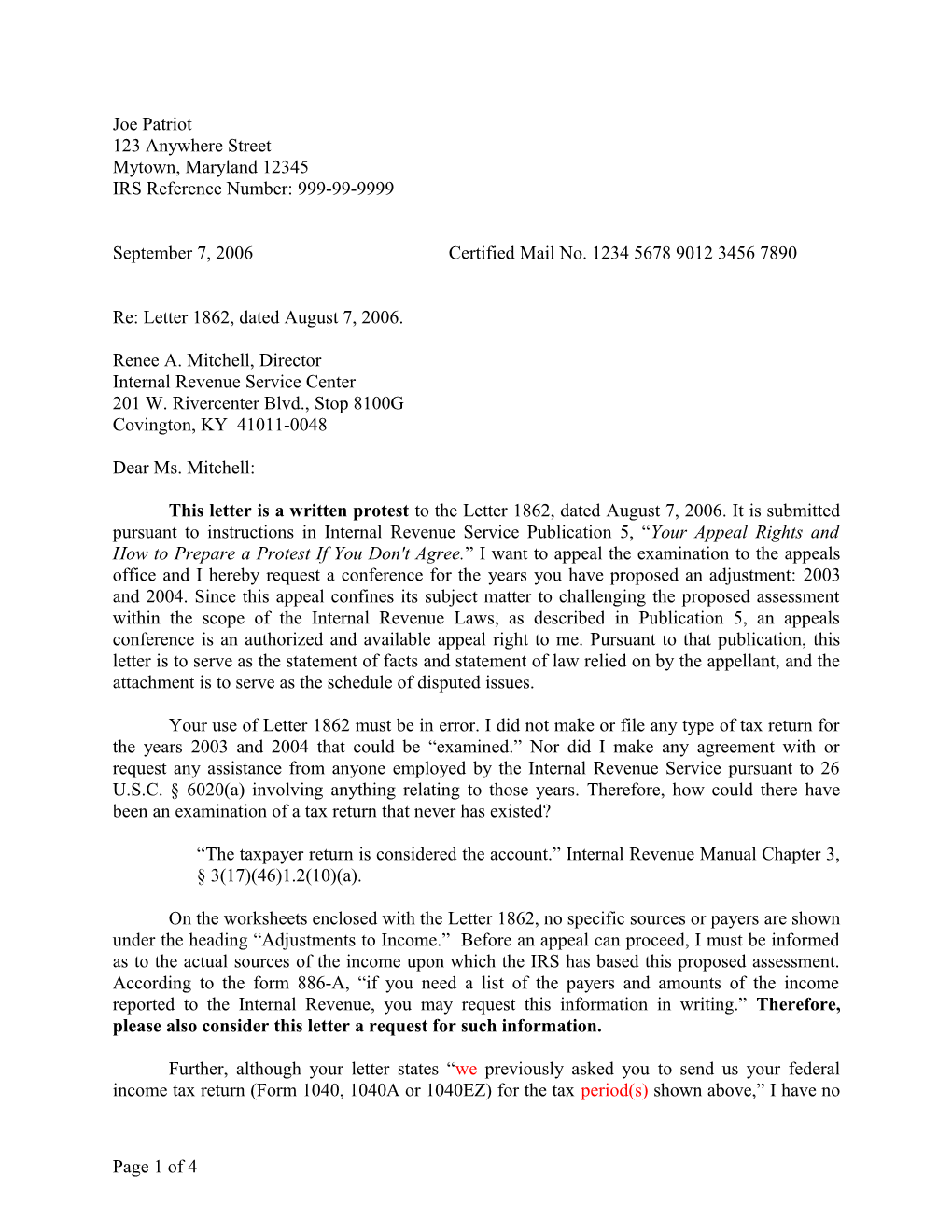

Joe Patriot 123 Anywhere Street Mytown, Maryland 12345 IRS Reference Number: 999-99-9999

September 7, 2006 Certified Mail No. 1234 5678 9012 3456 7890

Re: Letter 1862, dated August 7, 2006.

Renee A. Mitchell, Director Internal Revenue Service Center 201 W. Rivercenter Blvd., Stop 8100G Covington, KY 41011-0048

Dear Ms. Mitchell:

This letter is a written protest to the Letter 1862, dated August 7, 2006. It is submitted pursuant to instructions in Internal Revenue Service Publication 5, “Your Appeal Rights and How to Prepare a Protest If You Don't Agree.” I want to appeal the examination to the appeals office and I hereby request a conference for the years you have proposed an adjustment: 2003 and 2004. Since this appeal confines its subject matter to challenging the proposed assessment within the scope of the Internal Revenue Laws, as described in Publication 5, an appeals conference is an authorized and available appeal right to me. Pursuant to that publication, this letter is to serve as the statement of facts and statement of law relied on by the appellant, and the attachment is to serve as the schedule of disputed issues.

Your use of Letter 1862 must be in error. I did not make or file any type of tax return for the years 2003 and 2004 that could be “examined.” Nor did I make any agreement with or request any assistance from anyone employed by the Internal Revenue Service pursuant to 26 U.S.C. § 6020(a) involving anything relating to those years. Therefore, how could there have been an examination of a tax return that never has existed?

“The taxpayer return is considered the account.” Internal Revenue Manual Chapter 3, § 3(17)(46)1.2(10)(a).

On the worksheets enclosed with the Letter 1862, no specific sources or payers are shown under the heading “Adjustments to Income.” Before an appeal can proceed, I must be informed as to the actual sources of the income upon which the IRS has based this proposed assessment. According to the form 886-A, “if you need a list of the payers and amounts of the income reported to the Internal Revenue, you may request this information in writing.” Therefore, please also consider this letter a request for such information.

Further, although your letter states “we previously asked you to send us your federal income tax return (Form 1040, 1040A or 1040EZ) for the tax period(s) shown above,” I have no

Page 1 of 4 record of receiving any such request(s). Therefore, in your reply, please provide copies of any such requests you claim to have been sent.

Please also be aware of the following facts and laws concerning the alleged requirement for me to file an income tax return:

I am a citizen of the State of Maryland and not a ‘taxpayer’ as that legal term is defined in IR Code Section 7701(a)(14). With reference to withholding, I am not an alien, foreign corporation, officer, director, stockholder or employee of a foreign corporation, withholding agent, nor a citizen of the United States living and working abroad or in a possession of the United States. I do not reside in a federal enclave within any of the States and/or without the States of the Union, nor do I reside in any federal state.

Regarding a specific requirement to file an income tax return, I read Title 26 United States Code § 6012, PERSONS REQUIRED TO MAKE RETURNS OF INCOME, which states as follows: “(a) General Rule. —Returns with respect to income taxes under subtitle A shall be made by the following: (1)(A) Every individual having for the taxable year gross income which equals or exceeds the exemption amount, except that a return shall not be required of an individual ...”

I then went to Subtitle A and found that Chapter 1 was NORMAL TAXES AND SURTAXES; that Subchapter A was for the purpose of DETERMINATION OF TAX LIABILITY; that PART I of Subchapter A was TAX ON INDIVIDUALS; and further, that § 1 was TAX IMPOSED.

In order to find the proper return to use to report any tax liability, I checked PART 602 of the Internal Revenue Regulations. According to the listing for §1, it appears that the Office of Management and Budget assigned the identifying OMB Control Number 1545-0067 to the tax return to be used. Checking the list of approved forms published by the Office of Management and Budget, it identified that tax form to be Form 2555, FOREIGN EARNED INCOME. I did not earn any foreign earned income during this period. If there is some clerical error, or the National Office of the Internal Revenue Service listed the wrong form to be reviewed on the application for review to the OMB, please notify me.

Due to the fact that § 6012 did not list any requirement for Subtitle C, I did not bother to check for any form to be used for employment taxes.

Also, because you are basing this action on the provisions of Subtitle C, it is outside the authority of 26 U.S.C. § 6211, and subsequently § 6212; and in violation of §§ 6061 and 6065. Therefore, we insist that this notice be abated pursuant to 26 U.S.C. §§ 6213(b)(2) and 6404(a) (3).

If you are planning to continue pressing this claim of assessment, please cite the statutory authority that you claim to be acting in pursuance thereof.

Page 2 of 4 Ms. Mitchell, for the above reasons you can consider this letter as a challenge to your authority. I believe the circumstantial facts involving this matter are reason enough to put you on notice that this is a wrongful assessment procedure. If you do not respond within 30 days of your receipt of this protest granting a conference, I demand that you forward my appeal rights. If the above enumerated facts are not rebutted individually, they will be presumed to be correct.

I declare that the statement of facts presented in this protest and in any accompanying schedules are true, correct, and complete to the best of my knowledge and belief.

______Joe Patriot

Enclosures: Copy of Letter 1862 dated August 7, 2006; Schedule of Disputed Issues; Copy of 26 CFR Part 602; copy of Form 2555. cc: Retained for file.

Page 3 of 4 Schedule of Disputed Issues

(1) I have not filed a tax return that could be examined. Without this a “deficiency” in the “tax shown by the taxpayer on his return” under 26 USC 6211 cannot be justified, nor can a deficiency assessment be made under 26 USC 6212.

(2) I have neither signed a tax return under 26 USC 6020(a) or substitute agreement, nor consented to provide any information for the purpose of preparing a return under 26 USC 6020(a).

(3) The notice I received was not authenticated pursuant to 26 USC §§ 6061 and 6065.

(4) The notice I received contains no evidence whatsoever of the sources of the income alleged by the notice.

(5) According to the notice, certain amounts supporting the proposed assessment were includable under Gross Income under Subtitle A, Title 26, United States Code. The form submitted to the Office of Management and Budget by the National Office of the Internal Revenue Service, for payment of Income Taxes by individuals under Subtitle A, applies (and is limited) to “foreign-earned income.” I have not engaged in any activity outside of a State of the union for the period of the notice. Due to the fact that I do not have an income tax liability under Subtitle A, there can be no “deficiency” assessment under 26 USC 6212.

(6) According to the notice, certain amounts alleged to support the assessment were wages, which are limited to the provisions of Subtitle C of the Internal Revenue Code. As such, they are outside of the “deficiency” assessment authority in 26 USC §§ 6211 and 6212, because those sections restrict the sending of a deficiency notice to cases of tax returns filed under “subtitle A or B or chapter 41, 42, 43 or 44 [subtitle D]” of the Code.

Page 4 of 4