BRANCH ADMINISTRATION MANUAL

TFSA’s Nominee & Client Name Plans

Definition The Tax-Free Savings Account is a flexible, registered general-purpose savings vehicle that allows Canadians to earn tax-free investment income to more easily meet lifetime savings needs. The accounts can be held as Off Book or On Book.

Order Entry Type Process: Contacts > Add Plan Process Owner: Advisor > Assistant – to be followed up with the TFSA issuer Follow Up: Advisor > Branch With Whom: Fund Company

Forms / Paperwork Flow Form Branch HO Admin Issuer

NAAF (New Accounts only) Copy in Branch File BM to HO NA Original to Branch Manager TFSA Application Form Copy NA Original Purchase Instruction Form Copy in Branch File NA Original Copy to Branch Manager for Independents Account Disclosure To Client NA NA (New Account only)

Location: http://www.invest dfsi.ca/sales_solutions/investments/tfsa/index.php CCRA : http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/tfsa-celi/menu-eng.html?=slnk

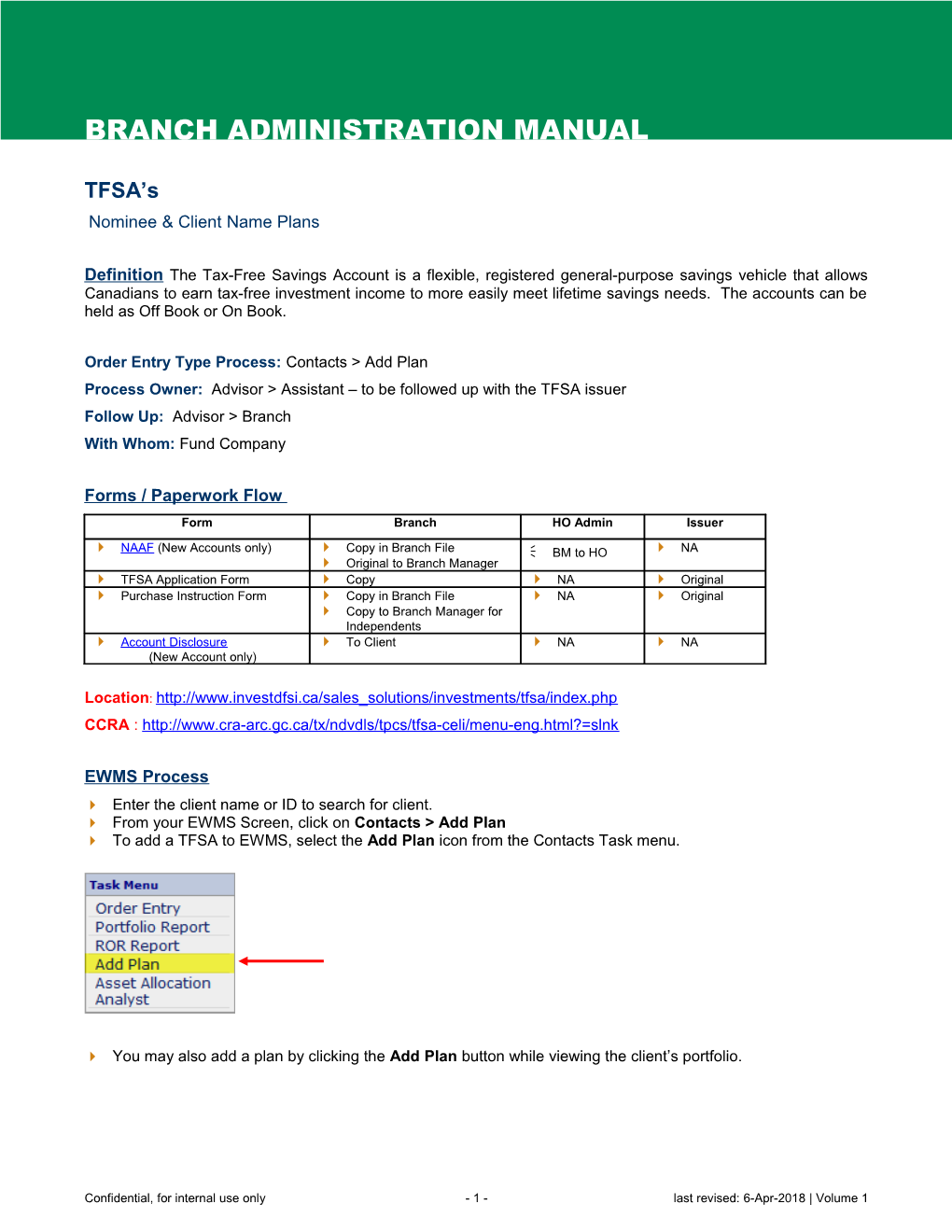

EWMS Process Enter the client name or ID to search for client. From your EWMS Screen, click on Contacts > Add Plan To add a TFSA to EWMS, select the Add Plan icon from the Contacts Task menu.

You may also add a plan by clicking the Add Plan button while viewing the client’s portfolio.

Confidential, for internal use only - 1 - last revised: 6-Apr-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

The plan administrator on Client Name held TFSA plans will always be the Company

The plan administrator on Nominee held TFSA plans will always be the DFS Investments Self Directed Plan.

Confidential, for internal use only - 2 - last revised: 6-Apr-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

Click Save when you are finished setting up the Plan and KYC.

Important Information

TFSA Top Rates can be found on Sales Solutions by clicking the TOP Rates

Rate Inquiry information can also be located under Products > Rates > Inquiry, be sure to review Special Instructions section for additional TFSA details.

Confidential, for internal use only - 3 - last revised: 6-Apr-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

Who is Eligible to Open a TFSA Canadian Residents age 18 and older with a valid Social Insurance Number can open a TFSA. In certain provinces and territories, the legal age at which an individual can enter into a contract (which would include opening a TFSA) is 19. In 2009 or later, in such jurisdictions, an 18-year-old who would be otherwise eligible, would accumulate $5,000 contribution room for that year and carry it over to the following year.

18 Years of Age 19 Years of Age

AB, SK, MB, ON PQ, PE NB, NS, NL, BC, NT, YT, NU

You may contribute up to $5000 per year to a TFSA plan. The contribution amount will be evaluated annually by the CRA based on inflation and adjusted to the nearest $500. There is no lifetime contribution limit. Unused contribution room can be carried forward indefinitely with no limit. Unused contribution room will be tracked by the CRA and available to the investor through the “My Account” function on the CRA website. Withdrawals from a TFSA are not subject to Income Tax. You may make withdrawals from a TFSA for any purpose at any time. DFS Investments is currently offering TFSAs in both Nominee and Client Name Accounts. Ensure to confirm if the GIC supplier accepts Nominee Accounts by reviewing the special instructions on the rate inquiry screen.

Death of a TFSA Holder After the holder of a TFSA dies, possible tax implications may vary somewhat depending on one or more of the following factors, as applicable: The type of TFSA The type of beneficiary Whether any income was earned after the date of death; and How long after the date of death, amounts are distributed to beneficiary(ies)\

Depending on which combination of the above factors applies, the following can be affected: Whether or not the deceased’s TFSA continues to exist or is considered to have ceased; How income earned after the date of death may be reported an taxed; Whether a beneficiary can transfer amounts received to their own TFSA, within certain limits, and whether such a transfer would affect their unused TFSA contribution room

Confidential, for internal use only - 4 - last revised: 6-Apr-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

Excess TFSA amount The total of all contributions made by the holder to all their TFSAs at a particular time in the calendar year, excluding a qualifying transfer or an exempt contribution MINUS the unused TFSA contribution room at the end of the preceding calendar year;

Qualifying Transfer Is a direct transfer between a holder’s TFSAs, or a direct transfer between a holder’s TFSA and the TFSA of their current or former spouse or common-law partner. If the transfer relates to payments under a decree, order, or judgment of a court, or under a written agreement relating to a division of property in settlement of rights arising from the breakdown of their relationship and they are living separate and apart at the time of the transfer.

Confidential, for internal use only - 5 - last revised: 6-Apr-2018 | Volume 1