Acct. 414 – Fall 2006 SOLUTION

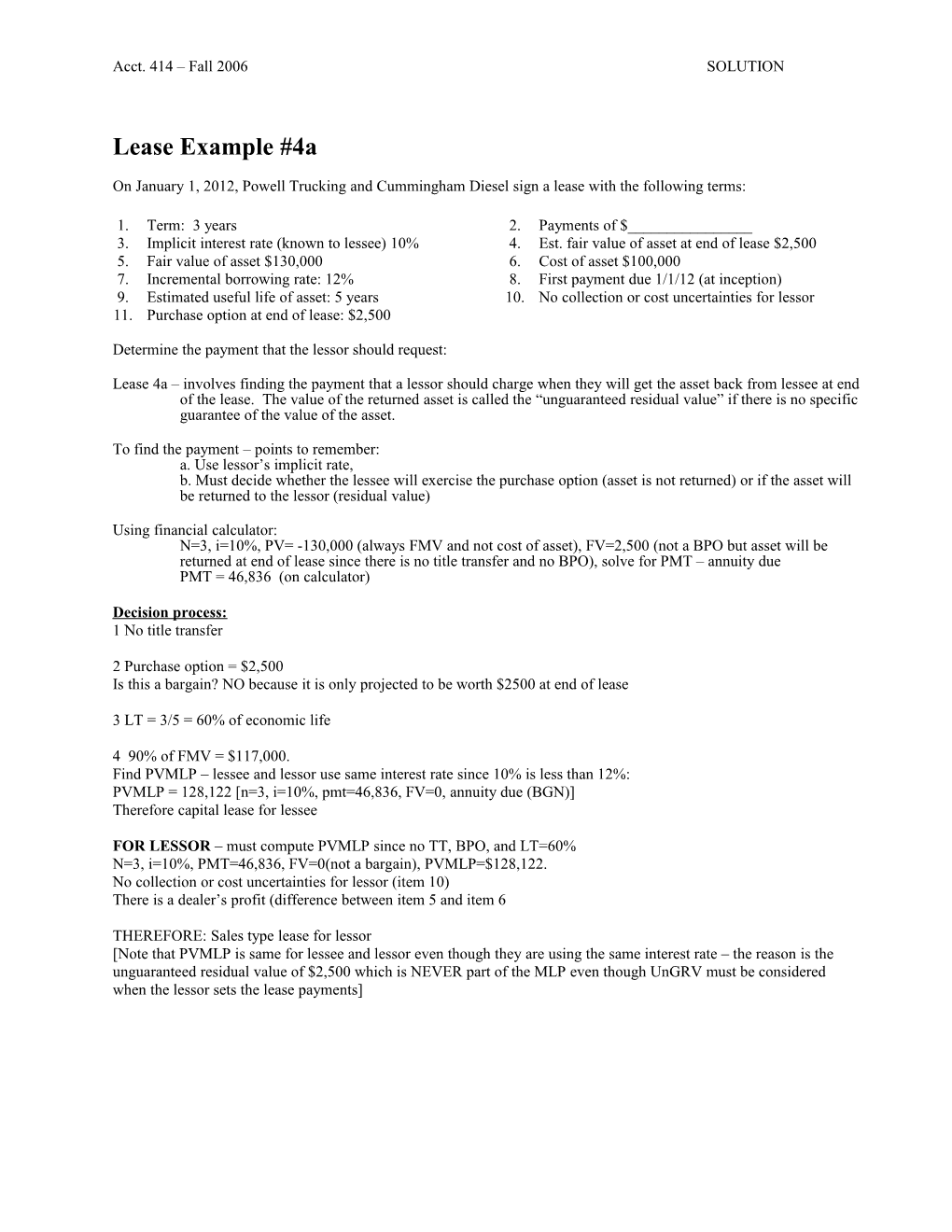

Lease Example #4a

On January 1, 2012, Powell Trucking and Cummingham Diesel sign a lease with the following terms:

1. Term: 3 years 2. Payments of $______3. Implicit interest rate (known to lessee) 10% 4. Est. fair value of asset at end of lease $2,500 5. Fair value of asset $130,000 6. Cost of asset $100,000 7. Incremental borrowing rate: 12% 8. First payment due 1/1/12 (at inception) 9. Estimated useful life of asset: 5 years 10. No collection or cost uncertainties for lessor 11. Purchase option at end of lease: $2,500

Determine the payment that the lessor should request:

Lease 4a – involves finding the payment that a lessor should charge when they will get the asset back from lessee at end of the lease. The value of the returned asset is called the “unguaranteed residual value” if there is no specific guarantee of the value of the asset.

To find the payment – points to remember: a. Use lessor’s implicit rate, b. Must decide whether the lessee will exercise the purchase option (asset is not returned) or if the asset will be returned to the lessor (residual value)

Using financial calculator: N=3, i=10%, PV= -130,000 (always FMV and not cost of asset), FV=2,500 (not a BPO but asset will be returned at end of lease since there is no title transfer and no BPO), solve for PMT – annuity due PMT = 46,836 (on calculator)

Decision process: 1 No title transfer

2 Purchase option = $2,500 Is this a bargain? NO because it is only projected to be worth $2500 at end of lease

3 LT = 3/5 = 60% of economic life

4 90% of FMV = $117,000. Find PVMLP – lessee and lessor use same interest rate since 10% is less than 12%: PVMLP = 128,122 [n=3, i=10%, pmt=46,836, FV=0, annuity due (BGN)] Therefore capital lease for lessee

FOR LESSOR – must compute PVMLP since no TT, BPO, and LT=60% N=3, i=10%, PMT=46,836, FV=0(not a bargain), PVMLP=$128,122. No collection or cost uncertainties for lessor (item 10) There is a dealer’s profit (difference between item 5 and item 6

THEREFORE: Sales type lease for lessor [Note that PVMLP is same for lessee and lessor even though they are using the same interest rate – the reason is the unguaranteed residual value of $2,500 which is NEVER part of the MLP even though UnGRV must be considered when the lessor sets the lease payments] Acct. 414 – Fall 2006 SOLUTION

PRACTICE VARIATION – same as 4c but lessee knows Lease 4b - What if the lessor’s implicit rate is the implicit interest rate. NOT known to lessee? Find the PVMLP. N=3 (annuity due) Lease #4d Amortization Table – Lessor i=12% Date Payment Interest Principal Balance Pmt=46,836 1/01/12 130,000 1/01/12 46,836 0 46,836 83,164 FV=0 (purchase option is not a bargain) 1/01/13 46,836 8,316 38,520 44,644 PVMLP=125,991 (with calculator) 1/01/14 46,836 4,464 42,372 2,273 Still capital lease because >90% of 130,000 = $117,000 1/01/15 2,500 227 2,273 0 143,008 13,008 130,000 0 What if lessee says their incremental borrowing rate is 20%? Sales Type with BPO Still a capital lease (PVMLP=$118,391) – but for a lease LESSOR with a longer life, a higher interest rate MIGHT cause the 1/2/2012 PVMLP test to fail even though the LESSOR met the Net Lease Receivable $ 83,164 90% rule! Cash 46,836 Lease 4c Sales $130,000 Computations using Excel n Lease 4 COGS $100,000 FMV = 130,000 Inventory $100,000 117,000 90% FMV 3 Lease Term 12/31/12 5 Economic Life 60.00% LT as % Eco. Life Net Lease Receivable $ 8,316 MLP Lessee Comments Interest Revenue $ 8,316 0 46,836 1 46,836 1/2/2005 – at end of lease – receipt of BPO 2 46,836 Cash $ 2,500 3 2,500 BPO Net Lease Receivable $ 2,500 4 10.00% Lessee's discount rate A Lessee's PVMLP: 130,000 Annuity Due LESSEE – assumes the lessee knows the implicit interest Lease 4 Type of Lease: rate and is therefore using the same amortization table as B FOR LESSEE: Why? the lessor (see above) Capital BPO 1/2/2012

Equipment (PVMLP) $130,000

Lessor Cash Flows Comments Lease Liability. $ 83,164 0 (83,164) Cash 46,836 1 46,836 2 46,836 12/31/12 (Use 5 year life) 3 2,500 BPO Depreciation Expense $ 26,000 4 Acc'd. Depreciation $ 26,000 10.00% Guess C 10.000% Implicit Rate MLP Lessor Comments Interest Expense $ 8,316 0 46,836 Lease Liability. $ 8,316 1 46,836 2 46,836 1/2/2005 at end of lease – payment of BPO 3 2,500 BPO Lease Liability $ 2,500 4 Cash $ 2,500 D Lessor's PVMLP = 130,000 Annuity Due Lease 4 Type of Lease: E FOR LESSOR: Why? Sales Type BPO Profit, no cost or collection uncertainties