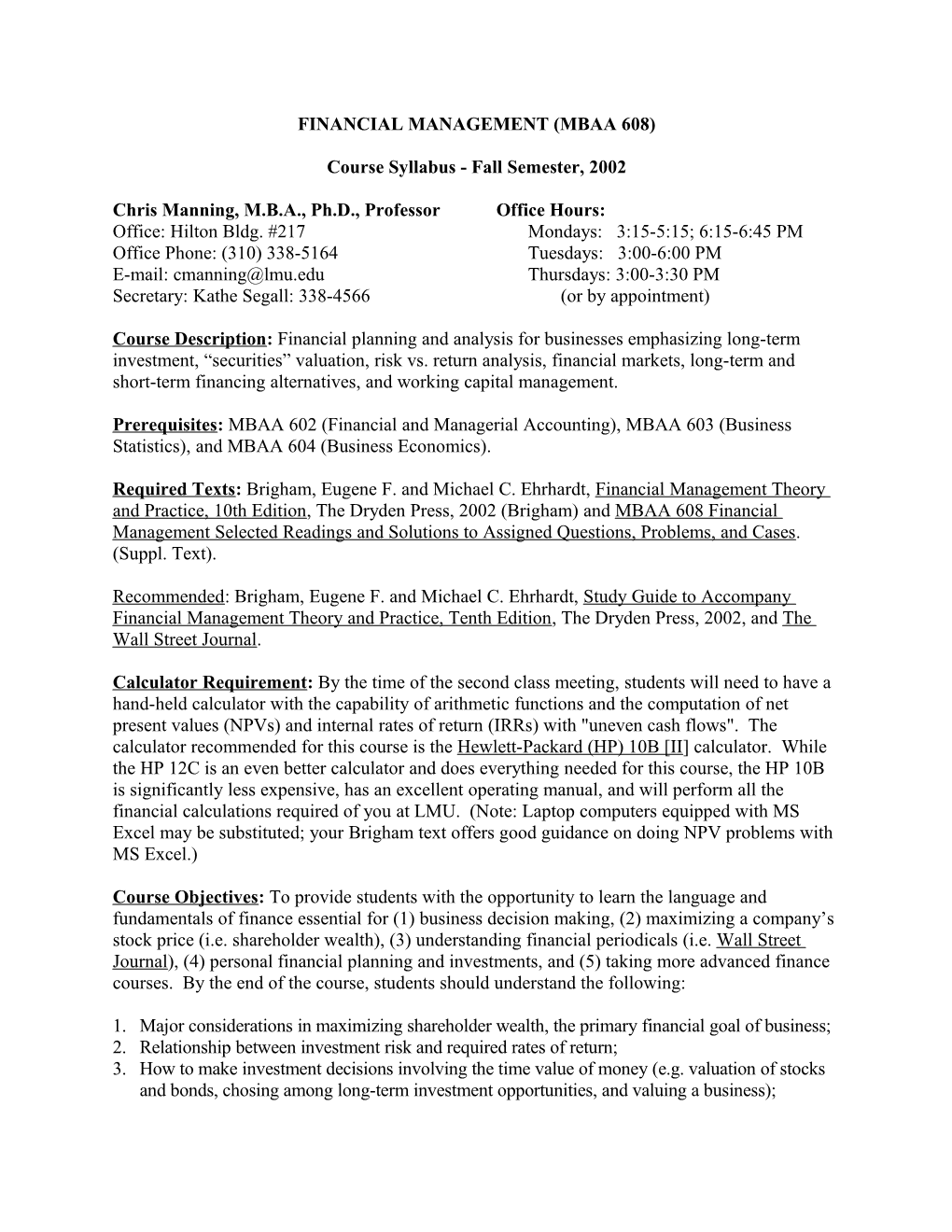

FINANCIAL MANAGEMENT (MBAA 608)

Course Syllabus - Fall Semester, 2002

Chris Manning, M.B.A., Ph.D., Professor Office Hours: Office: Hilton Bldg. #217 Mondays: 3:15-5:15; 6:15-6:45 PM Office Phone: (310) 338-5164 Tuesdays: 3:00-6:00 PM E-mail: [email protected] Thursdays: 3:00-3:30 PM Secretary: Kathe Segall: 338-4566 (or by appointment)

Course Description: Financial planning and analysis for businesses emphasizing long-term investment, “securities” valuation, risk vs. return analysis, financial markets, long-term and short-term financing alternatives, and working capital management.

Prerequisites: MBAA 602 (Financial and Managerial Accounting), MBAA 603 (Business Statistics), and MBAA 604 (Business Economics).

Required Texts: Brigham, Eugene F. and Michael C. Ehrhardt, Financial Management Theory and Practice, 10th Edition, The Dryden Press, 2002 (Brigham) and MBAA 608 Financial Management Selected Readings and Solutions to Assigned Questions, Problems, and Cases. (Suppl. Text).

Recommended: Brigham, Eugene F. and Michael C. Ehrhardt, Study Guide to Accompany Financial Management Theory and Practice, Tenth Edition, The Dryden Press, 2002, and The Wall Street Journal.

Calculator Requirement: By the time of the second class meeting, students will need to have a hand-held calculator with the capability of arithmetic functions and the computation of net present values (NPVs) and internal rates of return (IRRs) with "uneven cash flows". The calculator recommended for this course is the Hewlett-Packard (HP) 10B [II] calculator. While the HP 12C is an even better calculator and does everything needed for this course, the HP 10B is significantly less expensive, has an excellent operating manual, and will perform all the financial calculations required of you at LMU. (Note: Laptop computers equipped with MS Excel may be substituted; your Brigham text offers good guidance on doing NPV problems with MS Excel.)

Course Objectives: To provide students with the opportunity to learn the language and fundamentals of finance essential for (1) business decision making, (2) maximizing a company’s stock price (i.e. shareholder wealth), (3) understanding financial periodicals (i.e. Wall Street Journal), (4) personal financial planning and investments, and (5) taking more advanced finance courses. By the end of the course, students should understand the following:

1. Major considerations in maximizing shareholder wealth, the primary financial goal of business; 2. Relationship between investment risk and required rates of return; 3. How to make investment decisions involving the time value of money (e.g. valuation of stocks and bonds, chosing among long-term investment opportunities, and valuing a business); 4. Overview of financial markets and institutions; 5. Factors that determine interest rates, both long-term and short-term; 6. Characteristics of stocks and bonds, how the marketplace values each, and estimation of their expected rates of return based upon published market prices; 7. Market equilibrium (given efficient markets) and its application to valuation of stocks, bonds, and corporate long-term investment opportunities; 8. How to financially analyze a company’s accounting information, its usefulness, and its limitations; 9. How to evaluate and choose from among multiple long-term investment opportunities; 10. How to determine cash flows relevant for evaluating long-term investment opportunities; 11. What is “free cash flow,” how is it calculated, and why is it useful; 12. How to calculate a company’s cost of capital and why it is useful; 13. How to evaluate long-term investment opportunities that vary in risk; 14. How to determine a business’s funding requirements to accomplish it’s goals, objectives and business plan; 15. How to determine appropriate capital structure (i.e. debt vs. equity) for different types of businesses; 16. What happens when a company “fails” (e.g. types of reorganization, priorities in liquidation); 17. Different types of cash and stock distributions to shareholders along with advantages and disadvantages of each; 18. Different types of long-term financing, their sources, and advantages and disadvantages of each; 19. How to manage a company’s current assets; 20. Advantages and disadvantages of financing company assets with more short-term vs. long-term funding sources; 21. Costs and appropriateness of different forms of short-term financing.

Note: The class schedule is rigorous in that we cover virtually all major financial decisions in a single semester 3-hour course. Therefore, it is imperative that you keep up with the assigned material. No assignments are required to be handed in other than a paper on the last day of class. Thus, you must discipline yourself to keep up with the material and work with other students as needed.

Grading: Student work will be evaluated and weighted as follows:

Two midterm examinations (each worth 26%) 52% Comprehensive final examination 39% Paper Due for last class 4% Class participation 5% Total 100%

Class participation credit will be based upon the quality and quantity of student oral participation in class, the frequency of a student attending class, and a student's level of class preparedness. Getting involved in class discussions, by asking questions and providing answers, will never count against your grade, it can only help you. Letter grades will be awarded according to university standards with the average grade in the class between a B and B+. Make-ups on midterms will only be given in cases of verified illness, death in the immediate family, unavoidable job related responsibilities, and only when arrangements with the Professor have been made in advance of the scheduled midterm. [My home phone number is (310) 541-0353, and I receive my university email at home as well.]

Description of Assignments: Assignments will consist of attending and participating in class discussions; readings from textbooks; doing assigned questions, problems, text mini cases, professor's cases, and projects; learning financial management vocabulary and concepts, learning the cash flow system underlying businesses, and learning how to apply financial tools to decision making and problem-solving. You are expected to do assignments prior to the class meeting date for which they are assigned. Class discussions and review of assigned material will focus upon the more challenging text material assigned as well as introducing additional material for which you will be held responsible. To facilitate your class preparation, you will be assigned specific questions, problems, and mini cases at the end of text chapters. The answers to all assignments (along with some additional optional questions and problems) will be found in your MBAA 608 Financial Management Theory and Practice Selected Readings and Solutions to Assigned Questions, Problems, and Cases. Important: Assignments listed in your syllabus are made either as (1) definitely required to be done prior to class (indicated in bold and underlined when particularly important), (2) regular assignments expected of all students seeking more than a minimal passing grade and understanding of finance, and (3) optional readings (indicated as such) as well as optional questions and problems (where “extra” answers are provided in your supplemental text) for those students seeking a better understanding of finance fundamentals. If you find text material and problems particularly difficult and wish additional practice, the following three options are available to you: First, your textbook authors’ “Study Guide” (Brigham, Eugene F. and Michael C. Ehrhardt, Study Guide to accompany Financial Management Theory and Practice, 10th Edition, The Dryden Press, 2002, available at LMU’s bookstore), has been found very helpful by earlier MBA students as the problems are easier than the ones at the end of your Brigham textbook chapters. Second, there are “optional” textbook problems indicated as such where you find the solutions provided in your supplemental text for problems not assigned. Third, there are additional self-test problems at the end of each chapter in your Brigham textbook (with answers found in Appendix A at the back of your textbook Since we will not have sufficient class time to review all text-reading assignments and do all assigned problems, it is imperative that you keep up with the assignments and ask questions on those things not clear to you from your readings and problem solving. You are strongly encouraged to study with other students in the class and work assigned problems and cases together in advance of class where it will save you time in learning. On occasion, faculty colleagues visit each other's classes for ideas to improve teaching effectiveness. Please, don't let such visits distract you from class discussions and learning.

CLASS SCHEDULE FOR SEMESTER (BEGINS ON NEXT PAGE) BLOCK I: FINANCIAL MANAGEMENT THEORETICAL FOUNDATION

August 26, 2002: Topics: (1) Financial Perspective of Business, (2) Business Organizations, (3) Cash Flows, and (4) Taxation (Students will find the readings, questions, and problems assigned for the material covered in this first class listed under the Labor Day holiday week.) (Note: August 31, 2001 is the last day for program changes.)

September 2, 2002: Labor Day Holiday!! Class does not meet! The following readings and material were covered during your first class: Readings: Chapter 1 (pp. 6-10; pp. 11-13 are most important; but read entire chapter); and Chapter 2 (pp. 38-51 are most important; but read entire chapter); and Supplemental Text Sheets: “The Business System: An Overview”, “Generalized Overview of Financial Statements”, and “Shareholder Value Creation in a Cash Flow Context” and Optional Articles: "Industry Profile: Dipping Economy no Threat to Financial Services Professionals,” "How To Make More Good Decisions", "Wealth Is Much More Than Money", & "Success Is Much More Than Wealth." Assignment: Chapter 1: Ques. 1-2, 1-8; and Chapter 2: Ques. 2-5, 2-11, 2-15; and Probs. 2-2, 2-6 and Chapter 2: Mini Case (Parts a, b, c, d, j, n, o, p, r and t)

September 9, 2002: Topics: Financial Markets, Interest Rates, and Time Value of Money Theory Readings: Chapter 5 (pp.154-159; 168-172; 172-177; 177-188; other pages are optional reading); Chapter 8 (pp. 286-300; 304-320; 321-323) Assignment: Chapter 5: Questions 5-6, 5-7; and Problem 5-2; and Chapter 8: Questions 8-2, 8-5 and Problems 8-1, 8-2, 8-3; 8-4a-c; 8-5a-c, 8-6, 8-7, 8-8, 8-9, 8-10, 8-11a, 8-12; 8-13, 8-15 thru 8-17, 8-18, 8-19.

September 16, 2002: Topic: (1) Risk vs. Return and (2) Bonds and Their Valuation Readings: Chap. 6 (pp. 200-201; 201-211; 212-222; 223-229; 229-234; 234-236 most important, but read over the entire chapter) and Chapter 9 (pp. 340-343; 345-354; 355-361; 362-371) and three Articles: “Some Companies Weather Squeeze on Credit,” “Securities Underwriting Set Record,” and “Moody’s and S&P, Singed by Enron, May Speed Up Credit Downgrades” Assignment: Chapter 6: Questions 6-3, 6-4, 6-6, 6-7; and Problems 6-3, 6-4, 6-8, 6-12; and Chapter 9: Questions 9-3, 9-4, 9-5, 9-7; and Problems 9-1, 9-2, 9-3, 9-4, 9-5, 9-6, 9-7, and 9-13 September 23, 2002: Topics: (1) Common Stock, (2) Efficient Markets, and (3) Review for Midterm Readings: Chapter 10 (pp. 379-384; 385-393; 393-399; 399-407; 407; and Chapter 21 (pp. 810-812 and 814 only) and Articles: “Bottom-Line Blues: While Economy Lifts, Severe Profit Crunch Haunts Companies,” “False Bottom? Stocks May Decline Further,” “The Angry Market,” “Valuations Are Likely to Bar Repeat of ‘90s Heady Gains," “Market Beat: Some Investors Baffled,” “Goldman Study of Stocks' Rise in 80s Poses a Big Riddle," and “How Jacobs and Levy Crunch Stocks for Buying and Selling.” (Optional: “No-Load Fund Investor: Five Basic Insights” and “Mutual Funds Monthly Review”) Assignment: Chapter 10: Questions 10-2 through 10-6; and Problems 10-1, 10-2, 10-3, 10-4, 10-5, 10-11, 10-12, 10-20 and Chap. 10 Mini Case [Parts a, b, c, d(1), d(2), e, f, g, h, i, j, k, l, m]

September 30, 2002: First Midterm Examination

B LOCK II: STRATEGIC LONG TERM INVESTMENT AND FINANCING DECISIONS

October 7, 2002: Topic: (1) Cost of Capital and (2) Capital Budgeting Fundamentals and Decision Rules Readings: Chapter 11 (pp. 419-425; 426-429; 430-432; 434-443; 445-448; 449-450; remaining pages in this chapter are low priority optional reading); Chapter 13 (pp. 501-505; 505-517 [omit “discounted payback period” on pp. 508-509]; Also read 520-528; and 531-532); Supplemental Text Sheets: “Components of Investor Return” and “Problem Definition” Assignment: Chapter 11: Questions 11-2,11-3(a-c, f-j), 11-5 and Problems 11-6, 11-7, 11-8, 11-9, 11-11, and 11-12; and Chapter 11 Mini Case (omit part o) and Chapter 13: Questions 13-2, 13-3, 13-4, 13-5, 13-6 and Problems 13-1, 13-2, 13-3, 3-6, 13-10, 13-13, 13-15, and Chapter 13 Mini Case (omit parts c(3), c(4), and i thru l) October 14, 2002: Topics: (1) Corporate Valuation, (2) Cash Flow Estimation, and (3) Risk Analysis Readings: Chapter 12 (pp. 461; 462-470; 471-479) and Chapter 14 (pp. 546; 547-560; 561-563; 563-566; and 566-573; Assignment: Chapter 12: Problems 12-1 thru 12-4; 12-8, 12-9, and 12-10 and Chapter 12 Mini Case (parts a-c, d-f only) Chapter 14: Questions 14-2 thru 14-5 and Problems 14-4, 14-6 and Chapter 14 Mini Case (Parts a-h(1); h(3); i(1); and m only); and Spreadsheet problems 14-11, 14-12, 14-13(a-d) & 14-14 and Professor's Case #1: Sailboat Charter Business Opportunity (very important)

October 21, 2002: Topics: (1) Capital Structure and (2) Financial Statement Analysis Readings: Chapter 16: (pp. 619-638; 642-648; pp. 648-652) and Chapter 17 (p. 683) Chapter 3: (all) Supplemental Text: “Illustration of Financial Leverage Advantage,” “Questions to Answer Through Financial Analysis,” “Example of Industry Ratios,” and “Another View of Accounting and Cash Flow Performance” and Articles: “Climb in Corporate Debt Trips Alarm” and “Despite Rebound, Fears of Corporate Credit Crunch Linger” Assignment: Chapter 3: Ques. 3-2, 3-3, 3-5, 3-7, 3-9 and Problems 3-3, 3-13, 3-15, and Chapter 3 Mini Case (omit parts f & i; focus on h,j & l); and Financial Analysis of Martin Mfg. Case (found in your suppl. text); Chapter 16: Questions: 16-4, 16-5, 16-7, 16-8, 16-10, 16-11; In addition, you should discuss the financial leverage illustrations in your texts with other students in this class to insure your comprehension of this material as there are no assigned problems on financial leverage; and Optional work: Professor's Case #2: Is Your LMU MBA Really Worth the Cost?

October 28, 2002: Topics: (1) Real Options, (2) Long Term Financial Planning, and (3) Shareholder Distributions Reading: Chapter 15 (pp. 583-589; 596-603; and 608-610); and Chapter 4 (pp. 115-117; 117-129; 130-132; 133-136; 136-141) Chapter 18 (pp. 699-702; 703-715; pp. 716-726) and four Articles: “Dividends, Not Growth, Is Wave of the Future,” “Microsoft Has the Cash, and Holders Suggest A Dividend,” “Don’t Forget to Remember Dividends” and “Dividend Reductions Follow Falling Stock Prices” and Optional Article: “The Man With the Money” Assignment: Chapter 15: Problems 15-4, 15-6 (a-d); Chapter 4: Questions 4-2,4-3,4-4, 4-5; & Chapter 4: Mini Case (parts a-e); & Probs. 4-11; 4-12; Chapter 18: Questions 18-2e, 18-3, 18-4, 18-5, 18-6, 18-7; and Problems 18-4, 18-5, 18-6, 18-8, 18-9(a&b), 18-10 and Chapter 18 Mini-case (parts a, b, c, e, f, g) November 1, 2002: Last day to withdraw from class with grade of "W".

November 4, 2002: Second Midterm Examination

BLOCK III: LONG TERM FINANCING ALTERNATIVES AND WORKING CAPITAL MANAGEMENT

November 11, 2002: Topic: Where Do Companies Go For Financing To Grow? Readings: Chapter 19 (pp. 737-743; 743-754; 758-763; 766-772) and Chapter 21 (pp. 810-822, 824) and you should also review Chap. 5 (pp. 154-159), Chap 9 (pp. 340-343; 345; 356-371), and Chap 10 (pp. 380-385; 402-407); Assignments: Chapter 19: Question 19-6 a&b & Problem 19-3 (omit parts c & g) Chapter 21: Questions 21-2 thru 21-5a&b; Problems 21-1 and 21-2; and Professor’s Case #3 (Part A): Loyola Oil Bond Refunding Problem

November 18, 2002: Topics: (1) Risk Management, (2) Bankruptcy, (3) Corporate Restructuring and (3) Long-Term Investment Decision Making Integrated (Case #5) Readings: Chapter 24: (Read entire chapter [pp. 915-936] except for “Structured Notes” and “Inverse Floaters” [pp. 925-926]); and Chapter 25: (pp. 941-947; [pp. 947-957 optional]; and pp. 957-960, pp. 960-962); Chapter 26: (pp. 970-974; 974-978; 978-982; 993-1002) and Supplemental Text Articles: “The Outlook: Chapter 11 Is Becoming A More Popular Read” and “Why Oligopolies Are on the Rise” Assignment: Professor’s Case #3 (Part B): Loyola Oil Bond Refunding Problem and Chapter 24: Questions 24-1 through 24-4 and Chapter 25: Questions 25-3, 25-4, 15-5, 25-6 and Prob. 25-2 & 25-3, and Professor’s Case #4: Liquidation Under Bankruptcy Problem Professor’s Case #5: Clinton Computer Corporation Comprehensive Case Chapter 26: Chapter 26 Mini Case (parts b thru h, j, k, l); and for more practice: Acquisition Problems Set #1: Problems 2, 5, and 6 November 25, 2002: Topics: (1) Working Capital Management and (2) Short-Term Financing Readings: Chapter 22: (pp. 837-846); and Chapter 23: (pp. 884-901; 901-905) Supplemental Text Reading: “Managing Operating Funds” (4 sheets) and Articles: “A Dwindling Supply of Short-Term Credit Plagues Corporations,” “Uncertainty Makes Capital More Elusive – Companies Feel Consequences of Borrowing for Short-term,” “Fewer Banks Mean Costlier Credit Lines,” and “Fishing For Financing” Assignment: Chapter 23: Questions 23-4; 23-5; 23-6; 23-7; 23-9; 23-10; and Prob. ST-1, and Problems 23-1, 23-5; 23-8a-c, 23-11, 23-13, and Chapter 23 Mini Case (parts a, b, c, d, e, f , g, h);

December 2, 2002: Topics: (1) The Cash Budget, (2) Current Asset Management, and (3) "How is this all relevant to your world today?" Reading: Chapter 22 (pp. 841-870) Assignment: Chapter 22: Questions 22-6, 22-7, 22-8, 22-11; 22-12 and Problems 22-1, 22-5, 22-9, 22-11, and Chap. 22 Mini Case and In addition, individual students will write (and turn in) a brief paper (under two pages double- spaced and typed), illustrating in depth one example of how this course has been relevant to your understanding of today's world. Your illustration may be (1) work related, (2) reflect a change in how you view your personal finances, (3) a financial analysis of a company, (4) an economic and financial review of a recent corporate restructuring (e.g. merger, acquisition, spin off, divestiture, etc.) or (5) a critical evaluation of a recent article demonstrating your financial insight acquired from this course. The best individual student paper discussed in class tonight, within each small group of 6 students, will be presented to the entire class following the break. (Good oral presentations will count significantly toward class participation credit.)

December 9, 2002: Comprehensive Final Examination.