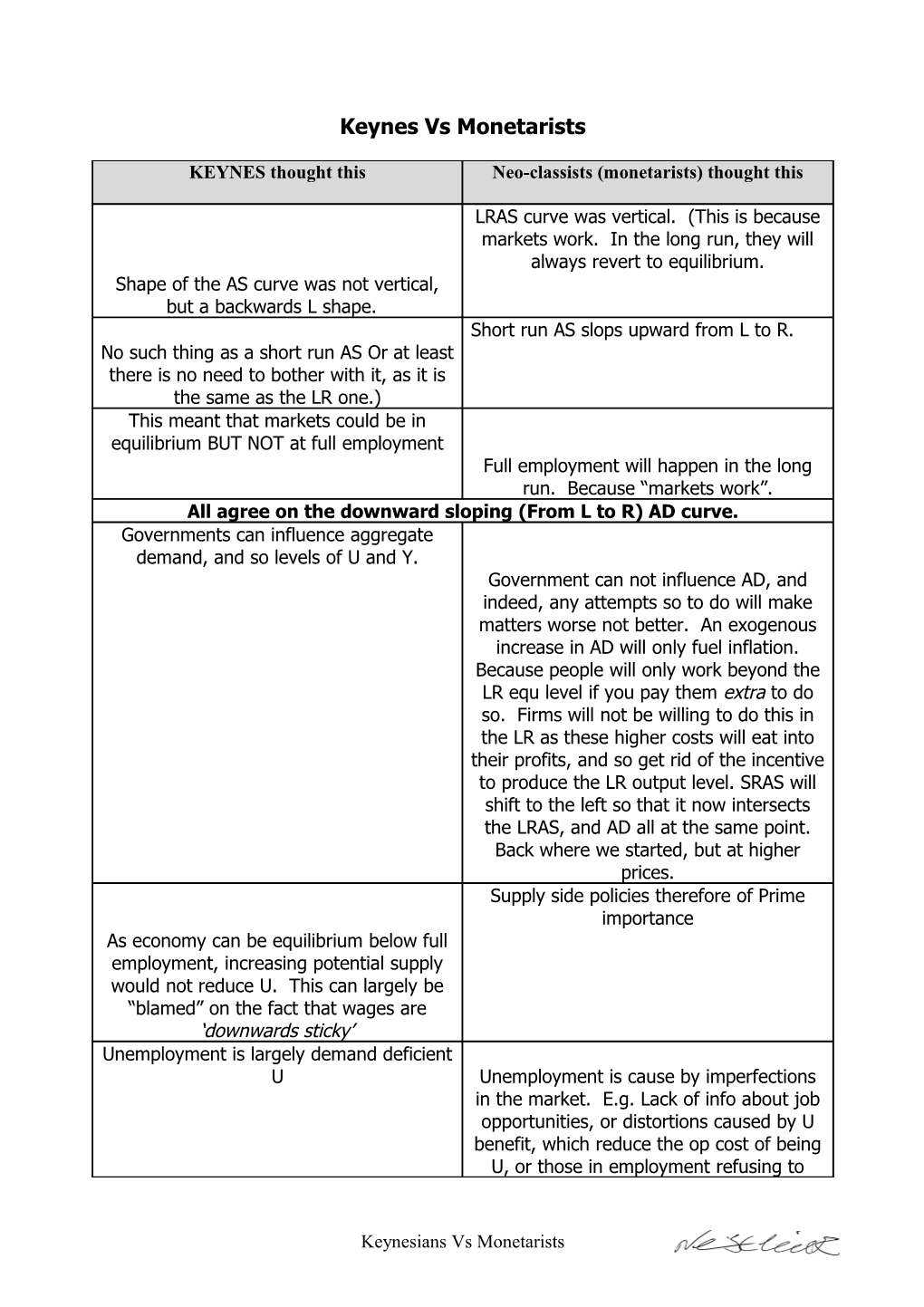

Keynes Vs Monetarists

KEYNES thought this Neo-classists (monetarists) thought this

LRAS curve was vertical. (This is because markets work. In the long run, they will always revert to equilibrium. Shape of the AS curve was not vertical, but a backwards L shape. Short run AS slops upward from L to R. No such thing as a short run AS Or at least there is no need to bother with it, as it is the same as the LR one.) This meant that markets could be in equilibrium BUT NOT at full employment Full employment will happen in the long run. Because “markets work”. All agree on the downward sloping (From L to R) AD curve. Governments can influence aggregate demand, and so levels of U and Y. Government can not influence AD, and indeed, any attempts so to do will make matters worse not better. An exogenous increase in AD will only fuel inflation. Because people will only work beyond the LR equ level if you pay them extra to do so. Firms will not be willing to do this in the LR as these higher costs will eat into their profits, and so get rid of the incentive to produce the LR output level. SRAS will shift to the left so that it now intersects the LRAS, and AD all at the same point. Back where we started, but at higher prices. Supply side policies therefore of Prime importance As economy can be equilibrium below full employment, increasing potential supply would not reduce U. This can largely be “blamed” on the fact that wages are ‘downwards sticky’ Unemployment is largely demand deficient U Unemployment is cause by imperfections in the market. E.g. Lack of info about job opportunities, or distortions caused by U benefit, which reduce the op cost of being U, or those in employment refusing to

Keynesians Vs Monetarists accept the wage cut that the large number of people clamouring for their jobs (The unemployed) would imply. i.e. a large rightward shift in the Supply of L. Multiplier is a key plank to K policy Multiplier did not work because of crowding out. Crowding out is the idea that extra I by G would not actually stimulate the economy, because if it were needed then it would be supplied by market forces anyway. Thus G does not add to AD, but subs public for private. (In fact they would argue that often it does so in an extremely inefficient way, and G Neo-Keynesians acknowledge that as you ‘meddling’ reduces AD rather than reach full employment the effect of the increases it. multiplier is reduced. (All that happens is that prices will rise rather than output.) Monetary policy much more important. Fiscal policy key Government policy. The link between tax cuts and supply of L is only very weak.

John Maynard Keynes Milton Friedman

Keynesians Vs Monetarists