Unit Five: The Expanded Ledger Assignment 1 (U5A1) Value 75

Group Members: and Date: Complete all questions in this document. Also, use the General Journal on the O: drive when required. Take your time to do this correctly. Use the Chapter 5 PowerPoint notes to aide you in completing this.

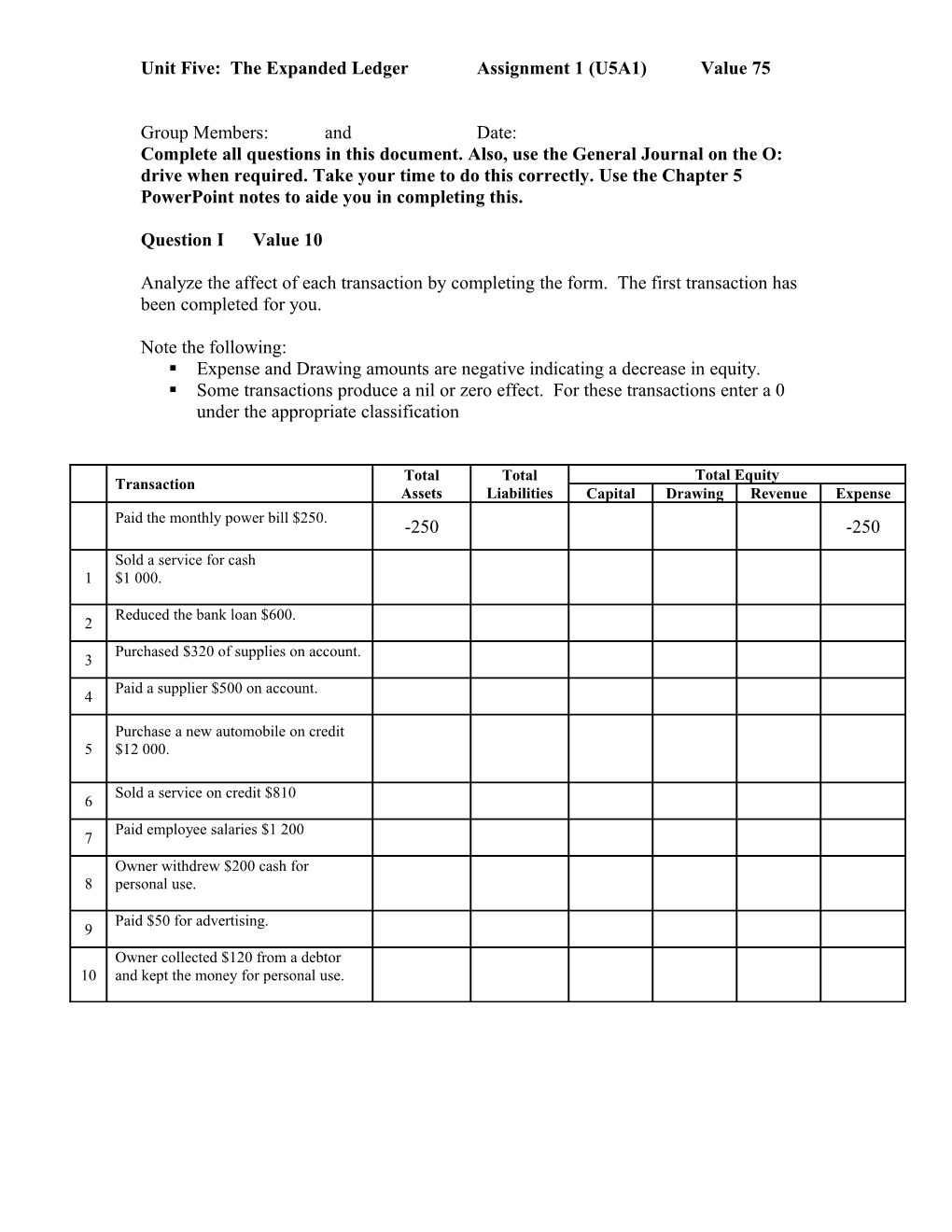

Question I Value 10

Analyze the affect of each transaction by completing the form. The first transaction has been completed for you.

Note the following: . Expense and Drawing amounts are negative indicating a decrease in equity. . Some transactions produce a nil or zero effect. For these transactions enter a 0 under the appropriate classification

Total Total Total Equity Transaction Assets Liabilities Capital Drawing Revenue Expense Paid the monthly power bill $250. -250 -250

Sold a service for cash 1 $1 000.

Reduced the bank loan $600. 2 Purchased $320 of supplies on account. 3 Paid a supplier $500 on account. 4

Purchase a new automobile on credit 5 $12 000.

Sold a service on credit $810 6 Paid employee salaries $1 200 7 Owner withdrew $200 cash for 8 personal use.

Paid $50 for advertising. 9 Owner collected $120 from a debtor 10 and kept the money for personal use. Unit Five: The Expanded Ledger Assignment 1 (U5A1) Value 75

Question II Value 10

Complete the following by selecting “debit” or “credit” from the drop-down form.

1. The Bank account normally has a Debit balance.

2. The owner takes a computer from the business for his person use. The Drawings account receives a Debit entry.

3. A revenue account normally has a Debit balance.

4. An expense account normally has a Debit balance.

5. Net loss can be thought of as a Debit to equity.

6. Receiving money from a debtor requires a Debit entry to the debtor’s account.

7. An increase in equity can be considered a Debit to the capital account.

8. A cash customer is given a refund. The bank account will receive a Debit entry and the revenue account will receive a Debit entry.

9. An advertisement in the local newspaper is purchased on credit. The expense account will receive a Debit entry.

Question III Value 20

Harriet Landry is lawyer in Saint John, New Brunswick. The following accounts are in Harriet’s ledger:

Bank A/P NB Power A/R J. Kelly H. Landry, Capital A/R G. Tilley H. Landry, Drawings A/R Z. Underhill Fees Earned Office Supplies Advertising Expense Furniture & Equipment Automobile Expense Automobiles Cleaning Expense Bank Loan Interest Expense A/P Avco Supply Telephone Expense A/P Savion’s Office Cleaner’s Co. Utilities Expense A/P Daily Journal Wages Expense

Record the following transactions using the chart provided. The first transaction is completed for you. Unit Five: The Expanded Ledger Assignment 1 (U5A1) Value 75

Transactions July 2 Issued a $250 cheque for the purchase of office supplies. 2 Received the monthly power bill for $275. The company has 30 days to pay. 5 Received $270 from a customer for services performed for cash 7 Issued a bill to J. Kelly for $490 for services sold on credit 10 Received a bill from the Daily Journal regarding a $120 advertisement placed in the newspaper on credit. 14 Received a bill from Savion’s Office Cleaners $150 for weekly cleaning. 14 Paid secretary wages of $380. 17 Received $285 from Z. Underhill in part payment of the amount owed. 23 Received a notice from the bank stating that $80 had been taken from the business’s bank account to pay for interest charges on the bank loan 28 Issued a $275 cheque to NB Power for the amount owing. 30 Issued a cheque for $200 to Harriet Landry, the owner, for her personal use.

Debits Credits Date Account(s) Amount Account(s) Amount July 2 Office Supplies 250 Bank 250

Unit Five: The Expanded Ledger Assignment 1 (U5A1) Value 75

Question IV Value 35

Simon Daigle owns and operates his own lawn care company. The following accounts are in Simon’s ledger:

Bank A/P East Coast Repair A/R P. Anderson S. Daigle, Capital A/R W. McPherson S. Daigle, Drawings A/R M. Osborn Revenue Supplies Advertising Expense Equipment Interest Expense Truck Telephone Expense Bank Loan Truck Expense A/P Green Supply Utilities Expense

Enter the following transactions on page 17 of the General Journal form provided. . Remember to include explanations and one blank line between transactions. (Correct account names and descriptions are each worth 0.5 marks, total of 1.5 per transaction). . Transfer the entries to the provided ledger and answer the questions found directly beneath the ledger accounts. Transactions

May

2 Received $210 cash for services performed. 3 Purchased $110 supplies on credit from Green Supply 8 Received $400 from P. Anderson as payment on account. 10 M. Osborn paid $100 on her account Simon Daigle, the owner, kept the money for personal use 10 Received a bill from East Cost Repair for $105 for repairs to the truck. 14 Received $500 cash for services performed. 18 Paid $50 cash for an advertisement in the Daily Journal. 21 Received notice from the bank indicating that $60 was taken from the bank account to pay for interest charges on the loan. 26 Performed $350 services for M. Osborn on credit 29 Issued a cheque for $120 to Green Supply in part payment of the amount owing.

Bank A/R Anderson A/R McPherson A/R Osborn Unit Five: The Expanded Ledger Assignment 1 (U5A1) Value 75

3000 600 100 100

Bal Bal Bal Bal

Supplies Equipment Truck 400 1 250 6 500

Bal Bal Bal

Bank Loan A/P Green Supply A/P East Cost Repair 1 800 200 100

Bal Bal Bal

S. Daigle, Capital S. Daigle, Drawings Revenue Advertising Expense 9 850

Bal Bal Bal Bal

Interest Expense Telephone Expense Truck Expense

Bal Bal Bal

What is the sum of the credit accounts? What is the sum of the debit accounts? What is the net income/loss for the month of May?