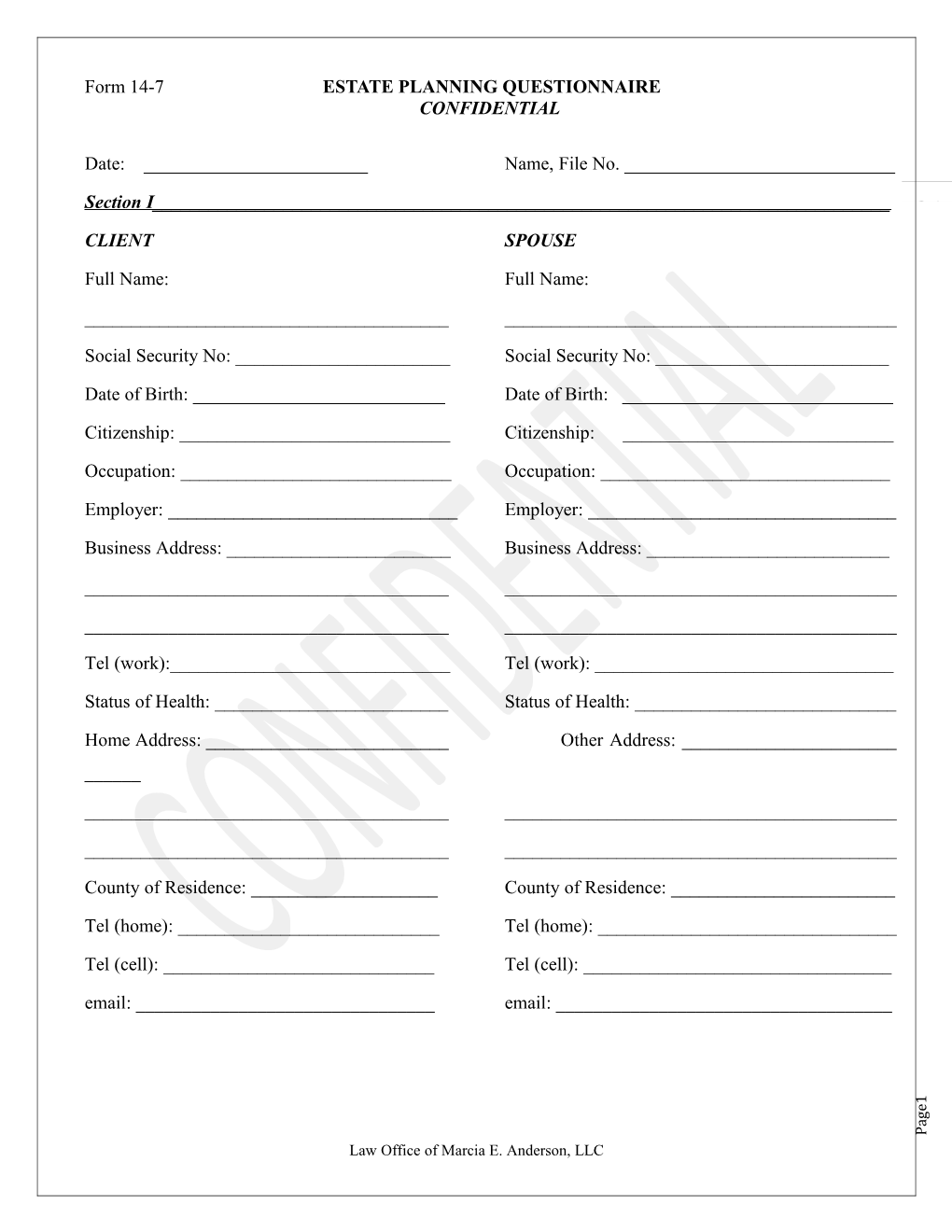

Form 14-7 ESTATE PLANNING QUESTIONNAIRE CONFIDENTIAL

Date: ______Name, File No. ______

Section I______Page | 1

CLIENT SPOUSE

Full Name: Full Name:

______

Social Security No: ______Social Security No: ______

Date of Birth: ______Date of Birth: ______

Citizenship: ______Citizenship: ______

Occupation: ______Occupation: ______

Employer: ______Employer: ______

Business Address: ______Business Address: ______

______

______

Tel (work):______Tel (work): ______

Status of Health: ______Status of Health: ______

Home Address: ______Other Address: ______

______

______

County of Residence: ______County of Residence: ______

Tel (home): ______Tel (home): ______

Tel (cell): ______Tel (cell): ______email: ______email: ______1 e g a P Law Office of Marcia E. Anderson, LLC Section II______

CHILDREN/GRANDCHILDREN Indicate if by previous marriage by writing PM before name; use two lines if needed: Page | 2 Name Birth Sex Soc Sec No. Home Address* Date M/F ______

______

______

______

______

______

*If not living at home

Section III______

BACKGROUND INFORMATION List any person from whom client or spouse may receive a significant inheritance or distribution from a trust: Benefactor Description (include Estimated V alue estimated date)

______

______

______

If a previous marriage ended in divorce, describe the resulting obligations under the divorce decree, or attach a copy of the decree or any agreement:

______

______

______1 e g a P Law Office of Marcia E. Anderson, LLC Describe any ante- nuptial agreement between client and spouse or attach a copy of the agreement:

______

______

Section IV______Page | 3

PRIOR TRANSFERS * List any prior transfers which exceeded the annual gift tax exclusion, including outright gifts and revocable or irrevocable trusts: Type of Date Transfer Recipient Amount ______

______

______

______

* Through December 31, 1983, the annual gift tax exclusion was $3,000. After that date, the exclusion was increased to $10,000 annually and, in 1997, indexed for inflation (currently $11,000). Where spouses agree to split gifts as donors, the exclusion amounts are doubled.

NOTE: Include in the above schedule any gifts to charity. List any charitable organization to be benefite d through a lifetime or testamentary gift: ______

______

______

Section V______

LIFE INSURANCE List current beneficiaries: Policy No. Insurance Co. Owner Beneficiary Face Amount

______

______1 e g

______a P Law Office of Marcia E. Anderson, LLC ______

______

______Page | 4 Section VI ______STATEMENT OF FINANCIAL CONDITION ASSETS Husband Wife Joint Cash Equivalents Checking accounts $ ______

Savings accounts ______Money market fund accounts ______Certificates of deposit ______U.S. Treasury bills ______Death benefits of life insurance (with cash value of life insurance) ______

Employer group life insurance ______

Investments Stocks ______Bonds ______Mutual fund investments ______Partnership interests ______Other investments ______

Retirement Funds Pension (present lump-sum value) ______Joint and survivor annuities ______IRAs and Keogh accounts ______Employee savings plans (e.g., 401(k)) ______

Personal Assets Principal residence ______1

Second residence ______e g a P Law Office of Marcia E. Anderson, LLC Collectibles/art/antiques ______Automobiles ______Home furnishings ______

Furs and jewelry ______Page | 5

Other assets ______

Total assets ______LIABILITIES Husband Wife Joint Charg e account balance ______Personal loans ______Investment loans (margin, real estate, etc.) ______

Home mortgages ______Home equity loans ______Life insurance policy loans ______Projected income tax liability ______

Total liabilities ______

Section VII______ADVISORS List name, firm, address and telephone:

Accountant: Telephone ______(___)______Banking Contact: ______(___)______

______1 e g a P Law Office of Marcia E. Anderson, LLC ______Investment Advisor/Stockbroker: ______(___)______

______Page | 6 ______Life Insurance Agent: ______(___)______Physician: ______(___)______Other: ______(___)______

Section VIII______LOCATIONS OF IMPORTANT DOCUMENTS AND OTHER INFORMATION Item Location Wills and codicils: ______Divorce decrees, separation agreements, prenuptial agreements: ______

Life insurance policies: ______Stocks and bonds: ______Notes or mortgages receivable: ______Deeds: ______Bank books and financial records: ______Income tax returns and gift tax returns, 1 e

federal and state: ______g a P Law Office of Marcia E. Anderson, LLC Trust instruments: ______Closely-held corporation buy-sell agreement: ______Page | 7 Safe deposit boxes: ______Other: ______

Section IX______DESIGNATION OF PERSONAL REPRESENTATIVES Full Name Relationship to Client Contact Information

______

______

______

______

______

______

DESIGNATION OF GUARDIANS

Full Name Relationship to Client Contact Information ______

______

______

______

______

______

______

DESIGNATION OF TRUSTEES 1 e g a P Law Office of Marcia E. Anderson, LLC Full Name Relationship to Client Contact Information ______

______

______Page | 8

______

______

______1 e g a P Law Office of Marcia E. Anderson, LLC