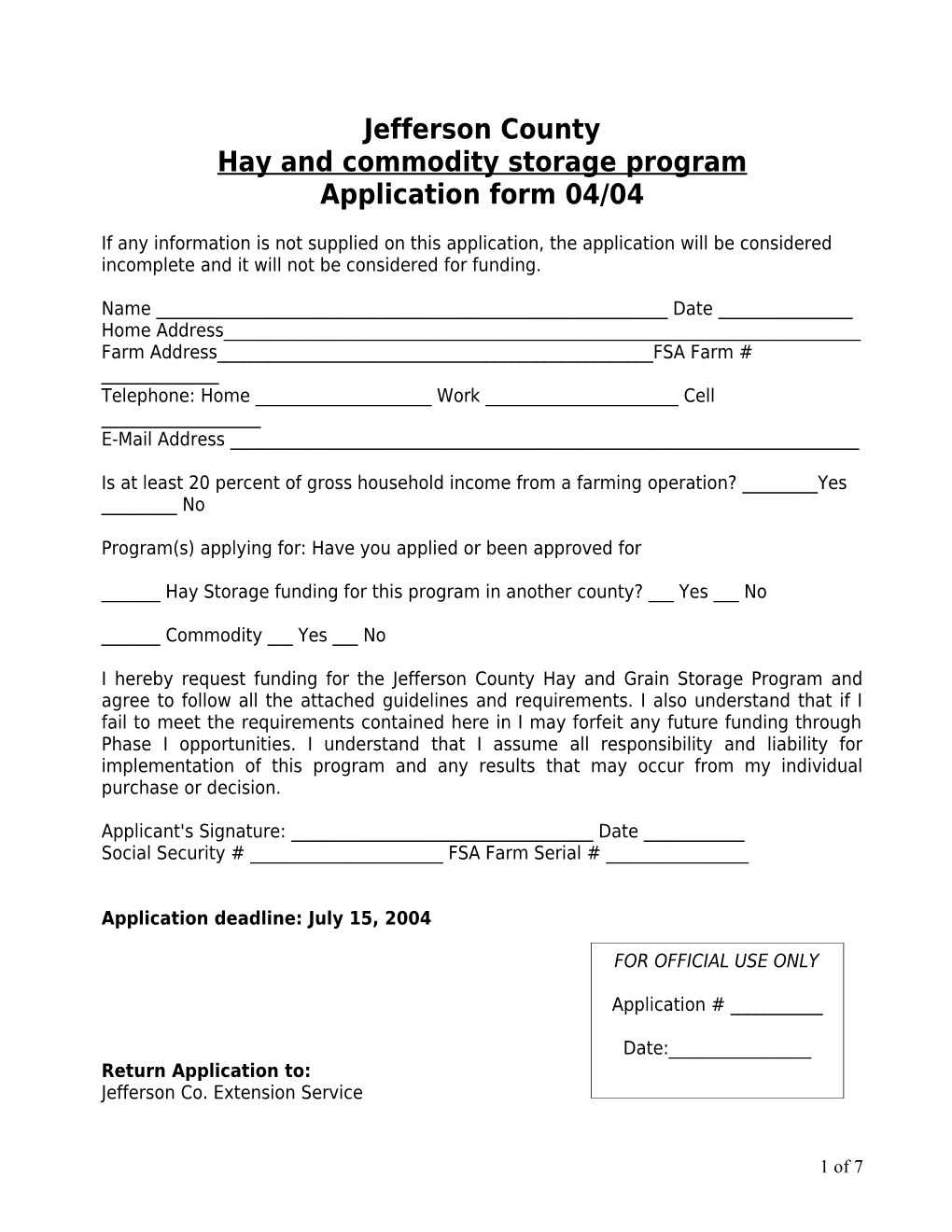

Jefferson County Hay and commodity storage program Application form 04/04

If any information is not supplied on this application, the application will be considered incomplete and it will not be considered for funding.

Name ______Date ______Home Address______Farm Address______FSA Farm # ______Telephone: Home ______Work ______Cell ______E-Mail Address ______

Is at least 20 percent of gross household income from a farming operation? ______Yes ______No

Program(s) applying for: Have you applied or been approved for

______Hay Storage funding for this program in another county? ___ Yes ___ No

______Commodity ___ Yes ___ No

I hereby request funding for the Jefferson County Hay and Grain Storage Program and agree to follow all the attached guidelines and requirements. I also understand that if I fail to meet the requirements contained here in I may forfeit any future funding through Phase I opportunities. I understand that I assume all responsibility and liability for implementation of this program and any results that may occur from my individual purchase or decision.

Applicant's Signature: ______Date ______Social Security # ______FSA Farm Serial # ______

Application deadline: July 15, 2004

FOR OFFICIAL USE ONLY

Application # ______

Date:______Return Application to: Jefferson Co. Extension Service

1 of 7 8012 Vinecrest Ave, Suite 1 Louisville, Kentucky 40222 hours M-F 8AM-4:30PM

General guidelines for all programs and for hay & commodity storage Model Program

Applicants for each program must be a Jefferson County farmer who receives at least 20% of their gross household income from a farming operation. Applicants who don’t meet this 20% eligibility requirement may be considered for funding on a case-by-case basis. Awarding of cost-share funds will be based on information provided in the Supplemental Application. The applications will NOT be considered on a first-come, first-serve basis. All applications may not be funded due to financial constraints. Applications can be considered for improvements made on the farm retroactive to January 1, 2003. Cost-share is on a 50/50 basis of eligible expenses. Labor costs are not eligible for cost-share. Program improvements or installations must be made within six months of application approval. There is a maximum cost-share amount in each program paid per farm/ producer/ partnership. There is any number of different family and partner farming arrangements across the county. The intent is that this is the maximum for each household. For anyone receiving over $600, a 1099 IRS form will be sent out at the end of the year.

In most of these programs, farmers are required to attend some type of educational session relating to that particular program. The Extension Service is offering a series of programs that will meet the educational requirements. As mentioned before, this money is considered government funds and must be accounted for. The local board has determined that the best way to do this is to have each producer fill out a form listing pertinent information at reimbursement time to set a baseline, and again one and two years later (depending on the program) as a means of judging success of the program. Any producer making application agrees to fill these out. This money is for the long-term improvement in agricultural profitability. To get the best possible use of the money, in some cases, some improvements and installations may need to be demonstrated to others. By making application, a farmer is agreeing to host an on-farm demonstration, if asked.

Maximum cost-share in this program is $5,000 ($1,500 for the filter fabric program) and lifetime limit per farm/partnership of $5,000... You’ll need to get soil tests from the UK lab, (other soil tests not eligible,) complete a forage plan and an information sheet on your forage and livestock operation. The forage plan is simply a description of how you plan to use improvements that are made. Each participant will be put on a special Extension Service mailing list to receive occasional timely production and management information.

Guidelines for hay storage program

Hay Storage: pays for materials and construction of permanent hay storage structures. Grain Storage: pays for purchase of, or materials and construction of commodity or grain storage structures.

Maximum cost-share for this program is $5000. You’ll need to attend an educational program on Hay and Feed Storage and Utilization, and have at least three lots of hay tested for quality. (Feed rations based on these tests will be developed by the Extension Service.) You'll also be put on a

2 of 7 special Extension Service mailing list to receive occasional timely forage production and management information.

3 of 7 Jefferson County Hay and commodity storage program Supplemental Application Form 04/04

This supplemental form must be completed with every application. Careful completion of this page will have a bearing on whether or not your application is approved. Attach another page, if necessary. If applying for more than one program, you only need to fill out this form once .

Please describe the farming operation that you materially participate in, (that is, you provide management and some labor, and you assume some financial risk.) Include a list of crops and livestock enterprises, along with acreages and numbers raised of each.

2000 2001 2002 2003 Tobacco Quota on farm ______

Did you grow the crop yourself? rent it, or lease it out? ______

How long have you been farming? ______years.

What other occupations or businesses provide portions of total family income?

What are your future plans for your farming operation? How do you plan to enlarge or improve your operation?

4 of 7 Jefferson County Hay and Commodity Storage Program

Livestock production is the most logical use of much of the Jefferson County landscape, and the most likely choice for improving farm income for most farmers. This cost-share project is designed to improve profitability by increasing the quality of stored feed, and allow farmers to invest in commodity feed storage. This will increase hay utilization and value, enhance feeding programs and allow for improved animal gain and production.

General Guidelines

* Applicant must be a Jefferson Co. farmer, with at least 20% of gross household income from a farming operation.

* Applicants who don’t meet the 20% farm income eligibility requirement may be considered on a case by case basis.

* Additional information on income (including tax forms) and farming operation may be requested before considering application approval.

* Award of cost-share funds will be based on information provided in the Supplemental Application Form. The order of receipt of application will NOT be considered in awarding of funds. All applications may not be funded due to financial constraints.

* Cost share is on a 50-50 basis of eligible expenses, listed in each detail section, based on receipts from vendors.

* Cost share does not include labor costs. Cost share can include work done retroactive to January 1, 2003.

* There is a $5,000 maximum paid per farm/producer/partnership for the lifetime of the program.

* Producer signature, Social Security number and FSA Farm Serial number must be on form in order to participate.

* After notice of application approval, improvements must be made and receipts presented within 6 months. Otherwise, funds will be reallocated to the next available application, and the producer must reapply to be considered for cost share funding.

* Producer agrees to fill out an information sheet on their operation before funds are distributed and complete an

5 of 7 evaluation one year after funding, and to participate in an on-farm demonstration, if asked.

* Producers receiving hay storage funds agrees to quality test at least 3 lots of hay that is stored in the funded structure. Cost of the three tests will be funded through Phase I Education and Outreach money. ($10 per test) Feed rations will be developed for each of the samples by the Extension Service.

* Producers receiving funds will be placed on a special Extension Service mailing list to receive occasional timely production and management information. * Applicant will attend an educational session on Hay and Feed Storage and Utilization.

* 90 % of approved funds will be distributed after the committee receives a dated receipt indicating buyer and seller.

* An itemized summary of expenses, information sheet, a photograph of new or modernized hay or commodity storage facility, and educational program certification must accompany receipts. The remaining 10% will be distributed after forage quality tests are completed (hay storage only) and the one year evaluation is turned in.

*Any individual receiving $600 or more will receive a 1099 IRS form.

* Spot checks may be made.

* Producer must retain adequate insurance coverage to replace any and all structures erected with or improved by Agricultural Development funds.

* Recipient must retain ownership of facilities for at least five years following awarding of funds.

* If a producer fails to meet requirements of the program, including the following year(s) evaluation, they will not be eligible for any future funding opportunities through any other Phase I program.

Eligible Cost Share Items

Hay & Straw Storage * Materials and construction of permanent hay sheds, pole barn or Quonset hut type hay storage, or materials necessary to convert/ retrofit existing structures for the sole purpose of hay storage

Grain Storage

6 of 7 * Purchase of new or used grain storage structures, or materials needed to construct commodity storage or to repair, upgrade or modernize existing grain storage structures, as well as drying and handling equipment that will increase efficiency, improve quality, and/or add value to the grain.

7 of 7