. What are the tax consequences to Julio? Please discuss taxable gain/loss on the transaction, if applicable, and comment on the basis of the stock to Julio and Lime’s basis in the transferred property.

2. Nancy, Guy, and Rod form Goldfinch Corporation with the following consideration:

Adjusted Basis Fair Market Value From Nancy: Cash $120,000 $120,000 Inventory 90,000 130,000

From Guy: Land and building 120,000 250,000

From Rod: Legal and accounting services to incorporate 0 50,000

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy, 200 to Guy, and 50 to Rod. In addition, Guy gets $50,000 in cash.

a. Does Nancy, Guy, or Rod recognize gain (or income) on the transaction?

b. What basis does Guy have in the Goldfinch stock?

c. What basis does Goldfinch have in the inventory? In the land and building?

d. What basis does Rod have in the Goldfinch stock?

3. Five years ago, Joe, a single taxpayer, acquired stock in a corporation that qualified as a small business corporation under § 1244, at a cost of $55,000. Joe wants to give his son, Jake, $15,000 to help finance Jake’s college education. The stock is currently worth $15,000. Joe is considering selling the stock in the current year for $15,000 and giving the cash to Jake. As an alternative, Joe could give the stock to Jake and let Jake sell it for $20,000. Which alternative should Joe choose? 4. Robert organized Redbird Corporation 10 years ago by contributing property worth $3 million, basis of $550,000, for 2,000 shares of the stock in Redbird, representing 100% of the stock in the corporation. Robert later gave each of his children, Brittany and Julie, 600 shares of the stock. In the current year, Robert transfers property worth $700,000, basis of $150,000, to Redbird for 1,000 shares in the corporation. What gain, if any, will Robert recognize on the transfer?

5. On January 1, Tulip Corporation (a calendar year taxpayer) has accumulated E&P of $300,000. Its current E&P for the year is $90,000 (before considering dividend distributions). Tulip distributes $600,000 ($300,000 each) to its equal shareholders, Anne and Tom. Anne has a basis in her stock of $65,000, while Tom’s basis is $120,000. What is the effect of the distribution by Tulip Corporation on Anne and Tom?

6. Ashley, the sole shareholder of Hawk Corporation, has a stock basis of $200,000 at the beginning of the year. On January 1, Hawk has accumulated E&P of $90,000 and during the year, current E&P of $160,000. On July 1, Ashley sells all of her stock to Matt for $1 million. Hawk makes the following distributions, $270,000 to Ashley on March 31 and $90,000 to Matt on December 1. How are the distributions taxed to Ashley and Matt? What is Ashley’s recognized gain on the sale to Matt?

7. Thistle Corporation declares a nontaxable dividend payable in rights to subscribe to common stock. One right and $25 entitle the holder to purchase one share of stock. One right is issued for each share of stock held. Annette, a shareholder, owns 200 shares of stock that she purchased five years ago for $3,000. At the date of distribution of the rights, the market values were $50 per share for the stock and $25 per right. Annette received 200 rights. She exercises 160 rights and purchases 160 additional shares of stock. She sells the remaining 40 rights for $1,000. What are the tax consequences to Annette?

8. Scarlet Corporation (a calendar year taxpayer) has taxable income of $150,000, and its financial records reflect the following for the year:

Federal income taxes paid $55,000 Net operating loss carryforward deducted currently 35,000 Gain recognized this year on an installment sale from a prior year 22,000 Depreciation deducted on tax return 20,000 (ADS would have been $5,000) Interest income on state of Iowa bonds 4,000

What is Scarlet Corporation’s current E&P?