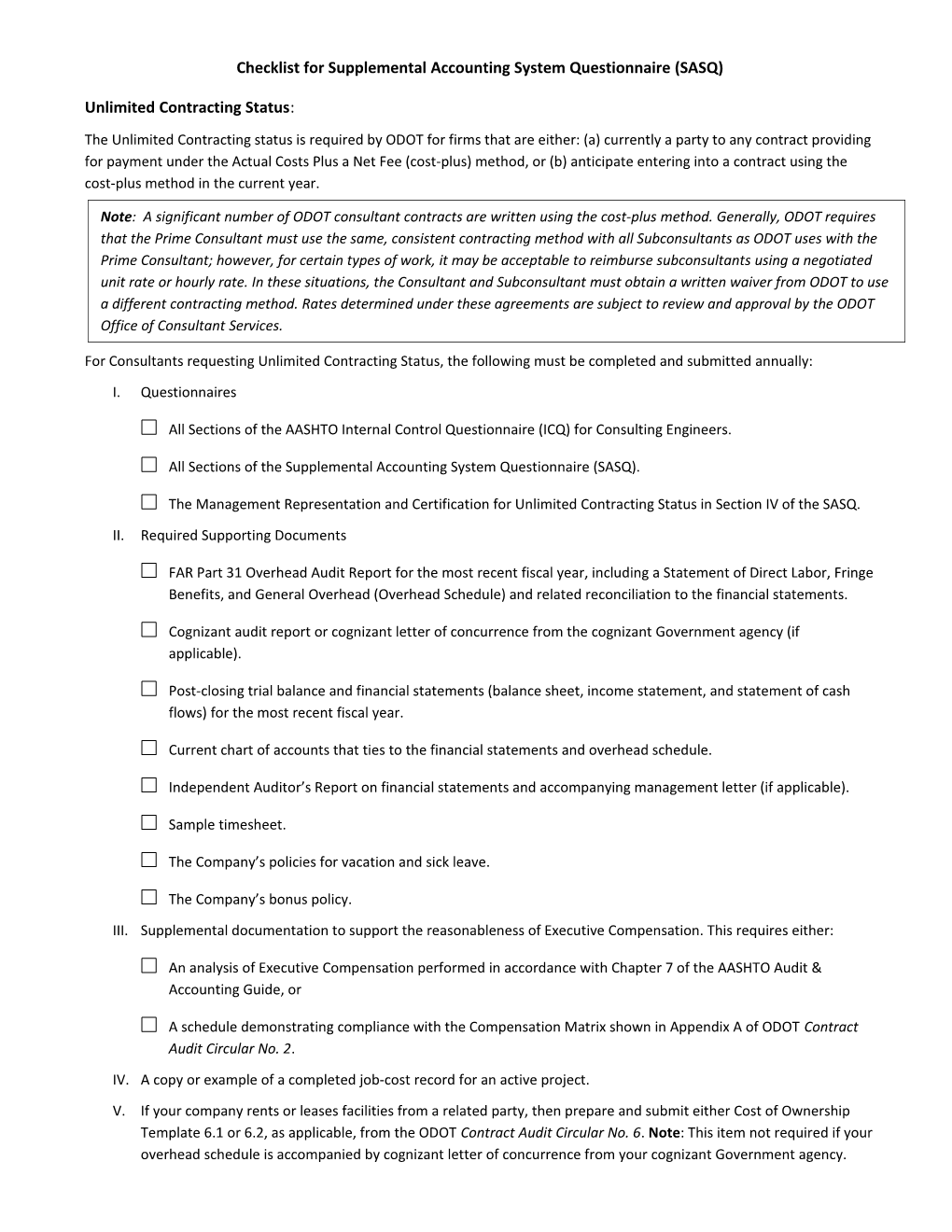

Checklist for Supplemental Accounting System Questionnaire (SASQ)

Unlimited Contracting Status:

The Unlimited Contracting status is required by ODOT for firms that are either: (a) currently a party to any contract providing for payment under the Actual Costs Plus a Net Fee (cost-plus) method, or (b) anticipate entering into a contract using the cost-plus method in the current year.

Note: A significant number of ODOT consultant contracts are written using the cost-plus method. Generally, ODOT requires that the Prime Consultant must use the same, consistent contracting method with all Subconsultants as ODOT uses with the Prime Consultant; however, for certain types of work, it may be acceptable to reimburse subconsultants using a negotiated unit rate or hourly rate. In these situations, the Consultant and Subconsultant must obtain a written waiver from ODOT to use a different contracting method. Rates determined under these agreements are subject to review and approval by the ODOT Office of Consultant Services.

For Consultants requesting Unlimited Contracting Status, the following must be completed and submitted annually: I. Questionnaires

All Sections of the AASHTO Internal Control Questionnaire (ICQ) for Consulting Engineers.

All Sections of the Supplemental Accounting System Questionnaire (SASQ).

The Management Representation and Certification for Unlimited Contracting Status in Section IV of the SASQ. II. Required Supporting Documents

FAR Part 31 Overhead Audit Report for the most recent fiscal year, including a Statement of Direct Labor, Fringe Benefits, and General Overhead (Overhead Schedule) and related reconciliation to the financial statements.

Cognizant audit report or cognizant letter of concurrence from the cognizant Government agency (if applicable).

Post-closing trial balance and financial statements (balance sheet, income statement, and statement of cash flows) for the most recent fiscal year.

Current chart of accounts that ties to the financial statements and overhead schedule.

Independent Auditor’s Report on financial statements and accompanying management letter (if applicable).

Sample timesheet.

The Company’s policies for vacation and sick leave.

The Company’s bonus policy. III. Supplemental documentation to support the reasonableness of Executive Compensation. This requires either:

An analysis of Executive Compensation performed in accordance with Chapter 7 of the AASHTO Audit & Accounting Guide, or

A schedule demonstrating compliance with the Compensation Matrix shown in Appendix A of ODOT Contract Audit Circular No. 2. IV. A copy or example of a completed job-cost record for an active project. V. If your company rents or leases facilities from a related party, then prepare and submit either Cost of Ownership Template 6.1 or 6.2, as applicable, from the ODOT Contract Audit Circular No. 6. Note: This item not required if your overhead schedule is accompanied by cognizant letter of concurrence from your cognizant Government agency. The ODOT Contract Audit Circulars referenced above are available at: http://www.dot.state.oh.us/Divisions/Finance/Auditing/Pages/Consultants.aspx

Submittal Method: The required documents listed above must be submitted either electronically via email to [email protected], or via fax to (614) 887-4010. The documents should be submitted in Microsoft Excel, Microsoft Word, or Adobe PDF format when possible. Due Date: Documents must be submitted/updated annually, no later than six months after the close of your company’s fiscal year. Accordingly, the documents are due by July 1 for calendar-year companies.