ECSPF Portfolio Performance end-September 2005

I. Portfolio Summary and Key Performance Indicators Below is a summary of the key issues related to ECSPF’s portfolio in September, 20051.

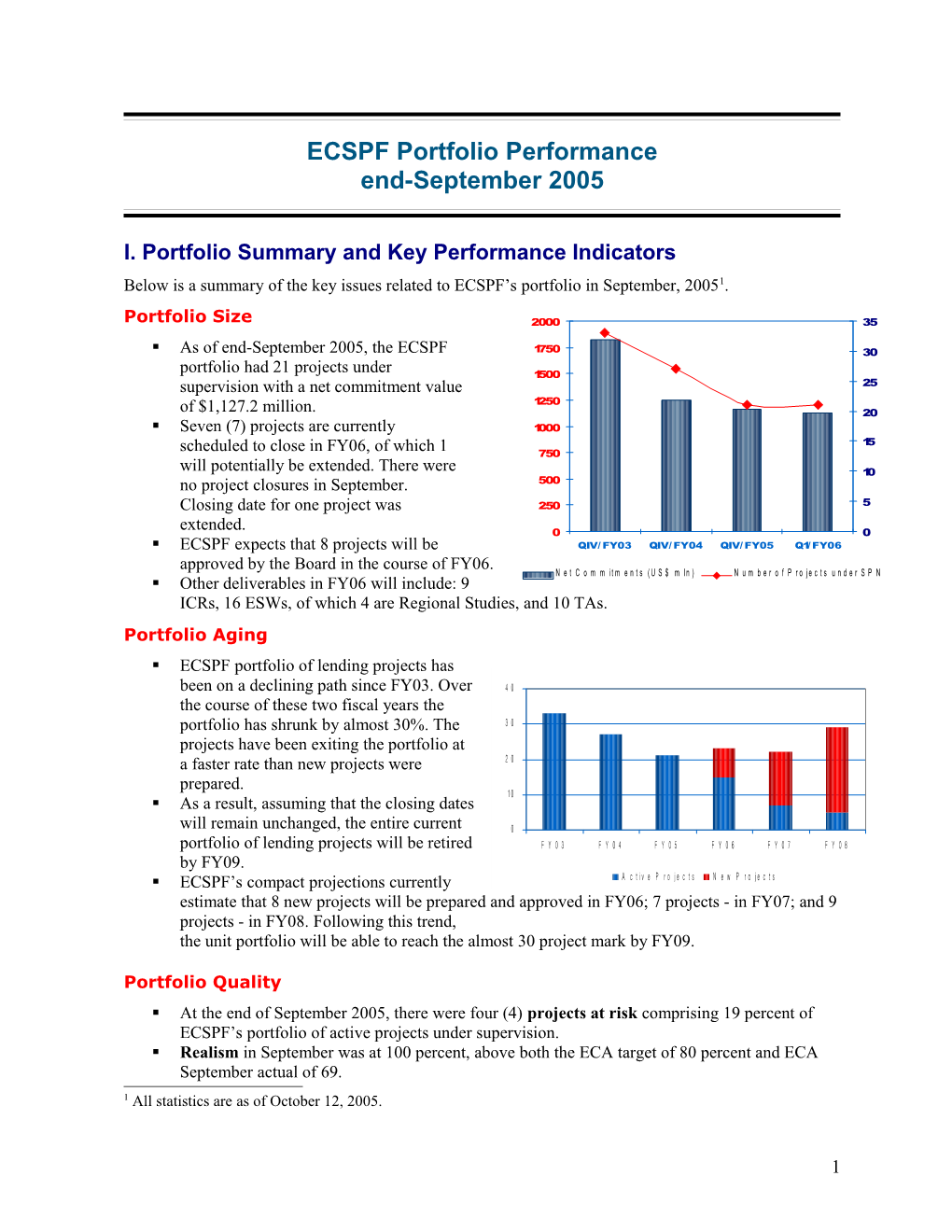

Portfolio Size 2000 35

. As of end-September 2005, the ECSPF 1750 30 portfolio had 21 projects under 1500 supervision with a net commitment value 25 1250 of $1,127.2 million. 20 . Seven (7) projects are currently 1000 scheduled to close in FY06, of which 1 15 750 will potentially be extended. There were 10 no project closures in September. 500 Closing date for one project was 250 5 extended. 0 0 . ECSPF expects that 8 projects will be QIV/ FY03 QIV/ FY04 QIV/ FY05 Q1/FY06 approved by the Board in the course of FY06. N e t C o m m i t m e n t s ( U S $ m l n ) N u m b e r o f P r o j e c t s u n d e r S P N . Other deliverables in FY06 will include: 9 ICRs, 16 ESWs, of which 4 are Regional Studies, and 10 TAs. Portfolio Aging . ECSPF portfolio of lending projects has been on a declining path since FY03. Over 4 0 the course of these two fiscal years the portfolio has shrunk by almost 30%. The 3 0 projects have been exiting the portfolio at a faster rate than new projects were 2 0 prepared. 1 0 . As a result, assuming that the closing dates

will remain unchanged, the entire current 0 portfolio of lending projects will be retired F Y 0 3 F Y 0 4 F Y 0 5 F Y 0 6 F Y 0 7 F Y 0 8 by FY09. . ECSPF’s compact projections currently A c t i v e P r o j e c t s N e w P r o j e c t s estimate that 8 new projects will be prepared and approved in FY06; 7 projects - in FY07; and 9 projects - in FY08. Following this trend, the unit portfolio will be able to reach the almost 30 project mark by FY09.

Portfolio Quality . At the end of September 2005, there were four (4) projects at risk comprising 19 percent of ECSPF’s portfolio of active projects under supervision. . Realism in September was at 100 percent, above both the ECA target of 80 percent and ECA September actual of 69. 1 All statistics are as of October 12, 2005.

1 . Proactivity remained unchanged in September at 83.3, slightly below the ECA regional target of 90 percent.

Major Operational Activities

. Negotiations for the Moldova Competitiveness Enhancement Project took place between September 21 and 22. The Board date is scheduled for October 27, 2005. . Negotiations for the Romania Knowledge Economy Project were held in Washington, D.C. from September 26, 2005 to September 30, 2005. . A pre-identification mission for the Albania Business Environment Enhancement and Institutional Reform (BEEIR) Project took place from September 26 - October 7. . Supervision mission for Croatia Science and Technology Project (STP) visited Croatia during September 29-October 3, 2005 period to follow up on the status of the effectiveness procedures and project operational matters. . Supervision mission for Russia Capital Markets Development Project took place from September 23-28. . Pre-appraisal mission for the Kyrgyz Enhancement of Business Environment Project visited Bishkek from September 29-October 13. . Appraisal and technical discussions mission for the Serbia First Programmatic Private and Financial Development Policy Project (PPFDPL-1) took place from September 12-22. . A preparation mission for Serbia Bor Regional Development Project and a supervision mission for the Serbia Privatization and Restructuring of Banks and Enterprises Project took place between September 12 and 22. . Supervision mission for the Armenia Enterprise Incubator LIL took place from September 11- 21. . A preparation mission for the Uzbekistan Microfinance LIL was held September 25 - October 1. The mission focused on identifying the main elements of project design and agreeing on basic project structure with counterparts from the Ministry of Finance and Central Bank of Uzbekistan. The loan is proposed to provide TA to Halq Bank in developing financial services tailored to unserved clients in poor and rural areas. . Implementation Completion Report for Moldova PSD-2 Project was completed and submitted to SECBO on September 29, 2005. . ICR mission for the Uzbekistan Enterprise Institution Building Project visited Tashkent between September 10 and 19. . A QER for the Turkey Access to Finance for SMEs Project was held on September 21. . A mission visited Kazakhstan from September 19-23 in the context of the Commonwealth of Independent States Payments and Securities Settlement Initiative (CISPI) to assess the payments systems of Kazakhstan with a view to identifying possible improvement measures in their safety, efficiency and integrity. . The second annual regional seminar of the CIS Payment and Securities Settlement System Initiative was held in St. Petersburg from September 14-16. The seminar was hosted by the World Bank in cooperation with the BIS Committee on Payment and Settlement Systems (CPSS), and the Central Bank of Russia. The event brought together both CIS authorities and international experts to discuss the most relevant trends in the area of payments and securities settlement and agree upon next steps for the development of the regional initiative.

II. Projects Under Implementation

2 The number of projects under supervision in the ECSPF portfolio of active projects has declined from 27 at the beginning of FY05 to 21 in September 2005. The disbursement ratio at the end of September was at 5.3 percent. Presently, there are 5 projects (or 24% of total active projects) in the ECSPF’s portfolio flagged for their “slow disbursement”.

Projects at Risk

Four projects were at risk as of end-September, all of which were actual problem projects.

Problem Projects

The four actual problem projects are in the following countries: Russia, Bosnia and Herzegovina, and Ukraine. Actual Problem Projects Ctry P0 # Proj TTL Mo’s in Remarks Name probl. Stat RU P008828 Fin Poznanskaya 45 Restructured in FY03 and partially cancelled in FY04, the project Inst continues to proceed as planned, and is being closely monitored in accordance with performance indicators (last mission in October 2004). The project implementation continues to remain satisfactory with a number of activities taking place as per the agreed Procurement Plan (leading to substantial increase in disbursements). The progress on Project Benchmarks agreed with the Bank earlier has also been satisfactory. Notwithstanding its prolonged problem status, the project was extended in December for another twelve months, and is now scheduled to close on December 31, 2005. BH P070917 PTAC Kreacic 16 The project performance ratings have been rated “unsatisfactory” due to slow procurement and hence slow disbursement of the project funds. At the request of the government, at end-December 2004 the project was extended for 20 months. Although the project has not been formally restructured, at the time of extension there was a reallocation between the categories of the project with a greater emphasis on the pre-privatization component to reflect the changes in privatization environment. The project disbursement is expected to accelerate as it supports the reforms under Corporate Restructuring DPL which is currently in the pipeline. BH P071001 BAC Kreacic 6 The project is currently rated at “moderately unsatisfactory”, however, taking into account recent progress toward achieving the objectives, the DO ratings are likely to be upgraded in the next ISR. The closing date of the credit has been extended until November 30, 2005. UA P054966 PSD Jedrzejczak 16 There are three major problems with this project, including slow disbursement, Government's unwillingness to finance VAT, and weak institutional capacity of implementing agencies. The country unit is in the process of closing the project.

Potential Problem Projects

There were no potential problem projects, i.e. project with three or more risk flags, recorded in ECSPF’s portfolio at end-September 2005.

3 “Watch” Projects

As of end-September, ECSPF had 10 “watch” projects (48% of projects under supervision) requiring close supervision in order to avoid falling into a problem or potential problem status. The projects with 2 or less risk flags classified as “watch” are shown in the table below; of these 5 projects (or 24%) are flagged for their slow disbursement, and 2 projects (10%) received “effectiveness delay” flag

“Watch” Projects under supervision Ctry P0 # Project Name # Risk Risk flags F l a g s RU P042622 CAP MRKT DEV 2 Country record, slow disbursement SM P074484 EXP FIN FAC 1 Slow disbursement HR P057767 TA INST REG REF 1 Slow disbursement KG P074881 PYMNT/BANK SYS 1 Country record GE P008416 ENT REHAB 1 Slow disbursement KO P088045 BUS ENV TA 1 Country Environment MK P079552 BUS ENV RE 1 Country Record UA P074885 E-DEVT TA 1 Effectiveness delay AZ P081616 FIN SERV DEVT 1 Effectiveness delay RO P069679 PPIBL 1 Slow disbursement

FY06 Project Closings and Extensions

Seven projects are scheduled to close in FY06. Closing date for Bosnia BAC was extended to November 30, 2005. Closing date for Serbia Privatization and Restructuring of Banks and Enterprises Project is in the process of being extended. The table below provides detailed information on projects with upcoming closing dates. Projects scheduled to close in FY06 Ctry P0 # Project Name TTL Revised Remarks Clo sin g Dat e BH P071001 Bus Enablg Env Kreacic 11/30/05 extended GE P008416 Enterprise Rehab Astrakhan 12/31/05 TR P009073 Industr Technol Ozdora 12/31/05 RU P008828 Fin Instit Poznanskaya 12/31/05 HR P057767 TA Inst Reg Ref Koryukin 12/31/05 AZ P070973 Fin Sect TA Brajovic 2/28/06 SM P077732 PRBE Pankov 4/30/06 potential extension

Performance Indicators and Quality

The table below compares ECSPF’s portfolio performance with regional averages and regional targets.

Summary of Performance Indicators as of September 30, 2005 Indicator ECA Target ECA Actual ECSPF Actual Backlogged ICRs (#) 0 0 0 Proactivity (%) 90 93.6 83.3

4 Realism (%) 80 69 100 Project at Risk (#, %) N/A 29 (9.7%) 4 (19%) Commitment at Risk (%) N/A 9.7 13.4 Actual Problem Projects (#, %) N/A 20 (6.7%) 4 (19%) Potential Problem Projects (#, %) N/A 9 (3.0%) 0 (0%) N/A = not applicable or not available

Implementation Status and Results (ISR) Timeliness While there were no stale ISRs as of end-September 2005, the team leaders are encouraged to prepare ISRs for their respective projects upon return from supervision missions. So far, ISRs for 3 projects have been updated in FY06 and archived. Working versions for 8 ISRs (or 38%) have been created in the system and are being finalized, however, ISRs for 5 projects (see table below) have been in a draft status for more than a month. It is encouraged that TTLs finalize these ISRs and submit for necessary clearances.

ISRs Timetable and Status Ctry P0 # Project Name TTL Last ISR Working Remarks

AM P044852 Ent incubator l Shojai 4/16/05 10/14/05 AZ P081616 Fin servs devt Brajovic 8/29/05 AZ P070973 Fin sct TA Brajovic 8/29/05 BH P071001 Bus enablg env Kreacic 3/24/05 8/16/05 to be finalized and archived BH P070917 Priv TA Kreacic 4/21/05 HR P057767 TA inst reg ref Koryukin 4/27/05 HR P080258 Sci & tech Genis n/a 10/12/05 GE P008416 Ent rehab Astrakhan 6/13/05 KG P074881 Pymnt/bank syst Drees-Gross 7/5/05 KO P088045 Bus Env TA Astrakhan n/a Initial ISR is required MK P079552 Bus Env Re Minotti n/a 6/28/05 to be finalized and archived RO P069679 PPIBL Shojai 5/24/05 RU P008828 Fin insts Poznanskaya 5/24/05 10/13/05 RU P042622 Cap mrkt dev Bossoutrot 5/24/05 8/1/05 to be finalized and archived YF P077732 Priv & rest of Pankov 6/7/05 YF P074484 Exp fin fac Edgecombe 6/10/05 TR P009073 Industrial tech Ozdora 4/13/05 5/11/05 to be finalized and archived TR P082801 Exp fin 2 Raina 6/6/05 TR P093568 Exp fin 3 Raina n/a 6/7/05 to be finalized and archived UA P074885 E-devt TA Jedrzejczak 6/16/05 UA P054966 Priv sec dev (a Jedrzejczak 3/24/05

5 Quality Enhancement Reviews . A QER for the Turkey Access to Finance for SMEs project was held on September 21.

III. FY05 Deliverables

Implementation Completion Reports

In FY06, ECSPF expects to deliver 9 ICRs. The ICR for Romania PIBL was delivered ahead of the scheduled deadline in FY05. ICR for Moldova PSD-2 has been delivered in September. The complete list of FY06 ICRs is summarized in the table below.

Implementation Completion Report Ctry P0 # Project Name TTL Closing ICR to Remarks D a t e MD P035811 PSD 2 Astrakhan 03/30/05 9/30/05 delivered AL P069079 FIN SEC IBTA Minotti 06/30/05 12/30/05 BH P070243 PRIV SECT CRDT Brajovic 06/30/05 12/30/05 UZ P055159 ENT INST BLDG Botha 06/30/05 12/30/05 BH P071001 BUS ENABLG ENV Kreacic 8/31/2005 02/28/06 RU P008828 FIN INSTS Poznanskaya 12/31/2005 06/30/05 GE P008416 ENT REHAB Astrakhan 12/31/2005 06/30/05 HR P057767 TA INST REG REF Koryukin 12/31/2005 06/30/05 TR P009073 INDUSTRIAL TECH Ozdora 12/31/2005 06/30/05

FY05 Quality at Exit

Of the 11 projects which exited portfolio in FY05, ICRs for 7 were completed by the end of the fiscal year. The OED has evaluated all 7 ICRs and found no disconnect between the ICR and OED PDO ratings.

Projects Under Preparation

According to the FY06 compact, ECSPF will have to deliver 8 new operations. At present, there are 16 projects with FY06 Board date. However, it is highly unlikely that all 16 will be delivered in FY06. The table below provides detailed information on the potential FY06 lending.

FY06 Project Pipeline: Lending Projects with the Board Approval scheduled in FY06 Ctry P0 # Project Name TTL Board Com- Remarks A p p r o v al RU P091405 SUAL Guarantee Bossoutrot 03/21/2006 MD P089124 CEP Astrakhan 10/27/2005 1 Negotiated UA P076553 Access to Fin Svcs Chaves 02/02/2006

6 UA P095203 EDP-2 Raina 06/15/2006 1 BH P089043 PDPC Kreacic 12/06/2005 1 SM P089116 PPFDPL-1 Edwards 11/15/2005 1 Appraised, and TDs conducted SM P092999 Bor Reg’l Dev’t Pankov 06/15/2006 HR P080258 Scien and Techn Koryukin 07/07/2005 1 Approved by the Board RO P088165 Knowl Economy Jedrzejczak 11/22/2005 1 Negotiated RO P083959 Jiu Valley Devt Aprahamian 11/15/2005 Drop pending TR P074181 EGDPL Chaves 04/11/2006 1 TR P082822 Acc to Fin for SME Motta 02/14/2006 1 SK P094410 E Govt TA Lanvin 11/10/2205 SK P094954 Innov TA Goldberg 01/17/2006 potentially to be converted to TA KG P087811 Bus Devt Enhanc Bossoutrot 12/15/2205 KZ P090695 Tech & Compet Watkins 12/15/2005

Economic Sector Work and Technical Assistance

Economic Sector Work

ECSPF is currently scheduled to deliver 16 ESWs in FY06. Of these, 3 are Investment Climate Assessments (ICAs) in Russia, Turkey, and FYR of Macedonia. In addition, the department foresees to deliver 4 regional studies. The table below provides a complete list of ECSPF ESWs and their status.

List of FY06 ESWs Ctry PO # Project Name Delivery Final Remarks

REG P089844 ECA KE Study 2/27/06 3/31/06 REG P096716 ECA KE Innovation 2 6/30/06 6/30/06 REG P089846 One Company Town Reh 6/1/06 6/1/06 REG P089848 Payment/Security Stlmnt 5/06/06 6/10/06 AL P092011 PSD Policy Note 7/05/05 7/05/05 Delivered CZ P097455 Corp Gov Mod for Pension Funds 1/31/06 1/31/06 KZ P096661 Fin’l Syst Enhanc (JERP) 5/15/06 6/15/06 MK P096639 ICA 3/30/06 5/12/06 PL P089146 Fin’l Serv Devt Plan 12/15/05 2/28/06 PL P094958 Corp Gov Mod for Insur 6/30/06 6/30/06 RO P096791 PSD Strategy Update 12/12/05 6/30/06 RU P089187 ICA 11/15/05 3/15/06 SK P089210 Corp Gov Mod for Insur 6/30/06 6/30/06 SK P089211 Corp Gov Mod for Banks 12/30/05 12/30/05 TJ P096837 Priv Sect Pol Note 3/21/06 4/12/06 TR P084255 ICA 2/28/06 6/15/06

Technical Assistance

Of the 21 TAs shown in table below, 11 have slipped into FY06, and were delivered in July. In addition to these 11 TAs, ECSPF also envisages to deliver 10 technical assistance activities in the course of FY06 as shown below.

7 List of FY06 TAs Ctry PO # Project Name Delivery Final Remarks t o

C l i e n t EU P089240 EU8 KE TA Acts 7/05/05 7/05/05 Delivered AM P092319 Fin Sect Support TA 7/05/05 7/05/05 Delivered BY P084065 Bus Env TA 7/05/05 7/05/05 Delivered BY P096712 FSAP Follow-up TA 3/15/06 6/14/06 CZ P093688 Cons Protect in Fin Serv 12/20/05 3/30/06 CZ P097456 TA for Integr Fin Spvn 6/16/06 6/15/06 GE P092322 Financial Sector Note 7/05/05 7/05/05 Delivered KZ P096848 Mgmt Gov of State Shldr 4/14/06 5/15/06 MD P089112 FSAP Follow-up TA 6/30/06 6/30/06 MK P096678 Fin Sec Govern & Reg Sp 6/20/06 6/27/06 RU P090522 Fin and Bank Sect Ref 7/05/05 7/05/05 Delivered RU P095540 Fin’l Sect Dialogue/TA 6/07/06 6/07/06 RU P097130 Reg’l Bank Conf /Acc Fin 12/30/05 1/30/06 SM P096750 Fid As TA (Montenegro) 3/30/06 3/30/06 SK P085031 FSAP Follow-up TA (Spn) 8/01/06 8/01/06 Delivered TR P097666 FSAP Prep TA 6/20/06 6/20/06 TJ P090677 Banking Sector TA 7/05/05 7/05/05 Delivered UA P079092 Savings Bank Restruc 7/05/05 7/05/05 Delivered UA P071282 Bus Environment TA 7/05/05 7/05/05 Delivered UA P071280 TA for Privatization 7/05/05 7/05/05 Delivered REG P094813 Anti-Money Laundering 7/05/05 7/05/05 Delivered

Financial Sector Assessment Program (FSAP)

While FSAPs are not counted against the outputs because they are considered FSE deliverables, the department is planning to undertake FSAPs in Turkey and Bosnia and Herzegovina. ECSPF will also lead FSAP updates in Georgia and Poland during this fiscal year.

8