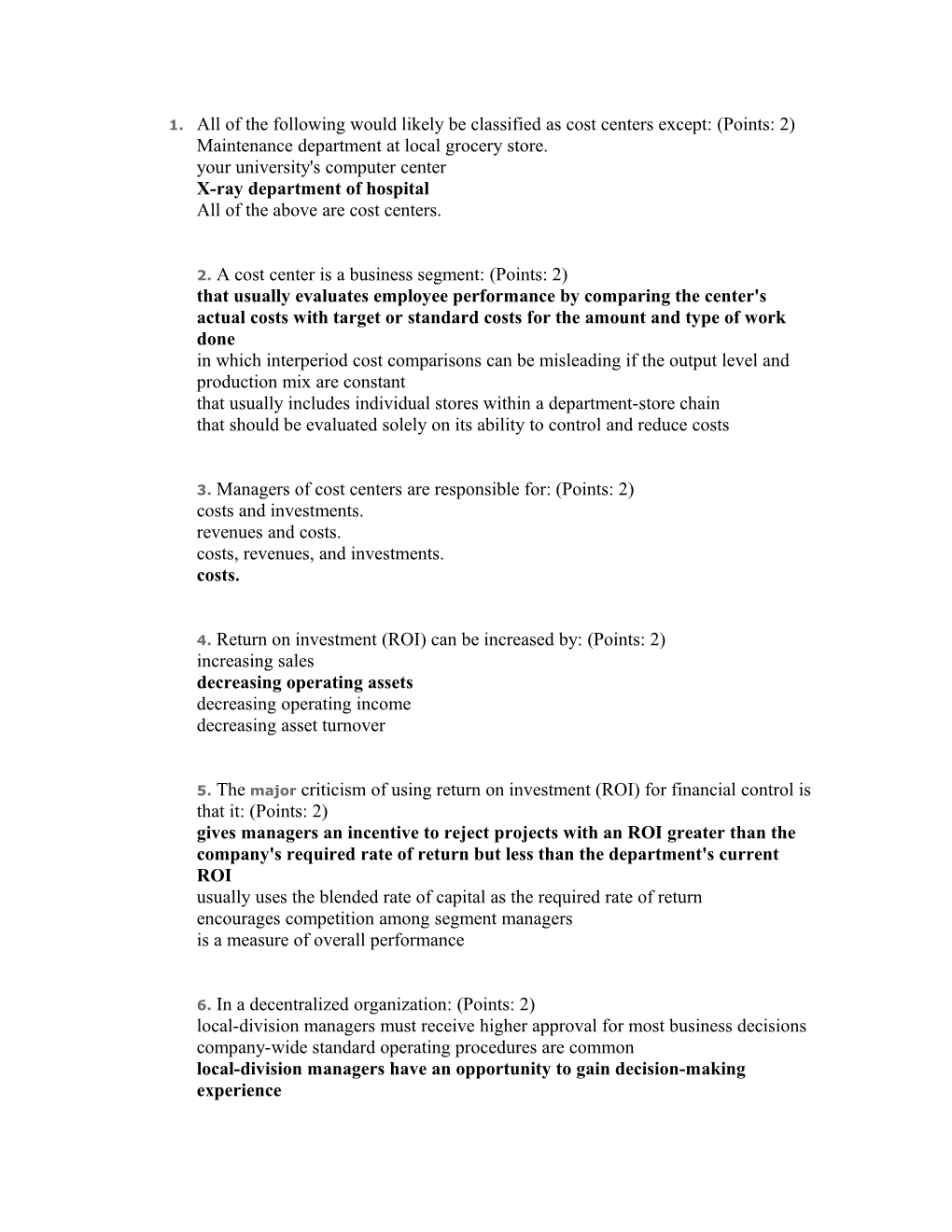

1. All of the following would likely be classified as cost centers except: (Points: 2) Maintenance department at local grocery store. your university's computer center X-ray department of hospital All of the above are cost centers.

2. A cost center is a business segment: (Points: 2) that usually evaluates employee performance by comparing the center's actual costs with target or standard costs for the amount and type of work done in which interperiod cost comparisons can be misleading if the output level and production mix are constant that usually includes individual stores within a department-store chain that should be evaluated solely on its ability to control and reduce costs

3. Managers of cost centers are responsible for: (Points: 2) costs and investments. revenues and costs. costs, revenues, and investments. costs.

4. Return on investment (ROI) can be increased by: (Points: 2) increasing sales decreasing operating assets decreasing operating income decreasing asset turnover

5. The major criticism of using return on investment (ROI) for financial control is that it: (Points: 2) gives managers an incentive to reject projects with an ROI greater than the company's required rate of return but less than the department's current ROI usually uses the blended rate of capital as the required rate of return encourages competition among segment managers is a measure of overall performance

6. In a decentralized organization: (Points: 2) local-division managers must receive higher approval for most business decisions company-wide standard operating procedures are common local-division managers have an opportunity to gain decision-making experience decisions are made by senior executives

7. Performance measures for financial control include all of the following EXCEPT: (Points: 2) reduced cycle times ROI ( return on investment) and economic value added profit cost

8. A cost center is a business segment: (Points: 2) that usually evaluates employee performance by comparing the work performed to a standard in which intraperiod cost comparisons can be misleading if the output mix and product-mix level are constant that usually includes individual stores within a department-store chain that should be evaluated solely on its ability to control and reduce costs

9. Segment margin includes: (Points: 2) all costs traceable to the segment the segment's share of allocated corporate costs the segment's share of allocated unavoidable costs All of these are correct.

10. The primary goal of transfer pricing is to: (Points: 2) motivate the decision maker to act in the organization's best interests obtain a high transfer price for the supplying unit obtain a high transfer price for the receiving unit agree on a price for external sales

11. All of the following are true of market-based transfer prices EXCEPT that they: (Points: 2) may lead to goods/services being purchased externally provide an independent valuation exist for all transferred products and services provide the proper economic incentives

12. All of the following are true of cost-based transfer prices EXCEPT that they: (Points: 2) provide no incentive to the supplying division to control costs when actual costs are used may use standard costs to help maintain operating efficiency promote the optimal level of transactions for the overall organization don't give proper guidance when operating capacity is constrained

13. An administered transfer price: (Points: 2) is most often used for infrequent transactions retains the accountability of both parties reflects pure economic considerations provides an arbitrary distribution of revenues and costs between the parties

14. Use the information below to answer the following question(s). The Jordan Company manufacturers only one type of shoe and has two divisions, the Sole Division and the Assembly Division. The Sole Division manufactures soles and then "sells" them to the Assembly Division, which completes the shoes and sells them to retailers. The market price for the Assembly Division to purchase a pair of soles is $20. Fixed costs are per pair at 100,000 units.

Calculate and compare the difference in overall corporate net income between Scenario A and Scenario B if the Assembly Division sells 100,000 pairs of shoes for $60 per pair to customers. (Points: 2) $500,000 more net income under Scenario A $500,000 of net income using Scenario B $100,000 of net income using Scenario A None of these is correct.

The net income would be the same under both scenarios.

15. Problems of using investment centers include all of the problems associated with profit centers plus all of the following EXCEPT: (Points: 2) how to identify the assets used by each investment center how to assign jointly-used assets such as buildings how to determine the value of the assets what method to use to depreciate the assets

16. All of the following equations represent return on investment (ROI) EXCEPT: (Points: 2) efficiency x productivity operating income/investment return on sales x inventory turnover (operating income/sales) x (sales/investment) 17. Use the information below to answer the following question(s). Randall Company makes and distributes outdoor play equipment. Last year sales were $12,000,000, operating income was $3,000,000, and the assets used were $15,000,000. The return on investment (ROI) is: (Points: 2) 20% 80% 25% 125%

ROS = $3,000,000 / $12,000,000 = 25% Asset Turnover = $12,000,000 / $15,000,000 = 80% ROI = 25% x 80% = 20%

18. A measure of operations efficiency generally divides: (Points: 2) output by input standard revenues by standard costs sales by cost of goods sold sales by investment

19. Lucy Company and Fred Company are identical except that Lucy Company uses the LIFO inventory costing method and Fred Company uses the FIFO inventory costing method. In a period of rising prices, the ratio that will be greater for Lucy Company is: (Points: 2) the current ratio the inventory turnover ratio the net profit margin ratio the accounts receivable turnover ratio

20. Question All of the following are limitations to ratio analysis EXCEPT that: (Points: 2) information to calculate the ratios may come from two different financial statements ratios are based on historical results companies choose different accounting methods for depreciation and inventory costing interpretation may be difficult due to the effect of unknown economic or competitive forces