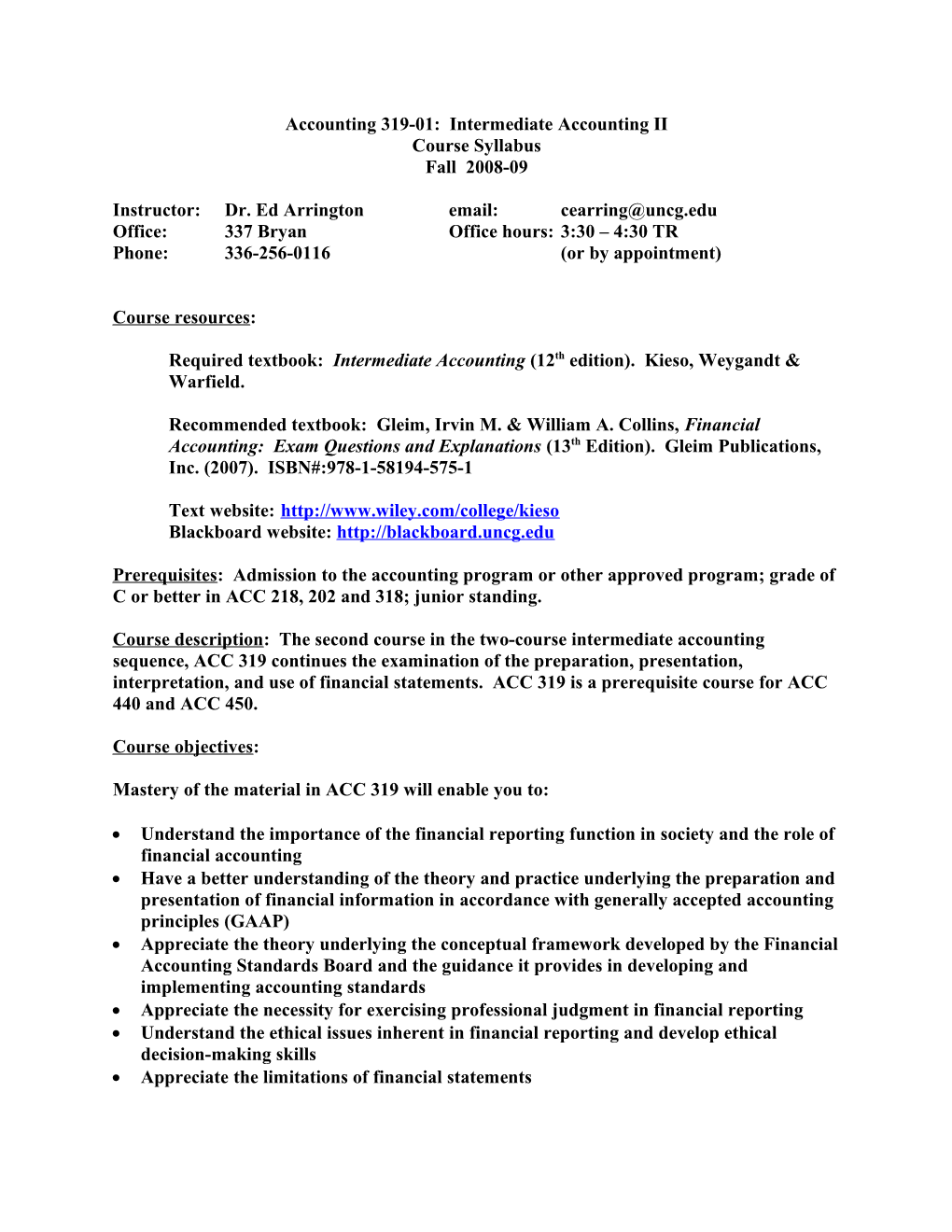

Accounting 319-01: Intermediate Accounting II Course Syllabus Fall 2008-09

Instructor: Dr. Ed Arrington email: [email protected] Office: 337 Bryan Office hours: 3:30 – 4:30 TR Phone: 336-256-0116 (or by appointment)

Course resources:

Required textbook: Intermediate Accounting (12th edition). Kieso, Weygandt & Warfield.

Recommended textbook: Gleim, Irvin M. & William A. Collins, Financial Accounting: Exam Questions and Explanations (13th Edition). Gleim Publications, Inc. (2007). ISBN#:978-1-58194-575-1

Text website: http://www.wiley.com/college/kieso Blackboard website: http://blackboard.uncg.edu

Prerequisites: Admission to the accounting program or other approved program; grade of C or better in ACC 218, 202 and 318; junior standing.

Course description: The second course in the two-course intermediate accounting sequence, ACC 319 continues the examination of the preparation, presentation, interpretation, and use of financial statements. ACC 319 is a prerequisite course for ACC 440 and ACC 450.

Course objectives:

Mastery of the material in ACC 319 will enable you to:

Understand the importance of the financial reporting function in society and the role of financial accounting Have a better understanding of the theory and practice underlying the preparation and presentation of financial information in accordance with generally accepted accounting principles (GAAP) Appreciate the theory underlying the conceptual framework developed by the Financial Accounting Standards Board and the guidance it provides in developing and implementing accounting standards Appreciate the necessity for exercising professional judgment in financial reporting Understand the ethical issues inherent in financial reporting and develop ethical decision-making skills Appreciate the limitations of financial statements Course Philosophy:

Mastery of the material covered in this course is essential for professional accountants, regardless of specialization. As future accounting professionals you must be prepared for a significantly more challenging and complex environment than ever before. It is no longer sufficient to obtain narrow technical training largely based on the memorization of existing rules and regulations. It is important that you acquire a thorough comprehension of the principles that govern financial accounting and reporting and that you are able to apply these principles to existing problems as well as to emerging issues. You also need to be aware of the ethical and international aspects of accounting and must be able to communicate information clearly and concisely.

Grading:

The grading formula for undergraduates and for graduate students differs. The UNCG Graduate School does not permit grades of D for graduate students. As such, any grade below 70% will be scored as an F for graduate students. Undergraduates will be graded according to the percentages indicated in the section “Requirements for specific grades” described below. For scores above 70, the grading scale is the same for graduate students as it is for undergraduate students.

The relative importance of assignments in calculating course grades is as follows:

Semester Exam 1 30% Semester Exam 2 30% Cumulative final exam 35% Class participation 5%

Requirements for specific grades are:

A+ = 97 and above; A = 93 to 96%; A- = 90 to 92% B+ = 87 to 89%; B = 83 to 86%; B- = 80 to 82% C+ = 77 to 79%; C = 70 to 76% D+ = 69 to 67%; D = 63 to 66%; D- = 60 to 62% F = Below 60%

Note that an accounting major requires a grade of at least a C to take further courses in accounting.

Exams:

Two midterm exams and a final exam will be administered as part of this course. The exams will consist of objective questions (e.g., multiple choice), subjective questions (e.g., short answer and/or essay), and problems. The two semester exams will be administered during class time on the dates indicated in the course schedule. Failure to attend class on the date of an exam will result in a grade of zero unless: (a) I am notified in advance; (b) the reason for missing the exam is valid; and, (c) acceptable documentation of the reason can be provided. If all three of these conditions are satisfied, a makeup exam will be administered at the earliest possible date following the scheduled exam. If these conditions are not met, then a grade of zero will be assigned to the missed exam. Class participation:

Class participation accounts for 5% of your course grade. Class attendance is mandatory.

Academic Integrity Policy and Faculty and Student Guidelines:

We are all bound by the UNCG Academic Integrity Policy. Please read it at http://www.uncg.edu/saf/studiscp/Honor.html. I will follow through on suspected violations of that policy in a manner consistent with the provisions of that policy. I will also require us to adhere to the Bryan School’s Faculty/Student Guidelines. These are available at http://www.uncg.edu/bae/faculty_student_guidelines.pdf.

Other Comments:

Accounting 319 is a rigorous and time-consuming course. It requires in-depth study and analysis and should not be undertaken casually.

1. Do not take this course in conjunction with a full class load, full-time work and an extensive social life. One or more of them will have to go. This course will require a substantial amount of time. You should plan to attend every class meeting prepared (having read and worked assigned problems ahead of time!) 2. Avoid too many similarly demanding courses. 3. Stay up-to-date in all assignments. 4. Consult me BEFORE YOU ARE HAVING SERIOUS DIFFICULTIES COURSE ASSIGNMENTS

All assignments are due at the start of class on the dates indicated. This means that you will do your reading and homework BEFORE we cover that material in class. That sometimes bothers students. However, understanding of and competence in this material is best served under this system. If you have not done the reading and the homework, our class time will be much less beneficial to you. On days when I collect your homework, I will NOT ACCEPT late assignments. Don’t ask.

August 26, Introduction; Dilutive Chapter 16, pages Chapter 16, Exercises Tuesday securities 777-785 1,2,3,4,7,9 August 28, Stock compensation plans Chapter 16, pages Chapter 16, Exercises Thursday 785-793. 10, 12. Concepts for Analysis (CA) 16-4. September 2, Earnings per share Chapter 16, pages Chapter 16, Exercises Tuesday 793-806. 15, 16,23,24,25. September 4, Completion of Chapter 16 Appendix A and Thursday Appendix B to Chapter 16. September 9, Investments in Debt Chapter 17, pages Chapter 17, Exercises 1, Tuesday Securities 837-846. 3,5, 6 September Investments in Equity Chapter 17, pages Chapter 17, Exercises 11, Thursday Securities and Disclosure 847-862. 11, 12, 16. Issues September Revenue Recognition Chapter 18, pages Chapter 18, Exercises 1, 16, Tuesday 905-917. 2. Problem 4. September Revenue Recognition Chapter 18, pages Chapter 18, Problems 2, 18, Thursday 918-935. 10, 11. September Revenue Recognition Chapter 18, pages Chapter 18, Exercises 23, Tuesday 935-940. 19, 21. CA 10. September REVIEW 25, Thursday September EXAM – 30, Tuesday CHAPTERS 16-18 October 2, Accounting for Income Taxes Chapter 19, pages Chapter 19, Exercises 2, Thursday 963-976. 3,4,5,6. October 7, Accounting for Income Taxes Chapter 19, pages Chapter 19, Exercises Tuesday 976-990. 9,12,14,17. October 9, Accounting for Income Taxes Chapter 19, pages Thursday 992-999. October 14, Accounting for Leases Chapter 21, pages Chapter 21, Exercises 1, Tuesday 1087-1102. 2,8,11. October 16, Accounting for Leases Chapter 21, pages Chapter 21, Exercises Thursday 1102-1116. 4, 6, 7,9,10. October 21, NO CLASSES; FALL Tuesday BREAK October 23, Accounting for Leases Chapter 21, pages Chapter 21, Exercises Thursday 1116-1131. 15,16. Problems 12, 15. October 28, REVIEW Tuesday October 30, EXAM – Thursday CHAPTERS 19 AND 21 November 4, Accounting changes – Chapter 22, pages Chapter 22, Exercises Tuesday changes in principles. 1151-1163. 1,2,4,5. November 6, Accounting changes Chapter 22, pages Chapter 22, Exercises Thursday --changes in estimates and 1164-1173. 11,12. Problem 4. CA changes in entities. 6. November Accounting changes and error Chapter 22, pages Chapter 22. Exercises 11, Tuesday analysis 1174-1187. 15,17,19,23. November Cash Flow Statement Chapter 23, pages Chapter 23, Exercises 13, Thursday 1211-1224. 1,3,6,8. November Cash Flow Statement Chapter 23, pages Chapter 23, Exercises 18, Tuesday 1224-1242. 9,11,12. November Cash Flow Statement Chapter 23. pages Chapter 23, Exercises 20, Thursday 1242-1251. 17, 19, 21. November Accounting for Pensions (use Chapter 20, pages Chapter 20, Exercises 25, Tuesday updated Chapter 20) 1019-1028 1,2,6, and part (a) of Exercise 9 November NO CLASS; 27, Thursday THANKSGIVING HOLIDAY December 2, An introduction to To be determined Tuesday governmental accounting December 5, An introduction to not-for- To be determined Thursday profit accounting December FINAL EXAM, 12:00-3:00 16, Tuesday PM