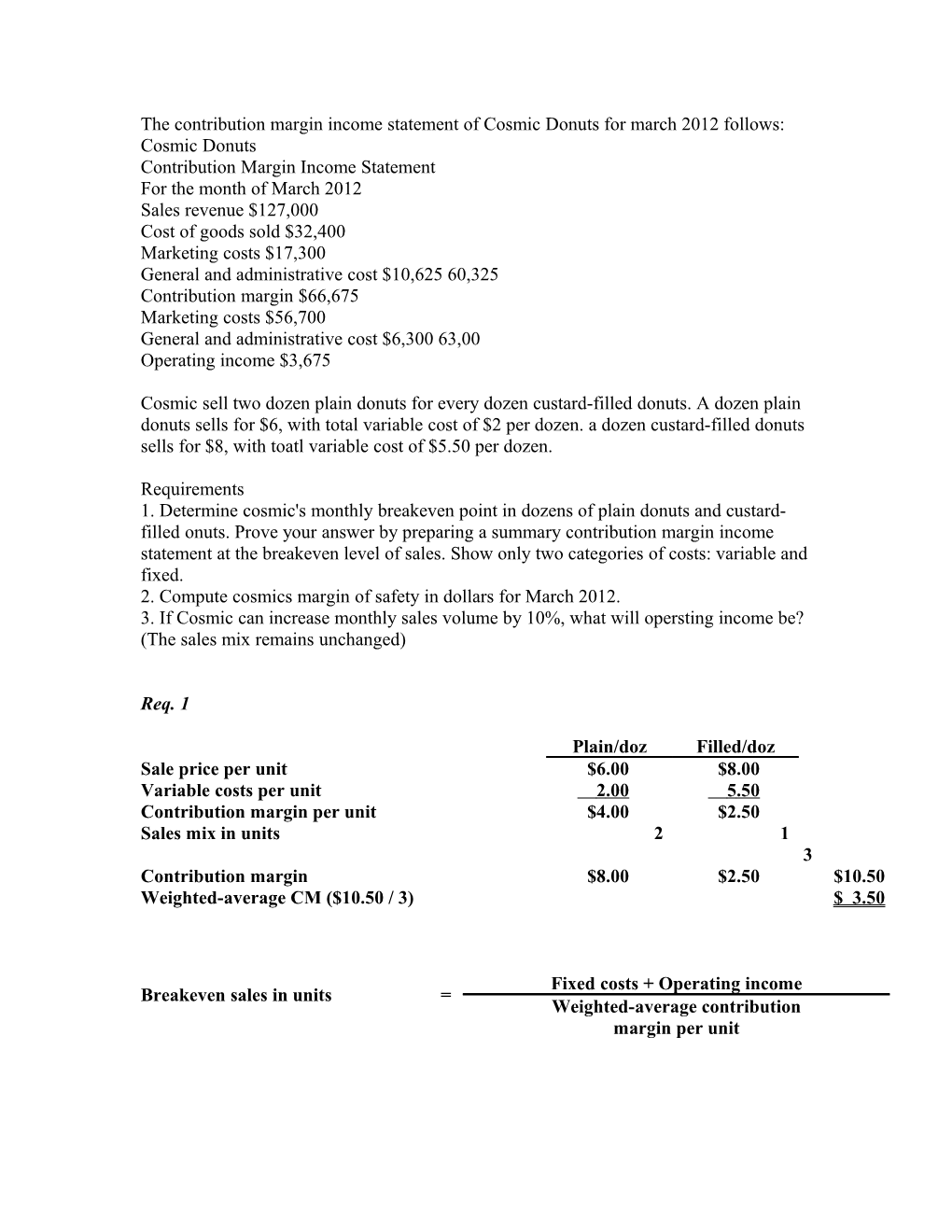

The contribution margin income statement of Cosmic Donuts for march 2012 follows: Cosmic Donuts Contribution Margin Income Statement For the month of March 2012 Sales revenue $127,000 Cost of goods sold $32,400 Marketing costs $17,300 General and administrative cost $10,625 60,325 Contribution margin $66,675 Marketing costs $56,700 General and administrative cost $6,300 63,00 Operating income $3,675

Cosmic sell two dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $6, with total variable cost of $2 per dozen. a dozen custard-filled donuts sells for $8, with toatl variable cost of $5.50 per dozen.

Requirements 1. Determine cosmic's monthly breakeven point in dozens of plain donuts and custard- filled onuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of costs: variable and fixed. 2. Compute cosmics margin of safety in dollars for March 2012. 3. If Cosmic can increase monthly sales volume by 10%, what will opersting income be? (The sales mix remains unchanged)

Req. 1

Plain/doz Filled/doz Sale price per unit $6.00 $8.00 Variable costs per unit 2 .00 5 .50 Contribution margin per unit $4.00 $2.50 Sales mix in units 2 1 3 Contribution margin $8.00 $2.50 $10.50 Weighted-average CM ($10.50 / 3) $ 3 .50

Fixed costs + Operating income Breakeven sales in units = Weighted-average contribution margin per unit $63,000 + $0 = $3.50

= 18,000 units

Breakeven units 18,000

Number of plain [18,000 × (2/3)] 12,000

Number of custard-filled [18,000 × (1/3)] 6,000

Proof:

Plain/doz Filled/doz Total Sales revenue $72,000 $48,000 $120,000 Variable costs 24,000 33,000 57,000 Contribution margin $48,000 $15,000 63,000 Fixed costs 63,000 Operating income $ 0

Req. 2

Margin of Safety = Expected Sales Dollars − Breakeven Sales Dollars $7,000 = $127,000 − $120,000

Req. 3

If monthly sales volume increases 10%, sales revenue will be $139,700 ($127,000 × 1.10). The new operating income is computed as follows:

Fixed costs + Operating income Sales in dollars = Contribution margin ratio

$63,000 + Operating income $139,700 = 0.525*

Operating income = $10,343 *From Req. 1 “proof,” $63,000 / $120,000 = 0.525.