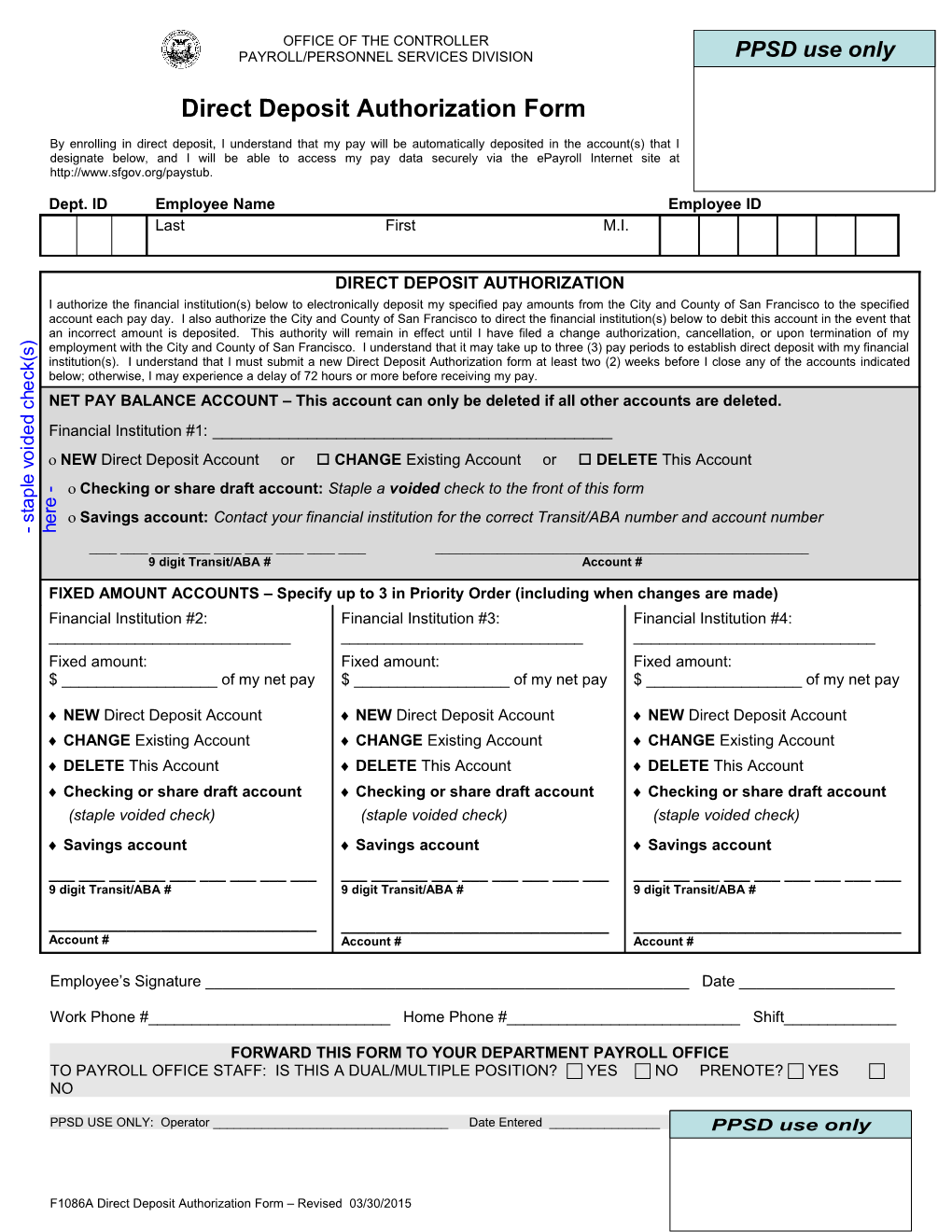

OFFICE OF THE CONTROLLER PAYROLL/PERSONNEL SERVICES DIVISION PPSD use only

Direct Deposit Authorization Form

By enrolling in direct deposit, I understand that my pay will be automatically deposited in the account(s) that I designate below, and I will be able to access my pay data securely via the ePayroll Internet site at http://www.sfgov.org/paystub.

Dept. ID Employee Name Employee ID Last First M.I.

DIRECT DEPOSIT AUTHORIZATION I authorize the financial institution(s) below to electronically deposit my specified pay amounts from the City and County of San Francisco to the specified account each pay day. I also authorize the City and County of San Francisco to direct the financial institution(s) below to debit this account in the event that an incorrect amount is deposited. This authority will remain in effect until I have filed a change authorization, cancellation, or upon termination of my

) employment with the City and County of San Francisco. I understand that it may take up to three (3) pay periods to establish direct deposit with my financial s ( institution(s). I understand that I must submit a new Direct Deposit Authorization form at least two (2) weeks before I close any of the accounts indicated k

c below; otherwise, I may experience a delay of 72 hours or more before receiving my pay. e h NET PAY BALANCE ACCOUNT – This account can only be deleted if all other accounts are deleted. c d e Financial Institution #1: ______d i o NEW Direct Deposit Account or CHANGE Existing Account or DELETE This Account v e l

- Checking or share draft account: Staple a voided check to the front of this form p e a t r s e Savings account: Contact your financial institution for the correct Transit/ABA number and account number

- h ______9 digit Transit/ABA # Account #

FIXED AMOUNT ACCOUNTS – Specify up to 3 in Priority Order (including when changes are made)

Financial Institution #2: Financial Institution #3: Financial Institution #4: ______Fixed amount: Fixed amount: Fixed amount: $ ______of my net pay $ ______of my net pay $ ______of my net pay

NEW Direct Deposit Account NEW Direct Deposit Account NEW Direct Deposit Account CHANGE Existing Account CHANGE Existing Account CHANGE Existing Account DELETE This Account DELETE This Account DELETE This Account Checking or share draft account Checking or share draft account Checking or share draft account (staple voided check) (staple voided check) (staple voided check) Savings account Savings account Savings account ______9 digit Transit/ABA # 9 digit Transit/ABA # 9 digit Transit/ABA #

______Account # Account # Account #

Employee’s Signature ______Date ______

Work Phone #______Home Phone #______Shift______

FORWARD THIS FORM TO YOUR DEPARTMENT PAYROLL OFFICE TO PAYROLL OFFICE STAFF: IS THIS A DUAL/MULTIPLE POSITION? YES NO PRENOTE? YES NO

PPSD USE ONLY: Operator ______Date Entered ______PPSDPrenote: use YES only NO

F1086A Direct Deposit Authorization Form – Revised 03/30/2015 OFFICE OF THE CONTROLLER PAYROLL/PERSONNEL SERVICES DIVISION US Bank Focus Card™ Authorization Form Employee First Name: ______MI: _____ Last Name: ______Employee ID : ______Date of Birth: ______Address: ______Apt. #: ______City: ______State: ______Zip Code: ______

US BANK Focus Card™AUTHORIZATION I authorize US Bank to electronically deposit my specified pay amounts from the City and County of San Francisco to the pre paid debit card each pay day. I also authorize the City and County of San Francisco to direct the financial institution(s) below to debit this account in the event that an incorrect amount is deposited. This authority will remain in effect until I have filed a change authorization, cancellation, or upon termination of my employment with the City and County of San Francisco. I understand that it may take up to three (3) pay periods to establish direct deposit with another financial institution(s). I understand that I must submit a new Direct Deposit Authorization form at least two (2) weeks before I close the account indicated below; otherwise, I may experience a delay of 72 hours or more before receiving my pay. NET PAY BALANCE ACCOUNT – This account can only be inactivated if direct deposit is activated. NEW US Bank FOCUS Pay Card or INACTIVATE US Bank FOCUS Pay Card

SCHEDULE OF CARDHOLDER FEES Focus Card™ Fee Schedule ACTIVITY COST Monthly Account Maintenance Free Purchases at Point-of-Sale (Domestic) Free Cash Back with Purchases (Domestic) Free ATM Transactions Cash Declined Balance Withdrawal Withdrawal Inquiry U.S. Bank ATM Free Free Free MoneyPass® ATM Free Free Free Other ATM $1.75 $0.50 $1.00 International ATM $3.00 $0.50 $1.00 *The owner of any Non-U.S. Bank or Non-MoneyPass ATM may assess an additional surcharge fee for any ATM transaction that you complete. Teller Cash Withdrawal Free Customer Service Automated Phone Service Free Online Free Live Phone Representative Free Text or Email Alerts (Standard messaging charges apply through your mobile carrier and message frequency depends Free on accounting settings) Inactivity $2.00 Per Month After 90 consecutive days (for a longer period of time or never, as restricted under applicable state law). Not assessed if balance is $0.00 Monthly Paper Statement If requested – up to $2.00 (as restricted under applicable state law) Card Replacement Standard mail or Issued by Employer (if applicable to your program) $5.00 (one free per rolling year) Expedited Mail $15.00 Overnight $25.00 ChekToday Convenience Checks Check Authorization Free Check Order Free Expedited Check Order $35.00 Check Return $25.00 Stop Payment $25.00 Lost/Stolen Check $25.00 Void Check Free Check Reversal $25.00 Check Copy $10.00 Foreign Transaction Up to 3% of transaction amount Transaction Limits Count Amount Maximum Card Balance N/A $40,000 Purchases (includes cash back) 20 per day $4,000 per transaction Cash Loads (if applicable to your program) 3 per day $950 per day Teller Cash Withdrawal 5 per day $5,000 per day ATM Withdrawal 5 per day $1,525 per day Loads or Deposits 10 per day $20,000 per day Signature-based POS returns 4 per day N/A Pending ACH Credits 5 per day $5,000 per day ACH Loads 5 per day $20,000 per day US Bank reserves the right to change the above fee schedule upon written notification to you as required by applicable law.

Employee’s Signature ______Date ______Work Phone #______Home Phone #______Shift______FORWARD THIS FORM TO YOUR DEPARTMENT PAYROLL OFFICE TO PAYROLL OFFICE STAFF: IS THIS A DUAL/MULTIPLE POSITION? YES NO PRENOTE? YES NO

PPSD USE ONLY: Operator ______Date Entered ______Prenote: YES NO

F1086A Direct Deposit Authorization Form – Revised 03/30/2015